A big ocean with a lot of fish

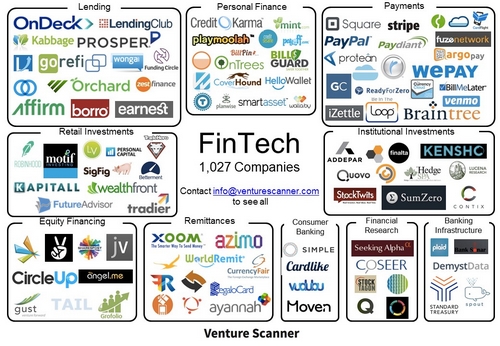

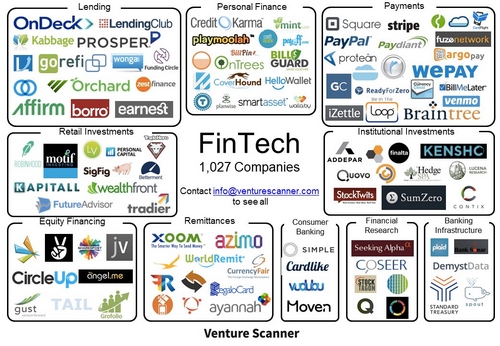

That is how we visualize the overall Fintech market. Fintech is big because Financial Services has been a big % of GDP (e.g. 7% in USA, 10% in UK) and most of it can be delivered digitally (or dramatically enhanced digitally).

Fintech is an ocean because whatever categories we define, the lines will be increasingly blurred over time and the fish (customers) will move from one part of the ocean to another, even if we can expect more of a certain type of fish in a certain part of the ocean. Business practices & models that evolved pre digitization defined the historical Financial Services categories and "bits don't stop at historical category boundaries”. If you take a customer centric approach (which startups have to do if they want to reach Product Market Fit), you ignore artificially defined categories to focus on the needs of real people. Read on for some examples.

How we define the different categories within Fintech

We have 5 Categories within Daily Fintech, neatly coinciding with the 5 days of the week.

- Digital Wealth Management

- Small Business Finance

- Consumer Finance including Underbanked

- Insurance

- The Tech in Fintech

Digital Wealth Management

We define Wealth broadly as being any amount of capital, small or large, that is allocated to financial assets (private equity, public stocks, bonds, currencies, real estate, precious metals, art etc). We include both short-term trading as well as long-term investment. Customers wanting their capital to grow can be passive (leaving it to professionals) or active (sending time to find assets to trade/invest).

Exchanges, brokers & dealers, investment banks, asset managers, private banks, retail and commercial banks, and the entire world within and behind all these front end scenes (such as research, custody & compliance); are all serving wealth creation needs of all sorts and at all levels, ranging from millennials to corporates.

Digital Wealth Management is so intrusive that in a few years we wont be able to distinguish it from all other basic lifestyle needs. The digitization of Wealth Management affects developed societies and underserved ones.

Small Business Finance

This is a massive opportunity, because banks have ignored small business for so long. Small Business is like a middle child - neither the oldest (big business) nor the youngest (consumer). This illustrates the old adage that innovation comes from those who have been excluded from the old way of doing things. Small business needs the same Corporate Finance products that big business needs (such as debt, equity, payments, foreign exchange) but to serve these efficiently to millions of small businesses requires a far higher degree of automation and different business models. The models for a small business service are just as likely to come from Consumer Finance as they are from Corporate Finance.

Consumer Finance including Underbanked

This also illustrates the old adage that innovation comes from those who have been excluded from the old way of doing things. There is a lot of competition for consumers in the West. You could classify this market as the Overbanked. As an entrepreneur would you target a market that is already well served by many competent competitors? Or do you go after the billions of people who are emerging into a global middle class even if the revenue per client is tiny? We cover Consumer Finance innovation everywhere, but we tend to see greater innovation traction coming from the Underbanked in the Rest of the World (formerly known as Emerging or Developing, such as China, India, Africa and Latin America). This also underscores the concept of traditional categories blurring. In the developing world, most people are self-employed entrepreneurs, so there is a lot of cross over with small business finance.

Insurance

We see InsurTech as a category within Fintech rather than separate. It is certainly viewed that way within traditional financial services where universal banks such as Citi grew out of a merger between an Insurance company and a Bank. Insurance has two sides. One side takes in Premiums and pays Claims. It is a customer service business with a focus on sales and marketing, business process management and statistical risk management. The other side of Insurance invests that cash flow to make sure they have the capital to pay Claims as needed. This part of Insurance is really part of the Digital Wealth Management category.

