SoftPoS stands for Software Point of Sale. If you lived in parts of the world outside of the US, you would have come across contactless payments. It made the payment experience seamless and almost invisible to the customer. As a result, in the UK for instance, by Q4 2018, contactless payments took over chip and pin.

Contactless is pretty helpful for a small coffee shop at a peak hour during a work day. It saves time, and the shop could take payments from more customers when compared to chip and pin. SoftPoS takes contactless payments one step further, mostly for the coffee shop.

The coffee shop does not need a PoS device to take payments anymore. The coffee shop could use a simple software (an app) that can be set up on a smartphone or a tablet. From this point, the customer can use their usual NFC based payment – only this time, they will bring their phone/card in contact with the coffee shop’s phone/tablet.

The user experience for the customer shouldn’t change – and that is good. Onboarding customers to a whole new payments experience is often a pain. However, for the retail outlets (our coffee shop), it offers a bag of benefits.

The coffee shop doesn’t need to invest in a third party PoS device any more. It also takes away some cost pressures on the shop. I did a quick search on PoS devices and their charges. For example, iZettle (a PoS device for SMEs) charge the merchant a flat 1.75% transaction fees. This fees would be saved with a SoftPoS solution.

The costs involved for the coffee shop in a SoftPoS setup is still not clear. If there is a cost saving as the PoS device provider is out of the picture, the coffee shop can use that saved amount to perhaps reward loyal customers.

Contactless is pretty helpful for a small coffee shop at a peak hour during a work day. It saves time, and the shop could take payments from more customers when compared to chip and pin. SoftPoS takes contactless payments one step further, mostly for the coffee shop.

The coffee shop does not need a PoS device to take payments anymore. The coffee shop could use a simple software (an app) that can be set up on a smartphone or a tablet. From this point, the customer can use their usual NFC based payment – only this time, they will bring their phone/card in contact with the coffee shop’s phone/tablet.

The user experience for the customer shouldn’t change – and that is good. Onboarding customers to a whole new payments experience is often a pain. However, for the retail outlets (our coffee shop), it offers a bag of benefits.

The coffee shop doesn’t need to invest in a third party PoS device any more. It also takes away some cost pressures on the shop. I did a quick search on PoS devices and their charges. For example, iZettle (a PoS device for SMEs) charge the merchant a flat 1.75% transaction fees. This fees would be saved with a SoftPoS solution.

The costs involved for the coffee shop in a SoftPoS setup is still not clear. If there is a cost saving as the PoS device provider is out of the picture, the coffee shop can use that saved amount to perhaps reward loyal customers.

At the IFA event in Berlin earlier this week, Visa, Fiserv and Samsung together announced their plans for a SoftPoS solution. Visa would provide the contactless feature, Fiserv will perform the settlement and Samsung will take care of the security. They plan to do a pilot run of the system in Poland that has high penetration for contactless payments.

