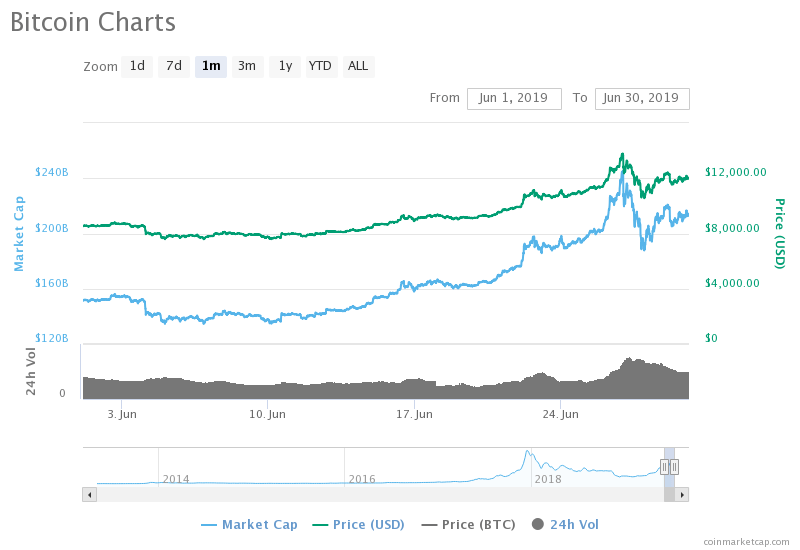

Bitcoin’s trajectory has been eye-catching. Most of last year it hovered below $4,000, and earlier this week its price reached $14,000. While still very explosive and volatile, many predict that it will soon go past $20,000, the highest price it ever reached, at the end of 2017.

Bitcoin’s phenomenal rise has made it hard to ignore, with many debating the potential of Bitcoin and cryptocurrencies.

Bitcoin’s phenomenal rise has made it hard to ignore, with many debating the potential of Bitcoin and cryptocurrencies.

Some have called Bitcoin a fraud and many have suggested that cryptocurrency prices are in a bubble, that will eventually burst. While claims like these have sidelined many investors from getting into the market, they are not the only reason. Volatility and lack of safeguards that other financial assets have also been critical for investors.

But, do bubble claims really hold any water?

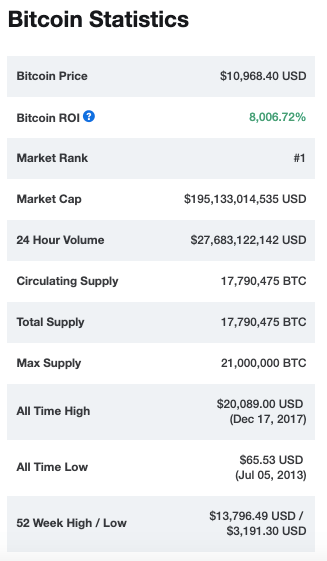

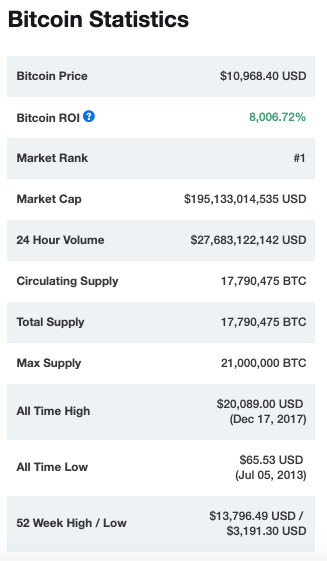

Well, since it was launched in 2009, Bitcoin has had over 8,000% ROI, according to CoinMarketCap.

But, do bubble claims really hold any water?

Well, since it was launched in 2009, Bitcoin has had over 8,000% ROI, according to CoinMarketCap.

If Bitcoin was a bubble, why do we see it keep coming back, rising from the dead?

Several factors are affecting Bitcoin’s price: Increased institutional involvement, Facebook’s Libra launch, Bakkt has been cleared to test it’s futures products in July, bringing us closer to a BTC ETF.

People are HODLing

The adoption of Bitcoin is increasing, but people are still not utilizing this coin to buy an asset. Research reveals that in the year 2019, above ninety percent (98.7%) Bitcoin transactions are contributed by exchanges and the remaining 1.3% from merchants. Its involvement in payment system around the globe is still negligible, and most people just hodl Bitcoin.

Several factors are affecting Bitcoin’s price: Increased institutional involvement, Facebook’s Libra launch, Bakkt has been cleared to test it’s futures products in July, bringing us closer to a BTC ETF.

People are HODLing

The adoption of Bitcoin is increasing, but people are still not utilizing this coin to buy an asset. Research reveals that in the year 2019, above ninety percent (98.7%) Bitcoin transactions are contributed by exchanges and the remaining 1.3% from merchants. Its involvement in payment system around the globe is still negligible, and most people just hodl Bitcoin.

