Just because the SEC continues to pretend there is nothing new with tokens, and tags most of them as securities, doesn’t mean that tokens are doomed and have no future except for being labelled and treated like securities.

To the contrary, the token model is a fundamental innovation of blockchain technology, and it will eventually gain its footing and respect with the regulators who haven’t yet seized the scope of the paradigm shift that tokens encapsulate.

I’ve been thinking about and analyzing the tokens phenomenon long enough to have acquired a significant depth in perspective [here, here, here, here, here and on Tokenomics]. What I’m seeing now is a significant lack of knowledge and understanding on the part of the gatekeepers of change. We could blame them for not trying hard enough, but we can also blame ourselves for not trying to better explain these changes.

Simplicity increases the chances that the general public, regulators and incumbents of all nature comprehend the need for change.

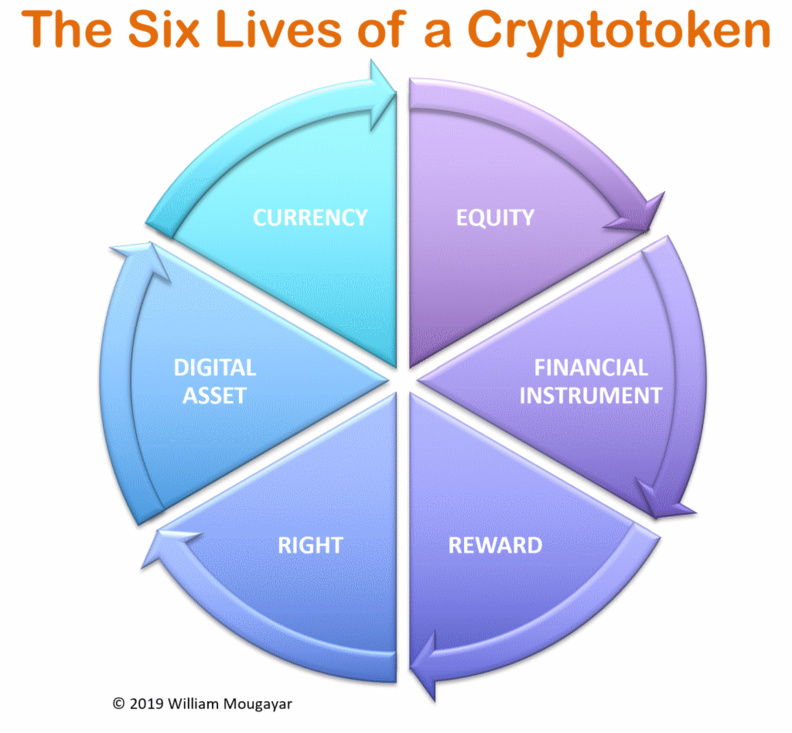

What makes the token difficult to comprehend is that it is a multiple function abstract, and we are not used to seeing something that simultaneous a) has several functional properties, b) represents diversified units of value, and c) is embodied in a digital form that binds it all together. Tokens are a new beast, and if we keep wanting to fit them or classify them within the previous paradigms or lenses we have, we will fail to seize their beckoning.

Simply put, tokens could simultaneously have properties of a:

1 Currency

2 Equity

3 Financial Instrument

4 Reward

5 Right

6 Digital Asset

To the contrary, the token model is a fundamental innovation of blockchain technology, and it will eventually gain its footing and respect with the regulators who haven’t yet seized the scope of the paradigm shift that tokens encapsulate.

I’ve been thinking about and analyzing the tokens phenomenon long enough to have acquired a significant depth in perspective [here, here, here, here, here and on Tokenomics]. What I’m seeing now is a significant lack of knowledge and understanding on the part of the gatekeepers of change. We could blame them for not trying hard enough, but we can also blame ourselves for not trying to better explain these changes.

Simplicity increases the chances that the general public, regulators and incumbents of all nature comprehend the need for change.

What makes the token difficult to comprehend is that it is a multiple function abstract, and we are not used to seeing something that simultaneous a) has several functional properties, b) represents diversified units of value, and c) is embodied in a digital form that binds it all together. Tokens are a new beast, and if we keep wanting to fit them or classify them within the previous paradigms or lenses we have, we will fail to seize their beckoning.

