The Greek sovereign debt crisis has deepened since last weekend: Today the financial support program will end. Also today, the Greek government will default to the IMF. The European Central Bank (ECB) has capped Emergency Liquidity Assistance (ELA) to Greek financial institutions. A week long bank holiday has been declared in the country and access to deposits is severely restricted. The Greek population is being asked to vote in a referendum that many observers believe is really about continued membership in the eurozone, even if the question is formally about whether or not the population endorses the program offered by Greece's European Union (EU) partners. The relationship between the leadership in Athens and the 18 other eurozone governments, as well as the European Commission and the IMF, is at an all-time low.

In this fluid environment many questions are being asked by investors about Standard & Poor's Ratings Services' view on Greece's sovereign rating and what the next steps might be. In the following, we address some of the most frequently asked questions on the subject.

Frequently Asked Questions:

Yesterday you lowered the rating on Greece again, this time to 'CCC-' with a negative outlook. Why?

We interpret Greece's decision to hold a referendum on official creditors' loan proposals as a further indication that the Tsipras government will prioritize domestic politics over financial and economic stability, commercial debt payments, and eurozone membership. We are of the view that the lack of a formal financial support program and a frozen financial system will further depress economic activity. We now expect the economy to shrink by 3% in 2015 after it had grown by 0.8% after six years of uninterrupted recession. The general government budget will also deteriorate again, with a deficit surpassing 5% of GDP. A default or a distressed-debt exchange appears to us to be inevitable this year, absent unanticipated significantly favorable changes in circumstances (see "Greece Long-Term Ratings Lowered To 'CCC-'; Outlook Negative", June 29, 2015 and "Criteria For Assigning 'CCC+', 'CCC', 'CCC-', And 'CC' Ratings", Oct.

1, 2012).

The government has announced that it will not pay the bundled IMF tranches that are due today. Will Standard & Poor's declare a Greece default?

No. Our sovereign ratings assess a sovereign's ability and willingness to service financial obligations to nonofficial (commercial) creditors. The rating on a sovereign does not reflect the sovereign's ability and willingness to service other types of obligations, such as obligations to other governments or obligations to supranationals, such as the IMF or the European Financial Stability Facility (EFSF, AAA/Negative/A-1+). However, our methodology takes into account these obligations' potential effect on a sovereign's ability to service its commercial financial obligations. (see "Sovereign Rating Methodology", Dec. 23, 2014, paragraphs 4 and 5).

On July 20, Greece needs to pay €3.5 billion in bonds held by the ECB. Will that be the date to declare default?

Again, no. The bonds in question are the result of a bond swap in early 2012 whereby the ECB exclusively exchanged an approximate €50 billion par amount of Greek government bonds it had purchased through the now-defunct Securities Market Program, for an equivalent par amount of new bonds. Some of those new bonds, totaling €6.7 billion, are falling due in July and August (see "ECB Greek Bond Swap Results In Effective Subordination Of Private Investors," Feb. 24, 2012). This swap effectively allowed the ECB to avoid the impact of the Greek sovereign default that immediately followed (see "Greece Ratings Lowered To 'SD' (Selective Default)," Feb. 27, 2012).

To our knowledge, the ECB has retained the totality of the new Greek sovereign bonds it received in the 2012 swap. Therefore nonpayment of those bonds would not directly affect any commercial creditors. In such an event, Standard & Poor's would not move its sovereign rating on Greece to 'SD' (selective default). (See "Greece's Nonpayment Of Bonds Held By ECB Would Not Constitute A Default Under Our Criteria", June 16, 2015).

So under which circumstances could Standard & Poor's declare a Greece default?

We would declare a Greece default if and when the Greek central government missed a payment on a commercial obligation. Greece's upcoming commercial debt payments include €2.0 billion in treasury bills due on July 10; €83 million on a Japanese yen obligation, due on July 14; and €71 million in interest, due on July 17 on a three-year commercial bond the government issued in July 2014. About €39 billion of Greece's total medium- and long-term debt is commercial, representing 22% of GDP. All of the remaining €261 billion in debt (excluding €15 billion in treasury bills) is owed to official creditors.

In light of Greece's non-payment to the IMF, will you not need to rethink "preferred creditor" treatment when rating multilateral lending institutions?

Preferred creditor treatment (PCT) is an important element in Standard & Poor's ratings on multilateral lending institutions (MLIs). PCT rests on an assumption regarding sovereign borrowers' future behavior. PCT positively affects MLIs' asset quality and risk-weighted capital ratios and, therefore, MLIs' creditworthiness. Should we come to believe that our assumption that MLIs will be paid more punctually than commercial or bilateral creditors will no longer hold, we could lower our ratings on MLI (see "How An Erosion Of Preferred Creditor Treatment Could Lead To Lower Ratings On Multilateral Lending Institutions", Aug. 26, 2013). However, the Greek non-payment to the IMF does not, in our view, in itself require this reassessment of PCT and the ratings on MLI. This is because we also expect Greece to default on its commercial obligations, as expressed in the issuer rating revision to 'CCC-'with a negative outlook. A generalized non-payment to commercial and official creditors alike due to inability to pay (which is our interpretation of the current Greek situation) does not in itself put into question the concept of PCT. This would, for example, be the case if Greece was to continue to service commercial obligations while subordinating official creditors that would have

expected to benefit from PCT. Regarding the Greek government's main official creditors, we note that: we do not rate the IMF; that our rating on the EFSF rests on its sovereign shareholder guarantees and not on its asset quality; and that our rating on the ECB derives from its shareholders' creditworthiness and its credibility of monetary policy.

How do you assess the likelihood of a "Grexit", i.e. Greece leaving the eurozone and reintroducing its own currency?

It has increased considerably. Given that the Greek government appears willing to accept the consequences on its banking sector and economy from the failure to reach an agreement, we now see a 50% likelihood of Greece eventually exiting the eurozone. Should this occur, Greece would permanently lose access to financing from the ECB, which, in our opinion, would create a serious foreign currency shortage for the private and public sectors, potentially leading to the rationing of key imports such as fuel. Under our methodology, exit from the eurozone would lead us to revise our transfer and convertibility assessment on Greece to 'CCC' from 'AAA', to reflect the loss of a reserve currency and the foreign currency shortage this would create.

