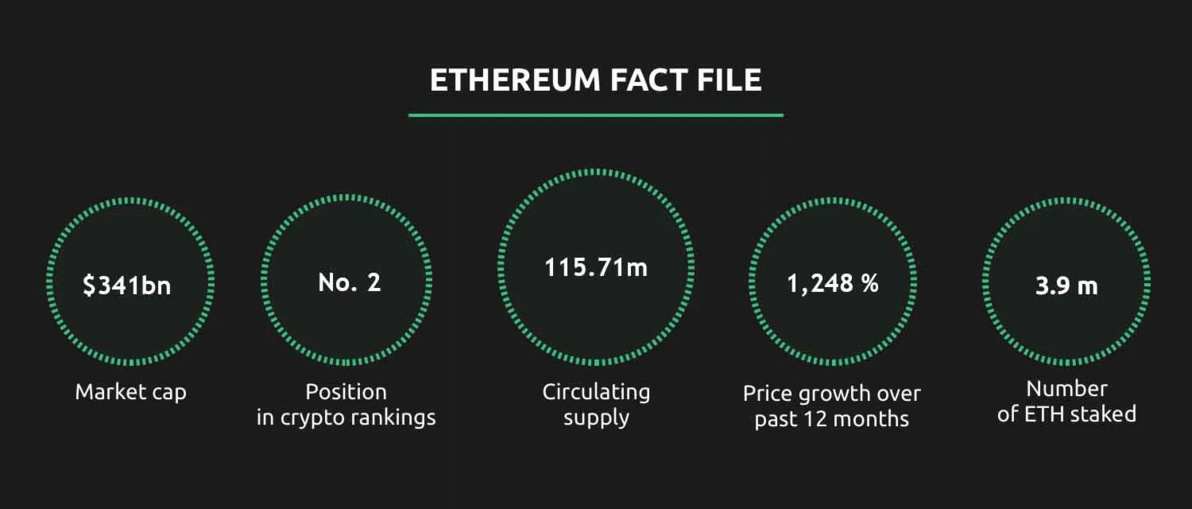

The cryptocurrency market ended the week with a total market capitalization of $2.23 trillion. After one of its worst periods in 2021, this week ended with gains across the board (Bitcoin +14%, Ethereum setting a new ATH, XRP +52% and Binance Coin +28%). Ethereum was in the spotlight with a 30% increase in value and setting a new all-time high $2,976.42, setting the stage to break past the $3,000 threshold. At its current price levels, Vitalik at the age of 27 has officially become the youngest crypto billionaire. The price increase comes after the European Investment Bank (EIB) announced on Wednesday that it issued its first ever digital bond on the Ethereum blockchain, leading to increased speculation that Ethereun is gaining traction among mainstream financial institutions. Ethereum maintains the number two position with 15% of the current crypto market and its getting ready for a major upgrade that will allow faster transaction times and reduce the amount of power required to process transactions. While it trails Bitcoin significantly, Ethereum’s fundamentals seem stronger.

Market makers are turning their heads to Ethereum. This week it was on fire, reaching a new all-time high. Despite the high gas fees, Ethereum is still the most active and most used blockchain platform. Ethereum is still setting records in terms of usage, from number of active developers and number of applications that are built on Ethereum to daily transactions and total value locked.

Market makers are turning their heads to Ethereum. This week it was on fire, reaching a new all-time high. Despite the high gas fees, Ethereum is still the most active and most used blockchain platform. Ethereum is still setting records in terms of usage, from number of active developers and number of applications that are built on Ethereum to daily transactions and total value locked.

Ethereum is younger than Bitcoin, but the Lindy effect still applies. At six, Ethereum has a better chance of succeeding on a long-term basis, as its popularity has grown over the years.

Ethereum has laid the groundwork for a decentralized version of the Internet, where users can enjoy self-sovereignty, without trusting the centralized authorities as in the case of Web 2.0. With the increasing use of the Ethereum blockchain, the demand for ETH will increase and the network will constantly break new all-times highs, in terms of network traffic and transactions.

Ethereum has laid the groundwork for a decentralized version of the Internet, where users can enjoy self-sovereignty, without trusting the centralized authorities as in the case of Web 2.0. With the increasing use of the Ethereum blockchain, the demand for ETH will increase and the network will constantly break new all-times highs, in terms of network traffic and transactions.

Competition

Ethereum has become the blockchain of choice for many decentralized app developers. Its has by far the largest developer community, even more than Bitcoin, as it is much more tech-oriented and developer-focused.

For years, several “Ethereum Killers”, layer 1 blockchains have guaranteed a faster and sophisticated smart contract platform but have vanished into the wind. Nonetheless, recently there have been more and more serious projects that are trying to dethrone Ethereum, like Cardano and Polkadot.

While Cardano and Polkadot have certain advantages, neither has managed to topple Ethereum yet. Cardano is listed as the 7th largest currency by market cap, followed by Polkadot in the 8th place. A report by Outlier Ventures found that Cardano was the second most evolved protocol behind Ethereum, while Polkadot doubled the number of monthly active core developers between July and November.

Even if Ethereum manages to retain its crown, some competitors may find certain niches to flourish. Still, Ethereum has earned the trust of investors and as we see with Bitcoin, trust is a valuable price driver.

Moving from PoW to PoS

Like Bitcoin, the Ethereum blockchain operates on a Proof-of-Work (PoW) consensus mechanism. However, some big changes are on the horizon. In July, Ethereum will make a big transition to Proof-of-Stake (PoS) something that will affect how many ETH can be mined and how transactions will be validated. PoS will make transactions much more efficient by not rewarding miners with a block reward, but with the actual transaction fee. PoS will significantly reduce the network’s energy consumption and hardware requirements, potentially resulting in lower transaction fees, which are currently skyrocketing, and higher throughput.

PoS mining means that anyone can stake their Ethereum tokens in a specific wallet, which will enable them to win fees by verifying new transactions on the blockchain. The more ETH the someone stakes the higher chance they will have of getting this fee.

Even though the amount of Ethereum that can be created is infinite, the change in the consensus mechanism is expected to create a scarcity model for the cryptocurrency. Ethereum will become a deflationary asset, reducing the supply of coins which will drive the price higher and attract more buyers.

Layer 2 Scaling

Demand to use Ethereum has exploded over the last year. This shows that Ethereum’s base layer is extremely useful and that many developers are building secondary layers on top of Ethereum.

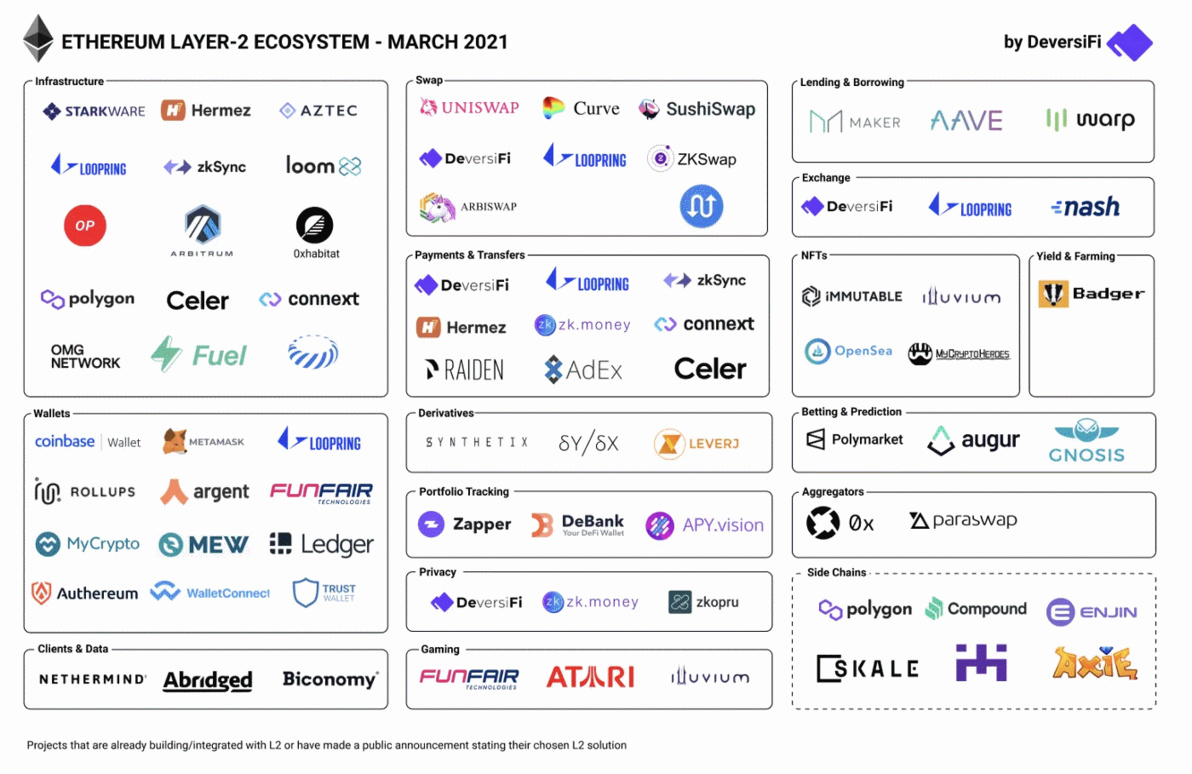

Layer 2 Scaling (L2s) are secondary blockchains that lay on top of another core blockchain, in which dApps can process transactions and state changes with only the occasional data reconciliation to L1.

The Ethereum L2s ecosystem has already bloomed, offering multiple and different avenues to scale Ethereum for the masses.

Ethereum has become the blockchain of choice for many decentralized app developers. Its has by far the largest developer community, even more than Bitcoin, as it is much more tech-oriented and developer-focused.

For years, several “Ethereum Killers”, layer 1 blockchains have guaranteed a faster and sophisticated smart contract platform but have vanished into the wind. Nonetheless, recently there have been more and more serious projects that are trying to dethrone Ethereum, like Cardano and Polkadot.

While Cardano and Polkadot have certain advantages, neither has managed to topple Ethereum yet. Cardano is listed as the 7th largest currency by market cap, followed by Polkadot in the 8th place. A report by Outlier Ventures found that Cardano was the second most evolved protocol behind Ethereum, while Polkadot doubled the number of monthly active core developers between July and November.

Even if Ethereum manages to retain its crown, some competitors may find certain niches to flourish. Still, Ethereum has earned the trust of investors and as we see with Bitcoin, trust is a valuable price driver.

Moving from PoW to PoS

Like Bitcoin, the Ethereum blockchain operates on a Proof-of-Work (PoW) consensus mechanism. However, some big changes are on the horizon. In July, Ethereum will make a big transition to Proof-of-Stake (PoS) something that will affect how many ETH can be mined and how transactions will be validated. PoS will make transactions much more efficient by not rewarding miners with a block reward, but with the actual transaction fee. PoS will significantly reduce the network’s energy consumption and hardware requirements, potentially resulting in lower transaction fees, which are currently skyrocketing, and higher throughput.

PoS mining means that anyone can stake their Ethereum tokens in a specific wallet, which will enable them to win fees by verifying new transactions on the blockchain. The more ETH the someone stakes the higher chance they will have of getting this fee.

Even though the amount of Ethereum that can be created is infinite, the change in the consensus mechanism is expected to create a scarcity model for the cryptocurrency. Ethereum will become a deflationary asset, reducing the supply of coins which will drive the price higher and attract more buyers.

Layer 2 Scaling

Demand to use Ethereum has exploded over the last year. This shows that Ethereum’s base layer is extremely useful and that many developers are building secondary layers on top of Ethereum.

Layer 2 Scaling (L2s) are secondary blockchains that lay on top of another core blockchain, in which dApps can process transactions and state changes with only the occasional data reconciliation to L1.

The Ethereum L2s ecosystem has already bloomed, offering multiple and different avenues to scale Ethereum for the masses.

50/50 rule

Many crypto investors have been tempted to buy into Ethereum because of how it has outperformed Bitcoin. Many believe that this trend will continue, and some have even set a price target of $10,000 for ETH in the near future.

A few weeks ago, Balaji Srinivasan, a well known entrepreneur and crypto advocate, went on the Tim Ferriss Show to talk about the future of Bitcoin. When asked about how he would spend $100 million dollars as a crypto investor, he said the simplest thing to do was “50/50 BTC and ETH”.

For both networks, decentralization is the fundamental guiding principle. Bitcoin is the catalyst that introduced Internet finance to the world, while Ethereum has emerged and spawned a whole ecosystem of its own. While DeFi has seen exponential growth over the last year, there are many exciting developments happening in Web3. One of the most promising evolutions is the emergence of NFTs, non-fungible tokens that offer provable ownership and scarcity of an asset.

DeFi, NFTs, Layer 2 scaling, EIP-1559 and PoS are elements that are solidifying Ethereum’s place in the Web3 world. As more protocols attach to Ethereum’s blockchain, the cryptocurrency’s price will increase tremendously in the process.

Both Bitcoin and Ethereum have dominated the market and you can expect that they will continue in the future. Keeping the largest part of your portfolio equally invested in these two coins is a great strategy.

Many crypto investors have been tempted to buy into Ethereum because of how it has outperformed Bitcoin. Many believe that this trend will continue, and some have even set a price target of $10,000 for ETH in the near future.

A few weeks ago, Balaji Srinivasan, a well known entrepreneur and crypto advocate, went on the Tim Ferriss Show to talk about the future of Bitcoin. When asked about how he would spend $100 million dollars as a crypto investor, he said the simplest thing to do was “50/50 BTC and ETH”.

For both networks, decentralization is the fundamental guiding principle. Bitcoin is the catalyst that introduced Internet finance to the world, while Ethereum has emerged and spawned a whole ecosystem of its own. While DeFi has seen exponential growth over the last year, there are many exciting developments happening in Web3. One of the most promising evolutions is the emergence of NFTs, non-fungible tokens that offer provable ownership and scarcity of an asset.

DeFi, NFTs, Layer 2 scaling, EIP-1559 and PoS are elements that are solidifying Ethereum’s place in the Web3 world. As more protocols attach to Ethereum’s blockchain, the cryptocurrency’s price will increase tremendously in the process.

Both Bitcoin and Ethereum have dominated the market and you can expect that they will continue in the future. Keeping the largest part of your portfolio equally invested in these two coins is a great strategy.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Autres articles

-

Revolut obtient une licence bancaire au Royaume-Uni

-

Nominations | Eight Advisory annonce deux nouveaux associés en France

-

NFT : L'Opéra de Paris dévoilera à la rentrée une nouvelle collection d'art numérique

-

WEB3 : L'Europe, le baby-blues des licornes ?

-

Finyear, partenaire média de la prochaine édition de l'IPEM Paris