The above aphorism from the inventor of the gastronomy essay can definitely be applied to the word of investing. “Tell me who you invest in and I will tell you what type of investor you are” or better “Tell me how you invest and I will tell you what type of investor you are”.

I was reminded of this aphorism when working on an investment opportunity recently. Typical story of a startup raising capital from a heterogeneous group of investors comprised of traditional VC firms, corporate VC firms and corporates.

Investors who specialize in a given sector and executives who operate in the same sector tend to work off of the same business assumptions and have a common understanding. As such, their analysis, although it may vary at the margin, usually overlaps materially in terms of conclusions and views. In other words, they usually share the same outlook on most business opportunities, on most startups.

Yet there is one thing – amongst many others I realize – that different types of investors and operators do not share and that is the discount rate they use to value the forward looking cash flow projections of a startup.

Early stage investing is a risky business where valuing a startup is more an art form than a science and where external events, such as the health of public markets, is a heavy factor – see these excellent posts from @mjsuster here and @thejoefloyd here. This makes it even more important to value startups without any exuberant bias on the upside – as much as that can be avoided – and to be fair without overly conservatism – so would the entrepreneurs rightly would want it. Too rich a valuation when a startup does not warrant it or is not ready for it can be a killer blow later one when traction and progress do not follow. In other words, beware of the high valuation you wish for as an entrepreneur as it can become a double edge sword.

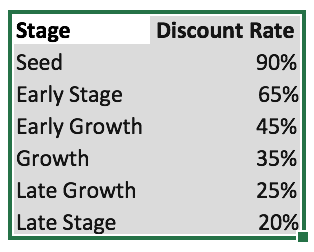

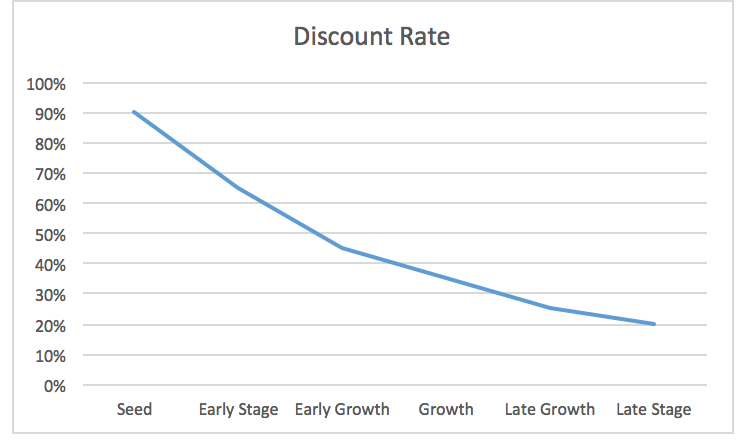

Now, much literature has been dedicated to figuring out – sometimes scientifically, sometimes less so – how to properly value a startup and how to find the right discount rate to do so. My point is not to recreate the wheel but to provide directional understanding. It is not unreasonable to state that discount rates for valuing startups can be as high as 90% and depend on the maturity of said startup. I have come up with the following graph to illustrate the discount rates one can use based on the stage of a startup. Obviously some will argue for different start and end points discount rates. Still, directionally, the resulting graph is appropriate.

Bio:

Life and work experiences have given Pascal an unmatched vantage point, seeing things as both venture capitalist and aspiring entrepreneur. He currently is a Venture Partner with Santander Innoventures – Santander Group’s Global Fintech fund. Previously he was General Partner with Route 66 Ventures where he built the firm’s venture arm into a top 20 global fintech investor. Pascal puts his experience to work managing early and late stage equity investments (VC/PE). This perspective and his knowledge of banking, financial services and software services have made Pascal a true innovator in the VC arena. His current focus is on emerging and high-growth FinServ and FinTech companies in consensus ledger technology (his term for blockchain and distributed ledger technology), digital banking and insurance in the U.S., Europe, and Asia.

Pascal launched his career as a commercial banker for Europe’s Banque Paribas, in Paris. During the late 1980s, he moved to managing investments at Dai Ichi Kangyo Bank, the world’s largest commercial bank based in Tokyo. Here, he built a diverse, $500+ million portfolio in senior, subordinated loans, and equity investments. Pascal moved to the U.S. in 1990, where he cemented his passion for operating early stage ventures and investing.

I was reminded of this aphorism when working on an investment opportunity recently. Typical story of a startup raising capital from a heterogeneous group of investors comprised of traditional VC firms, corporate VC firms and corporates.

Investors who specialize in a given sector and executives who operate in the same sector tend to work off of the same business assumptions and have a common understanding. As such, their analysis, although it may vary at the margin, usually overlaps materially in terms of conclusions and views. In other words, they usually share the same outlook on most business opportunities, on most startups.