Simply put, tokens could simultaneously have properties of a:

1 Currency

2 Equity

3 Financial Instrument

4 Reward

5 Right

6 Digital Asset

So far, we have used separate artifacts to symbolize each of these functions. Then, came the token that melded them together in a mush, causing our mental ability to also become mush.

For currency, we have had the dollar, yen, euro, pound, and scores of sovereign fiats.

For equity, we have share or stock units, and they are known as securities.

For financial instruments, we have derivatives, bonds, futures, options, swaps, etc. and they are typically administered by brokers, agents, custodians or exchanges.

For rewards, we have mileage points, airline miles, loyalty cards, and the likes.

For rights, we have government-issued identity cards, or share proxies that allow us to have a (voting) voice in the governance affairs of what matters to us.

Finally, we have a blockchain novelty: a singular representation of a digital asset as a uniquely transferable unit of value: the non-fungible token that could represent a caricature-like version of a cat (eg CryptoKitties), a cartoon monster, a tank toy, or a purple sword won at a game, but could also represent a concert ticket, a collectible, or maybe something else not invented yet.

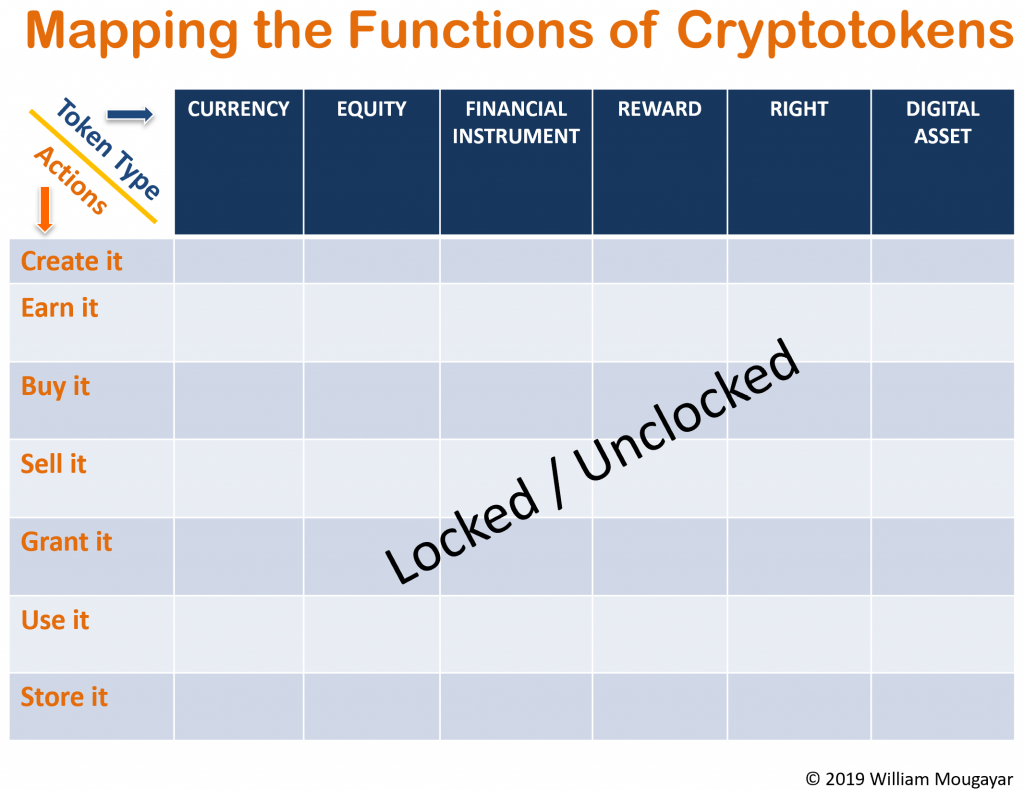

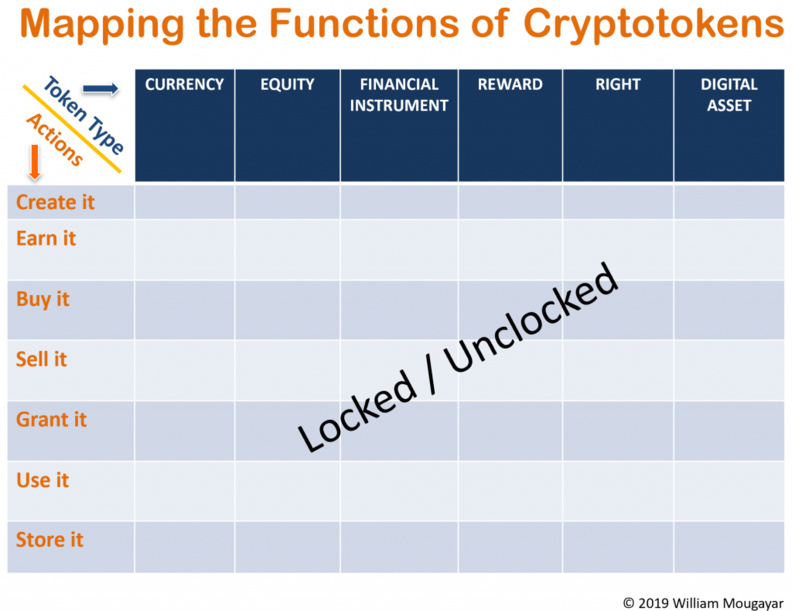

I believe that this classification covers all of the use cases for cryptotokens. Currency is used for payments, either for goods and services or for blockchain-related computer resources (eg gas). Equity represents ownership in a physical asset (eg real estate) or a proxy to some commodity (eg gold). Financial instruments include all of the existing (and new) financial services products that will eventually move to a purely digital format. Rewards embody what is also referred to as a “work token”, because some human or computer work has to be generated to earn these tokens, either actively by doing something or passively by sharing something else of value (eg our data). A right could include a right to vote (eg governance related), or a right to access something (eg digital content or some actionable service). The digital asset represents what is also called in the blockchain circles as NFT (non-fungible tokens), and they represent natively created digital objects that live only in a purely digital form, and have no physical equivalent. Finally, there’s one more factor that can apply to any token: they can be locked or unlocked, which means that their usage is tied to a time element.

