Bitcoin’s Lightning Network (LN) was the talk of the town this past week. Watching some of the videos from the Bitcoin 2022 conference in Miami, what stood out was that a string of companies, including Robinhood, Cash App, and Strike, unveiled support and expanded uses for the Lightning Network at the conference.

Robinhood announced that it was planning to join a growing number of companies that are already using the Lightning Network for fast and cheap bitcoin transactions.

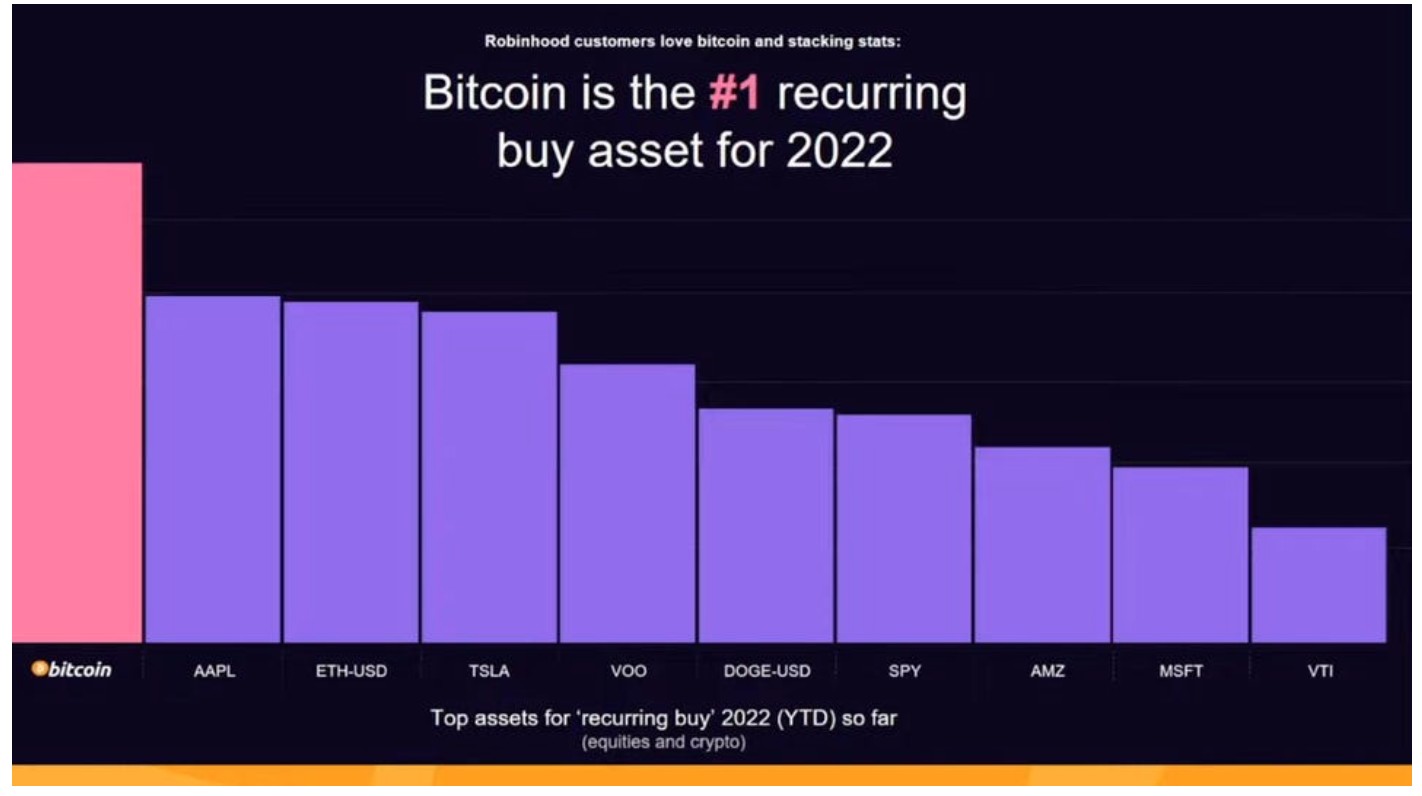

Robinhood also revealed that bitcoin is the number one “recurring buy” asset year-to-date in a presentation delivered at the conference.

Robinhood announced that it was planning to join a growing number of companies that are already using the Lightning Network for fast and cheap bitcoin transactions.

Robinhood also revealed that bitcoin is the number one “recurring buy” asset year-to-date in a presentation delivered at the conference.

Lightning will allow Robinhood users to send and receive instant bitcoin transactions for practically zero fees. The integration is part of their strategy to reduce users’ costs to transact with digital assets and increase interactions with the crypto ecosystem.

CashApp is also expanding its integration with the Lightning Network. Earlier this year, the company integrated with LN and now it announced that it will let users receive payments through the network as well.

And the list goes on.

BitPay has also integrated Lightning Network and so has Kraken.

Strike, revealed it was building a cheap, bitcoin-based payments network designed to rival credit card giants. If you don’t know Strike, it’s a digital payments platform built on Lightning Network and Is behind El Salvador’s shift to bitcoin

Strike has been involved in redfining payments for some time now and during Bitcoin2022, it announced that it partnered with Shopify, Blackhawk, and NCR to deliver Lightning-powered payments to online and brick-and-mortar stores everywhere.