How could a Grexit come about and what would be the consequences?

With capital controls in place, ELA discontinued, and shriveling tax revenues as both the ability and willingness to pay taxes declines, the economic situation will come to a head sooner rather than later. The euros at the government's disposal would only suffice to make an ever smaller share of its payment obligations. The cash-strapped government could issue IOUs to pay employees, pensioners, and suppliers. These IOUs will , at a discount, begin to circulate as a secondary means of exchange and, over time, lead to a national currency, which would operate as legal tender in the country (this would formally be the exit moment) after the government had legislated to redenominate financial contracts wherever legally possible.

In the circumstances of such a distressed eurozone exit, we expect that the exiting sovereign would likely suffer a deep and possibly prolonged recession, making its already high government debt burden unsustainable. This would be all the more likely if the value of its euro-denominated debt, as measured in the new national currency, increased as it depreciated against the euro. In Greece's case, an overwhelming amount of its sovereign debt is euro-denominated and, under our criteria, we would view any unilateral decision to change the denomination of payment as a default.

Furthermore, Greece is also highly dependent on the import of energy, food, and medicine, among other necessities.

With a shortage of euros, even short-term trade financing might dry up, putting further downward pressure on economic prospects and the living conditions of the population. Shortages and poverty would become more widespread. We could also envisage a wave of litigation following any redenomination of contracts. An overwhelmed justice system could lead to prolonged economic and investment paralysis while these cases were being heard.

In case of Grexit, how strong will be contagion to other eurozone sovereigns?

Grexit now would in our view be less financially risky for the remaining eurozone members than it would have been in 2012. This is because of the more robust financial support architecture in place today in the eurozone as well as the marked reduction of financial linkages between Greece and the rest of the eurozone. Consequently, a Grexit may not lead immediately to a negative ratings impact for other eurozone sovereigns.

Today's eurozone rescue architecture is more robust than in 2012. In October 2012, the eurozone member states introduced the European Stability Mechanism (ESM), which can financially support eurozone sovereigns should they come under market pressure following a hypothetical Grexit (although the ESM's currently available funds may be insufficient should a large sovereign request support). The recent success of the Ireland and Portugal economic adjustment programs, financially supported by official creditors, has in our view encouraged European governments to continue providing such assistance when needed. In our view, the ESM would mitigate against other sovereigns following Greece out of the eurozone, should it exit. Moreover, the fact that the ECB could--and in our view would--complement and effectively leverage ESM funds through its Outright Monetary Transactions (OMT) program via targeted secondary market purchases of a distressed eurozone sovereign's bonds further mitigates the possibility that any other country might leave the eurozone. If in 2012 the capital markets appeared to a certain degree to have dictated the European political reaction, in 2015, European political decisions appear to be driving the behavior of markets given that these decisions ultimately determine to what degree a sovereign and its banks can benefit from ECB access. And that access remains key (see: "A Greek Exit From The Eurozone Would Have Limited Direct Contagion Risks For Other Sovereign Ratings", Feb. 19, 2015).

Yesterday's mild market reaction (Spain's and Italy's 10-year bond yields rose by around 24 basis points and Portugal's by 34, the euro hardly moved) appear to support our view that contagion will be limited, as long as governments in other countries do not follow a similar confrontational course as Greece's Syriza-led coalition. We are also of the view that the demonstration effect of the likely calamitous economic and social repercussions that a Grexit would bring to Greek society could make it less likely that governments elsewhere might be willing to entertain the euro exit option.

What has led to the breakdown of the negotiations?

We believe that both sides have underestimated the resolve of the other side in sticking to their respective principles. This led to a constellation where last weekend both sides perceived that they were "blackmailed" by the other, which rendered any consensual solution elusive.

The Greek negotiation strategy appears to have assumed that the EU partners would be unwilling to risk a Greek default and potential Grexit. Negotiators seem to have been of the view that the partners would be unwilling to face the contagion risk (which the Greek side may have greatly overestimated), jeopardize the principle of the irreversibility of the euro, and to subordinate the preferences of European citizens to the democratic mandate Syriza believes to have received from the Greek electorate. It appears to us that Tsipras may still be misreading political reality in the EU when he works under the assumption that a "no" vote in Sunday's referendum will force creditor institutions to compromise. We believe that the opposite may be the case, as the referendum will only bind the Greek government.

On the other side, the EU partners seem to have assumed that if Tsipras is forced to choose between Syriza's two probably incompatible campaign promises "end austerity and supply-side reforms" on the one hand and "staying in the euro" on the other, he would opt for the latter. After all, Syriza accepted that it does not have the mandate to take Greece out of the euro. As it turns out, the creditors' assumption may have been just as misguided as Tsipras' view that the EU will eventually succumb to his demands if only he stays firm. While both parties to the negotiations may have miscalculated, the price for the error is very much higher for Greece than it is for the EU partners, whose economic and financial linkages with Greece (which accounts for less than 2% of eurozone GDP) are low.

What is the significance of the Greek referendum?

Next Sunday, on July 5, the Greek electorate will vote on whether or not the final offer of the EU partners should be accepted and implemented. The Syriza-led coalition urges the population to reject the program. Assuming the referendum can be prepared and held at such short notice (which, given the institutional weakness of Greek public administration, cannot be entirely taken for granted), the poll has no apparent objective. The program, on which Greeks are expected to opine, has been withdrawn and will formally lapse midnight today. Any further funding and conditionality will require a fresh set of negotiations and a new program. By the time the votes will have been counted, the economic and financial conditions will have worsened further, not least because of the drop of confidence related to the eight-day bank holiday. This may require a modification of the lapsed program measures, in any case.

