In 1994, Bill Gates said: “We need banking, but we don’t need banks anymore.” So why hasn’t Bill Gates opened a bank? Well, because technology giants don’t really want to be banks. Banking has a lot of the audit and compliance overhead, that tech giants don’t need or want. Big tech companies, Microsoft and GAFAs (Google, Apple, Facebook, Amazon), want data and want to figure out how to turn it into insights to sell products. Some call it “Surveillance Capitalism.” Yet, banks are sitting on a data gem that tech giants want.

Ilias Louis Hatzis is the Founder at Mercato Blockchain Corporation AG and a weekly columnist at DailyFintech.com

Big banks know they need to change with the times. This is the reason that many banks are partnering with big tech or buying smaller digital savvy startup competitors. The logic behind partnerships is simple. Banks can unlock the tech competencies of companies like Apple, Google or Square and catch up quickly, without having to build them internally.

A few days ago, Google announced that it will be launching checking accounts through a partnership with Citigroup, Stanford Federal Credit Union.

While Google is not planning on getting into the financial services game, it does appear to be interested in partnering with banks. Google teamed up with KBC Bank Ireland to demonstrate a new Google app that allows users to open a current account in under five minutes using a selfie for identification.

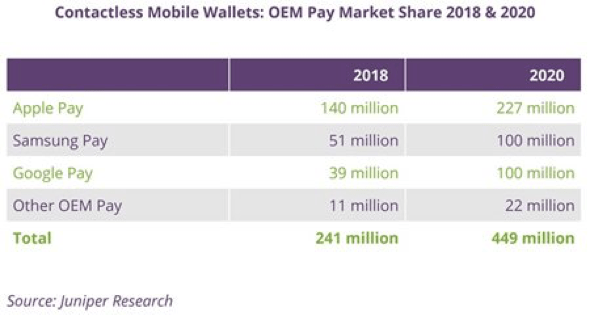

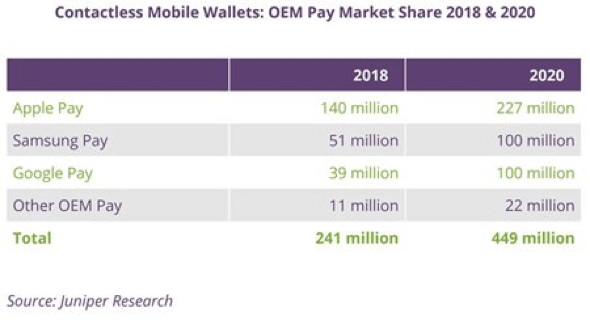

Google owns the first and second-most frequented websites on the Internet (Google.com and YouTube) and Android powers 2.5 billion active devices that are connected to the Internet. It already has a foot in the industry, with Google Pay, which is expected to reach 100 million by 2020. But for now Google prefers to work with banks, not against them.

Ilias Louis Hatzis is the Founder at Mercato Blockchain Corporation AG and a weekly columnist at DailyFintech.com

Big banks know they need to change with the times. This is the reason that many banks are partnering with big tech or buying smaller digital savvy startup competitors. The logic behind partnerships is simple. Banks can unlock the tech competencies of companies like Apple, Google or Square and catch up quickly, without having to build them internally.

A few days ago, Google announced that it will be launching checking accounts through a partnership with Citigroup, Stanford Federal Credit Union.

While Google is not planning on getting into the financial services game, it does appear to be interested in partnering with banks. Google teamed up with KBC Bank Ireland to demonstrate a new Google app that allows users to open a current account in under five minutes using a selfie for identification.

Google owns the first and second-most frequented websites on the Internet (Google.com and YouTube) and Android powers 2.5 billion active devices that are connected to the Internet. It already has a foot in the industry, with Google Pay, which is expected to reach 100 million by 2020. But for now Google prefers to work with banks, not against them.

Google already has plenty of big tech rivals in the financial service industry. Apple Pay has 140 million users and is expected to reach 225 million by 2020. Samsung Pay is expected to reach 100 million users in 2020. Facebook just launched Facebook Pay. Available to users on Facebook and Messenger for now, it eventually also will be available to users on Instagram and WhatsApp. Payments will be processed by partners such as PayPal and Stripe, and Facebook promises users advanced security and anti-fraud provisions, as well as privacy protections.

Today, Google wants your spending data.

Google wants to capitalize on our banking data to optimize its core competencies, specifically advertising. How we spend our money when we buy things, is the most reliable proxy for our real behavior. By enriching its existing data, our online behavior, with transaction data, Google could create the most effective prediction engine.

Many think that Google, Facebook, Apple and Amazon might become banks, and most people won’t even realize it, until it’s happened.

It’s already happening in Asia: Alipay has 400 million users, WeChat’s WeBank is very successful, so traditional banks in Asia are innovating like crazy, driving digital innovation to better position themselves against these companies.

While it won’t happen overnight, according to a recent study, 75 percent of tech-savvy customers are currently using at least one financial product provided by a technology giant. The report also found that customers are falling out of love with banks. Seventy percent (70%) are motivated by lower costs, 68 percent by the ease of use offered by digital players, and 54 percent just need a faster service to support them in the digital banking era.

