We surveyed more than 10,000 digitally active people in Australia, Canada, Hong Kong, Singapore, the United Kingdom and the United States to better understand the overall rate of FinTech adoption, which users are adopting which products and the outlook for future usage.

The FinTech phenomenon

FinTechs are moving in on the traditional financial services landscape and their products and services are catching on. For traditional financial services companies, including banks, insurers and wealth and asset management companies, the risk of disruption is real.

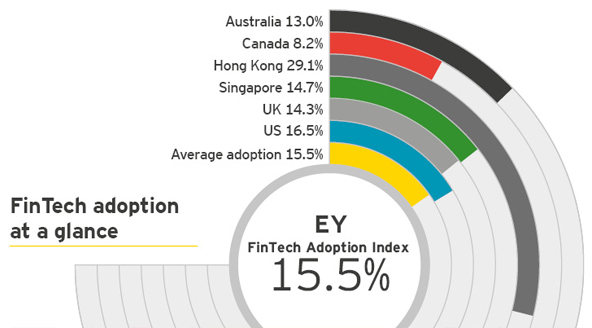

Our survey shows that 15.5% of digitally active consumers have used at least two FinTech products within the last six months. As awareness of the available products and services increases, adoption rates could double within the year.

Hong Kong has the highest rate of FinTech use of all markets surveyed (29.1%). The United States has the second-highest adoption rate (16.5%), followed by Singapore (14.7%), the United Kingdom (14.3%), Australia (13%) and Canada (8.2%).

The FinTech phenomenon

FinTechs are moving in on the traditional financial services landscape and their products and services are catching on. For traditional financial services companies, including banks, insurers and wealth and asset management companies, the risk of disruption is real.

Our survey shows that 15.5% of digitally active consumers have used at least two FinTech products within the last six months. As awareness of the available products and services increases, adoption rates could double within the year.

Hong Kong has the highest rate of FinTech use of all markets surveyed (29.1%). The United States has the second-highest adoption rate (16.5%), followed by Singapore (14.7%), the United Kingdom (14.3%), Australia (13%) and Canada (8.2%).

Eckart Zollner

Making life easier

As FinTech makes customers’ lives easier, traditional providers will need to step up their efforts to serve customers just as effectively.

Traditional financial services firms can learn from how FinTechs think about the customer proposition and how they are harnessing technology to deliver value and convenience.

Identifying which customers are most at risk from the new competition – and developing new products and services to retain them – is a must-do first step.

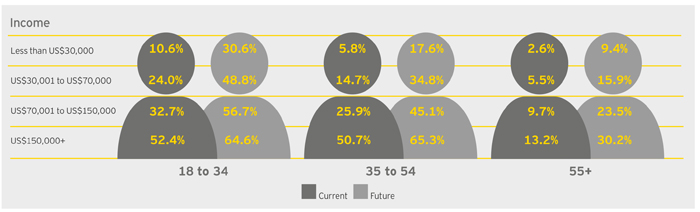

(Future use of FinTech)

As FinTech makes customers’ lives easier, traditional providers will need to step up their efforts to serve customers just as effectively.

Traditional financial services firms can learn from how FinTechs think about the customer proposition and how they are harnessing technology to deliver value and convenience.

Identifying which customers are most at risk from the new competition – and developing new products and services to retain them – is a must-do first step.

(Future use of FinTech)

A young, urban and valuable audience

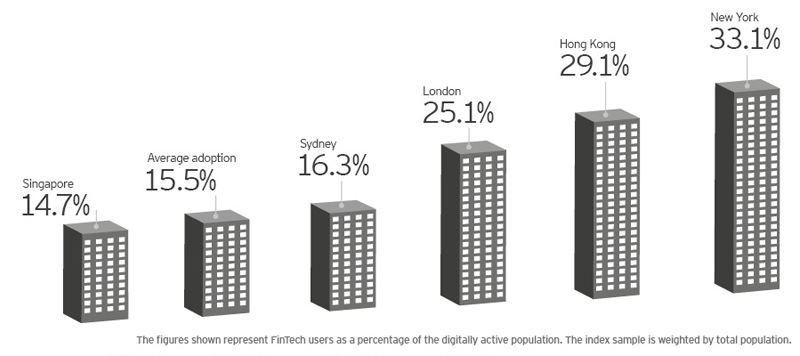

Early FinTech adopters tend to be younger, higher-income customers, with adoption concentrated in high-development urban areas such as New York, Hong Kong and London.

These users are some of banking and insurance's most valuable customers, and traditional providers must reconsider the way they meet these users’ needs if they want to stem the flight to FinTech.