The outcome of the referendum is difficult to predict. Should a majority vote against the program--as the government encourages it to do--there is a significant risk that the door to further meaningful negotiations will remain closed. We do not expect that the rest of Europe will consider itself bound by the preference of 11 million Greek citizens when the interests of the other 320 million eurozone citizens are involved. An emboldened Syriza government would drive hard for further substantial concessions, but they may not be on offer. The risk of a Grexit would rise beyond the 50% probability we currently assign and become the base case.

The anxiety related to deposit freezes, rising governmental payment arrears, as well as rising risks of shortages could lead Greek citizens to vote in favor of the package as fear of the unknown dominates. Should the electorate vote against the recommendation of the government in such an existential question, most observers would consider a continuation of the current coalition unlikely. The government would have to act as the guardian of a program it fundamentally rejects. It appears more likely that either new elections would be called or a unity government assembled. In either event, there could be renewed talks with creditors at the end of this political transition.

But even in this case the economic outlook will have darkened greatly. The time that will probably be required to negotiate a new program and passing it through a number of member states' parliaments (in a period when legislatures will typically be in summer recess) could lead Greece to default to the ECB on July 20. This would make it virtually impossible for the ECB to continue authorizing ELA. Capital controls would have to remain in place in such an environment, further depressing already moribund economic activity.

In this fluid environment many questions are being asked by investors about Standard & Poor's Ratings Services' view on Greece's sovereign rating and what the next steps might be. In the following, we address some of the most frequently asked questions on the subject.

Frequently Asked Questions:

Yesterday you lowered the rating on Greece again, this time to 'CCC-' with a negative outlook. Why?

We interpret Greece's decision to hold a referendum on official creditors' loan proposals as a further indication that the Tsipras government will prioritize domestic politics over financial and economic stability, commercial debt payments, and eurozone membership. We are of the view that the lack of a formal financial support program and a frozen financial system will further depress economic activity. We now expect the economy to shrink by 3% in 2015 after it had grown by 0.8% after six years of uninterrupted recession. The general government budget will also deteriorate again, with a deficit surpassing 5% of GDP. A default or a distressed-debt exchange appears to us to be inevitable this year, absent unanticipated significantly favorable changes in circumstances (see "Greece Long-Term Ratings Lowered To 'CCC-'; Outlook Negative", June 29, 2015 and "Criteria For Assigning 'CCC+', 'CCC', 'CCC-', And 'CC' Ratings", Oct.

1, 2012).

The government has announced that it will not pay the bundled IMF tranches that are due today. Will Standard & Poor's declare a Greece default?

No. Our sovereign ratings assess a sovereign's ability and willingness to service financial obligations to nonofficial (commercial) creditors. The rating on a sovereign does not reflect the sovereign's ability and willingness to service other types of obligations, such as obligations to other governments or obligations to supranationals, such as the IMF or the European Financial Stability Facility (EFSF, AAA/Negative/A-1+). However, our methodology takes into account these obligations' potential effect on a sovereign's ability to service its commercial financial obligations. (see "Sovereign Rating Methodology", Dec. 23, 2014, paragraphs 4 and 5).

On July 20, Greece needs to pay €3.5 billion in bonds held by the ECB. Will that be the date to declare default?

Again, no. The bonds in question are the result of a bond swap in early 2012 whereby the ECB exclusively exchanged an approximate €50 billion par amount of Greek government bonds it had purchased through the now-defunct Securities Market Program, for an equivalent par amount of new bonds. Some of those new bonds, totaling €6.7 billion, are falling due in July and August (see "ECB Greek Bond Swap Results In Effective Subordination Of Private Investors," Feb. 24, 2012). This swap effectively allowed the ECB to avoid the impact of the Greek sovereign default that immediately followed (see "Greece Ratings Lowered To 'SD' (Selective Default)," Feb. 27, 2012).

To our knowledge, the ECB has retained the totality of the new Greek sovereign bonds it received in the 2012 swap. Therefore nonpayment of those bonds would not directly affect any commercial creditors. In such an event, Standard & Poor's would not move its sovereign rating on Greece to 'SD' (selective default). (See "Greece's Nonpayment Of Bonds Held By ECB Would Not Constitute A Default Under Our Criteria", June 16, 2015).

So under which circumstances could Standard & Poor's declare a Greece default?

We would declare a Greece default if and when the Greek central government missed a payment on a commercial obligation. Greece's upcoming commercial debt payments include €2.0 billion in treasury bills due on July 10; €83 million on a Japanese yen obligation, due on July 14; and €71 million in interest, due on July 17 on a three-year commercial bond the government issued in July 2014. About €39 billion of Greece's total medium- and long-term debt is commercial, representing 22% of GDP. All of the remaining €261 billion in debt (excluding €15 billion in treasury bills) is owed to official creditors.

In light of Greece's non-payment to the IMF, will you not need to rethink "preferred creditor" treatment when rating multilateral lending institutions?

Preferred creditor treatment (PCT) is an important element in Standard & Poor's ratings on multilateral lending institutions (MLIs). PCT rests on an assumption regarding sovereign borrowers' future behavior. PCT positively affects MLIs' asset quality and risk-weighted capital ratios and, therefore, MLIs' creditworthiness. Should we come to believe that our assumption that MLIs will be paid more punctually than commercial or bilateral creditors will no longer hold, we could lower our ratings on MLI (see "How An Erosion Of Preferred Creditor Treatment Could Lead To Lower Ratings On Multilateral Lending Institutions", Aug. 26, 2013). However, the Greek non-payment to the IMF does not, in our view, in itself require this reassessment of PCT and the ratings on MLI. This is because we also expect Greece to default on its commercial obligations, as expressed in the issuer rating revision to 'CCC-'with a negative outlook. A generalized non-payment to commercial and official creditors alike due to inability to pay (which is our interpretation of the current Greek situation) does not in itself put into question the concept of PCT. This would, for example, be the case if Greece was to continue to service commercial obligations while subordinating official creditors that would have

expected to benefit from PCT. Regarding the Greek government's main official creditors, we note that: we do not rate the IMF; that our rating on the EFSF rests on its sovereign shareholder guarantees and not on its asset quality; and that our rating on the ECB derives from its shareholders' creditworthiness and its credibility of monetary policy.

How do you assess the likelihood of a "Grexit", i.e. Greece leaving the eurozone and reintroducing its own currency?

It has increased considerably. Given that the Greek government appears willing to accept the consequences on its banking sector and economy from the failure to reach an agreement, we now see a 50% likelihood of Greece eventually exiting the eurozone. Should this occur, Greece would permanently lose access to financing from the ECB, which, in our opinion, would create a serious foreign currency shortage for the private and public sectors, potentially leading to the rationing of key imports such as fuel. Under our methodology, exit from the eurozone would lead us to revise our transfer and convertibility assessment on Greece to 'CCC' from 'AAA', to reflect the loss of a reserve currency and the foreign currency shortage this would create.

How could a Grexit come about and what would be the consequences?

With capital controls in place, ELA discontinued, and shriveling tax revenues as both the ability and willingness to pay taxes declines, the economic situation will come to a head sooner rather than later. The euros at the government's disposal would only suffice to make an ever smaller share of its payment obligations. The cash-strapped government could issue IOUs to pay employees, pensioners, and suppliers. These IOUs will , at a discount, begin to circulate as a secondary means of exchange and, over time, lead to a national currency, which would operate as legal tender in the country (this would formally be the exit moment) after the government had legislated to redenominate financial contracts wherever legally possible.

In the circumstances of such a distressed eurozone exit, we expect that the exiting sovereign would likely suffer a deep and possibly prolonged recession, making its already high government debt burden unsustainable. This would be all the more likely if the value of its euro-denominated debt, as measured in the new national currency, increased as it depreciated against the euro. In Greece's case, an overwhelming amount of its sovereign debt is euro-denominated and, under our criteria, we would view any unilateral decision to change the denomination of payment as a default.

Furthermore, Greece is also highly dependent on the import of energy, food, and medicine, among other necessities.

With a shortage of euros, even short-term trade financing might dry up, putting further downward pressure on economic prospects and the living conditions of the population. Shortages and poverty would become more widespread. We could also envisage a wave of litigation following any redenomination of contracts. An overwhelmed justice system could lead to prolonged economic and investment paralysis while these cases were being heard.

In case of Grexit, how strong will be contagion to other eurozone sovereigns?

Grexit now would in our view be less financially risky for the remaining eurozone members than it would have been in 2012. This is because of the more robust financial support architecture in place today in the eurozone as well as the marked reduction of financial linkages between Greece and the rest of the eurozone. Consequently, a Grexit may not lead immediately to a negative ratings impact for other eurozone sovereigns.

Today's eurozone rescue architecture is more robust than in 2012. In October 2012, the eurozone member states introduced the European Stability Mechanism (ESM), which can financially support eurozone sovereigns should they come under market pressure following a hypothetical Grexit (although the ESM's currently available funds may be insufficient should a large sovereign request support). The recent success of the Ireland and Portugal economic adjustment programs, financially supported by official creditors, has in our view encouraged European governments to continue providing such assistance when needed. In our view, the ESM would mitigate against other sovereigns following Greece out of the eurozone, should it exit. Moreover, the fact that the ECB could--and in our view would--complement and effectively leverage ESM funds through its Outright Monetary Transactions (OMT) program via targeted secondary market purchases of a distressed eurozone sovereign's bonds further mitigates the possibility that any other country might leave the eurozone. If in 2012 the capital markets appeared to a certain degree to have dictated the European political reaction, in 2015, European political decisions appear to be driving the behavior of markets given that these decisions ultimately determine to what degree a sovereign and its banks can benefit from ECB access. And that access remains key (see: "A Greek Exit From The Eurozone Would Have Limited Direct Contagion Risks For Other Sovereign Ratings", Feb. 19, 2015).

Yesterday's mild market reaction (Spain's and Italy's 10-year bond yields rose by around 24 basis points and Portugal's by 34, the euro hardly moved) appear to support our view that contagion will be limited, as long as governments in other countries do not follow a similar confrontational course as Greece's Syriza-led coalition. We are also of the view that the demonstration effect of the likely calamitous economic and social repercussions that a Grexit would bring to Greek society could make it less likely that governments elsewhere might be willing to entertain the euro exit option.

What has led to the breakdown of the negotiations?

We believe that both sides have underestimated the resolve of the other side in sticking to their respective principles. This led to a constellation where last weekend both sides perceived that they were "blackmailed" by the other, which rendered any consensual solution elusive.

The Greek negotiation strategy appears to have assumed that the EU partners would be unwilling to risk a Greek default and potential Grexit. Negotiators seem to have been of the view that the partners would be unwilling to face the contagion risk (which the Greek side may have greatly overestimated), jeopardize the principle of the irreversibility of the euro, and to subordinate the preferences of European citizens to the democratic mandate Syriza believes to have received from the Greek electorate. It appears to us that Tsipras may still be misreading political reality in the EU when he works under the assumption that a "no" vote in Sunday's referendum will force creditor institutions to compromise. We believe that the opposite may be the case, as the referendum will only bind the Greek government.

On the other side, the EU partners seem to have assumed that if Tsipras is forced to choose between Syriza's two probably incompatible campaign promises "end austerity and supply-side reforms" on the one hand and "staying in the euro" on the other, he would opt for the latter. After all, Syriza accepted that it does not have the mandate to take Greece out of the euro. As it turns out, the creditors' assumption may have been just as misguided as Tsipras' view that the EU will eventually succumb to his demands if only he stays firm. While both parties to the negotiations may have miscalculated, the price for the error is very much higher for Greece than it is for the EU partners, whose economic and financial linkages with Greece (which accounts for less than 2% of eurozone GDP) are low.

What is the significance of the Greek referendum?

Next Sunday, on July 5, the Greek electorate will vote on whether or not the final offer of the EU partners should be accepted and implemented. The Syriza-led coalition urges the population to reject the program. Assuming the referendum can be prepared and held at such short notice (which, given the institutional weakness of Greek public administration, cannot be entirely taken for granted), the poll has no apparent objective. The program, on which Greeks are expected to opine, has been withdrawn and will formally lapse midnight today. Any further funding and conditionality will require a fresh set of negotiations and a new program. By the time the votes will have been counted, the economic and financial conditions will have worsened further, not least because of the drop of confidence related to the eight-day bank holiday. This may require a modification of the lapsed program measures, in any case.

The outcome of the referendum is difficult to predict. Should a majority vote against the program--as the government encourages it to do--there is a significant risk that the door to further meaningful negotiations will remain closed. We do not expect that the rest of Europe will consider itself bound by the preference of 11 million Greek citizens when the interests of the other 320 million eurozone citizens are involved. An emboldened Syriza government would drive hard for further substantial concessions, but they may not be on offer. The risk of a Grexit would rise beyond the 50% probability we currently assign and become the base case.

The anxiety related to deposit freezes, rising governmental payment arrears, as well as rising risks of shortages could lead Greek citizens to vote in favor of the package as fear of the unknown dominates. Should the electorate vote against the recommendation of the government in such an existential question, most observers would consider a continuation of the current coalition unlikely. The government would have to act as the guardian of a program it fundamentally rejects. It appears more likely that either new elections would be called or a unity government assembled. In either event, there could be renewed talks with creditors at the end of this political transition.

But even in this case the economic outlook will have darkened greatly. The time that will probably be required to negotiate a new program and passing it through a number of member states' parliaments (in a period when legislatures will typically be in summer recess) could lead Greece to default to the ECB on July 20. This would make it virtually impossible for the ECB to continue authorizing ELA. Capital controls would have to remain in place in such an environment, further depressing already moribund economic activity.

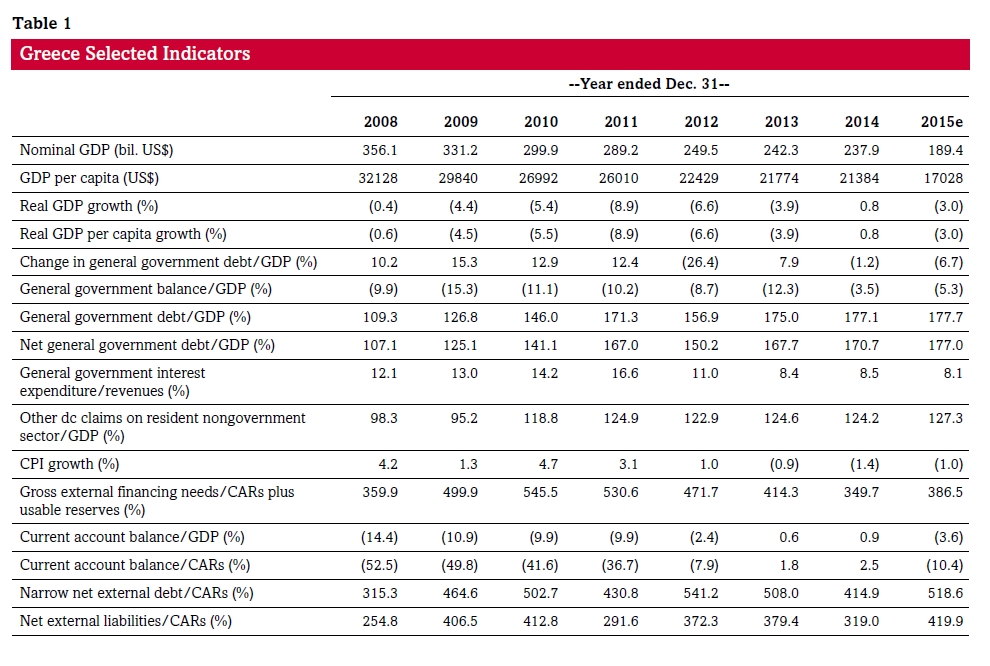

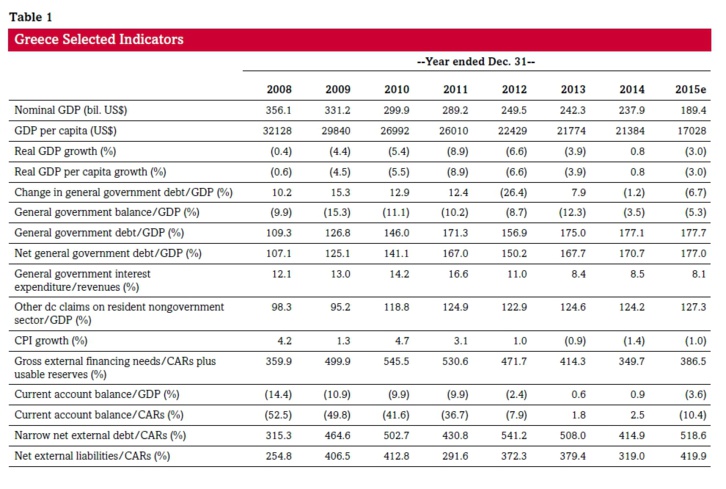

Table 1 - Greece Selected Indicators (cont.)

Other depository corporations (dc) are financial corporations (other than the central bank) whose liabilities are included in the national definition of broad money. Gross external financing needs are defined as current account payments plus short-term external debt at the end of the prior year plus nonresident deposits at the end of the prior year plus long-term external debt maturing within the year. Narrow net external debt is defined as the stock of foreign and local currency public- and private-sector borrowings from nonresidents minus official reserves minus public-sector liquid assets held by nonresidents minus financial-sector loans to, deposits with, or investments in nonresident entities. A negative number indicates net external lending. CARs--Current account receipts. e--Estimate. The data and ratios above result from Standard & Poor's own calculations, drawing on national as well as international sources, reflecting Standard & Poor's independent view on the timeliness, coverage, accuracy, credibility, and usability of available information.

Related Criteria And Research

Related Criteria

· Sovereign Rating Methodology, Dec. 23, 2014

· Criteria For Assigning 'CCC+', 'CCC', 'CCC-', And 'CC' Ratings, Oct. 1, 2012 Related Research

· Greece Long-Term Ratings Lowered To 'CCC-'; Outlook Negative, June 29, 2015

· ECB Greek Bond Swap Results In Effective Subordination Of Private Investors, Feb. 24, 2012

· Greece Ratings Lowered To 'SD' (Selective Default), Feb. 27, 2012

· Greece's Nonpayment Of Bonds Held By ECB Would Not Constitute A Default Under Our Criteria, June 16, 2015

· How An Erosion Of Preferred Creditor Treatment Could Lead To Lower Ratings On Multilateral Lending Institutions, Aug. 26, 2013

· A Greek Exit From The Eurozone Would Have Limited Direct Contagion Risks For Other Sovereign Ratings, Feb. 19, 2015

· Breaking Up Is Hard To Do: Rating Implications Of EU States Abandoning The Euro, Nov. 24, 2005

Under Standard & Poor's policies, only a Rating Committee can determine a Credit Rating Action (including a Credit Rating change, affirmation or withdrawal, Rating Outlook change, or CreditWatch action). This commentary and its subject matter have not been the subject of Rating Committee action and should not be interpreted as a change to, or affirmation of, a Credit Rating or Rating Outlook.

Other depository corporations (dc) are financial corporations (other than the central bank) whose liabilities are included in the national definition of broad money. Gross external financing needs are defined as current account payments plus short-term external debt at the end of the prior year plus nonresident deposits at the end of the prior year plus long-term external debt maturing within the year. Narrow net external debt is defined as the stock of foreign and local currency public- and private-sector borrowings from nonresidents minus official reserves minus public-sector liquid assets held by nonresidents minus financial-sector loans to, deposits with, or investments in nonresident entities. A negative number indicates net external lending. CARs--Current account receipts. e--Estimate. The data and ratios above result from Standard & Poor's own calculations, drawing on national as well as international sources, reflecting Standard & Poor's independent view on the timeliness, coverage, accuracy, credibility, and usability of available information.

Related Criteria And Research

Related Criteria

· Sovereign Rating Methodology, Dec. 23, 2014

· Criteria For Assigning 'CCC+', 'CCC', 'CCC-', And 'CC' Ratings, Oct. 1, 2012 Related Research

· Greece Long-Term Ratings Lowered To 'CCC-'; Outlook Negative, June 29, 2015

· ECB Greek Bond Swap Results In Effective Subordination Of Private Investors, Feb. 24, 2012

· Greece Ratings Lowered To 'SD' (Selective Default), Feb. 27, 2012

· Greece's Nonpayment Of Bonds Held By ECB Would Not Constitute A Default Under Our Criteria, June 16, 2015

· How An Erosion Of Preferred Creditor Treatment Could Lead To Lower Ratings On Multilateral Lending Institutions, Aug. 26, 2013

· A Greek Exit From The Eurozone Would Have Limited Direct Contagion Risks For Other Sovereign Ratings, Feb. 19, 2015

· Breaking Up Is Hard To Do: Rating Implications Of EU States Abandoning The Euro, Nov. 24, 2005

Under Standard & Poor's policies, only a Rating Committee can determine a Credit Rating Action (including a Credit Rating change, affirmation or withdrawal, Rating Outlook change, or CreditWatch action). This commentary and its subject matter have not been the subject of Rating Committee action and should not be interpreted as a change to, or affirmation of, a Credit Rating or Rating Outlook.

DEVISES : Cotations + Taux + Convertisseur

The Forex Quotes are Powered by Forexpros - The Leading Financial Portal.

The Exchange Rates are powered by Forexpros - The Leading Financial Portal.

The Exchange Rates are powered by Forexpros - The Leading Financial Portal.| The Currency Converter Powered by Forexpros - The Leading Financial Portal |

BOURSE : Indices + CAC40 + MP

Live World Indices are Powered by Forexpros - The Leading Financial Portal.

The Commodity Prices Powered by Forexpros - The Leading Financial Portal.

TAUX D'INTERET LEGAL & TAUX INTERBANCAIRES

L'ordonnance du 20 août 2014 (n°2014-947) a introduit deux taux différents, l'un s'appliquant aux créanciers personnes physiques n'agissant pas pour des besoins professionnels, l'autre "pour tous les autres cas".

Le gouvernement a également instauré un calcul semestriel du taux légal calculé "en fonction du taux directeur de la Banque centrale européenne sur les opérations principales de refinancement et des taux pratiqués par les établissements de crédit et les sociétés de financement".

Comme prévu par l'article 2 de l'ordonnance du 20 août 2014, les deux nouveaux taux ont été fixés par arrêté pour leur entrée en vigueur dès le 1er janvier 2015.

L'arrêté du 23 décembre 2014 publié au JO le 27 décembre 2014 indique ainsi que :

"Pour le premier semestre 2015, le taux de l'intérêt légal est fixé :

1° Pour les créances des personnes physiques n'agissant pas pour des besoins professionnels : à 4,06% ;

2° Pour tous les autres cas : à 0,93%."

Rappelons que :

- En 2014, il était de 0,04%

- En 2013, il était de 0,04%

- En 2012, il était de 0,71%

- En 2011, il était de 0,38%

- En 2010, il était de 0,65%

- En 2009, il était de 3,79%

- En 2008, il était de 3,99%

- En 2007, il était de 2,95 %

Lisez notre article "Taux d'intérêt légal et taux interbancaires (définitions et historiques)" en suivant ce lien

Taux quotidiens (Mise à jour quotidienne, tableau fourni par la Banque de France)

+

Moyennes mensuelles (Mise à jour mensuelle, tableau fourni par la Banque de France)

* Moyennes calculées avec le nombre de jours calendaires du mois

Le gouvernement a également instauré un calcul semestriel du taux légal calculé "en fonction du taux directeur de la Banque centrale européenne sur les opérations principales de refinancement et des taux pratiqués par les établissements de crédit et les sociétés de financement".

Comme prévu par l'article 2 de l'ordonnance du 20 août 2014, les deux nouveaux taux ont été fixés par arrêté pour leur entrée en vigueur dès le 1er janvier 2015.

L'arrêté du 23 décembre 2014 publié au JO le 27 décembre 2014 indique ainsi que :

"Pour le premier semestre 2015, le taux de l'intérêt légal est fixé :

1° Pour les créances des personnes physiques n'agissant pas pour des besoins professionnels : à 4,06% ;

2° Pour tous les autres cas : à 0,93%."

Rappelons que :

- En 2014, il était de 0,04%

- En 2013, il était de 0,04%

- En 2012, il était de 0,71%

- En 2011, il était de 0,38%

- En 2010, il était de 0,65%

- En 2009, il était de 3,79%

- En 2008, il était de 3,99%

- En 2007, il était de 2,95 %

Lisez notre article "Taux d'intérêt légal et taux interbancaires (définitions et historiques)" en suivant ce lien

Taux quotidiens (Mise à jour quotidienne, tableau fourni par la Banque de France)

+

Moyennes mensuelles (Mise à jour mensuelle, tableau fourni par la Banque de France)

* Moyennes calculées avec le nombre de jours calendaires du mois

Notes :

- Euro Overnight Index Average (EONIA) : taux calculé par la BCE et diffusé par la FBE (Fédération Bancaire de l'Union Européenne). Il résulte de la moyenne pondérée de toutes les transactions au jour le jour de prêts non garantis réalisées par les banques retenues pour le calcul de l'euribor.

- Euro Interbank Offered Rate (EURIBOR) : taux interbancaire offert entre banques de meilleures signatures pour la rémunération de dépôts dans la zone euro. Il est calculé en effectuant une moyenne quotidienne des taux prêteurs sur 13 échéances communiqués par un échantillon de 57 établissements bancaires les plus actifs de la zone Euro. Il est calculé sur la base de 360 jours et est diffusé à 11h le matin si au moins 50% des établissements constituant l'échantillon ont effectivement fourni une contribution. La moyenne est effectuée après élimination des 15% de cotation extrêmes (le nombre éliminé est toujours arrondi) et exprimée avec trois décimales.

Tableaux et historiques des TAUX D'INTERET DU MARCHE INTERBANCAIRE DE LA ZONE EURO édités par la Banque de France

- Euro Overnight Index Average (EONIA) : taux calculé par la BCE et diffusé par la FBE (Fédération Bancaire de l'Union Européenne). Il résulte de la moyenne pondérée de toutes les transactions au jour le jour de prêts non garantis réalisées par les banques retenues pour le calcul de l'euribor.

- Euro Interbank Offered Rate (EURIBOR) : taux interbancaire offert entre banques de meilleures signatures pour la rémunération de dépôts dans la zone euro. Il est calculé en effectuant une moyenne quotidienne des taux prêteurs sur 13 échéances communiqués par un échantillon de 57 établissements bancaires les plus actifs de la zone Euro. Il est calculé sur la base de 360 jours et est diffusé à 11h le matin si au moins 50% des établissements constituant l'échantillon ont effectivement fourni une contribution. La moyenne est effectuée après élimination des 15% de cotation extrêmes (le nombre éliminé est toujours arrondi) et exprimée avec trois décimales.

Tableaux et historiques des TAUX D'INTERET DU MARCHE INTERBANCAIRE DE LA ZONE EURO édités par la Banque de France

Taux de référence des bons du Trésor et OAT

Taux quotidiens (Mise à jour quotidienne, tableau fourni par la Banque de France)

+

Moyennes mensuelles (Mise à jour mensuelle, tableau fourni par la Banque de France)

* Moyennes calculées avec le nombre de jours calendaires du mois

Tableaux et historiques des taux de référence des bons du Trésor et OAT édités par la Banque de France

+

Moyennes mensuelles (Mise à jour mensuelle, tableau fourni par la Banque de France)

* Moyennes calculées avec le nombre de jours calendaires du mois

Tableaux et historiques des taux de référence des bons du Trésor et OAT édités par la Banque de France

INDICES OBLIGATAIRES

Indices Quotidiens TEC-N (Mise à jour quotidienne, tableau fourni par la Banque de France)

Description : L’indice quotidien CNO-TEC n, Taux de l’Echéance Constante n ans, pour n variant de 1 à 30, est le taux de rendement actuariel d’une valeur du Trésor fictive dont la durée de vie serait à chaque instant égale à n années.

Ce taux est obtenu par interpolation linéaire entre les taux de rendement actuariels annuels des 2 valeurs du Trésor qui encadrent au plus proche la maturité n.

Les historiques, réunis en un seul fichier, sont accessibles ici sur le site de la Banque de France.

Description : L’indice quotidien CNO-TEC n, Taux de l’Echéance Constante n ans, pour n variant de 1 à 30, est le taux de rendement actuariel d’une valeur du Trésor fictive dont la durée de vie serait à chaque instant égale à n années.

Ce taux est obtenu par interpolation linéaire entre les taux de rendement actuariels annuels des 2 valeurs du Trésor qui encadrent au plus proche la maturité n.

Les historiques, réunis en un seul fichier, sont accessibles ici sur le site de la Banque de France.

Indices Hebdomadaires (Mise à jour hebdomadaire, tableau fourni par la Banque de France)

Notice : (description et calcul)

THO : Taux hebdomadaire du marché primaire des émissions à plus de 7 ans (TEC 10 +0,25%)

THE : Taux hebdomadaire des emprunts d'Etat ayant une échéance de plus de 7 ans (TEC 10 +0,05%)

FELT : Rendement secondaire des emprunts d'Etat à plus de 7 ans (TEC 10 +0,05%)

FECT : Rendement secondaire des emprunts d'Etat entre 3 et 7 ans (TEC 5 +0,05%)

PRLT : Rendement secondaire des emprunts du secteur privé à plus de 7 ans (TEC 10 +0,25%)

PUCT : Rendement secondaire des emprunts du secteur public de 3 à 7 ans (TEC 5 +0,25%)

PULT : Rendement secondaire des emprunts du secteur public à plus de 7 ans (TEC 10 +0,25%)

Les historiques, réunis en un seul fichier, sont accessibles ici sur le site de la Banque de France.

