I/ A business innovation group

First of all, Luka is overseeing the a newly formed business innovation opportunity for all employees within SAP. This program is to help intrapreneurs develop their ideas and provide them with the skills that they may lack. Resources will be provided to those employees who innovate in the form of funds, mentorship and time off from their daily responsibilities. If the intrapreneur is a research and development professional, the mentors may provide him with market insight and sales skills. Alternatively, if the intrapreneur is more market focused, then, the mentors may provide them with research and development support. Also, when the product is good and has reached maturity, it will be backed up financially.

II/ Developing novel business models

Second of all, as we entered the digital age, traditional business models are being challenged by very different, new business models. In other words, innovation must require a kind of innovation in business modeling. Companies like Uber, BlaBlaCar, AirBnB are challenging established companies, but they are also based on a very different business model, one where the production capacity is to some extent outsourced. In the case of hotels, traditional companies own hotels while AirBnB owns a platform that puts the customers in touch with suppliers.

III/ Ray Kurzweil

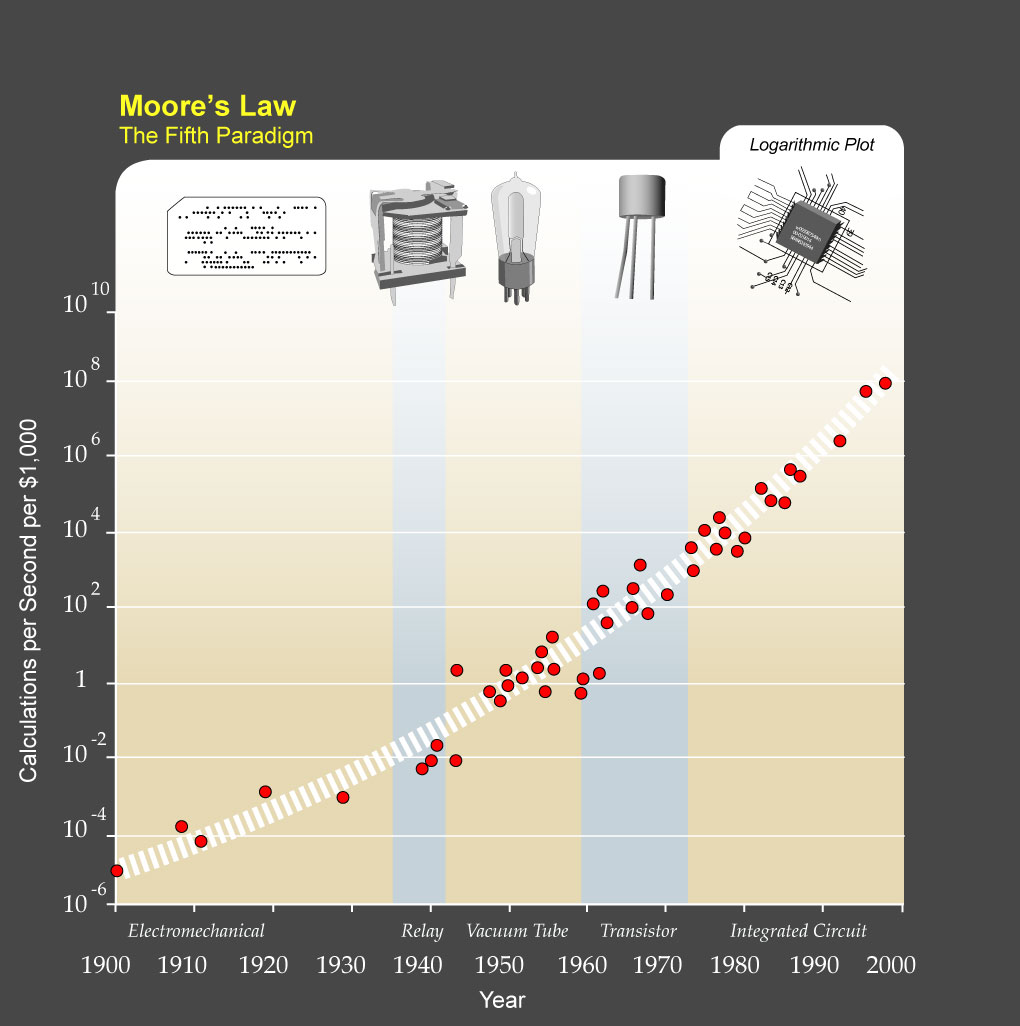

There is also another part and final part, to my discussion with Luka. I showed him Ray Kurzweil’s law of accelerating returns. In a logarithmic graph, the vertical axis expresses multiples rather than increments. In other words, calculations per second per $1000 go from 1 to 10, 100, 1000 rather than from 1, 2,3, 4… This leads to the following graph:

First of all, Luka is overseeing the a newly formed business innovation opportunity for all employees within SAP. This program is to help intrapreneurs develop their ideas and provide them with the skills that they may lack. Resources will be provided to those employees who innovate in the form of funds, mentorship and time off from their daily responsibilities. If the intrapreneur is a research and development professional, the mentors may provide him with market insight and sales skills. Alternatively, if the intrapreneur is more market focused, then, the mentors may provide them with research and development support. Also, when the product is good and has reached maturity, it will be backed up financially.

II/ Developing novel business models

Second of all, as we entered the digital age, traditional business models are being challenged by very different, new business models. In other words, innovation must require a kind of innovation in business modeling. Companies like Uber, BlaBlaCar, AirBnB are challenging established companies, but they are also based on a very different business model, one where the production capacity is to some extent outsourced. In the case of hotels, traditional companies own hotels while AirBnB owns a platform that puts the customers in touch with suppliers.

III/ Ray Kurzweil

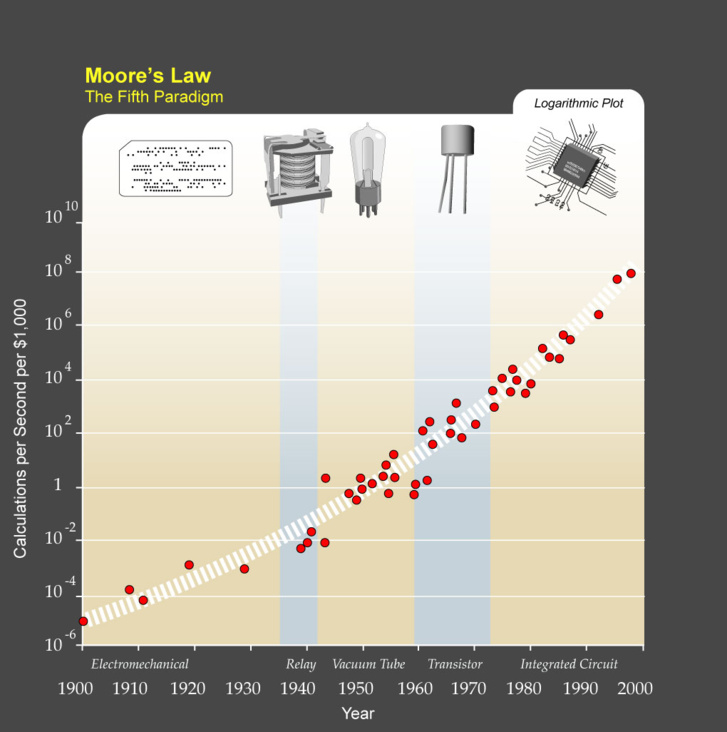

There is also another part and final part, to my discussion with Luka. I showed him Ray Kurzweil’s law of accelerating returns. In a logarithmic graph, the vertical axis expresses multiples rather than increments. In other words, calculations per second per $1000 go from 1 to 10, 100, 1000 rather than from 1, 2,3, 4… This leads to the following graph:

This graph is remarkable for many reasons:

• First of all, it shows that in the last century we witnessed exponential growth in calculations per second per $1000. Whereas Moore's Law is dependent upon a specific technology – transistors – one can see here that exponential progress continues, whatever the technology. When a specific technology paradigm reaches its limits, a new, more powerful technology is introduced and perpetuates exponential improvements.

• Second of all, the stability of the curve is amazing, considering that the tragedies of the 20th century: two world wars, the Shoah, the economic crisis of 1929, the meltdown of the Soviet Union… Despite dramatic events, exponential improvements in calculations per second continued, unchanged. While Karl Marx believed in decreasing returns, computer-powered production facilities offer exponential progress. According to Steve Jurvetson, a renowned VC in the Silicon Valley, Ray Kurzweil's Law Of Accelerating Returns (LOAR) is perhaps the most important graph to understand innovation economics today.

• Finally, exponential advancements are not limited to computer speed but include other computer capabilities such as memory space and miniaturization.