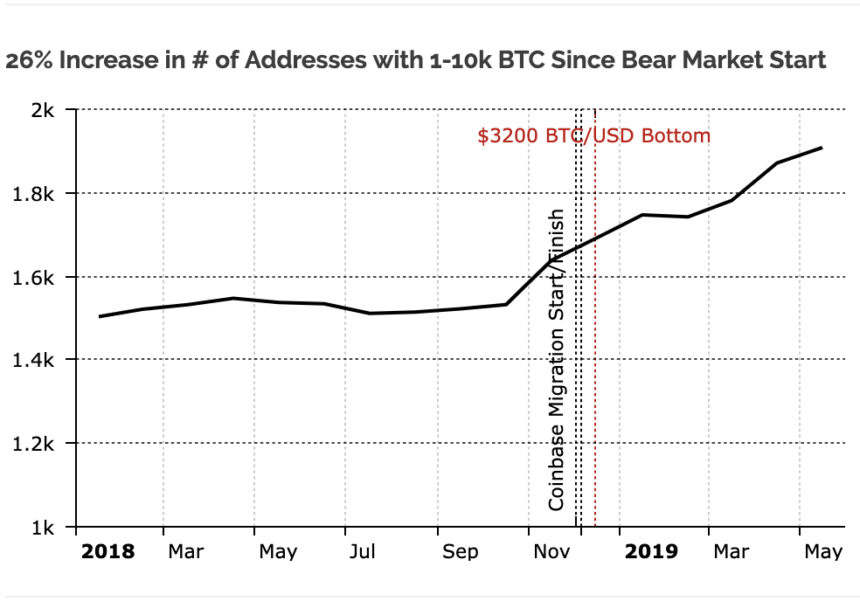

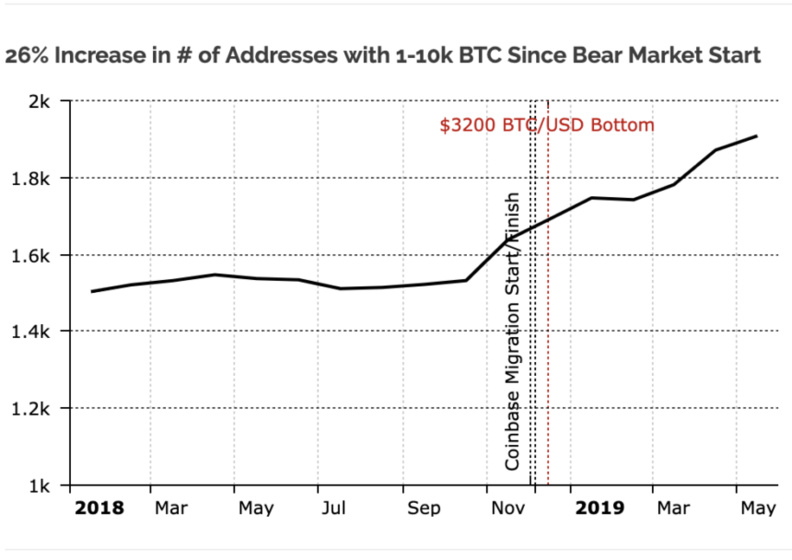

Diar revealed a 26% increase in the number of Bitcoin addresses holding 1-10K BTC, specifically after the cryptocurrency established $3,200 as its bottom on December 15 last year.

Upcoming Halving

Bitcoin prices could be rising because of a “halving” next year. When Bitcoin started 10 years ago, the payout to Bitcoin miners for verifying new blocks was 50 Bitcoins and in May 2020 it will be 6.25 Bitcoins.

The halving is a very positive for Bitcoin. It increases the scarcity of Bitcoin, since the number of Bitcoins created is less. The more scarce it becomes, is the greater the demand will be, which will likely lead to a price increase. This decrease in rate of supply growth, means less downward pressure on the price of Bitcoin over time.

Institutional Investors

Demand for Bitcoin by institutional investors appears to be increasing. Institutional investors are investing in cryptocurrencies like Bitcoin. There are also effective bitcoin trading apps developed to trade bitcoins like a professional. Visit https://www.bitcoingrowthfund.com/updates/ that talks about the bitcoin trading apps like bitcoin loophole.

JP Morgan Chase has been leading the way, having announced JPM Coin earlier this year, the first cryptocurrency issued by a big international bank.

Grayscale Bitcoin Trust (GBTC), a $1.4 billion closed-end fund that invests exclusively in bitcoin, serves as perhaps the best indicator of institutional investment in Bitcoin. Data is showing an uptick in the institutional demand. By the end of April 2019, GBTC held 225,638 Bitcoins or just under 1.3% of bitcoin’s total circulating supply. Bitcoin inflows, or the amount of bitcoin added to GBTC’s holdings, have reached an all-time high in April signaling an increase in institutional demand. Nearly $58.2 million was added to GBTC’s holdings in April, which is almost as high as $60.8 million at the height of the bull market in December 2017. This shows a shift of the sentiment in the market.

Asset manager Fidelity has begun buying and selling Bitcoin for institutions, bitcoin online broker TD Ameritrade rolled out trading of Bitcoin futures in December, and securities brokerage E*Trade is close to introducing cryptocurrency trading on its platform.

Libra

Facebook is one of the largest companies in the world, worth billions. Its recent launch of Project Libra has received the attention of digital and traditional media outlets. Everyone is talking about Facebook’s entrance into the cryptocurrency market. This is an amazing development for Bitcoin and other cryptocurrencies. On one hand it means that Bitcoin may face possible competition – and competition is always good because it moves things forward, it also means that huge numbers of retail investors through Facebook will get into the market. Facebook’s Libra Coin will introduce millions to the idea of cryptocurrencies. This lowers the chance of the crypto market vanishing, as some have predicted in the past.

US and China

The trade tensions between China and the United States have been good news for Bitcoin. The value of the cryptocurrency soared, as investors bought Bitcoinmto diversify their portfolios, as a hedge on investments.

A new study from Coinbase shows that 58% of Americans say they’ve heard of Bitcoin. The researchers point out key factors that indicate a rising interest in cryptocurrencies in the US, and an openness among more people to participate in a new global economy.

Well, Bitcoin didn’t die after the “last bubble.” Granted BTC fell over 80%, it has since recovered back to just 45% in the past few months. Since its bottom of $3,200 in mid-December, Bitcoin has made over 250% to current levels and it doesn’t look like it will stopping there. It has come back and with the market more mature, it’s stronger than it was before. IMHO the price of Bitcoin and cryptocurrencies are here to stay and prices will rise even more this year. The sky remains the limit.

Upcoming Halving

Bitcoin prices could be rising because of a “halving” next year. When Bitcoin started 10 years ago, the payout to Bitcoin miners for verifying new blocks was 50 Bitcoins and in May 2020 it will be 6.25 Bitcoins.

The halving is a very positive for Bitcoin. It increases the scarcity of Bitcoin, since the number of Bitcoins created is less. The more scarce it becomes, is the greater the demand will be, which will likely lead to a price increase. This decrease in rate of supply growth, means less downward pressure on the price of Bitcoin over time.

Institutional Investors

Demand for Bitcoin by institutional investors appears to be increasing. Institutional investors are investing in cryptocurrencies like Bitcoin. There are also effective bitcoin trading apps developed to trade bitcoins like a professional. Visit https://www.bitcoingrowthfund.com/updates/ that talks about the bitcoin trading apps like bitcoin loophole.

JP Morgan Chase has been leading the way, having announced JPM Coin earlier this year, the first cryptocurrency issued by a big international bank.

Grayscale Bitcoin Trust (GBTC), a $1.4 billion closed-end fund that invests exclusively in bitcoin, serves as perhaps the best indicator of institutional investment in Bitcoin. Data is showing an uptick in the institutional demand. By the end of April 2019, GBTC held 225,638 Bitcoins or just under 1.3% of bitcoin’s total circulating supply. Bitcoin inflows, or the amount of bitcoin added to GBTC’s holdings, have reached an all-time high in April signaling an increase in institutional demand. Nearly $58.2 million was added to GBTC’s holdings in April, which is almost as high as $60.8 million at the height of the bull market in December 2017. This shows a shift of the sentiment in the market.

Asset manager Fidelity has begun buying and selling Bitcoin for institutions, bitcoin online broker TD Ameritrade rolled out trading of Bitcoin futures in December, and securities brokerage E*Trade is close to introducing cryptocurrency trading on its platform.

Libra

Facebook is one of the largest companies in the world, worth billions. Its recent launch of Project Libra has received the attention of digital and traditional media outlets. Everyone is talking about Facebook’s entrance into the cryptocurrency market. This is an amazing development for Bitcoin and other cryptocurrencies. On one hand it means that Bitcoin may face possible competition – and competition is always good because it moves things forward, it also means that huge numbers of retail investors through Facebook will get into the market. Facebook’s Libra Coin will introduce millions to the idea of cryptocurrencies. This lowers the chance of the crypto market vanishing, as some have predicted in the past.

US and China

The trade tensions between China and the United States have been good news for Bitcoin. The value of the cryptocurrency soared, as investors bought Bitcoinmto diversify their portfolios, as a hedge on investments.

A new study from Coinbase shows that 58% of Americans say they’ve heard of Bitcoin. The researchers point out key factors that indicate a rising interest in cryptocurrencies in the US, and an openness among more people to participate in a new global economy.

Well, Bitcoin didn’t die after the “last bubble.” Granted BTC fell over 80%, it has since recovered back to just 45% in the past few months. Since its bottom of $3,200 in mid-December, Bitcoin has made over 250% to current levels and it doesn’t look like it will stopping there. It has come back and with the market more mature, it’s stronger than it was before. IMHO the price of Bitcoin and cryptocurrencies are here to stay and prices will rise even more this year. The sky remains the limit.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group