KPMG released their pulse report on global venture capital trends for Q3 2019 yesterday. There were some key highlights from the report worth discussing about. The most pleasantly surprising trend is the increase in VC investments in Europe.

Despite Brexit and Germany moving towards a recession, venture and scale up investments in Europe hit a record quarter in Q3 2019. On a global note, Asia has seen sustained slowdown in VC deals, largely dampened by action from China.

Here are my views on where I agree with the report, and where I don’t.

Let us first talk about Asia VC before coming back to Europe.

Asia:

Over the past few months, I have been closely tracking Venture capital trends in India and China in particular. In Q1 and Q2 2019, India had outperformed China, thanks to a few big deals in India. But most importantly, thanks to a massive fall in VC investments in late stage deals in China.

This trend has continued into Q3 2019 – across the money chain, top-down. Limited Partners (LPs) have become cautious about market conditions and have held back capital commitments to VC/PE funds in China. Liquidity has hence dried up, which results in startups moving towards a profitability mode rather than a growth mode. This was a much needed correction for a long time.

Deal Sizes and Volumes

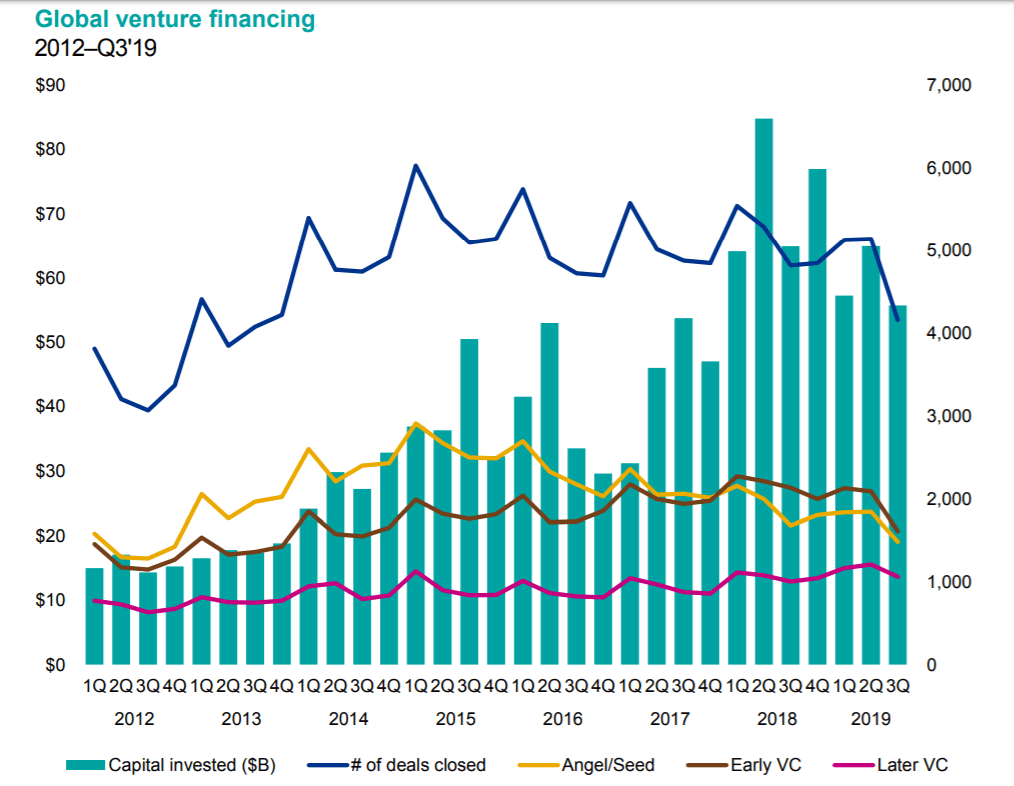

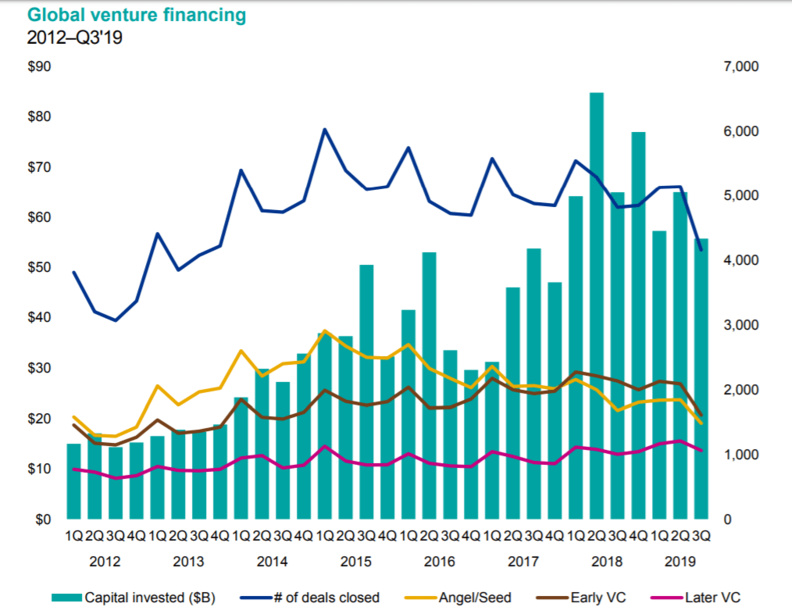

We often talk about deal sizes and volumes when we discuss Venture capital/private equity performance. Deal size refers to the size of the investments and deal volume refers to the number of investments. Both need to be healthy in an innovation ecosystem. A quick look at the global trend below shows a downward trend in both deal sizes and deal volumes.

Despite Brexit and Germany moving towards a recession, venture and scale up investments in Europe hit a record quarter in Q3 2019. On a global note, Asia has seen sustained slowdown in VC deals, largely dampened by action from China.

Here are my views on where I agree with the report, and where I don’t.

Let us first talk about Asia VC before coming back to Europe.

Asia:

Over the past few months, I have been closely tracking Venture capital trends in India and China in particular. In Q1 and Q2 2019, India had outperformed China, thanks to a few big deals in India. But most importantly, thanks to a massive fall in VC investments in late stage deals in China.

This trend has continued into Q3 2019 – across the money chain, top-down. Limited Partners (LPs) have become cautious about market conditions and have held back capital commitments to VC/PE funds in China. Liquidity has hence dried up, which results in startups moving towards a profitability mode rather than a growth mode. This was a much needed correction for a long time.

Deal Sizes and Volumes

We often talk about deal sizes and volumes when we discuss Venture capital/private equity performance. Deal size refers to the size of the investments and deal volume refers to the number of investments. Both need to be healthy in an innovation ecosystem. A quick look at the global trend below shows a downward trend in both deal sizes and deal volumes.

Globally VC-backed companies raised $55.7 Billion across 4154 deals. A breakdown based on investment stage (Early/Venture/Growth) offers key insights into sustaining and developing trends.