Despite the challenges Facebook’s Libra project has run into, it is one of the most ambitious projects today, that is partly fueled by the understanding that providing a seamless digital-only financial solution will meet with little resistance from customers.

Consumers might not resist, but the US government is. The US proposal to prevent big technology companies from functioning as financial institutions or issuing digital currencies, is short sighted. Barring big US tech companies from financial services is a double-edged sword. Competition is global and if the US prevents big tech and finance from mixing, other countries will not. This can only cause the US to lose its innovation leadership.

Data privacy and anticompetitive practices are huge concerns for big tech companies. Companies like Facebook have already demonstrated that they are unable, and in some cases unwilling, to secure user data. With everyone concerned about data privacy, Google’s strategy might be on the right track, at least for now. Google, Facebook, Amazon and the rest, already know a lot about us. We trust them with our search history, messages, and pictures of our dog. With so much information concentrated in the hands of just a few companies, instead of trying to do everything, Google’s partnerships with banks makes a lot of sense.

Today, Google wants your spending data.

Google wants to capitalize on our banking data to optimize its core competencies, specifically advertising. How we spend our money when we buy things, is the most reliable proxy for our real behavior. By enriching its existing data, our online behavior, with transaction data, Google could create the most effective prediction engine.

Many think that Google, Facebook, Apple and Amazon might become banks, and most people won’t even realize it, until it’s happened.

It’s already happening in Asia: Alipay has 400 million users, WeChat’s WeBank is very successful, so traditional banks in Asia are innovating like crazy, driving digital innovation to better position themselves against these companies.

While it won’t happen overnight, according to a recent study, 75 percent of tech-savvy customers are currently using at least one financial product provided by a technology giant. The report also found that customers are falling out of love with banks. Seventy percent (70%) are motivated by lower costs, 68 percent by the ease of use offered by digital players, and 54 percent just need a faster service to support them in the digital banking era.

Despite the challenges Facebook’s Libra project has run into, it is one of the most ambitious projects today, that is partly fueled by the understanding that providing a seamless digital-only financial solution will meet with little resistance from customers.

Consumers might not resist, but the US government is. The US proposal to prevent big technology companies from functioning as financial institutions or issuing digital currencies, is short sighted. Barring big US tech companies from financial services is a double-edged sword. Competition is global and if the US prevents big tech and finance from mixing, other countries will not. This can only cause the US to lose its innovation leadership.

Data privacy and anticompetitive practices are huge concerns for big tech companies. Companies like Facebook have already demonstrated that they are unable, and in some cases unwilling, to secure user data. With everyone concerned about data privacy, Google’s strategy might be on the right track, at least for now. Google, Facebook, Amazon and the rest, already know a lot about us. We trust them with our search history, messages, and pictures of our dog. With so much information concentrated in the hands of just a few companies, instead of trying to do everything, Google’s partnerships with banks makes a lot of sense.

