The European financial crisis has escalated again in the second quarter. Consumers’ assessments of the future of their economy and income as well as their willingness to make major purchases vary depending on the extent to which specific countries are affected by this development. Accordingly, a low mood among the population is particularly prevalent in the crisis countries Greece, Spain and Italy. These are findings of the GfK Consumer Climate Europe and USA survey, which provides an overview of the development of economic and income expectations and willingness to buy among consumers in 12 European countries and the USA.

In the last few weeks and months, an escalation of the banking crisis has seen financial crisis return to Europe. The situation in Spain demonstrates just how closely the fate of a country is linked to that of its banks. The EU has approved a €100 billion bailout for the government in Madrid in order to rescue its financial institutions. Greece and Ireland have also already received billion-euro bailouts for their banks. The worse the situation is in a country, the more critical it also becomes for its banks. This correlation has been reinforced by the crisis. On the one hand, financial institutions are supporting their troubled governments by purchasing government bonds. And, on the other, governments are stepping in when things become critical for their banks. If a country’s financial sector is in poor shape, sovereign debt essentially rises. As a result, rating agencies are quick to downgrade the rating for that country, as recently happened to Italy.

At the EU summit in Brussels at the end of June, European leaders agreed an expansion of the rescue package to support those eurozone countries that are potentially on shaky ground. In future, the European Financial Stability Facility (EFSF) and European Stability Mechanism (ESM) will have greater flexibility for implementing their existing rescue fund measures in order to stabilize government bond markets. Crisis countries will now have easier access to euro rescue funds and will have to comply with fewer conditions.

Italy and Spain are currently suffering from high interest rates and are really struggling to raise new money on the markets. The ESM crisis fund will be able to offer direct support to banks in future. This was not previously possible under the ESM Treaty. The money is to be transferred to the respective country, which would increase the sovereign debt of the countries, although, there were objections from Italy and Spain, who demanded that these funds were given directly to the rescued banks in order to preserve the national balance sheets. However, a prerequisite is that uniform banking supervision is established in the eurozone, in which the European Central Bank will play a central part. In addition, an economic recovery program of €120 billion was approved. Reactions from the markets to the fast track actions have so far been positive.

Whether these measures successfully reduce the severity of the financial crisis and prevent the breakup of the eurozone remains to be seen in the coming months. The willingness of affected national governments and their citizens to implement reforms will be decisive.

USA: Americans hope for economic recovery

The economy in the USA has so far struggled to really gain momentum. Experts think that it may currently be experiencing a second economic trough. In order to help stimulate growth, the government recently extended its lower payroll tax rate of 4.2 percent through 2012, a reduction of 2 percentage points was implemented in January 2011.

Americans are, however, noticeably more positive about the future of their economy overall than Europeans. In addition, they are hopeful about a recovery on the labor market in the coming months. At 8.1 percent in April, the unemployment rate dropped to its lowest level since January 2009. Part of this decrease in unemployment is due to many older workers entering early retirement because they have not been able to find new jobs. Since August last year, the economic expectations indicator has steadily increased from -3.9 points to its present level of 21.2 points. The average value for the previous survey period is nine points. Many US citizens are considerably less positive when it comes to the future of their own financial position. Income expectations are currently at 14.7 points and the average is 20 points.

The buying mood of consumers is weak and retail sales in the US fell again for the second consecutive time in May. Accordingly, the willingness to buy of American consumers has fallen further in the past few months. In June, the indicator value was a low -9.6 points and the average is -7 points. Americans have long since fallen back into old habits. While wages and salaries have hardly increased, consumers are once again buying on credit. In the past few months, the rate at which Americans borrowed money was the highest it has been in a decade. Conversely, the savings rate reached the lowest level since the end of 2007.

The real estate market may have bottomed out. Expensive rent and record low mortgage interest rate levels are motivating US citizens to purchase property again. The market is still some way from being in a strong position though and experts predict that it will not return to normality before 2016.

The banking sector has also not yet recovered from the US mortgage crisis. Many major banks have been downgraded by their rating agencies in recent weeks. On top of this, the European financial crisis has caused stock markets worldwide to drop, inspiring lower confidence in the markets. In light of this situation, American consumers are keeping a watchful eye on their spending. Experts predict that they will not be consuming more in the medium term either.

Economic expectations: 21.2 points Average: 9 points

Income expectations: 14.7 points Average: 20 points

Willingness to buy: -9.6 points Average: -7 points

United Kingdom: economy has slipped back into recession

In the first quarter of 2012, the gross national product in the United Kingdom fell for the second time in a row and the economy therefore slipped back into recession. It continues to grapple with the stringent austerity measures implemented by the government. Adding to this is the escalation of the financial crisis in eurozone countries. As the UK is not part of the single currency union, the country does not have to directly provide bailouts. But it is in fact contributing considerable sums indirectly via the IMF. As the banking crisis in Spain radically intensified, attention also once again focused on major British banks. Although the UK banking sector is not yet quaking, it is a problem by virtue of its magnitude alone. The total assets of the financial institutions are five times greater than the country’s gross domestic product. Furthermore, a number of banks are highly active with subsidiaries in crisis countries in particular. If the situation took a turn for the worse, the country would presumably not be able to save the failing banking giants. For this reason, the British government is making provisions and introducing stricter capital market regulations for banks than are in place in the eurozone.

Economic expectations: Italy slumps while Portugal becomes paragon

In the last few weeks and months, an escalation of the banking crisis has seen financial crisis return to Europe. The situation in Spain demonstrates just how closely the fate of a country is linked to that of its banks. The EU has approved a €100 billion bailout for the government in Madrid in order to rescue its financial institutions. Greece and Ireland have also already received billion-euro bailouts for their banks. The worse the situation is in a country, the more critical it also becomes for its banks. This correlation has been reinforced by the crisis. On the one hand, financial institutions are supporting their troubled governments by purchasing government bonds. And, on the other, governments are stepping in when things become critical for their banks. If a country’s financial sector is in poor shape, sovereign debt essentially rises. As a result, rating agencies are quick to downgrade the rating for that country, as recently happened to Italy.

At the EU summit in Brussels at the end of June, European leaders agreed an expansion of the rescue package to support those eurozone countries that are potentially on shaky ground. In future, the European Financial Stability Facility (EFSF) and European Stability Mechanism (ESM) will have greater flexibility for implementing their existing rescue fund measures in order to stabilize government bond markets. Crisis countries will now have easier access to euro rescue funds and will have to comply with fewer conditions.

Italy and Spain are currently suffering from high interest rates and are really struggling to raise new money on the markets. The ESM crisis fund will be able to offer direct support to banks in future. This was not previously possible under the ESM Treaty. The money is to be transferred to the respective country, which would increase the sovereign debt of the countries, although, there were objections from Italy and Spain, who demanded that these funds were given directly to the rescued banks in order to preserve the national balance sheets. However, a prerequisite is that uniform banking supervision is established in the eurozone, in which the European Central Bank will play a central part. In addition, an economic recovery program of €120 billion was approved. Reactions from the markets to the fast track actions have so far been positive.

Whether these measures successfully reduce the severity of the financial crisis and prevent the breakup of the eurozone remains to be seen in the coming months. The willingness of affected national governments and their citizens to implement reforms will be decisive.

USA: Americans hope for economic recovery

The economy in the USA has so far struggled to really gain momentum. Experts think that it may currently be experiencing a second economic trough. In order to help stimulate growth, the government recently extended its lower payroll tax rate of 4.2 percent through 2012, a reduction of 2 percentage points was implemented in January 2011.

Americans are, however, noticeably more positive about the future of their economy overall than Europeans. In addition, they are hopeful about a recovery on the labor market in the coming months. At 8.1 percent in April, the unemployment rate dropped to its lowest level since January 2009. Part of this decrease in unemployment is due to many older workers entering early retirement because they have not been able to find new jobs. Since August last year, the economic expectations indicator has steadily increased from -3.9 points to its present level of 21.2 points. The average value for the previous survey period is nine points. Many US citizens are considerably less positive when it comes to the future of their own financial position. Income expectations are currently at 14.7 points and the average is 20 points.

The buying mood of consumers is weak and retail sales in the US fell again for the second consecutive time in May. Accordingly, the willingness to buy of American consumers has fallen further in the past few months. In June, the indicator value was a low -9.6 points and the average is -7 points. Americans have long since fallen back into old habits. While wages and salaries have hardly increased, consumers are once again buying on credit. In the past few months, the rate at which Americans borrowed money was the highest it has been in a decade. Conversely, the savings rate reached the lowest level since the end of 2007.

The real estate market may have bottomed out. Expensive rent and record low mortgage interest rate levels are motivating US citizens to purchase property again. The market is still some way from being in a strong position though and experts predict that it will not return to normality before 2016.

The banking sector has also not yet recovered from the US mortgage crisis. Many major banks have been downgraded by their rating agencies in recent weeks. On top of this, the European financial crisis has caused stock markets worldwide to drop, inspiring lower confidence in the markets. In light of this situation, American consumers are keeping a watchful eye on their spending. Experts predict that they will not be consuming more in the medium term either.

Economic expectations: 21.2 points Average: 9 points

Income expectations: 14.7 points Average: 20 points

Willingness to buy: -9.6 points Average: -7 points

United Kingdom: economy has slipped back into recession

In the first quarter of 2012, the gross national product in the United Kingdom fell for the second time in a row and the economy therefore slipped back into recession. It continues to grapple with the stringent austerity measures implemented by the government. Adding to this is the escalation of the financial crisis in eurozone countries. As the UK is not part of the single currency union, the country does not have to directly provide bailouts. But it is in fact contributing considerable sums indirectly via the IMF. As the banking crisis in Spain radically intensified, attention also once again focused on major British banks. Although the UK banking sector is not yet quaking, it is a problem by virtue of its magnitude alone. The total assets of the financial institutions are five times greater than the country’s gross domestic product. Furthermore, a number of banks are highly active with subsidiaries in crisis countries in particular. If the situation took a turn for the worse, the country would presumably not be able to save the failing banking giants. For this reason, the British government is making provisions and introducing stricter capital market regulations for banks than are in place in the eurozone.

Economic expectations: Italy slumps while Portugal becomes paragon

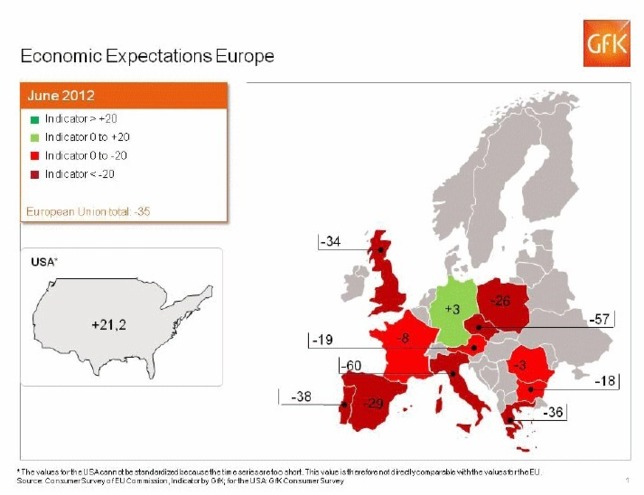

The renewed escalation of the financial crisis has taken almost all European economies by surprise. However, Portugal and Romania offer a glimmer of hope. The prospect of economic recovery was considered least likely by consumers in Italy (-60.2 points) and the Czech Republic (-57.1 point). The highest values were recorded in France (-8.2 points), Romania (-2.6 points) and Germany (3.0 points). The average in the European Union is -35 points. In the USA*, the indicator stands at 21.2 points.

In Italy, economic expectations have fallen significantly in the last three months. In March, the indicator value was -22.5 points and by June, this had plummeted to -60.2 points. The country has become the problem child of the EU. Italy is deep in recession and it does not look like it will emerge anytime soon. After the Italian economy declined by 0,8 percent in the first quarter of 2012, preliminary figures suggest that this poor development continued in the second quarter. This year, Italy could potentially suffer the worst recession in its history. Consumers are capping their purchases more than ever before and sales in the business sector are plummeting as a result. In addition, the government has to implement a strict austerity program.

Exports are not providing any relief and industry is becoming less and less of a presence on the global market. Exports of Italian products are now only worth €375 billion. Since the banking crisis in Spain intensified, Italian markets are again under closer scrutiny. Italy was downgraded by the rating agencies in recent weeks. As long as the economy does not recover, debt will continue to grow and the country will be forced to pay ever higher interest rates for government bonds. It remains to be seen whether the EU summit at the end of June has successfully instilled lasting trust in the markets.

Economic expectations in Austria have considerably improved again over the last few weeks and months, although the indicator did fall slightly in June. From -30.5 points in March, it rose to a high of -10.2 points and is currently at -18.6 points. This demonstrates that the population has confidence in the measures of its government. Austrians have perceived their government’s latest package of reforms, including tax and austerity measures, as a concrete move to cap debt and achieve long-term stable state finances. The clear recovery of the economic expectations indicator at a time when the European financial crisis is escalating is a testament to the confidence of Austrian consumers in their own economy. This comprises many competitive service providers and numerous medium-sized industrial enterprises, which have taken considerable risks in recent years. With an export ratio of 95 percent, they have conquered a series of global niche markets. Almost without other European countries realizing, Austria has become one of the world’s richest nations. It now boasts the third highest economic performance per head in Europe. This sound economic foundation means that Austria will most likely survive the European crisis with very little negative impact. Austrian consumers seem to think so in any case.

Despite renewed escalation of the European financial crisis, economic expectations in Romania have recovered further. While the indicator was at -26.2 points in March, it climbed to -2.6 points in June and therefore reached its highest value since November 2008. The indicator was at its lowest in June 2010 with -71 points. Despite all the trouble, the Romanian economy has steadily stabilized since. In 2011, the country registered economic growth of 2.5 percent of GDP. Economic expectations are also positive for 2012 and rates of between 1.5 percent and 2 percent of GDP are predicted. Romania successfully stayed within the set deficit threshold of 4.4 percent of GDP in 2011. Official registered unemployment is at 7.7 percent. This positive development is, however, still on shaky ground and is strongly dependent on the economic situation in the eurozone, which is responsible for 55 percent of Romanian exports. For 2012, the Romanian government has set a new borrowing limit of 1.9 percent of GDP. In Romania, too, there are increased calls to compensate for essential budget consolidation with greater incentives for growth and a significant improvement in competitiveness. Further economic development will depend on how effectively Romania revives domestic demand.

Economic expectations have only improved slightly in Portugal at the moment, from -40.6 points in March to -37.7 points in June. However, since September 2011, the country has shown signs of slow but steady growth. In fact, in June the indicator reached the highest value since September 2010. This corroborates with recent positive reports on the country.

Although Portugal was forced to seek a European bailout, it is fully employing EU aid and reform guidelines to become competitive once again. The government is demanding great sacrifices from its population: cuts for public sector wages and pensioners, in the health, education and social systems. VAT has been increased to 23 percent. As a result of the fuel tax, a liter of petrol now costs €1.78, which is more than in Germany. Vacation and Christmas bonuses were cut for the public sector and pensioners, but the court has ruled this unconstitutional as it infringes the equal treatment principle, making the task of keeping the budget under control harder for the government. Four national holidays will be canceled in 2013. Most motorways now charge a toll and healthcare is becoming more expensive with the introduction of a new tax. There is no general consensus in society that the European rescue measures are what is necessary and reforms which have been put into practice are far from being seen as successful. Still efforts reduced the budget deficit from 9.8 percent of GDP in 2010 to 4.5 percent in 2011. Tourism is still growing but at a slower pace due to lower internal demand and the economy will shrink by around three percent this year, so not all is on a positive path yet. Unemployment currently stands at around 15 percent. According to EU estimates, overall sovereign debt will rise to 114 percent of GDP in 2012. Portugal therefore has some way to go, but still hopes to overcome the crisis.

Income expectation: high in Germany; Greeks cautiously finding hope

In Italy, economic expectations have fallen significantly in the last three months. In March, the indicator value was -22.5 points and by June, this had plummeted to -60.2 points. The country has become the problem child of the EU. Italy is deep in recession and it does not look like it will emerge anytime soon. After the Italian economy declined by 0,8 percent in the first quarter of 2012, preliminary figures suggest that this poor development continued in the second quarter. This year, Italy could potentially suffer the worst recession in its history. Consumers are capping their purchases more than ever before and sales in the business sector are plummeting as a result. In addition, the government has to implement a strict austerity program.

Exports are not providing any relief and industry is becoming less and less of a presence on the global market. Exports of Italian products are now only worth €375 billion. Since the banking crisis in Spain intensified, Italian markets are again under closer scrutiny. Italy was downgraded by the rating agencies in recent weeks. As long as the economy does not recover, debt will continue to grow and the country will be forced to pay ever higher interest rates for government bonds. It remains to be seen whether the EU summit at the end of June has successfully instilled lasting trust in the markets.

Economic expectations in Austria have considerably improved again over the last few weeks and months, although the indicator did fall slightly in June. From -30.5 points in March, it rose to a high of -10.2 points and is currently at -18.6 points. This demonstrates that the population has confidence in the measures of its government. Austrians have perceived their government’s latest package of reforms, including tax and austerity measures, as a concrete move to cap debt and achieve long-term stable state finances. The clear recovery of the economic expectations indicator at a time when the European financial crisis is escalating is a testament to the confidence of Austrian consumers in their own economy. This comprises many competitive service providers and numerous medium-sized industrial enterprises, which have taken considerable risks in recent years. With an export ratio of 95 percent, they have conquered a series of global niche markets. Almost without other European countries realizing, Austria has become one of the world’s richest nations. It now boasts the third highest economic performance per head in Europe. This sound economic foundation means that Austria will most likely survive the European crisis with very little negative impact. Austrian consumers seem to think so in any case.

Despite renewed escalation of the European financial crisis, economic expectations in Romania have recovered further. While the indicator was at -26.2 points in March, it climbed to -2.6 points in June and therefore reached its highest value since November 2008. The indicator was at its lowest in June 2010 with -71 points. Despite all the trouble, the Romanian economy has steadily stabilized since. In 2011, the country registered economic growth of 2.5 percent of GDP. Economic expectations are also positive for 2012 and rates of between 1.5 percent and 2 percent of GDP are predicted. Romania successfully stayed within the set deficit threshold of 4.4 percent of GDP in 2011. Official registered unemployment is at 7.7 percent. This positive development is, however, still on shaky ground and is strongly dependent on the economic situation in the eurozone, which is responsible for 55 percent of Romanian exports. For 2012, the Romanian government has set a new borrowing limit of 1.9 percent of GDP. In Romania, too, there are increased calls to compensate for essential budget consolidation with greater incentives for growth and a significant improvement in competitiveness. Further economic development will depend on how effectively Romania revives domestic demand.

Economic expectations have only improved slightly in Portugal at the moment, from -40.6 points in March to -37.7 points in June. However, since September 2011, the country has shown signs of slow but steady growth. In fact, in June the indicator reached the highest value since September 2010. This corroborates with recent positive reports on the country.

Although Portugal was forced to seek a European bailout, it is fully employing EU aid and reform guidelines to become competitive once again. The government is demanding great sacrifices from its population: cuts for public sector wages and pensioners, in the health, education and social systems. VAT has been increased to 23 percent. As a result of the fuel tax, a liter of petrol now costs €1.78, which is more than in Germany. Vacation and Christmas bonuses were cut for the public sector and pensioners, but the court has ruled this unconstitutional as it infringes the equal treatment principle, making the task of keeping the budget under control harder for the government. Four national holidays will be canceled in 2013. Most motorways now charge a toll and healthcare is becoming more expensive with the introduction of a new tax. There is no general consensus in society that the European rescue measures are what is necessary and reforms which have been put into practice are far from being seen as successful. Still efforts reduced the budget deficit from 9.8 percent of GDP in 2010 to 4.5 percent in 2011. Tourism is still growing but at a slower pace due to lower internal demand and the economy will shrink by around three percent this year, so not all is on a positive path yet. Unemployment currently stands at around 15 percent. According to EU estimates, overall sovereign debt will rise to 114 percent of GDP in 2012. Portugal therefore has some way to go, but still hopes to overcome the crisis.

Income expectation: high in Germany; Greeks cautiously finding hope

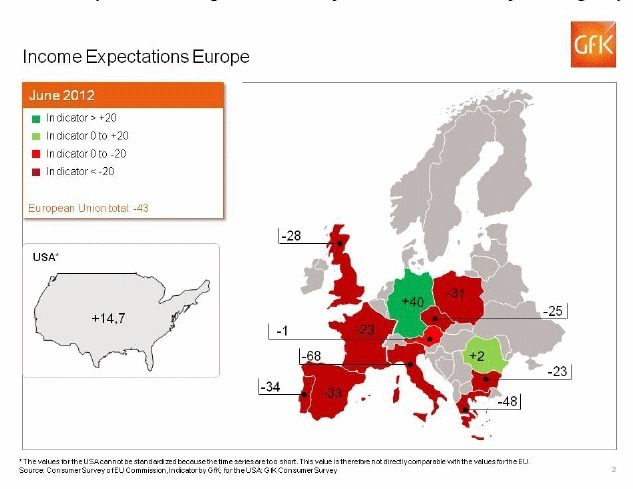

In many European countries, consumers are anticipating rising income in the coming months, albeit often at a very low level. The indicator has largely remained stable or even improved. The lowest values were recorded in Portugal (-33.7 points), Greece (-48.0 points) and Italy (-68.0 points). Increased income is expected by Austrians (-1.0 points), Romanians (1.6 points) and Germans (40.1 points). The average in the European Union is -43 points and in the USA*, the indicator is at 14.7 points.

Germans continue to expect an increase in income. From an already high level of 34.3 points in March, the indicator rose again to 40.1 points in June. This is attributable to extremely good general conditions. Even though economic expectations most recently dropped, growth is maintaining a comparatively high level, predicted at almost one percent for 2012. A decisive factor is that unemployment is continuing to decline and, at 6.6 percent, has dropped to the lowest rate since 1991. This is boosted by high wage agreements across all sectors. Pressure of inflation also recently abated somewhat. In May, the price rise for the cost of living dropped below the key psychological level of two percent. Especially petrol prices, which are a major psychological issue in Germany, dropped in price quite considerably recently. Consumers therefore feel that their purchasing power has been strengthened once again.

Overall, income expectations have been relatively stable at a low level in Spain over the past few months. The indicator was at -29.7 points in March and -32.9 points in June, although it did briefly plummet to -43 points in May. Spain’s most pressing problem is a high level of unemployment, which has risen to almost 25 percent at present. This is the highest rate of all industrialized countries worldwide. Overall, 60 percent of the unemployed population, young and old, thinks that finding a job in the next 12 months is highly or completely unlikely. As a result of high uncertainty in financial markets, sovereign debt and consequently the government deficit are rising higher and higher. The European Commission’s stipulation for Spain to increase excise duty is now starting to have an impact. The finance ministry has decided to impose a higher rate of VAT on a range of products. This also includes hotel accommodation, transport, movie theaters and food, which will now be under the basic tax rate of 10 percent, rather than the reduced 8 percent at present. This would of course also have a knock-on effect on the purchasing power of Spanish consumers. The already low income will in all probability be worth even less.

Although income expectations of Czech consumers had recovered slightly by January, they had fallen again to -42.7 points in May as a result of the escalating financial crisis. In June they improved again to the current level of -24.5 points. One reason for this recovery is the seasonal positive development on the labor market. The unemployment rate is currently at 6.7 percent. However, this rise will probably only be short-lived. The Czech economy fell into recession in the second quarter. For 2012, economic growth is only expected to be 0.2 percent. In addition, the government recently approved an increase in VAT at the beginning of 2013 from 14 percent and 20 percent to 15 percent and 21 percent respectively. Inflation is currently at 2.7 percent and therefore well above the critical 2-percent mark. As part of the reform process, thousands of officials will be made redundant in the public sector. These developments are all reasons why Czechs do not anticipate salary and wage increases or an improvement in their purchasing power.

In the last few months, Greeks’ income expectations have climbed from the lowest level this year (-66.6 points in February 2012) to -48 points at present. The indicator value appears to have bottomed out for now, but the situation remains extremely critical. Unemployment is well above 22 percent and many of those who do have a job have not been paid for months. The economy is stuck deep in recession and there is no end in sight. However, Greeks are holding on to the hope that the reelection in June (which was held after the survey was conducted) will bring a pro-European government back to power. This will negotiate with the Troika to buy the Greeks more time for fulfilling the conditions of the bailout. There is also hope that the initiated reforms will ultimately take effect and enable the economy to gradually recover. Consumers’ purchasing power is currently strengthened by falling prices for food and electronic devices, in particular.

Willingness to buy: French spend, Brits save

Germans continue to expect an increase in income. From an already high level of 34.3 points in March, the indicator rose again to 40.1 points in June. This is attributable to extremely good general conditions. Even though economic expectations most recently dropped, growth is maintaining a comparatively high level, predicted at almost one percent for 2012. A decisive factor is that unemployment is continuing to decline and, at 6.6 percent, has dropped to the lowest rate since 1991. This is boosted by high wage agreements across all sectors. Pressure of inflation also recently abated somewhat. In May, the price rise for the cost of living dropped below the key psychological level of two percent. Especially petrol prices, which are a major psychological issue in Germany, dropped in price quite considerably recently. Consumers therefore feel that their purchasing power has been strengthened once again.

Overall, income expectations have been relatively stable at a low level in Spain over the past few months. The indicator was at -29.7 points in March and -32.9 points in June, although it did briefly plummet to -43 points in May. Spain’s most pressing problem is a high level of unemployment, which has risen to almost 25 percent at present. This is the highest rate of all industrialized countries worldwide. Overall, 60 percent of the unemployed population, young and old, thinks that finding a job in the next 12 months is highly or completely unlikely. As a result of high uncertainty in financial markets, sovereign debt and consequently the government deficit are rising higher and higher. The European Commission’s stipulation for Spain to increase excise duty is now starting to have an impact. The finance ministry has decided to impose a higher rate of VAT on a range of products. This also includes hotel accommodation, transport, movie theaters and food, which will now be under the basic tax rate of 10 percent, rather than the reduced 8 percent at present. This would of course also have a knock-on effect on the purchasing power of Spanish consumers. The already low income will in all probability be worth even less.

Although income expectations of Czech consumers had recovered slightly by January, they had fallen again to -42.7 points in May as a result of the escalating financial crisis. In June they improved again to the current level of -24.5 points. One reason for this recovery is the seasonal positive development on the labor market. The unemployment rate is currently at 6.7 percent. However, this rise will probably only be short-lived. The Czech economy fell into recession in the second quarter. For 2012, economic growth is only expected to be 0.2 percent. In addition, the government recently approved an increase in VAT at the beginning of 2013 from 14 percent and 20 percent to 15 percent and 21 percent respectively. Inflation is currently at 2.7 percent and therefore well above the critical 2-percent mark. As part of the reform process, thousands of officials will be made redundant in the public sector. These developments are all reasons why Czechs do not anticipate salary and wage increases or an improvement in their purchasing power.

In the last few months, Greeks’ income expectations have climbed from the lowest level this year (-66.6 points in February 2012) to -48 points at present. The indicator value appears to have bottomed out for now, but the situation remains extremely critical. Unemployment is well above 22 percent and many of those who do have a job have not been paid for months. The economy is stuck deep in recession and there is no end in sight. However, Greeks are holding on to the hope that the reelection in June (which was held after the survey was conducted) will bring a pro-European government back to power. This will negotiate with the Troika to buy the Greeks more time for fulfilling the conditions of the bailout. There is also hope that the initiated reforms will ultimately take effect and enable the economy to gradually recover. Consumers’ purchasing power is currently strengthened by falling prices for food and electronic devices, in particular.

Willingness to buy: French spend, Brits save

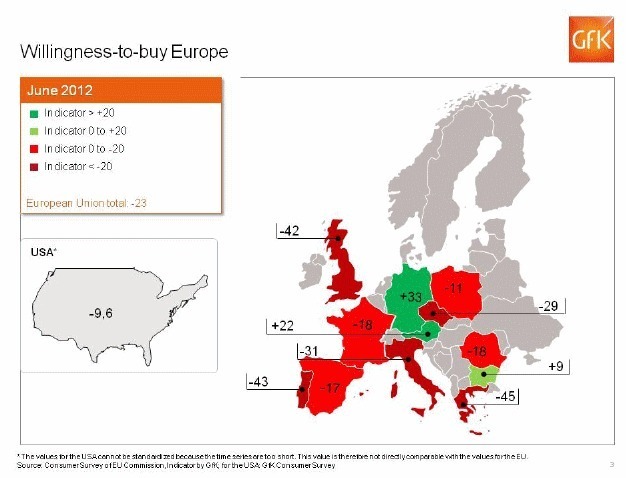

In most European countries, willingness to buy has been relatively constant at a low to very low level. It has improved in some countries in the last one to two months. Consumers are concerned about further tax increases as part of Europe-wide consolidation measures. In some countries, VAT rises coming into effect at the beginning of next year have already been approved. Consumers therefore think that now is a good time to make major purchases. However, there is an enormous difference between wanting to consume and being able to consume. Many people quite simply cannot afford major purchases at the moment, even if now would be a sensible time. At present, the lowest willingness to buy is in the United Kingdom (-42.3 points), Portugal (-43.2 points) and Greece (-45.2 points). The most eager to consume are the Bulgarians (8.5 points), Austrians (22.4 points) and Germans (32.7 points). The average across the European Union is -23 points. USA* has a level of -9.6 points.

Although the willingness to buy of Brits has slightly improved over the last three months, it remains at an extremely low level at -42.3 points. In March, the indicator was -49.5 points. The double dip of the British economy into a second recession at the start of the year was partly caused by disenchanted consumers. Conversely, this has further fueled uncertainty in the population.

Even if the UK is not part of the euro, it is certainly affected by the consequences. First, the country is involved in the bailout fund via the World Bank and the IMF. Second, the crisis has a direct impact on the entire British economy by reducing exports. And finally the UK had not yet overcome the first financial crisis after the collapse of Lehman Brothers in autumn 2008 when the second crisis hit. The crisis cost the UK dearly in terms of economic programs and the state deficit almost doubled. Unemployment, and especially long-term unemployment, continues to rise. In light of this, consumers are keeping a close eye on their money and thinking carefully about whether or not purchases are necessary. A bout of terrible weather over the last few weeks has further dampened the shopping spirit of British consumers.

In France, the willingness of consumers to spend money has steadily risen over the past few months. The indicator currently stands at -17.6 points, which is the highest value since November 2007. After surprising growth for the economy at the end of last year, it has once again slipped back into recession this year. The crisis has returned to France. In spring, the country’s credit rating was downgraded by several rating agencies. France has to pay higher interest rates for its government bonds and French banks are stuck in the depths of the financial crisis. This is above all attributable to its intense commitment in the crisis countries of Greece, Spain and Portugal, where major French banks have subsidiaries and are involved with a high degree of lending. The growing state debt is forcing the French government to implement radical austerity measures. Consumers are also anticipating an increase in taxes. As the population is currently still relatively well off, many are considering investing their money in high-value purchases now rather than saving it with crisis-troubled banks.

The willingness to buy in Poland clearly reflects the uncertainty of the population as a result of the renewed escalation of the financial crisis. In March, the indicator value was -3.6 points. Economic data was good across the board and positive developments were expected for the country. As the situation in Greece and Spain intensified in May, the indicator plummeted to -28.4 points. It recovered slightly in June and is currently at -11 points. Poles evidently fear that they will be drawn into the downward spiral with the crisis countries. All three indicators developed almost in parallel with those in the three crisis countries. Consumers are convinced that positive development of the Polish economy cannot be sustained if the situation in Europe overall, and Greece, Spain and Italy in particular, does not improve. Clearly high economic growth, a falling unemployment rate and rising salaries and wages are doing little to quash this fear.

Willingness to buy also continuously increased in Bulgaria over the last quarter. While the indicator was -7.4 points in March, it rose to 8.5 points in June. Alongside Austria and Germany, Bulgaria is therefore the only country with a positive value for willingness to buy. Following the crisis years of 2009 and 2010, the Bulgarian economy has found solid ground again and registered growth of 2.2 percent last year. It also increased in the first quarter of this year by 0.5 percent, which is not a bad value in light of the financial crisis. However, forecasts for economic growth this year are lower. Unemployment remains high at around 12 percent. This situation stirs up very mixed feelings among Bulgarian consumers. Nevertheless there is hope as slow but steady growth in income has been predicted for Bulgaria for the next few months. This is a good forecast at times of crisis and should stimulate a positive mood among consumers.

The survey

These findings are taken from the GfK Consumer Climate MAXX survey, which is based on consumer interviews conducted in all European Union countries each month on behalf of the EU Commission. The GfK Consumer Climate Europe provides an overview of the developments in economic and income expectations as well as willingness to buy of consumers in Austria, Bulgaria, the Czech Republic, France, Germany, Greece, Italy, Poland, Portugal, Romania, Spain and the United Kingdom. These twelve countries account for around 80% of the total population of all 27 EU countries.

The monthly interviews are distributed as follows among the countries observed:

Austria 1,500

Bulgaria 1,000

Czech Republic 1,000

France 3,300

Germany 2,000

Greece 1,500

Italy 2,000

Poland 1,000

Portugal 2,100

Romania 1,000

Spain 2,000

United Kingdom 2,000

*GfK has also been carrying out the Consumer Climate survey in the USA since March 2011. The questions are the same as for the survey in the European Union. Given the relatively short time series available, the data cannot be standardized. Consequently, it is not possible to set a long-term average at 0.

Further information: www.gfk.com/consumer_climate_europe

The table below provides an overview of the individual indicators:

- Economic expectations:

This index is based on the following question to consumers: “How do you think the general economic situation will develop in the next 12 months?” (improve considerably – improve somewhat – remain approximately the same – deteriorate somewhat – deteriorate considerably – don’t know)

- Income expectations:

This index is based on the following question to consumers: “How do you think the financial situation of your household will develop in the next 12 months?” (improve considerably – improve somewhat – remain approximately the same – deteriorate somewhat – deteriorate considerably – don’t know)

- Consumption and buying willingness:

This index is based on the following question to consumers: “Do you think it is advisable to make major purchases at the moment?” (Yes, it’s a good time to do so – now is neither a particularly good nor a particularly bad time - no, it is a bad time to do so – don’t know).

About GfK

GfK is one of the world’s largest research companies, with more than 11,500 experts working to discover new insights into the way people live, think and shop, in over 100 markets, every day. GfK is constantly innovating and using the latest technologies and the smartest methodologies to give its clients the clearest understanding of the most important people in the world: their customers. In 2011, GfK’s sales amounted to EUR 1.37 billion.

Although the willingness to buy of Brits has slightly improved over the last three months, it remains at an extremely low level at -42.3 points. In March, the indicator was -49.5 points. The double dip of the British economy into a second recession at the start of the year was partly caused by disenchanted consumers. Conversely, this has further fueled uncertainty in the population.

Even if the UK is not part of the euro, it is certainly affected by the consequences. First, the country is involved in the bailout fund via the World Bank and the IMF. Second, the crisis has a direct impact on the entire British economy by reducing exports. And finally the UK had not yet overcome the first financial crisis after the collapse of Lehman Brothers in autumn 2008 when the second crisis hit. The crisis cost the UK dearly in terms of economic programs and the state deficit almost doubled. Unemployment, and especially long-term unemployment, continues to rise. In light of this, consumers are keeping a close eye on their money and thinking carefully about whether or not purchases are necessary. A bout of terrible weather over the last few weeks has further dampened the shopping spirit of British consumers.

In France, the willingness of consumers to spend money has steadily risen over the past few months. The indicator currently stands at -17.6 points, which is the highest value since November 2007. After surprising growth for the economy at the end of last year, it has once again slipped back into recession this year. The crisis has returned to France. In spring, the country’s credit rating was downgraded by several rating agencies. France has to pay higher interest rates for its government bonds and French banks are stuck in the depths of the financial crisis. This is above all attributable to its intense commitment in the crisis countries of Greece, Spain and Portugal, where major French banks have subsidiaries and are involved with a high degree of lending. The growing state debt is forcing the French government to implement radical austerity measures. Consumers are also anticipating an increase in taxes. As the population is currently still relatively well off, many are considering investing their money in high-value purchases now rather than saving it with crisis-troubled banks.

The willingness to buy in Poland clearly reflects the uncertainty of the population as a result of the renewed escalation of the financial crisis. In March, the indicator value was -3.6 points. Economic data was good across the board and positive developments were expected for the country. As the situation in Greece and Spain intensified in May, the indicator plummeted to -28.4 points. It recovered slightly in June and is currently at -11 points. Poles evidently fear that they will be drawn into the downward spiral with the crisis countries. All three indicators developed almost in parallel with those in the three crisis countries. Consumers are convinced that positive development of the Polish economy cannot be sustained if the situation in Europe overall, and Greece, Spain and Italy in particular, does not improve. Clearly high economic growth, a falling unemployment rate and rising salaries and wages are doing little to quash this fear.

Willingness to buy also continuously increased in Bulgaria over the last quarter. While the indicator was -7.4 points in March, it rose to 8.5 points in June. Alongside Austria and Germany, Bulgaria is therefore the only country with a positive value for willingness to buy. Following the crisis years of 2009 and 2010, the Bulgarian economy has found solid ground again and registered growth of 2.2 percent last year. It also increased in the first quarter of this year by 0.5 percent, which is not a bad value in light of the financial crisis. However, forecasts for economic growth this year are lower. Unemployment remains high at around 12 percent. This situation stirs up very mixed feelings among Bulgarian consumers. Nevertheless there is hope as slow but steady growth in income has been predicted for Bulgaria for the next few months. This is a good forecast at times of crisis and should stimulate a positive mood among consumers.

The survey

These findings are taken from the GfK Consumer Climate MAXX survey, which is based on consumer interviews conducted in all European Union countries each month on behalf of the EU Commission. The GfK Consumer Climate Europe provides an overview of the developments in economic and income expectations as well as willingness to buy of consumers in Austria, Bulgaria, the Czech Republic, France, Germany, Greece, Italy, Poland, Portugal, Romania, Spain and the United Kingdom. These twelve countries account for around 80% of the total population of all 27 EU countries.

The monthly interviews are distributed as follows among the countries observed:

Austria 1,500

Bulgaria 1,000

Czech Republic 1,000

France 3,300

Germany 2,000

Greece 1,500

Italy 2,000

Poland 1,000

Portugal 2,100

Romania 1,000

Spain 2,000

United Kingdom 2,000

*GfK has also been carrying out the Consumer Climate survey in the USA since March 2011. The questions are the same as for the survey in the European Union. Given the relatively short time series available, the data cannot be standardized. Consequently, it is not possible to set a long-term average at 0.

Further information: www.gfk.com/consumer_climate_europe

The table below provides an overview of the individual indicators:

- Economic expectations:

This index is based on the following question to consumers: “How do you think the general economic situation will develop in the next 12 months?” (improve considerably – improve somewhat – remain approximately the same – deteriorate somewhat – deteriorate considerably – don’t know)

- Income expectations:

This index is based on the following question to consumers: “How do you think the financial situation of your household will develop in the next 12 months?” (improve considerably – improve somewhat – remain approximately the same – deteriorate somewhat – deteriorate considerably – don’t know)

- Consumption and buying willingness:

This index is based on the following question to consumers: “Do you think it is advisable to make major purchases at the moment?” (Yes, it’s a good time to do so – now is neither a particularly good nor a particularly bad time - no, it is a bad time to do so – don’t know).

About GfK

GfK is one of the world’s largest research companies, with more than 11,500 experts working to discover new insights into the way people live, think and shop, in over 100 markets, every day. GfK is constantly innovating and using the latest technologies and the smartest methodologies to give its clients the clearest understanding of the most important people in the world: their customers. In 2011, GfK’s sales amounted to EUR 1.37 billion.

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group