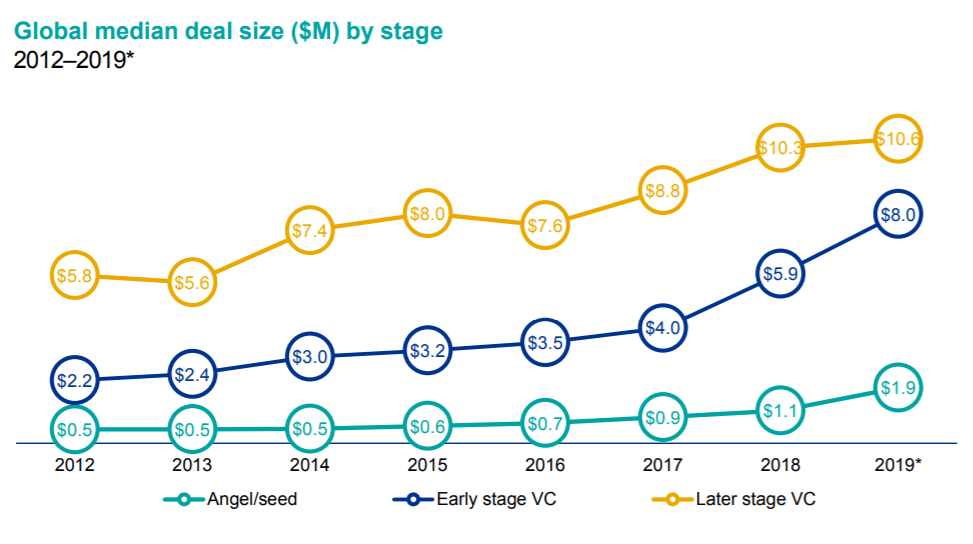

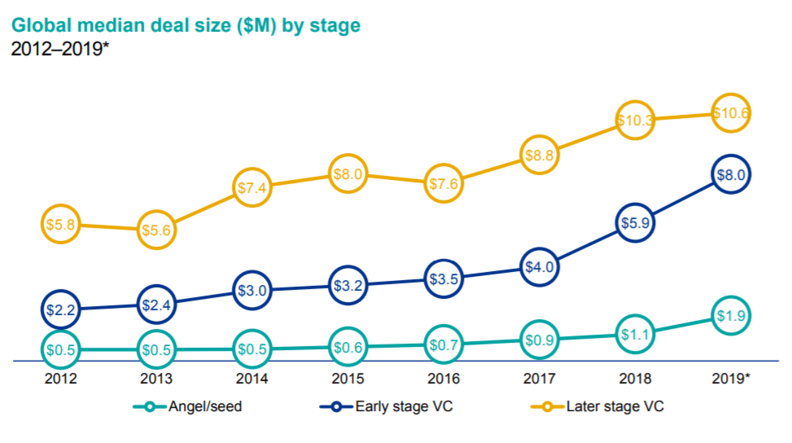

I have written earlier on DailyFintech about the rise of Corporate Venture Capital. Especially in Europe, the role of Corporate VC has been very pronounced. What does that do to these stats? Corporate VCs generally get into deals later in the game. Over the past 36 months or so, the rise of CVCs has increased the median sizes of late stage deals.

The other usual suspects to talk about are late stage VCs like the Softbank fund. A $100 Billion fund can move these stats one way or the other pretty significantly. The trend in late stage deals (increased size), has been amplified due to Softbank’s deployments too.

I have written earlier on DailyFintech about the rise of Corporate Venture Capital. Especially in Europe, the role of Corporate VC has been very pronounced. What does that do to these stats? Corporate VCs generally get into deals later in the game. Over the past 36 months or so, the rise of CVCs has increased the median sizes of late stage deals.

The other usual suspects to talk about are late stage VCs like the Softbank fund. A $100 Billion fund can move these stats one way or the other pretty significantly. The trend in late stage deals (increased size), has been amplified due to Softbank’s deployments too.

