Aside from Bitcoin, Ethereum is the most important blockchain platform. It has undoubtedly inspired and moved the whole crypto market forward.

Five and half years into its inception, I believe that Ethereum is at a proverbial fork in deciding what future trajectory it wants to choose.

Recently, there has been some public criticism about Ethereum’s evolution that I will not re-hash here. I have been mostly silent, as I wanted to fully analyze the situation and come-up with some solutions, before rushing into judgement. I decided that if I was going to express dissatisfaction, I would do it along a constructive path.

For background, and for some newcomers who have joined the blockchain (or Ethereum) ecosystems only in the past 2 or 3 years, my history with Ethereum and its Foundation takes roots to its inception days in the late 2013 timeframe. Starting in early 2014, soon after the white paper was published, I became one of the first advisors to the Ethereum Foundation, and witnessed up-close its evolution and early emancipation, leading-up to its public sale. Back in 2014, I helped the initial Ethereum co-founders figure out their key messaging and positioning, much of that work still showing its fingerprint today, via the “platform for decentralized applications” moniker. In 2015, at a time when the project was still very technical, I felt the need to explain its implications in a more friendly business language, so I wrote the first business-oriented essay explaining what Ethereum meant and what it could become, The Business Imperative Behind the Ethereum Vision. I remained closely associated with the Ethereum Foundation and Vitalik in particular, helping them gain their footing, until early 2017 when the Foundation dissolved their Ethereum Advisors.

Since then, I continued to be a fervent and vocal Ethereum advocate, speaking at various occasions about the strength of the Ethereum Ecosystem at key events such as DevCon1 in London (2015), Edcon in Paris (2017) and Toronto (2018), ETH-Waterloo (2017), ETH-Denver (2018, starts at 52:00), and more recently, in March 2019 at the Paris ETH-CC with a talk titled Challenges in Growing the Ethereum Ecosystem as a Community. In this last talk, I pondered if Ethereum’s greatest strength,- its community approach, has now become its key challenge. In addition, I’ve attended (or listened to) several core dev or community calls, and regularly interacted for several years now, with developers and entrepreneurs that are using the Ethereum platform.

For disclosure purposes and added context, I do have a few investments in Ethereum-related startups, technology projects or cryptocurrencies. I am therefore vested in the success of Ethereum, so my criticism is not intended to cause it harm at the benefit of another competing platform (as some other critics’ motives are). Rather, my observations are meant to (hopefully) send a strong message of self-introspection and potential change for the better.

First, I’d like to make it clear that I firmly believe that Ethereum still has a significant edge over other players in the blockchain industry. To properly measure Ethereum’s market leadership, you need to evaluate “together” the combination of the several dimensions of factors that determine a given blockchain platform’s success: size of its global community of developers, degree of technological decentralization, number of apps created on it, number of P2P nodes that support it, capital generated from it or invested into its startups, diversity of industries it touches, richness in functionality, choice of development tools and languages, scale of innovation that springs from it, smart contract language capabilities, regularity and breadth of software updates, quality of cryptographic advancement research, and I’ve probably left a few other components.

Add to all of this, Ethereum’s most important characteristic: the fact that it remains dogmatically committed to decentralization as an infallible raison d’être from an infrastructure perspective. Running close to 5,000 nodes harmoniously bestows Ethereum a handicap index that no other blockchain (except Bitcoin’s) can claim to inflict itself with, resulting in actually being a bona-fide sovereign-grade blockchain. That is an ambitious principle to live by, a principle that, once removed, would lower the degree of complexity of achieving scalability and speed, by orders of magnitude.

Today, Ethereum is still the envy of other blockchains, and as an expected result of being the leader, it gets attacked continuously. Most other emerging competitors try to angle for a perceived weakness that supposedly Ethereum has, such as on-chain governance, faster settlement times, less energy consumption, or unclear market messaging. But as I’ve been saying for a while: Ethereum’s most important feature is not a feature. It is rather the strength of its contributing and supporting community, and that’s something that no competitor can copy.

Most other blockchain competitors have stronger central, command-and-control modus operandi as they try to emulate Ethereum’s success in propagating their footprint into global communities or luring developers with grants and financial incentives. In contrast, having started with an original, powerful and magnetic vision, Ethereum’s community gets drawn to Ethereum by their own accord, and in a ground-swell fashion. Ethereum’s grants aren’t focused on luring developers from other platforms, rather they aim to fund efforts that contribute to Ethereum’s own strength. The Ethereum community’s growth is self- motivated. Many of its community events or hackathons regularly attract thousands of attendees whereas many of its competitors struggle to get a few hundred or dozen attendees at similar functions.

For an update on Ethereum’s strengths and uniqueness, please refer to Joseph Lubin’s presentation in Seoul and video where he introduces the concept of “Decentralized Transaction Processing” DTPS, a new measure that factors the degree of decentralization into blockchain transactions speed as a primordial factor that trumps fast, but less decentralized transaction throughput achievements in other blockchain platforms.

In light of the regulatory uncertainty that followed its ICO, the Ethereum Foundation went out of its way to not centralize itself. By its own admittance, and to prove the (SEC) loosely defined decentralized attributes, the Ethereum Foundation did not want to be a central force that drives or controls the economic outcomes of its underlying cryptocurrency. At the last DevCon 4, Ethereum’s Executive Director Aya Miyaguchi stated: “We are willing to decentralize decision-making and funding, no matter how chaotic it looks.”

However, this voluntary laissez-faire has been chaotic enough to the point of yielding inefficient progress, produced an extreme obsession with consensus decision-making (at the expense of some excessive delays in decisions), engendered overlapping agendas or efforts, and created an overall complacency for making changes happen fast enough.

Despite all this success, it is my opinion that the Ethereum Foundation must re-invent itself once again. How it evolves may determine Ethereum’s degree of future success. Change must come together from the outside, and not only from the Foundation itself. Ultimately, that would elevate the eventual state of effective decentralization it aspires to continuously live-up to.

How Ethereum evolves is a primordial topic today, and I don’t know of a better to way to express it than to lay out my specific thoughts about it.

Here’s what I think should happen with the evolution of Ethereum.

Five and half years into its inception, I believe that Ethereum is at a proverbial fork in deciding what future trajectory it wants to choose.

Recently, there has been some public criticism about Ethereum’s evolution that I will not re-hash here. I have been mostly silent, as I wanted to fully analyze the situation and come-up with some solutions, before rushing into judgement. I decided that if I was going to express dissatisfaction, I would do it along a constructive path.

For background, and for some newcomers who have joined the blockchain (or Ethereum) ecosystems only in the past 2 or 3 years, my history with Ethereum and its Foundation takes roots to its inception days in the late 2013 timeframe. Starting in early 2014, soon after the white paper was published, I became one of the first advisors to the Ethereum Foundation, and witnessed up-close its evolution and early emancipation, leading-up to its public sale. Back in 2014, I helped the initial Ethereum co-founders figure out their key messaging and positioning, much of that work still showing its fingerprint today, via the “platform for decentralized applications” moniker. In 2015, at a time when the project was still very technical, I felt the need to explain its implications in a more friendly business language, so I wrote the first business-oriented essay explaining what Ethereum meant and what it could become, The Business Imperative Behind the Ethereum Vision. I remained closely associated with the Ethereum Foundation and Vitalik in particular, helping them gain their footing, until early 2017 when the Foundation dissolved their Ethereum Advisors.

Since then, I continued to be a fervent and vocal Ethereum advocate, speaking at various occasions about the strength of the Ethereum Ecosystem at key events such as DevCon1 in London (2015), Edcon in Paris (2017) and Toronto (2018), ETH-Waterloo (2017), ETH-Denver (2018, starts at 52:00), and more recently, in March 2019 at the Paris ETH-CC with a talk titled Challenges in Growing the Ethereum Ecosystem as a Community. In this last talk, I pondered if Ethereum’s greatest strength,- its community approach, has now become its key challenge. In addition, I’ve attended (or listened to) several core dev or community calls, and regularly interacted for several years now, with developers and entrepreneurs that are using the Ethereum platform.

For disclosure purposes and added context, I do have a few investments in Ethereum-related startups, technology projects or cryptocurrencies. I am therefore vested in the success of Ethereum, so my criticism is not intended to cause it harm at the benefit of another competing platform (as some other critics’ motives are). Rather, my observations are meant to (hopefully) send a strong message of self-introspection and potential change for the better.

First, I’d like to make it clear that I firmly believe that Ethereum still has a significant edge over other players in the blockchain industry. To properly measure Ethereum’s market leadership, you need to evaluate “together” the combination of the several dimensions of factors that determine a given blockchain platform’s success: size of its global community of developers, degree of technological decentralization, number of apps created on it, number of P2P nodes that support it, capital generated from it or invested into its startups, diversity of industries it touches, richness in functionality, choice of development tools and languages, scale of innovation that springs from it, smart contract language capabilities, regularity and breadth of software updates, quality of cryptographic advancement research, and I’ve probably left a few other components.

Add to all of this, Ethereum’s most important characteristic: the fact that it remains dogmatically committed to decentralization as an infallible raison d’être from an infrastructure perspective. Running close to 5,000 nodes harmoniously bestows Ethereum a handicap index that no other blockchain (except Bitcoin’s) can claim to inflict itself with, resulting in actually being a bona-fide sovereign-grade blockchain. That is an ambitious principle to live by, a principle that, once removed, would lower the degree of complexity of achieving scalability and speed, by orders of magnitude.

Today, Ethereum is still the envy of other blockchains, and as an expected result of being the leader, it gets attacked continuously. Most other emerging competitors try to angle for a perceived weakness that supposedly Ethereum has, such as on-chain governance, faster settlement times, less energy consumption, or unclear market messaging. But as I’ve been saying for a while: Ethereum’s most important feature is not a feature. It is rather the strength of its contributing and supporting community, and that’s something that no competitor can copy.

Most other blockchain competitors have stronger central, command-and-control modus operandi as they try to emulate Ethereum’s success in propagating their footprint into global communities or luring developers with grants and financial incentives. In contrast, having started with an original, powerful and magnetic vision, Ethereum’s community gets drawn to Ethereum by their own accord, and in a ground-swell fashion. Ethereum’s grants aren’t focused on luring developers from other platforms, rather they aim to fund efforts that contribute to Ethereum’s own strength. The Ethereum community’s growth is self- motivated. Many of its community events or hackathons regularly attract thousands of attendees whereas many of its competitors struggle to get a few hundred or dozen attendees at similar functions.

For an update on Ethereum’s strengths and uniqueness, please refer to Joseph Lubin’s presentation in Seoul and video where he introduces the concept of “Decentralized Transaction Processing” DTPS, a new measure that factors the degree of decentralization into blockchain transactions speed as a primordial factor that trumps fast, but less decentralized transaction throughput achievements in other blockchain platforms.

In light of the regulatory uncertainty that followed its ICO, the Ethereum Foundation went out of its way to not centralize itself. By its own admittance, and to prove the (SEC) loosely defined decentralized attributes, the Ethereum Foundation did not want to be a central force that drives or controls the economic outcomes of its underlying cryptocurrency. At the last DevCon 4, Ethereum’s Executive Director Aya Miyaguchi stated: “We are willing to decentralize decision-making and funding, no matter how chaotic it looks.”

However, this voluntary laissez-faire has been chaotic enough to the point of yielding inefficient progress, produced an extreme obsession with consensus decision-making (at the expense of some excessive delays in decisions), engendered overlapping agendas or efforts, and created an overall complacency for making changes happen fast enough.

Despite all this success, it is my opinion that the Ethereum Foundation must re-invent itself once again. How it evolves may determine Ethereum’s degree of future success. Change must come together from the outside, and not only from the Foundation itself. Ultimately, that would elevate the eventual state of effective decentralization it aspires to continuously live-up to.

How Ethereum evolves is a primordial topic today, and I don’t know of a better to way to express it than to lay out my specific thoughts about it.

Here’s what I think should happen with the evolution of Ethereum.

Let’s start with the Ethereum Foundation (EF). If its current annual burn rate of $20 million supporting 100 employees is correct, there is definitely room for improving what’s being delivered, and how its resources could be more efficiently managed. Historically, the EF has not excelled at efficiently managing its people, regularly communicating with the market (although it did so more on its blog previously), or being transparent about how it manages its financial and operational affairs.

I propose to keep the $20 million annual budget, but distribute it differently. Here’s a set of specific recommendations:

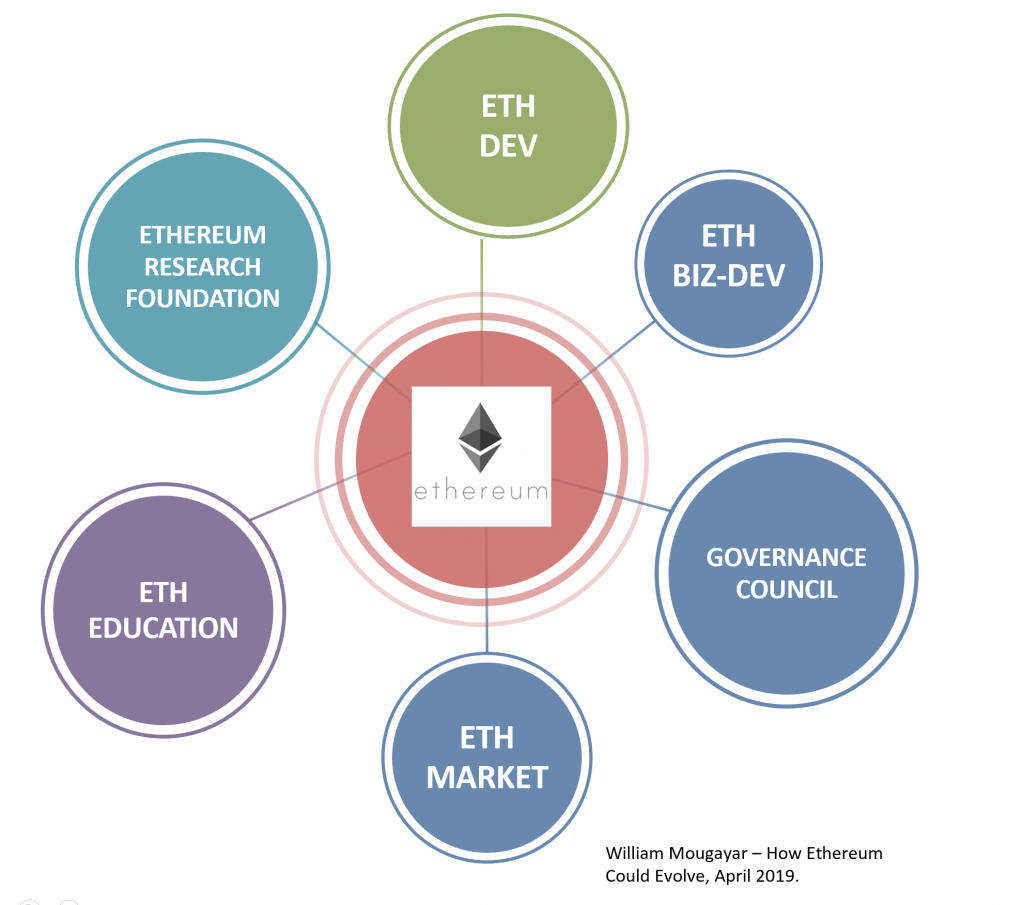

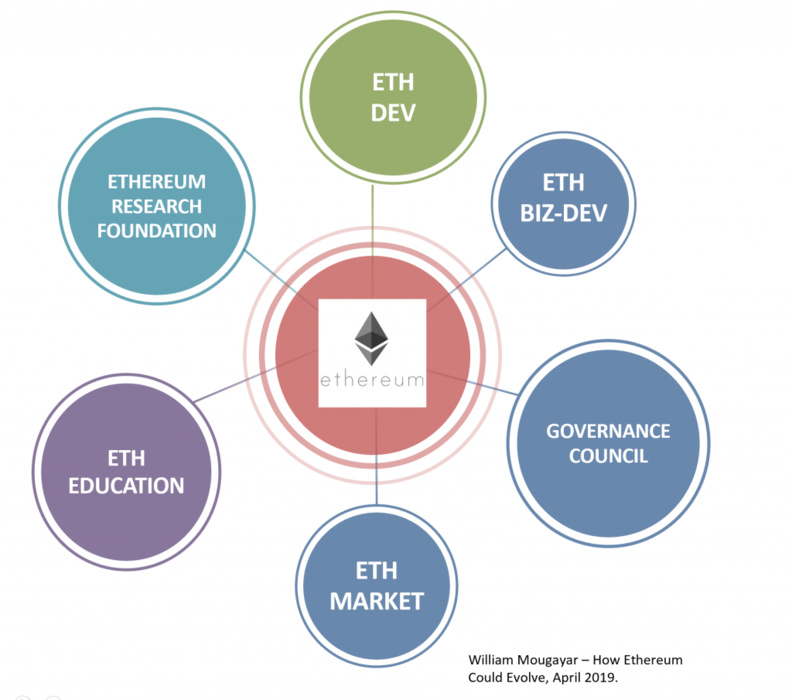

#1 Rename the Ethereum Foundation to Ethereum Research Foundation

The Ethereum Foundation’s focus should be on research, not development, and therefore could be renamed as the Ethereum Research Foundation. Let’s face it. The core of the Ethereum Foundation has been research, an area they excel and revel in, but since Jeffrey Wilcke and Gavin Wood left it, they have not been so efficient at rolling out a good cadence of software updates and improvements. I realize that splitting research from development is a delicate operation, given how embroiled both functions have become within the Ethereum Foundation, but there is a precedent if you look at how Microsoft Research is run for example. Budget $7.5M.

#2 Revive EthDev with a Focus on Software Development

Soon after raising $18M from its ICO, the Ethereum Foundation set-up a group called EthDev, a development oriented organization focused on delivering what they promised. I suggest to revive EthDev or form an equivalent organization that is headed by an experienced full-time CTO or Head of Software Engineering. That group should be laser-focused on software development and delivery based on known and agreed-upon priorities, across all aspects of Ethereum’s evolution,- Eth 1.x, Eth 2.0 and sharding implementations included. Budget $7.5M.

#3 Fund EthMarket to Properly and Regularly Communicate Ethereum’s Positions and Updates

Create a small group that focuses on officially communicating all of the work that Ethereum is doing, properly messaging to the market Ethereum’s strengths, and defending/rebutting claims made by the competition. Allow this group to organize the next Ethereum global conference, not just as a DevCon but as a true melding of business and technical communities together. And it would provide a unified voice that can re-reclaim the “Ethereum narrative”. Initial budget $1M.

#4 Spin EthHub as EthEducation, the Education Jumping Point

Energize EthHub’s excellent work, and make it a cohesive jumping point for everything related to Ethereum education for developers. Beef it up even further. Initial budget $1M.

#5 Create EthBizDev to Support the Strategic Adoption of Ethereum Technology

Ethereum can take a page from AWS or Microsoft Azure’s approach to forging and nurturing relationships with key developer organizations. Form a small group, focused on strategic relationships, evangelism, and adoption. Initial budget $1M.

#6 Form an Ethereum Governance Council with a Mixed Business and Technical Composition

This Ethereum Council would become the new Ethereum heartbeat. Initially, it could consist of 1 representative from each of the above groups (except for 2 reps from the Ethereum Research Foundation), and another 4-6 external members with noted business experience in growing and managing tech organizations. A 6-month chair rotation could be implemented. The council would meet once per month, with an agenda of updating each other on progress, discussing issues, making some decisions, and taking back action items to their respective groups.

What I’m proposing is not to shake or disturb any of the good ground community work and initiatives that are already taking place, but rather harness them better. Activities like the Ethereum EIPs, Ethereum Magicians, Ethereum Cat Herders, EthCC, EthGlobal, Ethereum Gitter, EthResearch, the Ethereum Enterprise Alliance, Ethereum Github’s repository would continue as they are vibrant and important, but they will be given extra shots in the arm if a newly invigorated distributed organizational structure takes place. A virtual, but more accountable organizational structure would help ensure that no good efforts (or intentions) are being squandered, nor that unproductive work sucks the air out of an otherwise healthy ecosystem that wants to strive and not spin its wheels unnecessarily.

Basically, what I’m proposing is a measured decentralization of activity, with better accountability and a thin layer of old-fashioned management to oversee the overall progress. In essence, we would be giving more muscle to Ethereum.

Let’s face it: the times, they have changed. We aren’t in 2015 or 2016 anymore when Ethereum was the only viable alternative to Bitcoin. Today, there is fierce competition, and it is a factor that cannot be ignored. Even if Ethereum continues to “play nice”, other players are not. The market mistakes Vitalik Buterin’s pleasant and charismatic personality as a soft spot. Some people conflate Vitalik’s kindness and intellectual generosity as an Ethereum project weakness, and exploit that to their own advantages.

Today, the Ethereum 2.0 that’s needed is not just technical. It’s also organizational. Company re-organizations are a common occurrence. For growth reasons or changing market conditions, what worked then doesn’t work anymore, and it gets changed. There is nothing wrong is being loud and clear about the need to change the structure of an organization, and then to proceed by just doing it.

It is my opinion based on what I’m hearing and sensing that if the Ethereum Foundation doesn’t overtly start to initiate change, that change will happen around them. The proposal to levy a % of mining fees as a continuous funding for development was a direct response to a lack of proper funding from the Ethereum Foundation. Where there is smoke, there is usually fire.

Throughout Ethereum’s journey, the Ethereum Foundation has been its spark, but going forward, we need to ensure it doesn’t become its anchor.

I hope this proposal gets debated and taken seriously. More importantly, that change happens for the better.

I propose to keep the $20 million annual budget, but distribute it differently. Here’s a set of specific recommendations:

#1 Rename the Ethereum Foundation to Ethereum Research Foundation

The Ethereum Foundation’s focus should be on research, not development, and therefore could be renamed as the Ethereum Research Foundation. Let’s face it. The core of the Ethereum Foundation has been research, an area they excel and revel in, but since Jeffrey Wilcke and Gavin Wood left it, they have not been so efficient at rolling out a good cadence of software updates and improvements. I realize that splitting research from development is a delicate operation, given how embroiled both functions have become within the Ethereum Foundation, but there is a precedent if you look at how Microsoft Research is run for example. Budget $7.5M.

#2 Revive EthDev with a Focus on Software Development

Soon after raising $18M from its ICO, the Ethereum Foundation set-up a group called EthDev, a development oriented organization focused on delivering what they promised. I suggest to revive EthDev or form an equivalent organization that is headed by an experienced full-time CTO or Head of Software Engineering. That group should be laser-focused on software development and delivery based on known and agreed-upon priorities, across all aspects of Ethereum’s evolution,- Eth 1.x, Eth 2.0 and sharding implementations included. Budget $7.5M.

#3 Fund EthMarket to Properly and Regularly Communicate Ethereum’s Positions and Updates

Create a small group that focuses on officially communicating all of the work that Ethereum is doing, properly messaging to the market Ethereum’s strengths, and defending/rebutting claims made by the competition. Allow this group to organize the next Ethereum global conference, not just as a DevCon but as a true melding of business and technical communities together. And it would provide a unified voice that can re-reclaim the “Ethereum narrative”. Initial budget $1M.

#4 Spin EthHub as EthEducation, the Education Jumping Point

Energize EthHub’s excellent work, and make it a cohesive jumping point for everything related to Ethereum education for developers. Beef it up even further. Initial budget $1M.

#5 Create EthBizDev to Support the Strategic Adoption of Ethereum Technology

Ethereum can take a page from AWS or Microsoft Azure’s approach to forging and nurturing relationships with key developer organizations. Form a small group, focused on strategic relationships, evangelism, and adoption. Initial budget $1M.

#6 Form an Ethereum Governance Council with a Mixed Business and Technical Composition

This Ethereum Council would become the new Ethereum heartbeat. Initially, it could consist of 1 representative from each of the above groups (except for 2 reps from the Ethereum Research Foundation), and another 4-6 external members with noted business experience in growing and managing tech organizations. A 6-month chair rotation could be implemented. The council would meet once per month, with an agenda of updating each other on progress, discussing issues, making some decisions, and taking back action items to their respective groups.

What I’m proposing is not to shake or disturb any of the good ground community work and initiatives that are already taking place, but rather harness them better. Activities like the Ethereum EIPs, Ethereum Magicians, Ethereum Cat Herders, EthCC, EthGlobal, Ethereum Gitter, EthResearch, the Ethereum Enterprise Alliance, Ethereum Github’s repository would continue as they are vibrant and important, but they will be given extra shots in the arm if a newly invigorated distributed organizational structure takes place. A virtual, but more accountable organizational structure would help ensure that no good efforts (or intentions) are being squandered, nor that unproductive work sucks the air out of an otherwise healthy ecosystem that wants to strive and not spin its wheels unnecessarily.

Basically, what I’m proposing is a measured decentralization of activity, with better accountability and a thin layer of old-fashioned management to oversee the overall progress. In essence, we would be giving more muscle to Ethereum.

Let’s face it: the times, they have changed. We aren’t in 2015 or 2016 anymore when Ethereum was the only viable alternative to Bitcoin. Today, there is fierce competition, and it is a factor that cannot be ignored. Even if Ethereum continues to “play nice”, other players are not. The market mistakes Vitalik Buterin’s pleasant and charismatic personality as a soft spot. Some people conflate Vitalik’s kindness and intellectual generosity as an Ethereum project weakness, and exploit that to their own advantages.

Today, the Ethereum 2.0 that’s needed is not just technical. It’s also organizational. Company re-organizations are a common occurrence. For growth reasons or changing market conditions, what worked then doesn’t work anymore, and it gets changed. There is nothing wrong is being loud and clear about the need to change the structure of an organization, and then to proceed by just doing it.

It is my opinion based on what I’m hearing and sensing that if the Ethereum Foundation doesn’t overtly start to initiate change, that change will happen around them. The proposal to levy a % of mining fees as a continuous funding for development was a direct response to a lack of proper funding from the Ethereum Foundation. Where there is smoke, there is usually fire.

Throughout Ethereum’s journey, the Ethereum Foundation has been its spark, but going forward, we need to ensure it doesn’t become its anchor.

I hope this proposal gets debated and taken seriously. More importantly, that change happens for the better.

William Mougayar is a Toronto-based entrepreneur, Ethereum Foundation advisor and advisor to Consensus 2016, CoinDesk's flagship conference. He is also the author of the upcoming book, The Business Blockchain: https://www.kickstarter.com/projects/wmougayar/the-business-blockchain-books

Finyear - Daily News

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

Autres articles

-

Blockchain : BNP Paribas ne détient "que" 1030 iShares Bitcoin Trust (IBIT) ?

-

Etude | les Français, les moyens de paiement et l'impact écologique

-

La Blockchain Business School et PyratzLabs lancent un programme de financement boursier pour démocratiser l’accès à la formation blockchain

-

Erable : une nouvelle étape avec l'acquisition de "WE DO GOOD" ?

-

France Fintech édite le guide pratique à l'usage des fintechs