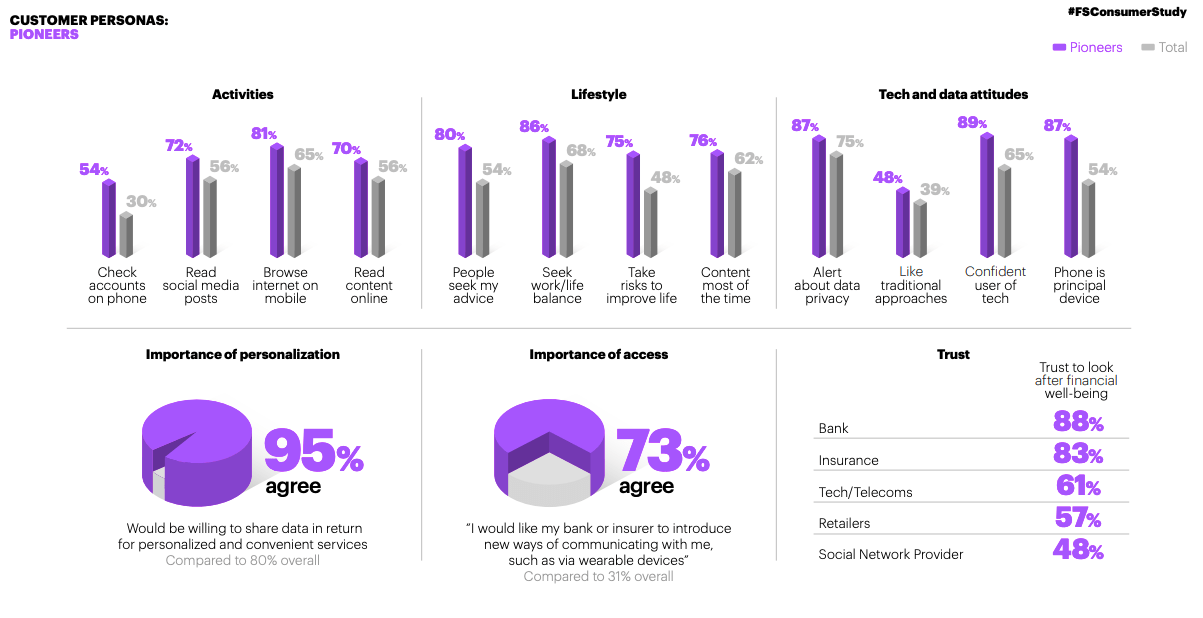

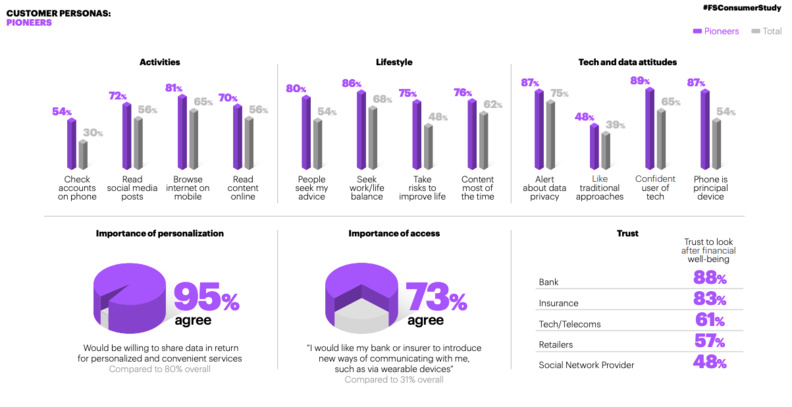

Banks are still widely trusted. Accenture recently surveyed 47,000 consumers in 28 countries for its Global Financial Services Consumer Study about their attitudes toward sharing data with banks. The survey showed that 59% of customers would be willing to share more information with their banks and 53% would be fine with their bank using location information to offer personalized local offers.

Banks sit on a wealth of data that is stored in our transactions: our daily needs, our actual expenses, our habits and preferences. And it’s not just that, through personal financial management tools, they also know our financial goals. This data is extremely valuable and definitely accurate and actionable.

Up to now, most banks use bank accounts as a channel to promote their own financial products and services. But with new models emerging and increasing competition from big tech and challenger banks, like Revolut and N26, banks are planning on providing customers, with customized offers, beyond cards and loans, and influencing people’s intent in real time.

Banks are watching the Googles, Apples and Facebooks of the world and they are looking for ways to weave managing money and financial decisions into their customers’ everyday lives.

Banks are unleashing new banking experiences, that are on par with big tech leaders. We can expect the same contextual, personalized and predictive experiences from our banks, that we have every day with big tech brands. AI-powered bots and assistants will play a big role in this digital transformation. Banks need to be like Google, Apple or Facebook, but not too much like them.

Our bank accounts are changing, but if traditional banks really want to compete with big tech and challenger banks, they need to put to work decentralized technologies and cryptocurrencies, something centralized big tech is not doing.

Traditional banks need to morph into decentralized banks. An example of a decentralized bank is Founders Bank, that will receive its EU license by the end of this year. A decentralized bank ensures that its participants are unlikely to become a victim of a financial crisis and lose their digital-assets, just like what happened in the financial crisis of 2008. Trust is key and that alone is big difference with big tech, that own and monetize everything we do online.

Banks sit on a wealth of data that is stored in our transactions: our daily needs, our actual expenses, our habits and preferences. And it’s not just that, through personal financial management tools, they also know our financial goals. This data is extremely valuable and definitely accurate and actionable.

Up to now, most banks use bank accounts as a channel to promote their own financial products and services. But with new models emerging and increasing competition from big tech and challenger banks, like Revolut and N26, banks are planning on providing customers, with customized offers, beyond cards and loans, and influencing people’s intent in real time.

Banks are watching the Googles, Apples and Facebooks of the world and they are looking for ways to weave managing money and financial decisions into their customers’ everyday lives.

Banks are unleashing new banking experiences, that are on par with big tech leaders. We can expect the same contextual, personalized and predictive experiences from our banks, that we have every day with big tech brands. AI-powered bots and assistants will play a big role in this digital transformation. Banks need to be like Google, Apple or Facebook, but not too much like them.

Our bank accounts are changing, but if traditional banks really want to compete with big tech and challenger banks, they need to put to work decentralized technologies and cryptocurrencies, something centralized big tech is not doing.

Traditional banks need to morph into decentralized banks. An example of a decentralized bank is Founders Bank, that will receive its EU license by the end of this year. A decentralized bank ensures that its participants are unlikely to become a victim of a financial crisis and lose their digital-assets, just like what happened in the financial crisis of 2008. Trust is key and that alone is big difference with big tech, that own and monetize everything we do online.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

CoinShares débarque "concrètement" aux USA avec l'ouverture d'un bureau à New York

-

Fungiball un pré-seed à 2,2 millions avant le lancement en accès gratuit ?

-

Après une première étape d'investissement bouclée en deux heures, Vantard lance aujourd'hui sa deuxième phase de financement

-

Tide acquiert Folk, les fintechs au UK aussi dans un mouvement de consolidation ?

-

La BCE fait des vagues dans l'écosystème Bitcoin ?