Whats in a hashtag name?

A year ago we spelled out InsuranceTech. Now the markets seems to have coalesced around #Insurtech. Insuretech with an e is perfectly logical, but it is less popular (as per Google Trends). Instech is still the most popular on Google Trends but suffers from a disambiguation problem - many of the top 5 results have nothing to do with Insurance and we see that people who chose Instech initially (with great logic) are using both Instech and Insurtech. We believe that Insurtech is what the market is signaling.

Mind the MVP PMF Chasm

When you get off the Tube (American = Subway) at Bank (American = Wall Street), the announcer tells you to "mind the gap" (between the train and the platform).

Startup investors have learned to worry about something much bigger than a gap, namely a chasm. In this case it is the chasm between Minimum Viable Product (MVP) and Product Market Fit (PMF).

Insurtech is currently in the Cambrian Explosion phase, which is the conceptual story phase when a lot of MVP ventures hit the market. Early stage Funding is based on a highly plausible conceptual story about where value will be created. A lot of new ventures are created. There is a lot of media hype. The story shows massive market opportunity enabled by disruptive technology. Both are real. It is possible for all companies formed in the Cambrian explosion to fail, but this is unusual. What is quite normal is for all companies formed in the Cambrian explosion to appear to fail temporarily. Sometimes the story is right, but the timing is off. For example, the Dot Com bubble and burst and eventual rebirth from 2003 to 2011 followed this trajectory. Once enough people had Internet connectivity (almost) all the conceptual story phase dreams of the Dot Com era did become true, but we had to go through a major slough of despond first. The ventures that make it to PMF then enter the ScaleUp phase and since digitization went mainstream, the time between PMF and ScaleUp has become really short and the growth rates of ventures in the ScaleUp phase are stunning. So, despite the chasm between MVP and PMF, this early stage Cambrian Explosion phase attracts a lot of great entrepreneurs and investors.

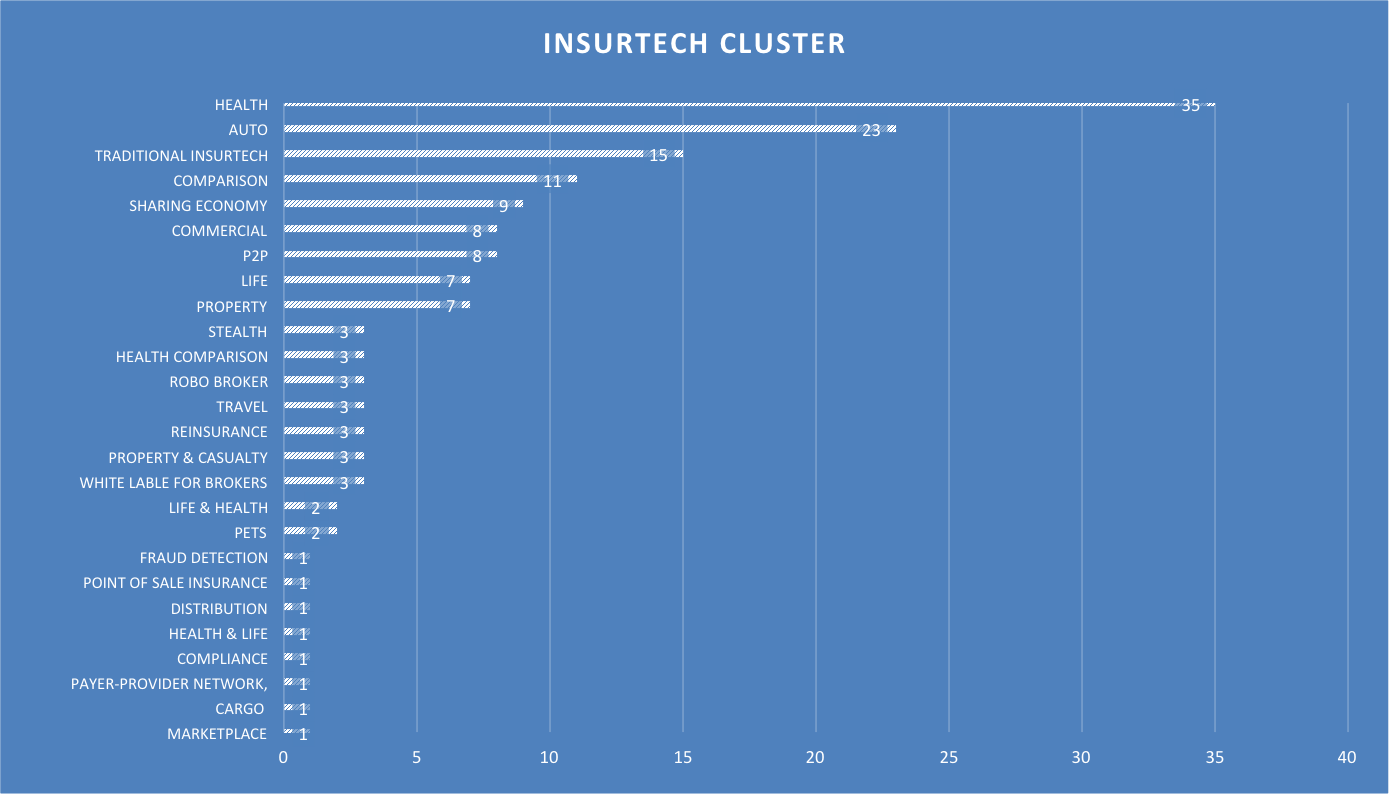

How many in each Category

Here is the chart:

