The U.S. market for cash management technology remains a fragmented one, says Aite Group in its latest report, 2014 Evaluation of the Leading U.S. Cash Management Providers.

Approximately 42% of large and midsize banks in North America are not satisfied with their existing corporate online banking and corporate portal applications, and off those institutions, 45% plan to increase their IT spending in this area over the next 24 months.

In addition to this, only 19% of U.S.-based corporations find their banks' reports to be customizable and to provide exactly what they are looking for. The large majority either have to create some of their own reports or choose not to use any of the bank-offered reports. Reporting is, therefore, now an area of focus for banks as well as their technology vendor partners.

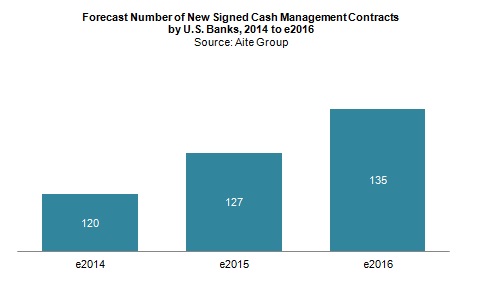

While many banks are not satisfied with their existing online and mobile cash management offerings, the number of U.S.-based financial institutions signing contracts to replace their existing cash management solutions has declined slightly during each of the last few years. This slowdown in activity has been due in part to other priorities and regulatory distractions that cause financial institutions to place several cash management initiatives on a back burner. Yet despite the current outlook, Aite Group still forecasts a 6% increase in the number of new cash management contracts that will be signed over the next few years.

Aite Group's research also explores some of the key trends within the U.S. cash management industry. One key trend—greater use of the mobile channel, and especially the tablet—is having the largest impact on usability enhancements. In fact, the superior user interface achieved on a tablet is now driving change online. Financial institutions should, therefore, partner with a technology provider that offers mobile banking capabilities through both smartphone and tablet devices, offering a user experience similar to that experienced online.

Approximately 42% of large and midsize banks in North America are not satisfied with their existing corporate online banking and corporate portal applications, and off those institutions, 45% plan to increase their IT spending in this area over the next 24 months.

In addition to this, only 19% of U.S.-based corporations find their banks' reports to be customizable and to provide exactly what they are looking for. The large majority either have to create some of their own reports or choose not to use any of the bank-offered reports. Reporting is, therefore, now an area of focus for banks as well as their technology vendor partners.

While many banks are not satisfied with their existing online and mobile cash management offerings, the number of U.S.-based financial institutions signing contracts to replace their existing cash management solutions has declined slightly during each of the last few years. This slowdown in activity has been due in part to other priorities and regulatory distractions that cause financial institutions to place several cash management initiatives on a back burner. Yet despite the current outlook, Aite Group still forecasts a 6% increase in the number of new cash management contracts that will be signed over the next few years.

Aite Group's research also explores some of the key trends within the U.S. cash management industry. One key trend—greater use of the mobile channel, and especially the tablet—is having the largest impact on usability enhancements. In fact, the superior user interface achieved on a tablet is now driving change online. Financial institutions should, therefore, partner with a technology provider that offers mobile banking capabilities through both smartphone and tablet devices, offering a user experience similar to that experienced online.

“Corporate customers can expect a lot of changes in the appearance as well as the usefulness of their bank’s online offerings over the coming months. In addition to gaining easier access to more consolidated information, corporations can expect better reporting capabilities, greater automation, and a continued focus on enhancing security,” says Christine Barry, research director in Wholesale Banking at Aite Group.

"The technology providers that will ultimately succeed will be the ones that continue to evolve their strategies and offerings for financial institutions, while maintaining an architecture flexible enough to quickly address the needs of tomorrow's customers."

Aite Group

aitegroup.com

"The technology providers that will ultimately succeed will be the ones that continue to evolve their strategies and offerings for financial institutions, while maintaining an architecture flexible enough to quickly address the needs of tomorrow's customers."

Aite Group

aitegroup.com

Les médias du groupe Finyear

Chaque jour (5j/7) lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Chaque mois lisez gratuitement :

Le magazine digital :

- Finyear Magazine

Les 6 lettres digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

- GRC Manager

- Le Contrôleur de Gestion (PROJET 2014)

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Chaque mois lisez gratuitement :

Le magazine digital :

- Finyear Magazine

Les 6 lettres digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

- GRC Manager

- Le Contrôleur de Gestion (PROJET 2014)

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group