A cryptotoken can be all of the above functions at once, or it can be some of them. Or, it could start as one thing, and develop into different ones, hence lies the puzzle and head scratcher that regulators and others are grappling with: how can we regulate, let alone understand this novelty concept that has many concurrent lives, when we have been used to seeing them and treating them as distinct units?

Furthermore, each token can have many different permutations in how it can be created, earned, bought, sold, granted (or received), stored, or used. And the most important remaining feature is that these tokens can be exchanged, traded or transmitted in a purely peer-to-peer fashion, without the friction of central actors.

For currency, we have had the dollar, yen, euro, pound, and scores of sovereign fiats.

For equity, we have share or stock units, and they are known as securities.

For financial instruments, we have derivatives, bonds, futures, options, swaps, etc. and they are typically administered by brokers, agents, custodians or exchanges.

For rewards, we have mileage points, airline miles, loyalty cards, and the likes.

For rights, we have government-issued identity cards, or share proxies that allow us to have a (voting) voice in the governance affairs of what matters to us.

Finally, we have a blockchain novelty: a singular representation of a digital asset as a uniquely transferable unit of value: the non-fungible token that could represent a caricature-like version of a cat (eg CryptoKitties), a cartoon monster, a tank toy, or a purple sword won at a game, but could also represent a concert ticket, a collectible, or maybe something else not invented yet.

I believe that this classification covers all of the use cases for cryptotokens. Currency is used for payments, either for goods and services or for blockchain-related computer resources (eg gas). Equity represents ownership in a physical asset (eg real estate) or a proxy to some commodity (eg gold). Financial instruments include all of the existing (and new) financial services products that will eventually move to a purely digital format. Rewards embody what is also referred to as a “work token”, because some human or computer work has to be generated to earn these tokens, either actively by doing something or passively by sharing something else of value (eg our data). A right could include a right to vote (eg governance related), or a right to access something (eg digital content or some actionable service). The digital asset represents what is also called in the blockchain circles as NFT (non-fungible tokens), and they represent natively created digital objects that live only in a purely digital form, and have no physical equivalent. Finally, there’s one more factor that can apply to any token: they can be locked or unlocked, which means that their usage is tied to a time element.