The Tech in Fintech

We focus on the use of technology. A more techie description of this category might be cross cutting concerns, those things that cut across all the 4 categories above. So we include Payments within this category. Mostly we focus on technology such as Blockchain, XBRL and AI as well as the change from mass adoption of mobile technology. We view technology as disruptive, but our focus is on the use of technology and customers don't care about disruption - they just want better, faster, cheaper financial services which maybe enabled by technology.

That is how we visualize the overall Fintech market. Fintech is big because Financial Services has been a big % of GDP (e.g. 7% in USA, 10% in UK) and most of it can be delivered digitally (or dramatically enhanced digitally).

Fintech is an ocean because whatever categories we define, the lines will be increasingly blurred over time and the fish (customers) will move from one part of the ocean to another, even if we can expect more of a certain type of fish in a certain part of the ocean. Business practices & models that evolved pre digitization defined the historical Financial Services categories and "bits don't stop at historical category boundaries”. If you take a customer centric approach (which startups have to do if they want to reach Product Market Fit), you ignore artificially defined categories to focus on the needs of real people. Read on for some examples.

How we define the different categories within Fintech

We have 5 Categories within Daily Fintech, neatly coinciding with the 5 days of the week.

- Digital Wealth Management

- Small Business Finance

- Consumer Finance including Underbanked

- Insurance

- The Tech in Fintech

Digital Wealth Management

We define Wealth broadly as being any amount of capital, small or large, that is allocated to financial assets (private equity, public stocks, bonds, currencies, real estate, precious metals, art etc). We include both short-term trading as well as long-term investment. Customers wanting their capital to grow can be passive (leaving it to professionals) or active (sending time to find assets to trade/invest).

Exchanges, brokers & dealers, investment banks, asset managers, private banks, retail and commercial banks, and the entire world within and behind all these front end scenes (such as research, custody & compliance); are all serving wealth creation needs of all sorts and at all levels, ranging from millennials to corporates.

Digital Wealth Management is so intrusive that in a few years we wont be able to distinguish it from all other basic lifestyle needs. The digitization of Wealth Management affects developed societies and underserved ones.

Small Business Finance

This is a massive opportunity, because banks have ignored small business for so long. Small Business is like a middle child - neither the oldest (big business) nor the youngest (consumer). This illustrates the old adage that innovation comes from those who have been excluded from the old way of doing things. Small business needs the same Corporate Finance products that big business needs (such as debt, equity, payments, foreign exchange) but to serve these efficiently to millions of small businesses requires a far higher degree of automation and different business models. The models for a small business service are just as likely to come from Consumer Finance as they are from Corporate Finance.

Consumer Finance including Underbanked

This also illustrates the old adage that innovation comes from those who have been excluded from the old way of doing things. There is a lot of competition for consumers in the West. You could classify this market as the Overbanked. As an entrepreneur would you target a market that is already well served by many competent competitors? Or do you go after the billions of people who are emerging into a global middle class even if the revenue per client is tiny? We cover Consumer Finance innovation everywhere, but we tend to see greater innovation traction coming from the Underbanked in the Rest of the World (formerly known as Emerging or Developing, such as China, India, Africa and Latin America). This also underscores the concept of traditional categories blurring. In the developing world, most people are self-employed entrepreneurs, so there is a lot of cross over with small business finance.

Insurance

We see InsurTech as a category within Fintech rather than separate. It is certainly viewed that way within traditional financial services where universal banks such as Citi grew out of a merger between an Insurance company and a Bank. Insurance has two sides. One side takes in Premiums and pays Claims. It is a customer service business with a focus on sales and marketing, business process management and statistical risk management. The other side of Insurance invests that cash flow to make sure they have the capital to pay Claims as needed. This part of Insurance is really part of the Digital Wealth Management category.

The Tech in Fintech

We focus on the use of technology. A more techie description of this category might be cross cutting concerns, those things that cut across all the 4 categories above. So we include Payments within this category. Mostly we focus on technology such as Blockchain, XBRL and AI as well as the change from mass adoption of mobile technology. We view technology as disruptive, but our focus is on the use of technology and customers don't care about disruption - they just want better, faster, cheaper financial services which maybe enabled by technology.

Bernard Lunn

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Blockchain révolution & Digital transformation.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief FinTech Officer

- The Chief Blockchain Officer

- The Chief Digital Officer

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Blockchain révolution & Digital transformation.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief FinTech Officer

- The Chief Blockchain Officer

- The Chief Digital Officer

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group