Yet there is one thing – amongst many others I realize – that different types of investors and operators do not share and that is the discount rate they use to value the forward looking cash flow projections of a startup.

Early stage investing is a risky business where valuing a startup is more an art form than a science and where external events, such as the health of public markets, is a heavy factor – see these excellent posts from @mjsuster here and @thejoefloyd here. This makes it even more important to value startups without any exuberant bias on the upside – as much as that can be avoided – and to be fair without overly conservatism – so would the entrepreneurs rightly would want it. Too rich a valuation when a startup does not warrant it or is not ready for it can be a killer blow later one when traction and progress do not follow. In other words, beware of the high valuation you wish for as an entrepreneur as it can become a double edge sword.

Now, much literature has been dedicated to figuring out – sometimes scientifically, sometimes less so – how to properly value a startup and how to find the right discount rate to do so. My point is not to recreate the wheel but to provide directional understanding. It is not unreasonable to state that discount rates for valuing startups can be as high as 90% and depend on the maturity of said startup. I have come up with the following graph to illustrate the discount rates one can use based on the stage of a startup. Obviously some will argue for different start and end points discount rates. Still, directionally, the resulting graph is appropriate.

Bio:

Life and work experiences have given Pascal an unmatched vantage point, seeing things as both venture capitalist and aspiring entrepreneur. He currently is a Venture Partner with Santander Innoventures – Santander Group’s Global Fintech fund. Previously he was General Partner with Route 66 Ventures where he built the firm’s venture arm into a top 20 global fintech investor. Pascal puts his experience to work managing early and late stage equity investments (VC/PE). This perspective and his knowledge of banking, financial services and software services have made Pascal a true innovator in the VC arena. His current focus is on emerging and high-growth FinServ and FinTech companies in consensus ledger technology (his term for blockchain and distributed ledger technology), digital banking and insurance in the U.S., Europe, and Asia.

Pascal launched his career as a commercial banker for Europe’s Banque Paribas, in Paris. During the late 1980s, he moved to managing investments at Dai Ichi Kangyo Bank, the world’s largest commercial bank based in Tokyo. Here, he built a diverse, $500+ million portfolio in senior, subordinated loans, and equity investments. Pascal moved to the U.S. in 1990, where he cemented his passion for operating early stage ventures and investing.

I have segmented the life of a startup into 6 stages – some will segment differently I realize. I then ascribed decreasing discount rates for each stage, from Seed to Late Stage, to reflect the base risk free return which does not change from one stage to another and the liquidity and risk premiums needed to be added to the risk free return at each stage. I started with a 90% discount rate for seed ending with a 20% discount rate for late stage. Again, I do not pretend to be mathematically correct, just to set the stage for discussion.

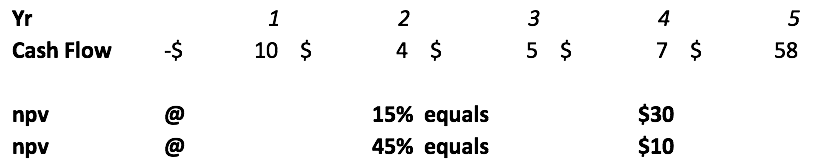

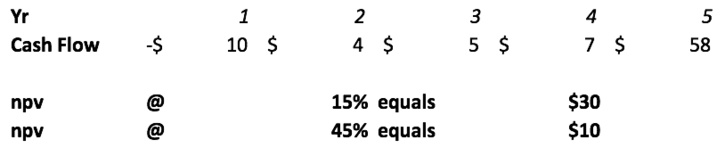

Next, I came up with a hypothetical string of cash flows for a startup over a 5 year horizon (let’s suspend disbelief and for ease of calculation, not take into account any terminal value), with said startup being in early growth stage . I then calculated a net present value (npv), which for all intent purposes will equate to the valuation of a company an investor would calculate. I calculated said valuation based on two discount rates: 45% and 15%.

The 45% discount rate is equivalent to early stage growth and would typically be used by an independent venture firm.

The 15%, obviously much lower than any of the rates used in the above graph, could be used by a corporate as its Weighted Average Cost of Capital (WACC). Indeed banks or insurance companies may very well use a 15% WACC to analyze any investment project.

Various investors value discrete investment or projects based on their own hurdle rates. There is nothing wrong with that per se – one’s own WACC can be a competitive advantage. Still, when one values a early stage investment, one does not value any “old” project. Startups are very risky endeavors and the rate of failure is extremely high. If one value a startup without the proper framework and with inappropriate discount rates, one may badly shoot oneself in the foot so to speak, and hurt the startup one invests in too.