This will require re-evaluating their own multi-channel strategies as well as exploring partnerships with FinTech providers.

(FinTech use in major urban areas)

Early FinTech adopters tend to be younger, higher-income customers, with adoption concentrated in high-development urban areas such as New York, Hong Kong and London.

These users are some of banking and insurance's most valuable customers, and traditional providers must reconsider the way they meet these users’ needs if they want to stem the flight to FinTech.

This will require re-evaluating their own multi-channel strategies as well as exploring partnerships with FinTech providers.

(FinTech use in major urban areas)

Payments transformed

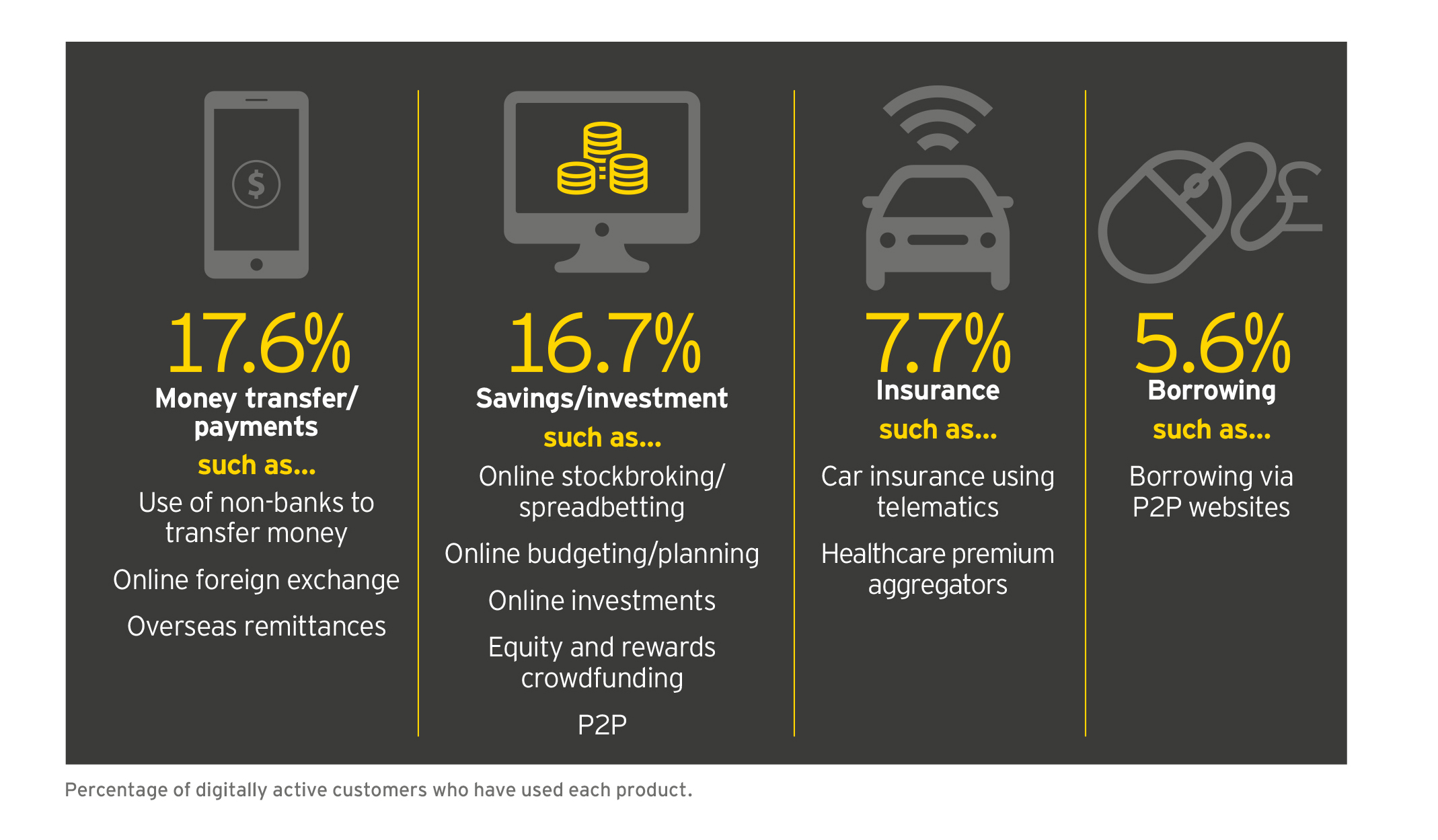

FinTech is revolutionizing the way we pay for goods and services, transfer money between accounts and send it overseas. These three activities are the most-used FinTech services according to our survey, and are followed closely by savings and investment products such as online stockbroking/spreadbetting, online budgeting/planning, online investments, equity and rewards crowdfunding and peer-to-peer or marketplace lending.