A year ago we spelled out InsuranceTech. Now the markets seems to have coalesced around #Insurtech. Insuretech with an e is perfectly logical, but it is less popular (as per Google Trends). Instech is still the most popular on Google Trends but suffers from a disambiguation problem - many of the top 5 results have nothing to do with Insurance and we see that people who chose Instech initially (with great logic) are using both Instech and Insurtech. We believe that Insurtech is what the market is signaling.

Mind the MVP PMF Chasm

When you get off the Tube (American = Subway) at Bank (American = Wall Street), the announcer tells you to "mind the gap" (between the train and the platform).

Startup investors have learned to worry about something much bigger than a gap, namely a chasm. In this case it is the chasm between Minimum Viable Product (MVP) and Product Market Fit (PMF).

Insurtech is currently in the Cambrian Explosion phase, which is the conceptual story phase when a lot of MVP ventures hit the market. Early stage Funding is based on a highly plausible conceptual story about where value will be created. A lot of new ventures are created. There is a lot of media hype. The story shows massive market opportunity enabled by disruptive technology. Both are real. It is possible for all companies formed in the Cambrian explosion to fail, but this is unusual. What is quite normal is for all companies formed in the Cambrian explosion to appear to fail temporarily. Sometimes the story is right, but the timing is off. For example, the Dot Com bubble and burst and eventual rebirth from 2003 to 2011 followed this trajectory. Once enough people had Internet connectivity (almost) all the conceptual story phase dreams of the Dot Com era did become true, but we had to go through a major slough of despond first. The ventures that make it to PMF then enter the ScaleUp phase and since digitization went mainstream, the time between PMF and ScaleUp has become really short and the growth rates of ventures in the ScaleUp phase are stunning. So, despite the chasm between MVP and PMF, this early stage Cambrian Explosion phase attracts a lot of great entrepreneurs and investors.

How many in each Category

Here is the chart:

Here is our analysis of the Top 8 Categories:

- Health. No surprise here. It is a US specific opportunity but massive. Here is our take on one of the biggest players – Oscar.

- Auto. The Telematics sensors opportunity (aka Internet of Things In My Car) is a potential game-changer to assess risk (and thus to price premiums).

- Comparison Sites. This sounds boring and is certainly not disruptive. However, it is a really useful service for consumers and has a simple proven business model and we assume that at least one Comparison site by country and by insurance specialty will probably thrive.

- Sharing Economy. This is a blue ocean opportunity. It is so new as a need that the incumbents don’t offer a clear focused proposition, leaving the market window open for startups.

- Commercial. There is a complexity in Small Business Insurance that is an advantage for ventures that understand the nuances. Insurance incumbents, like banks, have tended to ignore Small Business, leaving the market window open for startups.

- P2P. Peer To Peer Insurance is one of those concepts that may change the world or may fade away. The jury aka market is still out on this one and the MVP to PMF chasm awaits any that stumble on route to market. Our take on Lemonade is here.

- Life. As Amy Radin points out, Life Insurance has been a market left to decay by incumbents, leaving the market window open for startups.

- Property. There is a lot of room for innovation around using Blockchain for provenance/title and there is big risk to manage around new non-linear risks (not easy to model statistically) related to extreme weather and terrorism.

- Health. No surprise here. It is a US specific opportunity but massive. Here is our take on one of the biggest players – Oscar.

- Auto. The Telematics sensors opportunity (aka Internet of Things In My Car) is a potential game-changer to assess risk (and thus to price premiums).

- Comparison Sites. This sounds boring and is certainly not disruptive. However, it is a really useful service for consumers and has a simple proven business model and we assume that at least one Comparison site by country and by insurance specialty will probably thrive.

- Sharing Economy. This is a blue ocean opportunity. It is so new as a need that the incumbents don’t offer a clear focused proposition, leaving the market window open for startups.

- Commercial. There is a complexity in Small Business Insurance that is an advantage for ventures that understand the nuances. Insurance incumbents, like banks, have tended to ignore Small Business, leaving the market window open for startups.

- P2P. Peer To Peer Insurance is one of those concepts that may change the world or may fade away. The jury aka market is still out on this one and the MVP to PMF chasm awaits any that stumble on route to market. Our take on Lemonade is here.

- Life. As Amy Radin points out, Life Insurance has been a market left to decay by incumbents, leaving the market window open for startups.

- Property. There is a lot of room for innovation around using Blockchain for provenance/title and there is big risk to manage around new non-linear risks (not easy to model statistically) related to extreme weather and terrorism.

Bernard Lunn

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Blockchain révolution & Digital transformation.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief FinTech Officer

- The Chief Blockchain Officer

- The Chief Digital Officer

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Blockchain révolution & Digital transformation.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief FinTech Officer

- The Chief Blockchain Officer

- The Chief Digital Officer

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group