Based on the above example, and assuming a corporate investor and a venture investor have common understanding of the startup they are valuing but are using different discount rates, the corporate investor will value said startup three times higher than the venture investor.

I argue this is potentially very dangerous. I do not know if choice of discount rate is part of the root causes for valuation creep with later stage startups we have experienced lately. I do know that, as many have noted, non-VC investors (corporates, sovereign funds among them) have increased their investment participations with pre IPO later stage startups. What I do know, and this with first hand experience, is that a corporate that invests directly from its balance sheet and is either not sophisticated or inflexible with its valuation frameworks will end up using lower and therefore inappropriate discount rates. A startup CEO may find the end result attractive, YET should think twice about the consequences of accepting a high valuation twice, especially if his/her company is not operationally ready.

Getting back to the fintech world, a financial services incumbent investing on-balance sheet may be prone to such a mistake and the head of a business unit within a bank may have to use too low of a discount rate – whether forced or by ignorance. Financial services incumbents that have set up independent venture funds off-balance sheet will not make the same mistake, presumably, as the captive venture fund will not be similarly constrained when valuing investments. Clearly independent venture funds will never fall prey to this mistake – they make other mistakes mind you. Financial services incumbents may use mitigation tactics such as a) build “cost to build” scenarios with internal IT teams and compare with valuations derived from discounted cash flow methods (DCF), b) ask pure play venture funds to price and lead investments, c) or stop investing on-balance sheet and set up their own venture funds off-balance sheet or in more extreme cases invest in pure play venture firms.

I favor as diverse an approach when valuing a startup, ensuring diversity of view and approach, knowing there is a benefit in being broad but not necessarily in going deep – spending too much time on details tends to create a false sense of accuracy – when setting pre money targets.

I will not get into other types of valuation frameworks in this post – statistical vs deterministic for example – as it is beyond the scope of what I want to illustrate. Be that as it may, does anyone have first hand knowledge of how corporates in general, banks or insurance companies investing on-balance sheet in particular, use discount rates and valuation frameworks when valuing startups? Let me know.

The 45% discount rate is equivalent to early stage growth and would typically be used by an independent venture firm.

The 15%, obviously much lower than any of the rates used in the above graph, could be used by a corporate as its Weighted Average Cost of Capital (WACC). Indeed banks or insurance companies may very well use a 15% WACC to analyze any investment project.

Various investors value discrete investment or projects based on their own hurdle rates. There is nothing wrong with that per se – one’s own WACC can be a competitive advantage. Still, when one values a early stage investment, one does not value any “old” project. Startups are very risky endeavors and the rate of failure is extremely high. If one value a startup without the proper framework and with inappropriate discount rates, one may badly shoot oneself in the foot so to speak, and hurt the startup one invests in too.

Based on the above example, and assuming a corporate investor and a venture investor have common understanding of the startup they are valuing but are using different discount rates, the corporate investor will value said startup three times higher than the venture investor.

I argue this is potentially very dangerous. I do not know if choice of discount rate is part of the root causes for valuation creep with later stage startups we have experienced lately. I do know that, as many have noted, non-VC investors (corporates, sovereign funds among them) have increased their investment participations with pre IPO later stage startups. What I do know, and this with first hand experience, is that a corporate that invests directly from its balance sheet and is either not sophisticated or inflexible with its valuation frameworks will end up using lower and therefore inappropriate discount rates. A startup CEO may find the end result attractive, YET should think twice about the consequences of accepting a high valuation twice, especially if his/her company is not operationally ready.

Getting back to the fintech world, a financial services incumbent investing on-balance sheet may be prone to such a mistake and the head of a business unit within a bank may have to use too low of a discount rate – whether forced or by ignorance. Financial services incumbents that have set up independent venture funds off-balance sheet will not make the same mistake, presumably, as the captive venture fund will not be similarly constrained when valuing investments. Clearly independent venture funds will never fall prey to this mistake – they make other mistakes mind you. Financial services incumbents may use mitigation tactics such as a) build “cost to build” scenarios with internal IT teams and compare with valuations derived from discounted cash flow methods (DCF), b) ask pure play venture funds to price and lead investments, c) or stop investing on-balance sheet and set up their own venture funds off-balance sheet or in more extreme cases invest in pure play venture firms.

I favor as diverse an approach when valuing a startup, ensuring diversity of view and approach, knowing there is a benefit in being broad but not necessarily in going deep – spending too much time on details tends to create a false sense of accuracy – when setting pre money targets.

I will not get into other types of valuation frameworks in this post – statistical vs deterministic for example – as it is beyond the scope of what I want to illustrate. Be that as it may, does anyone have first hand knowledge of how corporates in general, banks or insurance companies investing on-balance sheet in particular, use discount rates and valuation frameworks when valuing startups? Let me know.

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group