But I would be surprised if these trends are not affected in the medium term due to a couple of reasons. Global economic sentiments are poor, and corporates are holding on to capital more and more. This trend is particularly visible in the US, where Q3 2019 saw CVC investments fall below 7%. I expect this trend to continue.

Coming back to the Softbank fund, the Wework saga that has unfolded in the last few weeks has affected Softbank’s plans for their fund 2. If Fund 2 doesn’t happen or gets delayed, it will have its effect on late stage funding too. We will start seeing fewer deals by these players, and there is a good possibility that these deals will get smaller too.

Europe

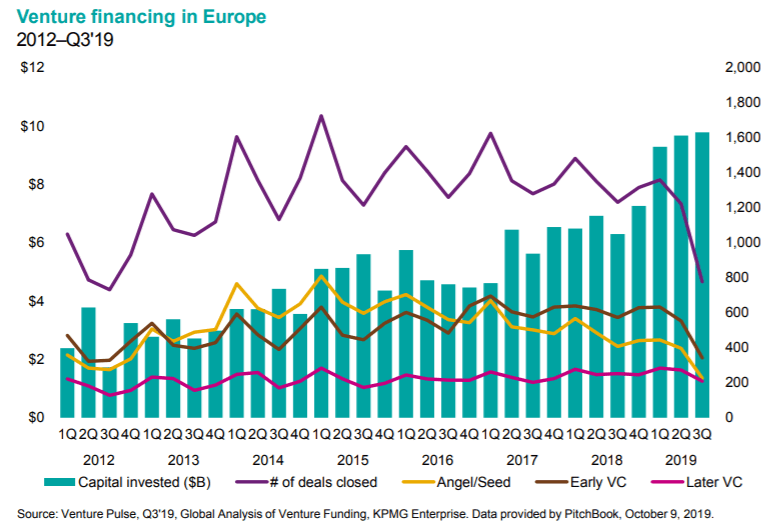

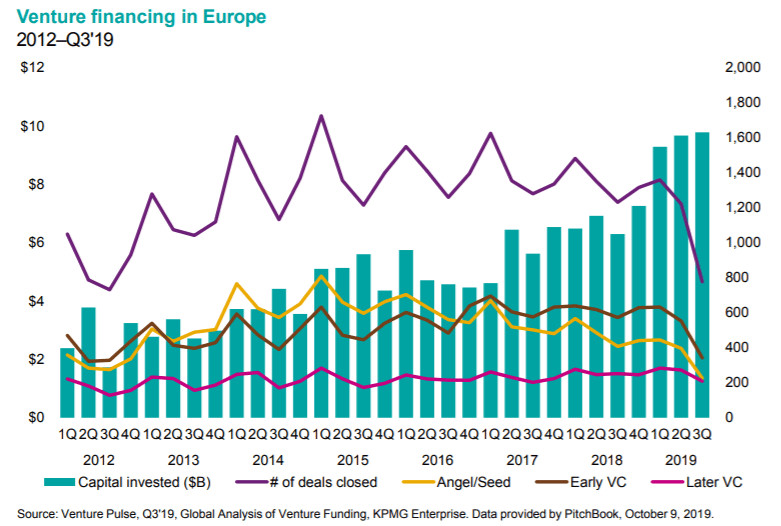

About $10 Billion invested in Europe startups across 777 deals – These are healthy numbers, with both UK and Germany (considering the political drama) leading the way with big deals across Babylon health and N26. However, the worrying sign for me, is the fall in the number of deals in Europe. Generally a fall in the number of deals is caused by a fall in early stage deals – as early stage deals get closed faster. That is certainly the case with Europe.

