Foreword

This paper is written for boards of directors and senior executives – the people responsible, in their capacity as strategic leaders, for identifying and responding to the killer risks and game-changing opportunities that face an enterprise. These are the risks and opportunities often referred to as “strategic,” since managing the former and taking advantage of the latter is an essential part of an effective business strategy. In this paper, we discuss why boards and directors often suffer from an incomplete understanding of strategic risk – and what they can do to avoid being blindsided by the unexpected.

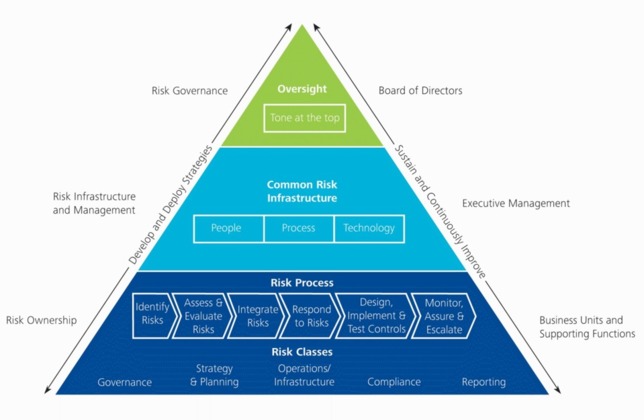

We believe that an expanded understanding of strategic risk is essential for leaders to carry out their responsibilities for risk governance, depicted at the apex of the triangle in the Risk Intelligent EnterpriseTM framework (Figure 1). Effective risk governance requires leaders to understand that risk is integral to the pursuit of value, and to guide the enterprise in managing risk exposures so that it incurs just enough of the right kinds of risk – no more, no less – to effectively pursue its strategic goals. We hope that this publication brings you new insights on how to identify the “right” kinds of risks for your enterprise, and helps you shape a strategy that helps you make the most of the risks you choose to take.

To maintain alignment between risk exposures and business strategy, a Risk Intelligent Enterprise draws on the coordinated efforts of three levels of risk management responsibility, graphically represented as a three-layered triangle in Deloitte’s Risk Intelligent Enterprise framework (Figure 1):

- Risk governance, including strategic decision-making and risk oversight, led by the board of directors

- Risk infrastructure and management, including designing, implementing, and maintaining an effective risk management program, led by executive management

- Risk ownership, including identifying, measuring, monitoring, and reporting on specific risks, led by the business units and functions.

Figure 1. The Risk Intelligent EnterpriseTM framework

This paper is written for boards of directors and senior executives – the people responsible, in their capacity as strategic leaders, for identifying and responding to the killer risks and game-changing opportunities that face an enterprise. These are the risks and opportunities often referred to as “strategic,” since managing the former and taking advantage of the latter is an essential part of an effective business strategy. In this paper, we discuss why boards and directors often suffer from an incomplete understanding of strategic risk – and what they can do to avoid being blindsided by the unexpected.

We believe that an expanded understanding of strategic risk is essential for leaders to carry out their responsibilities for risk governance, depicted at the apex of the triangle in the Risk Intelligent EnterpriseTM framework (Figure 1). Effective risk governance requires leaders to understand that risk is integral to the pursuit of value, and to guide the enterprise in managing risk exposures so that it incurs just enough of the right kinds of risk – no more, no less – to effectively pursue its strategic goals. We hope that this publication brings you new insights on how to identify the “right” kinds of risks for your enterprise, and helps you shape a strategy that helps you make the most of the risks you choose to take.

To maintain alignment between risk exposures and business strategy, a Risk Intelligent Enterprise draws on the coordinated efforts of three levels of risk management responsibility, graphically represented as a three-layered triangle in Deloitte’s Risk Intelligent Enterprise framework (Figure 1):

- Risk governance, including strategic decision-making and risk oversight, led by the board of directors

- Risk infrastructure and management, including designing, implementing, and maintaining an effective risk management program, led by executive management

- Risk ownership, including identifying, measuring, monitoring, and reporting on specific risks, led by the business units and functions.