Notice : (description et calcul)

THO : Taux hebdomadaire du marché primaire des émissions à plus de 7 ans (TEC 10 +0,25%)

THE : Taux hebdomadaire des emprunts d'Etat ayant une échéance de plus de 7 ans (TEC 10 +0,05%)

FELT : Rendement secondaire des emprunts d'Etat à plus de 7 ans (TEC 10 +0,05%)

FECT : Rendement secondaire des emprunts d'Etat entre 3 et 7 ans (TEC 5 +0,05%)

PRLT : Rendement secondaire des emprunts du secteur privé à plus de 7 ans (TEC 10 +0,25%)

PUCT : Rendement secondaire des emprunts du secteur public de 3 à 7 ans (TEC 5 +0,25%)

PULT : Rendement secondaire des emprunts du secteur public à plus de 7 ans (TEC 10 +0,25%)

Les historiques, réunis en un seul fichier, sont accessibles ici sur le site de la Banque de France.

Indices mensuels (Mise à jour mensuelle, tableau fourni par la Banque de France)

Description :

TMO : Moyenne arithmétique des THO du mois

TMB : Moyenne arithmétique des THB du mois ( THB = Taux Hebdomadaire d'adjudication des Bons du trésor à 13 semaines)

TME : Moyenne arithmétique des THE du mois

Les historiques, réunis en un seul fichier, sont accessibles ici sur le site de la Banque de France.

Tableaux et historiques des INDICES OBLIGATAIRES édités par la Banque de France

Description :

TMO : Moyenne arithmétique des THO du mois

TMB : Moyenne arithmétique des THB du mois ( THB = Taux Hebdomadaire d'adjudication des Bons du trésor à 13 semaines)

TME : Moyenne arithmétique des THE du mois

Les historiques, réunis en un seul fichier, sont accessibles ici sur le site de la Banque de France.

Tableaux et historiques des INDICES OBLIGATAIRES édités par la Banque de France

INFORMATIONS LÉGALES

Disclaimer:

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data .

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

AVERTISSEMENT LÉGAL CONCERNANT LES COMMENTAIRES ET AVIS D'EXPERTS:

Les commentaires et avis d'experts figurant dans cette série d'articles publiés par Finyear sont émis à titre d’information et ne doivent pas être considérés comme un conseil d’investissement.

Plus particulièrement, les contenus figurant sur ce site Internet Finyear.com ne sauraient être interprétés comme des conseils fournis ou approuvés par tout membre du Groupe Finyear, ou comme une sollicitation ou une incitation à souscrire, vendre ou acheter un quelconque instrument financier.

Les analyses et opinions exprimées sont celles des sociétés et experts référencés dans chaque article à la date indiquée et sont susceptibles de changer à tout moment. Toutes projections économiques ou prévisions figurant dans ces articles document reflètent les hypothèses et jugements subjectifs des auteurs. Des événements imprévus peuvent se produire.

Ces commentaires et avis sont fournis uniquement à des fins d’information aux prestataires de services d’investissement ou aux autres professionnels ou investisseurs qualifiés.

Le site Internet Finyear.com ne contient aucun conseil financier, fiscal ou commercial, ni aucun conseil en investissement ou autre conseil proposé ou recommandé par le Groupe Finyear (et ne doit pas être interprété comme fournissant de tels conseils), et ne doit pas être considéré comme une liste des cours de placement, ni comme une offre, une incitation ou une sollicitation, en vue de la souscription, l'achat ou la vente de tout instrument financier.

Toute personne prenant une décision d'investissement en se fondant sur des informations disponibles sur Finyear.com agit à ses propres risques, et Finyear (y compris ses filiales) ne saurait en aucun cas être tenue responsable de toute perte subie de ce fait.

Tous les efforts ont été fournis afin de s’assurer de la justesse de l’information délivrée mais aucune assurance ou garantie ne peut être donnée.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data .

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

AVERTISSEMENT LÉGAL CONCERNANT LES COMMENTAIRES ET AVIS D'EXPERTS:

Les commentaires et avis d'experts figurant dans cette série d'articles publiés par Finyear sont émis à titre d’information et ne doivent pas être considérés comme un conseil d’investissement.

Plus particulièrement, les contenus figurant sur ce site Internet Finyear.com ne sauraient être interprétés comme des conseils fournis ou approuvés par tout membre du Groupe Finyear, ou comme une sollicitation ou une incitation à souscrire, vendre ou acheter un quelconque instrument financier.

Les analyses et opinions exprimées sont celles des sociétés et experts référencés dans chaque article à la date indiquée et sont susceptibles de changer à tout moment. Toutes projections économiques ou prévisions figurant dans ces articles document reflètent les hypothèses et jugements subjectifs des auteurs. Des événements imprévus peuvent se produire.

Ces commentaires et avis sont fournis uniquement à des fins d’information aux prestataires de services d’investissement ou aux autres professionnels ou investisseurs qualifiés.

Le site Internet Finyear.com ne contient aucun conseil financier, fiscal ou commercial, ni aucun conseil en investissement ou autre conseil proposé ou recommandé par le Groupe Finyear (et ne doit pas être interprété comme fournissant de tels conseils), et ne doit pas être considéré comme une liste des cours de placement, ni comme une offre, une incitation ou une sollicitation, en vue de la souscription, l'achat ou la vente de tout instrument financier.

Toute personne prenant une décision d'investissement en se fondant sur des informations disponibles sur Finyear.com agit à ses propres risques, et Finyear (y compris ses filiales) ne saurait en aucun cas être tenue responsable de toute perte subie de ce fait.

Tous les efforts ont été fournis afin de s’assurer de la justesse de l’information délivrée mais aucune assurance ou garantie ne peut être donnée.

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 5 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 5 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group