Coming back to the Softbank fund, the Wework saga that has unfolded in the last few weeks has affected Softbank’s plans for their fund 2. If Fund 2 doesn’t happen or gets delayed, it will have its effect on late stage funding too. We will start seeing fewer deals by these players, and there is a good possibility that these deals will get smaller too.

Europe

About $10 Billion invested in Europe startups across 777 deals – These are healthy numbers, with both UK and Germany (considering the political drama) leading the way with big deals across Babylon health and N26. However, the worrying sign for me, is the fall in the number of deals in Europe. Generally a fall in the number of deals is caused by a fall in early stage deals – as early stage deals get closed faster. That is certainly the case with Europe.

The above chart shows a massive dip in Angel and Early stage deals. I believe the health of an innovation ecosystem should be measured more by Angel and Early stage deals than late stage deals. Late stage deals that we have seen in Europe are largely due to investors moving away from IPOs and funnelling capital into the private markets in desperation.

However, the real litmus test is if there was capital flowing into early stage VC. I believe Europe is failing that litmus test, although the implication of that will be evident over the next 24 months or so. As early stage funding dries up, we will start seeing less and less late stage deals too.

I have personally seen two trends based on my work at Green Shores Capital. In the last quarter alone, we have seen atleast four series A funding rounds fold due to LPs pulling capital out of VC funds. This is a worrying sign for Europe.

The other trend is that Family offices have become desperate with allocating capital. I have seen some unusually big and overpriced deals where family offices have deployed capital. This is largely because they have wanted to move away from the IPO market, and have chosen to deploy their capital in desperation into bigger VC tickets.

I have been in deal discussions where I have been shocked at the unfortunate enthusiasm from family offices towards bad deals. I fear, they deploy too much capital into too many bad deals as they sometimes lack the ability to identify top startups to invest into. This trend can’t last.

The short and sweet of it is that, I don’t agree with KPMG’s assessment that the “European Venture Ecosystem is definitely thriving”. I believe, this quarter results are due to a few successful late stage deals going through, and is more of an anomaly. There is a systematic slow down globally, and the trend is obvious in early stage deals in Europe too.

When the slowdown really hits Europe, it may not be as pronounced as it is in China and Asia. However, I believe the headline of this post could perhaps be, “If China is going down, can Europe be far behind !”.

However, the real litmus test is if there was capital flowing into early stage VC. I believe Europe is failing that litmus test, although the implication of that will be evident over the next 24 months or so. As early stage funding dries up, we will start seeing less and less late stage deals too.

I have personally seen two trends based on my work at Green Shores Capital. In the last quarter alone, we have seen atleast four series A funding rounds fold due to LPs pulling capital out of VC funds. This is a worrying sign for Europe.

The other trend is that Family offices have become desperate with allocating capital. I have seen some unusually big and overpriced deals where family offices have deployed capital. This is largely because they have wanted to move away from the IPO market, and have chosen to deploy their capital in desperation into bigger VC tickets.

I have been in deal discussions where I have been shocked at the unfortunate enthusiasm from family offices towards bad deals. I fear, they deploy too much capital into too many bad deals as they sometimes lack the ability to identify top startups to invest into. This trend can’t last.

The short and sweet of it is that, I don’t agree with KPMG’s assessment that the “European Venture Ecosystem is definitely thriving”. I believe, this quarter results are due to a few successful late stage deals going through, and is more of an anomaly. There is a systematic slow down globally, and the trend is obvious in early stage deals in Europe too.

When the slowdown really hits Europe, it may not be as pronounced as it is in China and Asia. However, I believe the headline of this post could perhaps be, “If China is going down, can Europe be far behind !”.

Arunkumar Krishnakumar

Arunkumar Krishnakumar is a Venture Capital investor at Green Shores Capital focusing on Inclusion and a podcast host.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

dailyfintech.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

NFT : L'Opéra de Paris dévoilera à la rentrée une nouvelle collection d'art numérique

-

WEB3 : L'Europe, le baby-blues des licornes ?

-

Finyear, partenaire média de la prochaine édition de l'IPEM Paris

-

Banque Delubac & Cie, bientôt des crypto ?

-

MiCA : les Autorités Européennes de Surveillance consultent sur les lignes directrices