Therefore, I asked Luka to help me understand the graph through his eyes. In other words, what implications does a chief financial officer see that others may not? In what way does it shape the innovation strategy?

IV/ SAP is an innovation front runner

Luka's response was quite clear. Large established companies, like SAP, in many aspects, take a fast follower innovation strategy. In other words, they let other players, like startups, develop innovation. Once the innovation is proven to work and to be profitable, then, they would move in and acquire the necessary competencies and technologies. This fast follower innovation strategy helps minimize risk. But, the fact that computing capacity is increasing exponentially must lead to changing the innovation policy from « fast follower » to « front runner » in key areas. Leading companies must preempt moves and always try to get there first in their core business. Again, the chief financial officer of SAP is spearheading innovation: Luka is the first customer of the company's finance innovation products, like Simple Finance, S/4HANA and the newest product that isn’t launched yet and that bears the working name « Boardroom redefined ». It allows the Executive and Supervisory Boards to do simulations on the basis of real-time data from within the company and combine it with real-time market data. This way, Luka as CFO again pushes for a more aggressive innovation strategy of his company.

Sum-up

Initially, I believed that finance and innovation were very different. But Luka informed me that this is changing:

• the financial function is taking a more active role in innovation

• novel technologies, including the Internet of things, are helping finance perform its job better by reducing costs all along the value chain

• financial executives are changing the conversation they're having, to some degree, with their shareholders, to let innovative businesses grow

• internally, financial executives should be supporting and funding innovation projects

• finally, disruptive innovations require innovation in the core business model

• CFOs should be pushing for a frontrunner innovation strategy rather than a fast follower approach

This summarizes my discussion with Luka.

• First of all, it shows that in the last century we witnessed exponential growth in calculations per second per $1000. Whereas Moore's Law is dependent upon a specific technology – transistors – one can see here that exponential progress continues, whatever the technology. When a specific technology paradigm reaches its limits, a new, more powerful technology is introduced and perpetuates exponential improvements.

• Second of all, the stability of the curve is amazing, considering that the tragedies of the 20th century: two world wars, the Shoah, the economic crisis of 1929, the meltdown of the Soviet Union… Despite dramatic events, exponential improvements in calculations per second continued, unchanged. While Karl Marx believed in decreasing returns, computer-powered production facilities offer exponential progress. According to Steve Jurvetson, a renowned VC in the Silicon Valley, Ray Kurzweil's Law Of Accelerating Returns (LOAR) is perhaps the most important graph to understand innovation economics today.

• Finally, exponential advancements are not limited to computer speed but include other computer capabilities such as memory space and miniaturization.

Therefore, I asked Luka to help me understand the graph through his eyes. In other words, what implications does a chief financial officer see that others may not? In what way does it shape the innovation strategy?

IV/ SAP is an innovation front runner

Luka's response was quite clear. Large established companies, like SAP, in many aspects, take a fast follower innovation strategy. In other words, they let other players, like startups, develop innovation. Once the innovation is proven to work and to be profitable, then, they would move in and acquire the necessary competencies and technologies. This fast follower innovation strategy helps minimize risk. But, the fact that computing capacity is increasing exponentially must lead to changing the innovation policy from « fast follower » to « front runner » in key areas. Leading companies must preempt moves and always try to get there first in their core business. Again, the chief financial officer of SAP is spearheading innovation: Luka is the first customer of the company's finance innovation products, like Simple Finance, S/4HANA and the newest product that isn’t launched yet and that bears the working name « Boardroom redefined ». It allows the Executive and Supervisory Boards to do simulations on the basis of real-time data from within the company and combine it with real-time market data. This way, Luka as CFO again pushes for a more aggressive innovation strategy of his company.

Sum-up

Initially, I believed that finance and innovation were very different. But Luka informed me that this is changing:

• the financial function is taking a more active role in innovation

• novel technologies, including the Internet of things, are helping finance perform its job better by reducing costs all along the value chain

• financial executives are changing the conversation they're having, to some degree, with their shareholders, to let innovative businesses grow

• internally, financial executives should be supporting and funding innovation projects

• finally, disruptive innovations require innovation in the core business model

• CFOs should be pushing for a frontrunner innovation strategy rather than a fast follower approach

This summarizes my discussion with Luka.

Passionné d'innovation, Guillaume Villon de Benveniste est l'auteur de Les secrets des entrepreneurs de la Silicon Valley chez Eyrolles et de The Innovation and Strategy Blog

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 5 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 5 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres