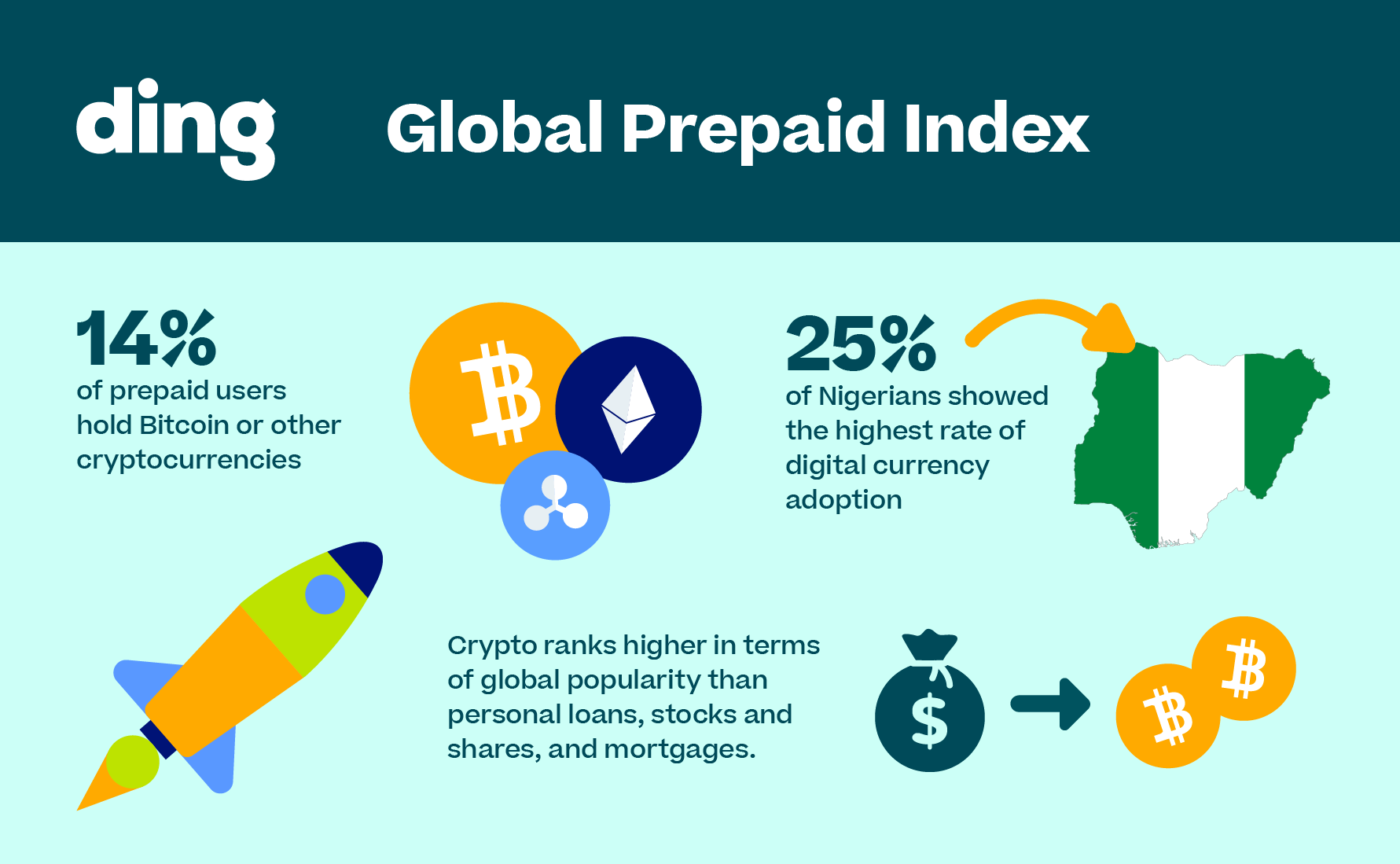

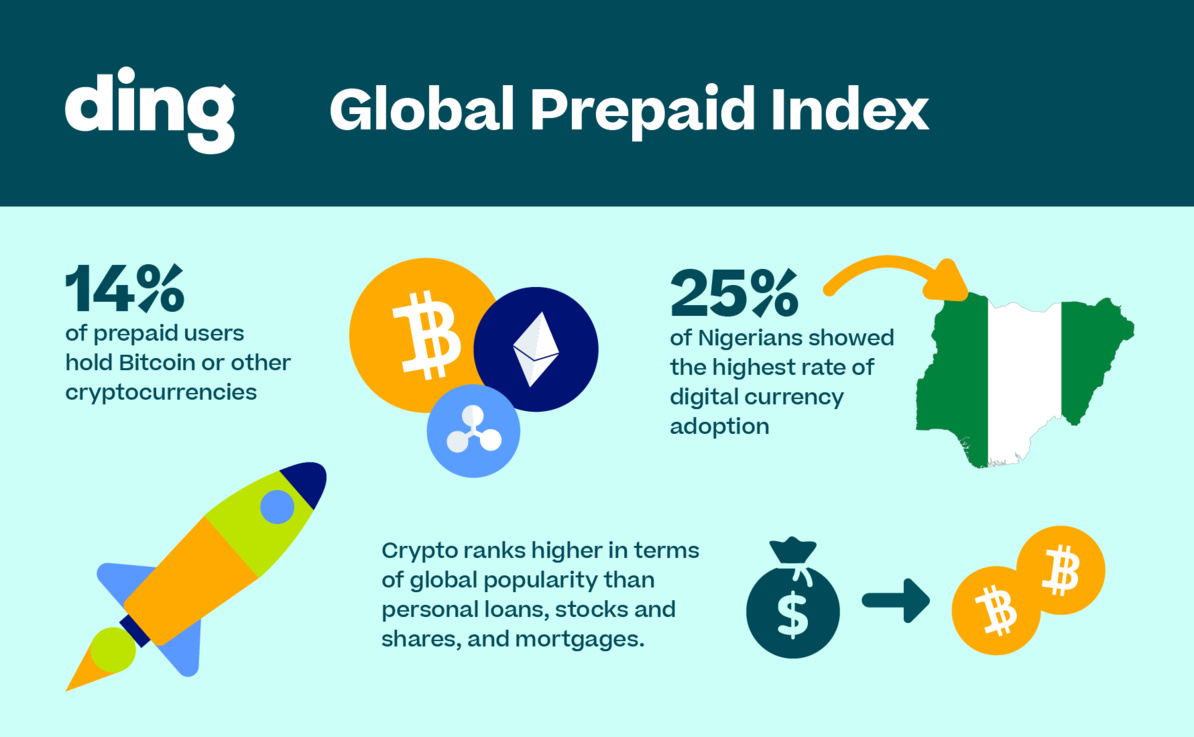

Ding, the best way to send international top up, has released its second Global Prepaid Index, revealing that 14% of users hold Bitcoin or other cryptocurrencies. Adoption is even as high as 25% in some developing countries. The report also shows that many consumers are putting digital assets ahead of other, more traditional financial products, such as personal loans.

This bi-annual global study commissioned by Ding, the world’s largest mobile top-up service, examines the views of 6,250 respondents across the KSA, UAE, Nigeria, Indonesia, Germany, India, Mexico, Brazil, and the Philippines, regarding their engagement in the prepaid market and their attitudes towards the economy.

Among the countries surveyed, Nigeria showed the highest rate of digital currency adoption, with 25% of users confirming they currently hold Bitcoin or other cryptocurrencies. It was followed by the Philippines and Indonesia, where 19% and 18% of respondents, respectively, confirmed they hold crypto. In contrast, cryptocurrency adoption was lowest in Germany and Mexico, with 8% each, followed by Saudi Arabia with 10%.

Perhaps most surprising was the global finding that respondents showed a higher preference for cryptocurrencies than for some traditional financial products. Cryptocurrencies ranked sixth out of thirteen options, with traditional bank accounts, savings accounts, and credit cards the most popular products. However, crypto ranked higher in terms of global popularity than personal loans, stocks and shares, and mortgages among GPI respondents.

The report also revealed some broader findings about the global prepaid market, showing that over three-quarters of users have engaged with prepaid products or services. However, far from being the last resort of those who don’t qualify for a phone contract or credit card, the survey overwhelmingly found that people opt for prepaid due to reasons such as better budgeting and expenditure control. In contrast, only 11% said they used prepaid because they had no other choice.

“Although prepaid is a far more developed market, we see many parallels between crypto and the global prepaid sector, and their attraction to consumers,” said Rupert Shaw, Chief Commercial Officer at Ding. “The GPI findings consistently show that consumers value flexibility, freedom, and choice when making spending and financial decisions. The increasing appetite for prepaid products and cryptocurrencies reflects these preferences and the significant growth opportunities for both segments.”

Cryptocurrencies have been gathering steady momentum in 2021, buoyed by all-time price highs and a slew of positive headlines around developments such as non-fungible tokens. However, security issues continue to persist throughout the industry. Another interesting finding of the GPI report is the high correlation between fear of cybercrimes and cryptocurrency adoption. Over half of respondents from Nigeria, the Philippines, and Indonesia expressed fear of incidents such as theft of financial information, identity fraud, or hacking – more than other countries. Respondents from these countries were also more likely to report fear of government or corporate data harvesting.

In contrast, Indian consumers were the least likely to be concerned about online financial crime and data fraud, while German respondents were least concerned about data collection.

About the Ding Global Prepaid Index (GPI)

The Ding Global Prepaid Index (GPI) is a major bi-annual survey analyzing the prepaid market. The second GPI shines a light on the growing appetite among people across the socio-economic divide for consumer goods or services in the Prepaid economy. The survey gathered insights from 6,250 respondents from across Europe, Asia, and the Americas regarding their use of prepaid offerings, examining their attitudes, activities, and outlook for the future.

About Ding

Ding was founded to improve people’s lives by helping those with less gain access to more. As the number one international mobile top-up service in the world, Ding has been keeping people connected since 2006, when it launched this first-of-a-kind service. Today, Ding’s users have successfully sent close to a half a billion top-ups globally, via the app, online at Ding.com, and via over 8,000 DingConnect partners, and over 600K retail outlets. DingConnect.com is the leading top-up API provider & online portal for businesses that want to offer prepaid products as a compliment to their existing website, app and retail outlets. Ding delivers a top-up every second, via 550+ operators, across 140+ countries – helping families and friends around the world to stay connected.

http://www.ding.com/

This bi-annual global study commissioned by Ding, the world’s largest mobile top-up service, examines the views of 6,250 respondents across the KSA, UAE, Nigeria, Indonesia, Germany, India, Mexico, Brazil, and the Philippines, regarding their engagement in the prepaid market and their attitudes towards the economy.

Among the countries surveyed, Nigeria showed the highest rate of digital currency adoption, with 25% of users confirming they currently hold Bitcoin or other cryptocurrencies. It was followed by the Philippines and Indonesia, where 19% and 18% of respondents, respectively, confirmed they hold crypto. In contrast, cryptocurrency adoption was lowest in Germany and Mexico, with 8% each, followed by Saudi Arabia with 10%.

Perhaps most surprising was the global finding that respondents showed a higher preference for cryptocurrencies than for some traditional financial products. Cryptocurrencies ranked sixth out of thirteen options, with traditional bank accounts, savings accounts, and credit cards the most popular products. However, crypto ranked higher in terms of global popularity than personal loans, stocks and shares, and mortgages among GPI respondents.

The report also revealed some broader findings about the global prepaid market, showing that over three-quarters of users have engaged with prepaid products or services. However, far from being the last resort of those who don’t qualify for a phone contract or credit card, the survey overwhelmingly found that people opt for prepaid due to reasons such as better budgeting and expenditure control. In contrast, only 11% said they used prepaid because they had no other choice.

“Although prepaid is a far more developed market, we see many parallels between crypto and the global prepaid sector, and their attraction to consumers,” said Rupert Shaw, Chief Commercial Officer at Ding. “The GPI findings consistently show that consumers value flexibility, freedom, and choice when making spending and financial decisions. The increasing appetite for prepaid products and cryptocurrencies reflects these preferences and the significant growth opportunities for both segments.”

Cryptocurrencies have been gathering steady momentum in 2021, buoyed by all-time price highs and a slew of positive headlines around developments such as non-fungible tokens. However, security issues continue to persist throughout the industry. Another interesting finding of the GPI report is the high correlation between fear of cybercrimes and cryptocurrency adoption. Over half of respondents from Nigeria, the Philippines, and Indonesia expressed fear of incidents such as theft of financial information, identity fraud, or hacking – more than other countries. Respondents from these countries were also more likely to report fear of government or corporate data harvesting.

In contrast, Indian consumers were the least likely to be concerned about online financial crime and data fraud, while German respondents were least concerned about data collection.

About the Ding Global Prepaid Index (GPI)

The Ding Global Prepaid Index (GPI) is a major bi-annual survey analyzing the prepaid market. The second GPI shines a light on the growing appetite among people across the socio-economic divide for consumer goods or services in the Prepaid economy. The survey gathered insights from 6,250 respondents from across Europe, Asia, and the Americas regarding their use of prepaid offerings, examining their attitudes, activities, and outlook for the future.

About Ding

Ding was founded to improve people’s lives by helping those with less gain access to more. As the number one international mobile top-up service in the world, Ding has been keeping people connected since 2006, when it launched this first-of-a-kind service. Today, Ding’s users have successfully sent close to a half a billion top-ups globally, via the app, online at Ding.com, and via over 8,000 DingConnect partners, and over 600K retail outlets. DingConnect.com is the leading top-up API provider & online portal for businesses that want to offer prepaid products as a compliment to their existing website, app and retail outlets. Ding delivers a top-up every second, via 550+ operators, across 140+ countries – helping families and friends around the world to stay connected.

http://www.ding.com/

Laurent Leloup

Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

Autres articles

-

Revolut obtient une licence bancaire au Royaume-Uni

-

Nominations | Eight Advisory annonce deux nouveaux associés en France

-

NFT : L'Opéra de Paris dévoilera à la rentrée une nouvelle collection d'art numérique

-

Ferrari étend son système de paiement en crypto-monnaie à l'Europe après son lancement aux États-Unis

-

WEB3 : L'Europe, le baby-blues des licornes ?