The need for an improved online banking experience is strong among corporate treasurers, many of whom are currently served through outdated and unintegrated bank technologies, according to a new report from Aite Group, Enhancing the Online Customer Experience: Feedback From Corporate Treasurers.

It is not uncommon for corporations to face multiple system logins, unintuitive customer interfaces, and reports that don't meet their needs. The result has been low customer satisfaction levels and a corporate perception that banks don't understand what they require.

It is not uncommon for corporations to face multiple system logins, unintuitive customer interfaces, and reports that don't meet their needs. The result has been low customer satisfaction levels and a corporate perception that banks don't understand what they require.

Aite Group research conducted in association with Union Bank from July to August 2013 surveyed 185 corporate treasurers at US-based corporations. Respondents were asked to rate the impact of several planned bank initiatives on improving their overall online cash management experience.

Banks are clearly responding to corporate customers’ needs more, and those surveyed highlight key initiatives, including the integration of systems, the development of customer-driven dashboards, an increased focus on reporting, and the rollout and expansion of the mobile channel. There are also plans for more forward-looking initiatives such as a greater incorporation of analytics and social media.

While banks' social media usage has primarily occurred on the consumer side, financial institutions around the globe are beginning to consider ways to leverage social media to better serve corporate customers. This is likely to include using social media to offer educational information to customers, positioning banks as advisors, partners, and sources of information as opposed to simply sellers of financial products.

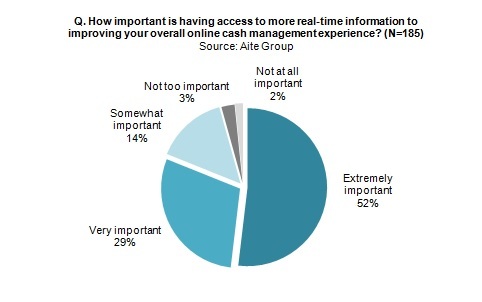

Aite Group recommends that financial institutions continue to plan out and move forward with their corporate portal and dashboard initiatives to significantly improve the online banking experience for customers. They should also examine the real-time capabilities they offer corporate customers—older technology solutions may be preventing the provision of real-time information, or customers may be simply unaware of what is already available.

Over the next few years, analytics will also be more critical for corporate clients. Financial institutions should therefore start to consider analytics as a way to differentiate themselves as well as a means to offer better customer service and prevent disintermediation.

“Banks can better position themselves as partners to deepen customer relationships by investing in technology to achieve many of the initiatives and enhancements that their corporate treasurer customers require,” says Christine Barry, research director in Wholesale Banking at Aite Group. “Tomorrow's problems can't be solved with yesterday's technology, so banks must invest in newer, more flexible systems, break down silos to pave the way for integration, and focus on system usability.”

aitegroup.com

Banks are clearly responding to corporate customers’ needs more, and those surveyed highlight key initiatives, including the integration of systems, the development of customer-driven dashboards, an increased focus on reporting, and the rollout and expansion of the mobile channel. There are also plans for more forward-looking initiatives such as a greater incorporation of analytics and social media.

While banks' social media usage has primarily occurred on the consumer side, financial institutions around the globe are beginning to consider ways to leverage social media to better serve corporate customers. This is likely to include using social media to offer educational information to customers, positioning banks as advisors, partners, and sources of information as opposed to simply sellers of financial products.

Aite Group recommends that financial institutions continue to plan out and move forward with their corporate portal and dashboard initiatives to significantly improve the online banking experience for customers. They should also examine the real-time capabilities they offer corporate customers—older technology solutions may be preventing the provision of real-time information, or customers may be simply unaware of what is already available.

Over the next few years, analytics will also be more critical for corporate clients. Financial institutions should therefore start to consider analytics as a way to differentiate themselves as well as a means to offer better customer service and prevent disintermediation.

“Banks can better position themselves as partners to deepen customer relationships by investing in technology to achieve many of the initiatives and enhancements that their corporate treasurer customers require,” says Christine Barry, research director in Wholesale Banking at Aite Group. “Tomorrow's problems can't be solved with yesterday's technology, so banks must invest in newer, more flexible systems, break down silos to pave the way for integration, and focus on system usability.”

aitegroup.com

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group