Sites that are using Shopify for card transactions will now be able to receive bitcoin from customers and instantly convert it to fiat, without any fees or processing delays.

Some of the biggest retailers in America, including McDonald’s, Walmart, Home Depot, Best Buy, Starbucks, Chipotle, El Corte Ingles, Lowe’s, Staples, Woolworths work with Blackhawk and NCR, and more than 2.6 million merchants in the US sell using Shopify.

People will be able to pay for groceries or shop online on bitcoin payment rails. This is a massive step toward the mass adoption of bitcoin as a day-to-day payment solution, rather than being solely used as digital gold.

Paying with debit and credit cards costs merchants hefty fees. But with the Lightning Network, merchants will be able to accept payments without any of these costs. By leveraging the Lightning Network, Strike offers merchants an alternative to traditional credit card networks, such as Visa and MasterCard.

Earlier this week, Lightning Labs, the company behind the Lightning Network, developed Taro, a new protocol that enables the issuance of digital assets and collectibles on the bitcoin network. Basically, the protocol will introduce assets like stablecoins, letting users easily increase or reduce their exposure to bitcoin’s volatility and send money across the world, almost instantaneously and at a low cost, through the Lightning Network.

The Lightning Network has proven itself over the years. Last year, LN experienced parabolic growth in terms of capacity and usage, and its growth is displaying no signs of a slowdown. Currently, there are 3,675 BTC locked in the Lightning Network and the network could grow at a 30% compounded rate over time.

The Bitcoin2022 conference really showed that Lightning’s adoption has turned a corner.

Lightning has this incredible ability to communicate peer-to-peer, and protocols like Taro make Lightning a useful payment rail with the potential to replace networks like Swift and route all the world‘s fiat currencies through bitcoin. On the other hand, using existing payment networks like Visa and Mastercard, merchants pay high fees, usually passed on to customers, and have to deal with the uncertainty of chargebacks.

The Lightning Network gives bitcoin the wings it needs to scale and compete with every fiat currency and payment network on the planet.

CashApp is also expanding its integration with the Lightning Network. Earlier this year, the company integrated with LN and now it announced that it will let users receive payments through the network as well.

And the list goes on.

BitPay has also integrated Lightning Network and so has Kraken.

Strike, revealed it was building a cheap, bitcoin-based payments network designed to rival credit card giants. If you don’t know Strike, it’s a digital payments platform built on Lightning Network and Is behind El Salvador’s shift to bitcoin

Strike has been involved in redfining payments for some time now and during Bitcoin2022, it announced that it partnered with Shopify, Blackhawk, and NCR to deliver Lightning-powered payments to online and brick-and-mortar stores everywhere.

Sites that are using Shopify for card transactions will now be able to receive bitcoin from customers and instantly convert it to fiat, without any fees or processing delays.

Some of the biggest retailers in America, including McDonald’s, Walmart, Home Depot, Best Buy, Starbucks, Chipotle, El Corte Ingles, Lowe’s, Staples, Woolworths work with Blackhawk and NCR, and more than 2.6 million merchants in the US sell using Shopify.

People will be able to pay for groceries or shop online on bitcoin payment rails. This is a massive step toward the mass adoption of bitcoin as a day-to-day payment solution, rather than being solely used as digital gold.

Paying with debit and credit cards costs merchants hefty fees. But with the Lightning Network, merchants will be able to accept payments without any of these costs. By leveraging the Lightning Network, Strike offers merchants an alternative to traditional credit card networks, such as Visa and MasterCard.

Earlier this week, Lightning Labs, the company behind the Lightning Network, developed Taro, a new protocol that enables the issuance of digital assets and collectibles on the bitcoin network. Basically, the protocol will introduce assets like stablecoins, letting users easily increase or reduce their exposure to bitcoin’s volatility and send money across the world, almost instantaneously and at a low cost, through the Lightning Network.

The Lightning Network has proven itself over the years. Last year, LN experienced parabolic growth in terms of capacity and usage, and its growth is displaying no signs of a slowdown. Currently, there are 3,675 BTC locked in the Lightning Network and the network could grow at a 30% compounded rate over time.

The Bitcoin2022 conference really showed that Lightning’s adoption has turned a corner.

Lightning has this incredible ability to communicate peer-to-peer, and protocols like Taro make Lightning a useful payment rail with the potential to replace networks like Swift and route all the world‘s fiat currencies through bitcoin. On the other hand, using existing payment networks like Visa and Mastercard, merchants pay high fees, usually passed on to customers, and have to deal with the uncertainty of chargebacks.

The Lightning Network gives bitcoin the wings it needs to scale and compete with every fiat currency and payment network on the planet.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Autres articles

-

Revolut obtient une licence bancaire au Royaume-Uni

-

Nominations | Eight Advisory annonce deux nouveaux associés en France

-

NFT : L'Opéra de Paris dévoilera à la rentrée une nouvelle collection d'art numérique

-

Ferrari étend son système de paiement en crypto-monnaie à l'Europe après son lancement aux États-Unis

-

WEB3 : L'Europe, le baby-blues des licornes ?