While they do exist, health insurance premium aggregators, car insurance telematics and peer-to-peer online borrowing websites are among the less commonly used services.

(Most used FinTech services)

FinTech is revolutionizing the way we pay for goods and services, transfer money between accounts and send it overseas. These three activities are the most-used FinTech services according to our survey, and are followed closely by savings and investment products such as online stockbroking/spreadbetting, online budgeting/planning, online investments, equity and rewards crowdfunding and peer-to-peer or marketplace lending.

While they do exist, health insurance premium aggregators, car insurance telematics and peer-to-peer online borrowing websites are among the less commonly used services.

(Most used FinTech services)

Easy and convenient

The relative ease in setting up an account was overwhelmingly cited by respondents in our survey as the top reason for using FinTech. More attractive rates, access to different products and services and a better online experience were also popular responses but it is the simplicity involved in using FinTech products and services that is driving adoption.

While many traditional providers are grappling with how to replace cumbersome, outdated and time-consuming account establishment forms and processes, FinTechs are enabling customers to set up services with as little as one click.

(Top seven reasons for using FinTech)

The relative ease in setting up an account was overwhelmingly cited by respondents in our survey as the top reason for using FinTech. More attractive rates, access to different products and services and a better online experience were also popular responses but it is the simplicity involved in using FinTech products and services that is driving adoption.

While many traditional providers are grappling with how to replace cumbersome, outdated and time-consuming account establishment forms and processes, FinTechs are enabling customers to set up services with as little as one click.

(Top seven reasons for using FinTech)

Identifying the obstacles

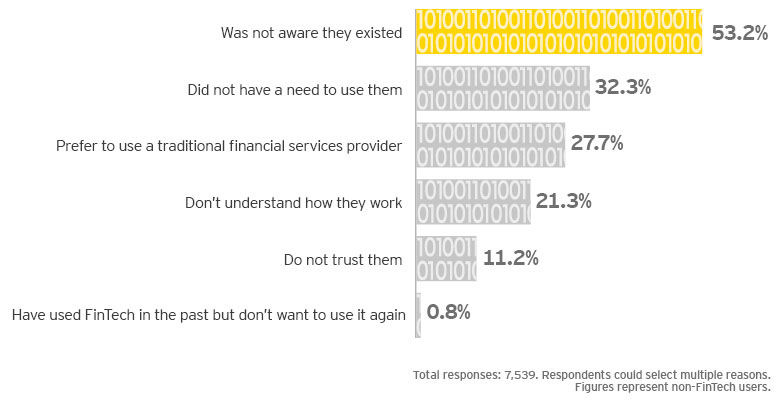

While ease of use remains FinTech’s key selling point, it’s a lack of awareness that is the main impediment to its adoption – the majority of non-FinTech users claim they don’t know such products exist.

Other respondents feel they don’t need the products or they prefer traditional financial services providers.

Interestingly, trust has not been a major obstacle to FinTech use, with only 11.2% of respondents saying they don’t trust FinTech products.

(Top six reasons for not using FinTech)

While ease of use remains FinTech’s key selling point, it’s a lack of awareness that is the main impediment to its adoption – the majority of non-FinTech users claim they don’t know such products exist.

Other respondents feel they don’t need the products or they prefer traditional financial services providers.

Interestingly, trust has not been a major obstacle to FinTech use, with only 11.2% of respondents saying they don’t trust FinTech products.

(Top six reasons for not using FinTech)

Our survey

The first EY FinTech Adoption Index shows significant opportunity for both traditional and new generation of financial services providers to gain valuable market share by offering innovative FinTech products and services.

The index defines FinTech services as financial services products developed by non-bank, non-insurance, online companies. We evaluated 10 services in four categories: savings and investments, money transfer and payments, borrowing and insurance. Users were defined as digitally active consumers who use two or more FinTech products or services. The survey was conducted from 1 September 2015 to 6 October 2015.

www.ey.com

The first EY FinTech Adoption Index shows significant opportunity for both traditional and new generation of financial services providers to gain valuable market share by offering innovative FinTech products and services.

The index defines FinTech services as financial services products developed by non-bank, non-insurance, online companies. We evaluated 10 services in four categories: savings and investments, money transfer and payments, borrowing and insurance. Users were defined as digitally active consumers who use two or more FinTech products or services. The survey was conducted from 1 September 2015 to 6 October 2015.

www.ey.com

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group