A cryptotoken can be all of the above functions at once, or it can be some of them. Or, it could start as one thing, and develop into different ones, hence lies the puzzle and head scratcher that regulators and others are grappling with: how can we regulate, let alone understand this novelty concept that has many concurrent lives, when we have been used to seeing them and treating them as distinct units?

Furthermore, each token can have many different permutations in how it can be created, earned, bought, sold, granted (or received), stored, or used. And the most important remaining feature is that these tokens can be exchanged, traded or transmitted in a purely peer-to-peer fashion, without the friction of central actors.

As a chameleon symbol, the token is a weapon that punches through societal, governmental, and business related constructs via a technology component that is powerful and potent. It collapses many constructs into one.

This brings us back to regulation. It is erroneous to start with a securities framework for regulating how we want to govern the advent of tokens. Not only is that starting point like fitting a square peg into a round hole, it’s like trying to apply something where it doesn’t belong. More importantly, it chokes the new business models that want to emerge out of these token use cases.

Therefore, we need to recognize that the token is a unique type of asset. For a lack of a better set of words, it is “a new asset class” that needs its own laws and regulation. Unlike the “security” moniker that regulators want to box it in, the token doesn’t always represent a personal financial interest nor an equity share of a financial stake into something else. It is a new type of proxy to our increasingly digital lives.

The token needs to be given respect and it needs to be accepted as such. If the current regulators want to govern it, they will need to open their minds much wider, and one way to help them is by trying to explain it in a more friendly manner with a simple language like I’ve attempted here.

I don’t believe we have explained tokens in a simple enough layman’s language, yet. That is largely why change makers quickly put their blinders on when they approach the topic, or they only see what they can comprehend.

I believe that regulatory headwinds are the most imminent hurdles facing token adoption, and we must work on those first, by making it easy for everyone to talk about tokens, and to be accepting of the many applications that want to include them.

This brings us back to regulation. It is erroneous to start with a securities framework for regulating how we want to govern the advent of tokens. Not only is that starting point like fitting a square peg into a round hole, it’s like trying to apply something where it doesn’t belong. More importantly, it chokes the new business models that want to emerge out of these token use cases.

Therefore, we need to recognize that the token is a unique type of asset. For a lack of a better set of words, it is “a new asset class” that needs its own laws and regulation. Unlike the “security” moniker that regulators want to box it in, the token doesn’t always represent a personal financial interest nor an equity share of a financial stake into something else. It is a new type of proxy to our increasingly digital lives.

The token needs to be given respect and it needs to be accepted as such. If the current regulators want to govern it, they will need to open their minds much wider, and one way to help them is by trying to explain it in a more friendly manner with a simple language like I’ve attempted here.

I don’t believe we have explained tokens in a simple enough layman’s language, yet. That is largely why change makers quickly put their blinders on when they approach the topic, or they only see what they can comprehend.

I believe that regulatory headwinds are the most imminent hurdles facing token adoption, and we must work on those first, by making it easy for everyone to talk about tokens, and to be accepting of the many applications that want to include them.

William Mougayar is a Toronto-based entrepreneur, Ethereum Foundation advisor and advisor to Consensus 2016, CoinDesk's flagship conference. He is also the author of the upcoming book, The Business Blockchain: https://www.kickstarter.com/projects/wmougayar/the-business-blockchain-books

Finyear - Daily News

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

Autres articles

-

NFT : L'Opéra de Paris dévoilera à la rentrée une nouvelle collection d'art numérique

-

WEB3 : L'Europe, le baby-blues des licornes ?

-

Finyear, partenaire média de la prochaine édition de l'IPEM Paris

-

Banque Delubac & Cie, bientôt des crypto ?

-

MiCA : les Autorités Européennes de Surveillance consultent sur les lignes directrices