Figure 1. The Risk Intelligent EnterpriseTM framework

Shaping a Risk Intelligent strategy

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

– Mark Twain

Of all the risks of concern to boards and executives, strategic risk is the kind most likely to pose significant threats and opportunities to an enterprise. Indeed, leaders today are well aware of the need to manage risks to their chosen strategy. Most boards and executives have rightly put significant effort into identifying potential threats that could stand in the way of executing their strategy, devising scenarios to model various situations and developing contingency plans to manage adversity.

Yet many of these same boards and executives may suffer from a blind spot with respect to strategic risk that can be as dangerous as it is difficult to recognize. That blind spot is the failure to consider the possibility that the strategy itself may be flawed because it is based on assumptions that may no longer be valid.

A strategy that was once finely adapted to succeed under particular circumstances may fail if those circumstances change. And the forces of creative destruction are always at work. In fact, the only guarantee in business, as in life, is that circumstances are always changing. In a turbulent environment, where circumstances are subject to inevitable but unpredictable, sudden, and violent shifts, it is anything but certain whether what has worked in the past will still work in the future.

Any strategy that is founded on what “just ain’t so” is almost sure to fail, no matter how well it is executed, even if it was once the recipe for success. That’s why a full understanding of strategic risk requires systematically and regularly challenging the fundamental assumptions that underlie the strategy. Such understanding is an essential step to creating a robust and agile strategy in the midst of turbulence and uncertainty. We offer a simple conceptual framework to help leaders challenge their assumptions in a constructive and meaningful way.

Experience can be misleading

Many of our most strongly held assumptions are the product of experience – our interpretation of the events we have encountered throughout our lives. At some basic level, the lessons learned from experience are essential to our ability to act. However, there is a potential problem with taking experience too much to heart. The problem is that experience, even experience gained over a span of years, is not always a reliable guide to action. Why? Because shift happens! The environment is constantly changing, and lessons learned under one set of circumstances may be completely invalid under a different set of circumstances.

Questioning the lessons of one’s experience does not, for most people, come easily. There is a natural human attachment to assumptions born of experience. In fact, the more successful a businessperson has been, the more tightly he or she is apt to cling to the assumptions that have historically brought success. That’s because most successful people are likely to have encountered and overcome many challenges in the past – and one doesn’t lightly discard the lessons learned from past successes. The problem is that while today’s challenges may be similar, they are not identical, and the same path that one has taken in the past may not succeed under different circumstances.

Certain assumptions are especially hard to challenge because they seem to be supported by a great deal of evidence in their favor, sometimes so much so that the assumption may be mistaken for an unquestionable truth. (Consider the once-widespread assumption that “the sun goes around the earth,” a view that our everyday experience seems to strongly support.) Contradictory evidence can be hard to find and, even when found, hard to recognize as such: Most people tend to be reluctant to consider evidence that runs counter to their deeply held beliefs. It can even be hard to make the effort to look for contradictory evidence, if people believe so strongly in the old ways of succeeding that they think that questioning them would be a waste of time.

However, the sense of security in pursuing old ways of succeeding, in today’s turbulent and changeable environment, is more often than not a false one. Indeed, in an environment where change is constant, it’s more likely than ever that any given assumption could turn out to be unsound, either today or in the future. And unsound assumptions are a poor basis for business strategy, no matter how solid they may seem to the uncritical eye.

What once was the formula for success can almost overnight become a recipe for disaster. An unquestioning dedication to the approaches that once made a company successful – especially in a rapidly changing environment – can cause leaders to fail to perceive or adapt to a significant change in the environment, and thus cease to be successful or even survive. The biggest risk for market leaders as the dominant incumbents is often an unwillingness to challenge the underlying assumptions of their business strategies and execution efforts until it is too late. On the other hand, many successful marketplace challengers owe their success to their willingness to take “frontier” risks – in other words, to boldly challenge conventional assumptions by introducing changes that may initially seem counter intuitive, such as (for instance) cannibalizing their existing products and services.

Lessons learned

History is rich with examples of failures due to false assumptions about what was “known for sure” that ended up not being so. There are also many examples of successes for those who were able to effectively challenge those assumptions. In the first case, consider what happened to the sub prime mortgage industry several years ago. Some of the industry’s major assumptions, among others, were that national housing prices in the U.S. would continue to rise indefinitely, that credit would continue to be freely available, that liquidity would not evaporate overnight, that the risk of ruin was infinitesimal, and that people would have time to get out in the event of a collapse. Not so.

In contrast, consider the success of one media company whose subscription-based business model for video rentals challenged the conventional wisdom by which many traditional video rental businesses operated. Instead of assuming that customers would demand immediate access to movies – and that, therefore, the company would need to fund the operation of thousands of brick-and-mortar stores open 24/7 – the company bet on the existence of a sizeable market of movie aficionados who would be willing to order online and wait a day or two to receive a title through the mail. Instead of assuming that customers would only return movies if they were charged late fees, the company developed a system in which customers pay no late fees, but only receive new titles after they return the old ones. And instead of assuming that the company would make most of its money through late fees, the company realized that charging customers a subscription fee for its rental service could be highly profitable.

But creative destruction continues. A postscript to this company’s success story has come from cloud computing, which allows the direct streaming of media on a mobile basis. The direct-streaming model challenges the conventional wisdom that the use of content is necessarily tied to the possession of a physical object (say, a cassette, DVD, or book). Instead, thanks to the rise of streaming media, the price of purchase or rental now gives a buyer access rights to content rather than physical possession of the recording medium. In another marketplace shift in the making, some media companies are now offering TV shows, movies, and other forms of entertainment through streaming media, a delivery method that may shortly eclipse the traditional model of offering DVDs for rent.

Thesis-Antithesis-Synthesis: A conceptual framework for thinking the unthinkable

How can boards and executives guard against being misled by potentially unsound assumptions? One approach is to use the Thesis-Antithesis-Synthesis (TAS) tool – a method that originated in the fields of logic and philosophy, but that can be applied in a business context to powerful effect.

Boiled down to its essentials, the first step in TAS is to state a thesis: a proposition or assumption. This should be a “life or death” assumption essential to the success or failure of the business. (For example, a consumer business might state as one of its foundational assumptions, “In the next three years, the U.S. economy will return to prior economic levels, and disposable income will increase.”) The thesis represents conventional wisdom, or what one believes to be true – the expected events, or the “white swans”1 (to borrow Nassim Taleb’s terminology).

The second step is to state the thesis’s exact opposite, or antithesis (“In the next three years, the U.S. economy will not return to prior economic levels, and disposable income will not increase.”) The antithesis represents the unconventional view – the “black swan” (1) or the unexpected event. Stating the antithesis requires leaders to ask themselves, “What if we are wrong?”

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

– Mark Twain

Of all the risks of concern to boards and executives, strategic risk is the kind most likely to pose significant threats and opportunities to an enterprise. Indeed, leaders today are well aware of the need to manage risks to their chosen strategy. Most boards and executives have rightly put significant effort into identifying potential threats that could stand in the way of executing their strategy, devising scenarios to model various situations and developing contingency plans to manage adversity.

Yet many of these same boards and executives may suffer from a blind spot with respect to strategic risk that can be as dangerous as it is difficult to recognize. That blind spot is the failure to consider the possibility that the strategy itself may be flawed because it is based on assumptions that may no longer be valid.

A strategy that was once finely adapted to succeed under particular circumstances may fail if those circumstances change. And the forces of creative destruction are always at work. In fact, the only guarantee in business, as in life, is that circumstances are always changing. In a turbulent environment, where circumstances are subject to inevitable but unpredictable, sudden, and violent shifts, it is anything but certain whether what has worked in the past will still work in the future.

Any strategy that is founded on what “just ain’t so” is almost sure to fail, no matter how well it is executed, even if it was once the recipe for success. That’s why a full understanding of strategic risk requires systematically and regularly challenging the fundamental assumptions that underlie the strategy. Such understanding is an essential step to creating a robust and agile strategy in the midst of turbulence and uncertainty. We offer a simple conceptual framework to help leaders challenge their assumptions in a constructive and meaningful way.

Experience can be misleading

Many of our most strongly held assumptions are the product of experience – our interpretation of the events we have encountered throughout our lives. At some basic level, the lessons learned from experience are essential to our ability to act. However, there is a potential problem with taking experience too much to heart. The problem is that experience, even experience gained over a span of years, is not always a reliable guide to action. Why? Because shift happens! The environment is constantly changing, and lessons learned under one set of circumstances may be completely invalid under a different set of circumstances.

Questioning the lessons of one’s experience does not, for most people, come easily. There is a natural human attachment to assumptions born of experience. In fact, the more successful a businessperson has been, the more tightly he or she is apt to cling to the assumptions that have historically brought success. That’s because most successful people are likely to have encountered and overcome many challenges in the past – and one doesn’t lightly discard the lessons learned from past successes. The problem is that while today’s challenges may be similar, they are not identical, and the same path that one has taken in the past may not succeed under different circumstances.

Certain assumptions are especially hard to challenge because they seem to be supported by a great deal of evidence in their favor, sometimes so much so that the assumption may be mistaken for an unquestionable truth. (Consider the once-widespread assumption that “the sun goes around the earth,” a view that our everyday experience seems to strongly support.) Contradictory evidence can be hard to find and, even when found, hard to recognize as such: Most people tend to be reluctant to consider evidence that runs counter to their deeply held beliefs. It can even be hard to make the effort to look for contradictory evidence, if people believe so strongly in the old ways of succeeding that they think that questioning them would be a waste of time.

However, the sense of security in pursuing old ways of succeeding, in today’s turbulent and changeable environment, is more often than not a false one. Indeed, in an environment where change is constant, it’s more likely than ever that any given assumption could turn out to be unsound, either today or in the future. And unsound assumptions are a poor basis for business strategy, no matter how solid they may seem to the uncritical eye.

What once was the formula for success can almost overnight become a recipe for disaster. An unquestioning dedication to the approaches that once made a company successful – especially in a rapidly changing environment – can cause leaders to fail to perceive or adapt to a significant change in the environment, and thus cease to be successful or even survive. The biggest risk for market leaders as the dominant incumbents is often an unwillingness to challenge the underlying assumptions of their business strategies and execution efforts until it is too late. On the other hand, many successful marketplace challengers owe their success to their willingness to take “frontier” risks – in other words, to boldly challenge conventional assumptions by introducing changes that may initially seem counter intuitive, such as (for instance) cannibalizing their existing products and services.

Lessons learned

History is rich with examples of failures due to false assumptions about what was “known for sure” that ended up not being so. There are also many examples of successes for those who were able to effectively challenge those assumptions. In the first case, consider what happened to the sub prime mortgage industry several years ago. Some of the industry’s major assumptions, among others, were that national housing prices in the U.S. would continue to rise indefinitely, that credit would continue to be freely available, that liquidity would not evaporate overnight, that the risk of ruin was infinitesimal, and that people would have time to get out in the event of a collapse. Not so.

In contrast, consider the success of one media company whose subscription-based business model for video rentals challenged the conventional wisdom by which many traditional video rental businesses operated. Instead of assuming that customers would demand immediate access to movies – and that, therefore, the company would need to fund the operation of thousands of brick-and-mortar stores open 24/7 – the company bet on the existence of a sizeable market of movie aficionados who would be willing to order online and wait a day or two to receive a title through the mail. Instead of assuming that customers would only return movies if they were charged late fees, the company developed a system in which customers pay no late fees, but only receive new titles after they return the old ones. And instead of assuming that the company would make most of its money through late fees, the company realized that charging customers a subscription fee for its rental service could be highly profitable.

But creative destruction continues. A postscript to this company’s success story has come from cloud computing, which allows the direct streaming of media on a mobile basis. The direct-streaming model challenges the conventional wisdom that the use of content is necessarily tied to the possession of a physical object (say, a cassette, DVD, or book). Instead, thanks to the rise of streaming media, the price of purchase or rental now gives a buyer access rights to content rather than physical possession of the recording medium. In another marketplace shift in the making, some media companies are now offering TV shows, movies, and other forms of entertainment through streaming media, a delivery method that may shortly eclipse the traditional model of offering DVDs for rent.

Thesis-Antithesis-Synthesis: A conceptual framework for thinking the unthinkable

How can boards and executives guard against being misled by potentially unsound assumptions? One approach is to use the Thesis-Antithesis-Synthesis (TAS) tool – a method that originated in the fields of logic and philosophy, but that can be applied in a business context to powerful effect.

Boiled down to its essentials, the first step in TAS is to state a thesis: a proposition or assumption. This should be a “life or death” assumption essential to the success or failure of the business. (For example, a consumer business might state as one of its foundational assumptions, “In the next three years, the U.S. economy will return to prior economic levels, and disposable income will increase.”) The thesis represents conventional wisdom, or what one believes to be true – the expected events, or the “white swans”1 (to borrow Nassim Taleb’s terminology).

The second step is to state the thesis’s exact opposite, or antithesis (“In the next three years, the U.S. economy will not return to prior economic levels, and disposable income will not increase.”) The antithesis represents the unconventional view – the “black swan” (1) or the unexpected event. Stating the antithesis requires leaders to ask themselves, “What if we are wrong?”

The final step is to describe the implications of the thesis and the antithesis for the enterprise and to identify a new, unified approach that potentially combines both the thesis and the antithesis in a “best of both worlds” scenario. (For example: “If competitors are caught off guard in a weakened state, we can use our strong cash position to acquire them at lower valuations.” This approach, of course, assumes that the company actually has a strong cash position. If it does not, then leaders might want to think about ways to defend against possible hostile takeover attempts by others.)

TAS makes an excellent organizing device for identifying one’s current assumptions and constructively challenging them. It enables the organization to make explicit the assumptions on which it has based its strategy, and to hold up those assumptions for critical examination. It helps leaders identify and describe the antitheses of their assumptions and examine the environment for signs of the antitheses’ emergence, a vital exercise that plays a major role in risk monitoring and preparedness. And it allows leaders to develop approaches that can be applied under a range of circumstances, whether or not those circumstances play out as expected.

The hardest part of TAS is usually not in formulating the antitheses or even developing a synthesis. Most often, the biggest difficulty lies in making current assumptions explicit. This is often an iterative process, since our most deeply held assumptions constitute “the sea we swim in” – concepts we take so much for granted that it takes repeated attempts to recognize them as assumptions rather than objective truth. Yet the importance of recognizing assumptions as such is undeniable. To return to the sub prime mortgage example, if more people had been able to recognize that expectations of indefinite growth and low risk were assumptions rather than truths – or if more people had been receptive to dissenting voices pointing to contradictory evidence – the market may have responded more swiftly and reduced the impact.

Two further steps

Arriving at a synthesis of an assumption and its antithesis is a significant step toward constructing a Risk Intelligent strategy. By taking two additional steps, leaders can deepen their understanding of how unexpected events might shape their businesses, and move closer to a strategy that accounts for the best of both worlds with respect to both the expected and the unexpected.

First, scan the landscape for signals that unexpected events may be about to occur or may already be occurring. To be alert to these signals on an ongoing basis, it is important to build an early detection “risk intelligence” system within an enterprise that can identify, recognize, and analyze faint signals amid a background of constant noise (see sidebar, “Retrospective predictability and signal detection”).

Second, if any signs of unexpected events have been recognized, ask: Are they “friend or foe”? Examining whether the events in question pose opportunities, threats, or both can help leaders better understand the significance of each event to the business and help the organization make plans to deal with them if and when it becomes necessary. Importantly, asking the “friend or foe” question can also help leaders avoid the view that all unexpected events are unwelcome, helping them stay alert to emerging opportunities that may be seized ahead of the competition.

Retrospective predictability and signal detection

Nassim Taleb describes the phenomenon of “retrospective predictability”: the tendency for people, after an unusual or unexpected event has occurred, to try to develop explanations for that event that make it seem predictable. This phenomenon highlights that it is often easy, in hindsight, to identify warning signs and signals that went unnoticed or were dismissed at the time.

To avoid being taken off guard by unexpected events, enterprises need to develop the ability to prospectively identify signals of potentially extreme shifts – that is, to identify, recognize, and interpret the signs and signals that indicate that an unexpected event may be on its way. One way to help hone an enterprise’s signal-detection capabilities is to continually strive to develop your people’s awareness and ability to gather internal and external intelligence about the competitive environment. Another is to utilize “open source” electronic intelligence-gathering systems that are programmed to scan the global environment for events that may signal the emergence of unexpected events or circumstances.

Holding open strategic options

Once key assumptions have been identified, challenged, and appropriately modified, leaders should have enough insight into what the “unexpected” could mean for the business to create a Risk Intelligent strategy. This requires creating a portfolio of different strategic options, which should be kept open until the preferred option emerges (see sidebar, “Requisite variety and coarse adaptation”). Critically important, too, is to develop an appropriate portfolio of options in advance of the actual “fork in the road.” Organizations that prepare ahead of time to take advantage of shifts in the environment are far more likely to be able to move in time to seize competitive advantage than those who do not. In fact, one way to gain a competitive advantage is to create shifts that would be helpful to one’s business – not just to see shifts coming, but to accelerate them so as to become the disruptor in the process of creative destruction. As Google’s Eric Schmidt once said, “We are disruptive by design” – a fitting philosophy for the company many hold up as an exemplar of innovation.

Requisite variety and coarse adaptation

The concept of requisite variety, developed by W. Ross Ashby in 1956,(2) essentially states that only complexity can deal with complexity. In a business context, it means that an enterprise operating in a complex, unpredictable, and turbulent environment requires a variety, or rather the right variety, of strategies, structures, and skills in order to survive and thrive.

An analogy can be drawn with the adaptation of biological species to their environments. A species that is “finely” adapted to the environment is exquisitely fitted to thrive in that particular environment. The better fitted a species is to a specific environment, the more likely it is to survive and thrive – unless the environment changes, in which case a finely adapted species may find itself on a rapid path to extinction. A “coarsely” adapted species, on the other hand, is not optimally fitted for any particular environment, but rather is able to survive in a variety of environments. It may not do as well in any particular environment as a finely adapted species – yet it is much better positioned to survive if the environment changes, since it can survive under a range of different circumstances.(3)

In a world where the future is unknowable, an organization must be “coarsely adapted” in order to be both agile and resilient. In the book The Strategy Paradox, Michael Raynor makes a similar point about strategic flexibility. The more committed an enterprise is to a particular strategy, the more likely it is to either succeed or to fail. He argues for developing options that increase strategic flexibility and deferring firm commitments until uncertainty is reduced. Raynor notes that wholehearted commitment to a strategy keyed to a specific environment can bring success as long as the environment remains unchanged. Unfortunately, such commitment leaves the organization less able to adapt to sudden environmental change, which occurs much more often than we typically think. “The downside of commitment,” Raynor observes, “is that if you happen to make the wrong commitments, it can take a long time to undo them and make new ones.”

The idea of holding open a portfolio of strategic options runs counter to conventional strategy-setting approach, in which leaders try to select a single “maximizing” strategy that drives the greatest returns. However, a maximizing strategy is usually highly tailored to current circumstances – and thus, no matter how well it may work in the short term, is apt to fail when circumstances inevitably change. This is why we recommend pursuing a requisite variety of “optimizing” strategies rather than a single “maximizing” strategy: Such an approach is far more resilient to shifts in the marketplace and therefore more appropriate for survival and success over the long term.

Steps to a Risk Intelligent strategy

A Risk Intelligent strategy begins with constructively challenging one’s own assumptions, is refined through signal detection and interpretation, and concludes with a portfolio of strategic options that the organization holds in readiness against the day when it knows which potential future has or will become reality. To develop a Risk Intelligent

strategy for your own organization, consider doing the following:

- Use the TAS framework to identify and challenge the fundamental assumptions (the white swans) on which your current strategy is based. Create a list of unexpected events and consider the significance of each to the enterprise.

- Identify and look for signals that may indicate whether the occurrence or emergence of unexpected events.

- Ask if each unexpected event is a “friend or foe”: Understand whether it is an opportunity, a threat, or both.

- Develop a strategy that contains a requisite variety of strategic options. Hold open the appropriate number and type of strategic alternatives that will allow your business to be resilient in adversity and agile in seizing fleeting opportunity.

A Risk Intelligent approach to strategy is the foundation of the successful enterprise. Challenging one’s most strongly held assumptions is a crucial step in the formulation of a Risk Intelligent strategy. The rapid pace of change in today’s turbulent economy demands a Risk Intelligent approach to strategic planning and decision making that has considered, and appropriately taken into account, the possibility that what people “know for sure … just ain’t so.”

TAS makes an excellent organizing device for identifying one’s current assumptions and constructively challenging them. It enables the organization to make explicit the assumptions on which it has based its strategy, and to hold up those assumptions for critical examination. It helps leaders identify and describe the antitheses of their assumptions and examine the environment for signs of the antitheses’ emergence, a vital exercise that plays a major role in risk monitoring and preparedness. And it allows leaders to develop approaches that can be applied under a range of circumstances, whether or not those circumstances play out as expected.

The hardest part of TAS is usually not in formulating the antitheses or even developing a synthesis. Most often, the biggest difficulty lies in making current assumptions explicit. This is often an iterative process, since our most deeply held assumptions constitute “the sea we swim in” – concepts we take so much for granted that it takes repeated attempts to recognize them as assumptions rather than objective truth. Yet the importance of recognizing assumptions as such is undeniable. To return to the sub prime mortgage example, if more people had been able to recognize that expectations of indefinite growth and low risk were assumptions rather than truths – or if more people had been receptive to dissenting voices pointing to contradictory evidence – the market may have responded more swiftly and reduced the impact.

Two further steps

Arriving at a synthesis of an assumption and its antithesis is a significant step toward constructing a Risk Intelligent strategy. By taking two additional steps, leaders can deepen their understanding of how unexpected events might shape their businesses, and move closer to a strategy that accounts for the best of both worlds with respect to both the expected and the unexpected.

First, scan the landscape for signals that unexpected events may be about to occur or may already be occurring. To be alert to these signals on an ongoing basis, it is important to build an early detection “risk intelligence” system within an enterprise that can identify, recognize, and analyze faint signals amid a background of constant noise (see sidebar, “Retrospective predictability and signal detection”).

Second, if any signs of unexpected events have been recognized, ask: Are they “friend or foe”? Examining whether the events in question pose opportunities, threats, or both can help leaders better understand the significance of each event to the business and help the organization make plans to deal with them if and when it becomes necessary. Importantly, asking the “friend or foe” question can also help leaders avoid the view that all unexpected events are unwelcome, helping them stay alert to emerging opportunities that may be seized ahead of the competition.

Retrospective predictability and signal detection

Nassim Taleb describes the phenomenon of “retrospective predictability”: the tendency for people, after an unusual or unexpected event has occurred, to try to develop explanations for that event that make it seem predictable. This phenomenon highlights that it is often easy, in hindsight, to identify warning signs and signals that went unnoticed or were dismissed at the time.

To avoid being taken off guard by unexpected events, enterprises need to develop the ability to prospectively identify signals of potentially extreme shifts – that is, to identify, recognize, and interpret the signs and signals that indicate that an unexpected event may be on its way. One way to help hone an enterprise’s signal-detection capabilities is to continually strive to develop your people’s awareness and ability to gather internal and external intelligence about the competitive environment. Another is to utilize “open source” electronic intelligence-gathering systems that are programmed to scan the global environment for events that may signal the emergence of unexpected events or circumstances.

Holding open strategic options

Once key assumptions have been identified, challenged, and appropriately modified, leaders should have enough insight into what the “unexpected” could mean for the business to create a Risk Intelligent strategy. This requires creating a portfolio of different strategic options, which should be kept open until the preferred option emerges (see sidebar, “Requisite variety and coarse adaptation”). Critically important, too, is to develop an appropriate portfolio of options in advance of the actual “fork in the road.” Organizations that prepare ahead of time to take advantage of shifts in the environment are far more likely to be able to move in time to seize competitive advantage than those who do not. In fact, one way to gain a competitive advantage is to create shifts that would be helpful to one’s business – not just to see shifts coming, but to accelerate them so as to become the disruptor in the process of creative destruction. As Google’s Eric Schmidt once said, “We are disruptive by design” – a fitting philosophy for the company many hold up as an exemplar of innovation.

Requisite variety and coarse adaptation

The concept of requisite variety, developed by W. Ross Ashby in 1956,(2) essentially states that only complexity can deal with complexity. In a business context, it means that an enterprise operating in a complex, unpredictable, and turbulent environment requires a variety, or rather the right variety, of strategies, structures, and skills in order to survive and thrive.

An analogy can be drawn with the adaptation of biological species to their environments. A species that is “finely” adapted to the environment is exquisitely fitted to thrive in that particular environment. The better fitted a species is to a specific environment, the more likely it is to survive and thrive – unless the environment changes, in which case a finely adapted species may find itself on a rapid path to extinction. A “coarsely” adapted species, on the other hand, is not optimally fitted for any particular environment, but rather is able to survive in a variety of environments. It may not do as well in any particular environment as a finely adapted species – yet it is much better positioned to survive if the environment changes, since it can survive under a range of different circumstances.(3)

In a world where the future is unknowable, an organization must be “coarsely adapted” in order to be both agile and resilient. In the book The Strategy Paradox, Michael Raynor makes a similar point about strategic flexibility. The more committed an enterprise is to a particular strategy, the more likely it is to either succeed or to fail. He argues for developing options that increase strategic flexibility and deferring firm commitments until uncertainty is reduced. Raynor notes that wholehearted commitment to a strategy keyed to a specific environment can bring success as long as the environment remains unchanged. Unfortunately, such commitment leaves the organization less able to adapt to sudden environmental change, which occurs much more often than we typically think. “The downside of commitment,” Raynor observes, “is that if you happen to make the wrong commitments, it can take a long time to undo them and make new ones.”

The idea of holding open a portfolio of strategic options runs counter to conventional strategy-setting approach, in which leaders try to select a single “maximizing” strategy that drives the greatest returns. However, a maximizing strategy is usually highly tailored to current circumstances – and thus, no matter how well it may work in the short term, is apt to fail when circumstances inevitably change. This is why we recommend pursuing a requisite variety of “optimizing” strategies rather than a single “maximizing” strategy: Such an approach is far more resilient to shifts in the marketplace and therefore more appropriate for survival and success over the long term.

Steps to a Risk Intelligent strategy

A Risk Intelligent strategy begins with constructively challenging one’s own assumptions, is refined through signal detection and interpretation, and concludes with a portfolio of strategic options that the organization holds in readiness against the day when it knows which potential future has or will become reality. To develop a Risk Intelligent

strategy for your own organization, consider doing the following:

- Use the TAS framework to identify and challenge the fundamental assumptions (the white swans) on which your current strategy is based. Create a list of unexpected events and consider the significance of each to the enterprise.

- Identify and look for signals that may indicate whether the occurrence or emergence of unexpected events.

- Ask if each unexpected event is a “friend or foe”: Understand whether it is an opportunity, a threat, or both.

- Develop a strategy that contains a requisite variety of strategic options. Hold open the appropriate number and type of strategic alternatives that will allow your business to be resilient in adversity and agile in seizing fleeting opportunity.

A Risk Intelligent approach to strategy is the foundation of the successful enterprise. Challenging one’s most strongly held assumptions is a crucial step in the formulation of a Risk Intelligent strategy. The rapid pace of change in today’s turbulent economy demands a Risk Intelligent approach to strategic planning and decision making that has considered, and appropriately taken into account, the possibility that what people “know for sure … just ain’t so.”

This whitepaper is based on concepts discussed in the book Surviving and Thriving in Uncertainty: Creating the Risk Intelligent Enterprise, written by Frederick Funston and Stephen Wagner (Wiley & Sons, 2010). More information on the book is available at www.deloitte.com/us/survivingandthriving

Very special thanks to retired Deloitte & Touche LLP principal Frederick Funston for contributing to this whitepaper.

(1) Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable (New York: Random House, 2007).

(2) W. Ross Ashby, An Introduction to Cybernetics (London: Chapman & Hall, 1956).

(3) See Richard Bookstaber, “A demon of our own design: Markets, Hedge Funds and the Perils of Financial Innovation,” John Wiley & Sons, 2007.

Very special thanks to retired Deloitte & Touche LLP principal Frederick Funston for contributing to this whitepaper.

(1) Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable (New York: Random House, 2007).

(2) W. Ross Ashby, An Introduction to Cybernetics (London: Chapman & Hall, 1956).

(3) See Richard Bookstaber, “A demon of our own design: Markets, Hedge Funds and the Perils of Financial Innovation,” John Wiley & Sons, 2007.

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group