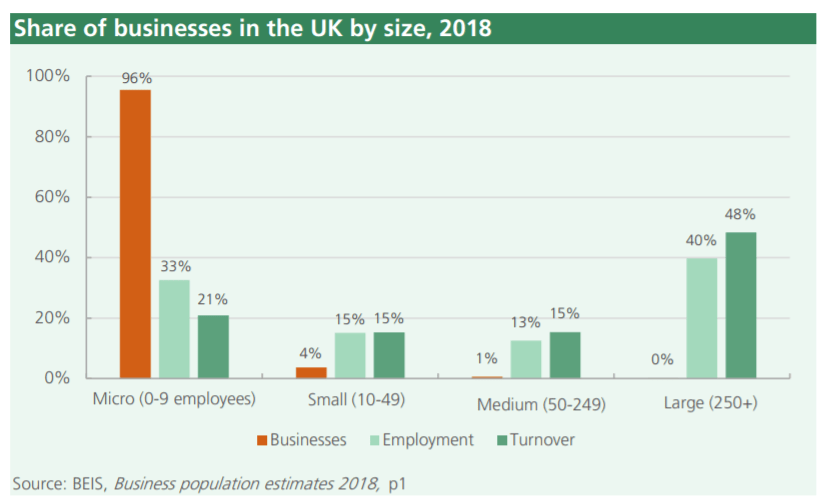

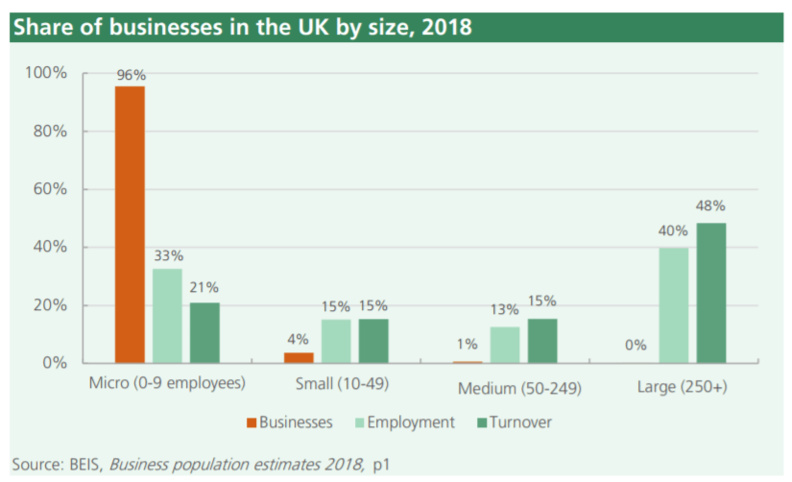

I did a quick analysis on how impactful this change could be for UK merchants. Some stats that caught my attention are as follows,

- In the UK there are around 5.7 Million private companies,

- Of which 99.9% are Small and Medium Enterprises (SMEs).

- The definition of an SME in the UK is a firm with less the 250 employees.

However, this change will be most beneficial for the shopkeeper who has less than 10 employees working for him/her.

- A business in the UK that has less than 10 employees is called a Micro-SME.

- 96% of all private companies in the UK are Micro SMEs.

- Micro SMEs contribute 33% of employment in Private sector, and 21% of turnover.

I did a quick analysis on how impactful this change could be for UK merchants. Some stats that caught my attention are as follows,

- In the UK there are around 5.7 Million private companies,

- Of which 99.9% are Small and Medium Enterprises (SMEs).

- The definition of an SME in the UK is a firm with less the 250 employees.

However, this change will be most beneficial for the shopkeeper who has less than 10 employees working for him/her.

- A business in the UK that has less than 10 employees is called a Micro-SME.

- 96% of all private companies in the UK are Micro SMEs.

- Micro SMEs contribute 33% of employment in Private sector, and 21% of turnover.

Let us look at the impact of retail companies in the UK

- Retail companies make up 10% of all UK private companies

- Retail companies employ 19% of the UK private sector workforce, and generate 33% of the turnover generated by all UK industries.

I couldn’t find the numbers for Micro SMEs that are in the retail industry. If we really want to drill into that space, we could do some estimates from the figures above. In any case, the numbers are massive and the impact of helping Micro-SMEs would be felt at the grassroots of the society.

This technology could also be rolled out into emerging markets where Point of Sale devices are yet to penetrate into rural areas. This is yet another interesting space, as financial inclusion (cards) reaches the last mile, payment infrastructure could perhaps leap frog to SoftPoS. Interesting times ahead.

- Retail companies make up 10% of all UK private companies

- Retail companies employ 19% of the UK private sector workforce, and generate 33% of the turnover generated by all UK industries.

I couldn’t find the numbers for Micro SMEs that are in the retail industry. If we really want to drill into that space, we could do some estimates from the figures above. In any case, the numbers are massive and the impact of helping Micro-SMEs would be felt at the grassroots of the society.

This technology could also be rolled out into emerging markets where Point of Sale devices are yet to penetrate into rural areas. This is yet another interesting space, as financial inclusion (cards) reaches the last mile, payment infrastructure could perhaps leap frog to SoftPoS. Interesting times ahead.

Arunkumar Krishnakumar

Arunkumar Krishnakumar is a Venture Capital investor at Green Shores Capital focusing on Inclusion and a podcast host.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

dailyfintech.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group