Eleven years ago, the Bitcoin white paper was published, changing forever technology, finance, and our relationship with money. In these 10 years, Bitcoin has become more valuable than gold, we’ve developed blockchain and other cryptocurrencies and seen a possible decentralized future where people are no longer required to trust an organization, but rather are given the opportunity to create trust, transparency and verify whatever they want. Decentralization introduced the idea that organizations can’t be evil.

Bitcoin’s price dropped below $9,000 pulling down the entire cryptocurrency market. For many analysts, such a move was not surprising because it was predicted. Now, it seems like BTC could be prepping for a further downward trend. There are so many people on opposite sides of the fence expressing their opinions.

Some say it was due to extra Tether being minted. Others because Mark Zuckerburg gave testimony in Congress. And others say that it was expected, the charts predicted it (my favorite). “All I know is that I know nothing.” — Socrates

From a macro-perspective, Bitcoin is still bullish despite the recent downturn. While this downward price has made some analysts talk about further drops, Bitcoin may be coiling up for another leg upward. In fact, a leading analyst has shown that the cryptocurrency’s recent price action has validated a bullish chart pattern. which implies another surge to the upside.

Bitcoin’s price dropped below $9,000 pulling down the entire cryptocurrency market. For many analysts, such a move was not surprising because it was predicted. Now, it seems like BTC could be prepping for a further downward trend. There are so many people on opposite sides of the fence expressing their opinions.

Some say it was due to extra Tether being minted. Others because Mark Zuckerburg gave testimony in Congress. And others say that it was expected, the charts predicted it (my favorite). “All I know is that I know nothing.” — Socrates

From a macro-perspective, Bitcoin is still bullish despite the recent downturn. While this downward price has made some analysts talk about further drops, Bitcoin may be coiling up for another leg upward. In fact, a leading analyst has shown that the cryptocurrency’s recent price action has validated a bullish chart pattern. which implies another surge to the upside.

A few days ago, a friend asked me can I make money with Bitcoin? Is it too late for me to get into Bitcoin? Well, that’s not the right question to ask.

Before I or anyone else can answer this question. we need to discuss the difference between trading and investing.

Investing is something all of us should be doing, with the goal that the value of the assets we invest in, will increase over time. If you’re an investor, what you invest on, should be long term decision. When you pick the asset classes you want to put your money in, you should plan to stay with them for a while. On the other hand if you’re a trader, that means that you’re going to get in and out of the market quickly. Right now if you get involved with Bitcoin, you are a trader. At the current price and volatility levels, it’s not really an investment. You have to put up a sizable amount to make an investment and to see any kind of significant future returns.

Yo can expect Bitcoin to shoot up to crazy heights and come down crashing to crazy lows. If you don’t know how and when to get in and out of the market and if you don’t have the guts… if don’t have the stomach to handle seeing something losing half it’t value in a short period of time, then you shouldn’t be in Bitcoin. Trading is one of the hardest things you will ever do. It’s easier to become a successful professional athlete than to become a successful trader. You’re competing against the smartest people in the world, you’re competing against hedge funds, you’re competing against everyone and their mother trying to make a buck. So if you’re getting into Bitcoin now, you’re a trader not an investor and make sure you understand what it means and you’re are prepared for it.

The crypto market may not be growing as quickly as many hoped, and we’ve certainly seen some unexpected twists and turns. Yet, blockchain is more mature now than it was two years ago. Needless fat has been removed and a leaner and meaner ecosystem has taken shape.

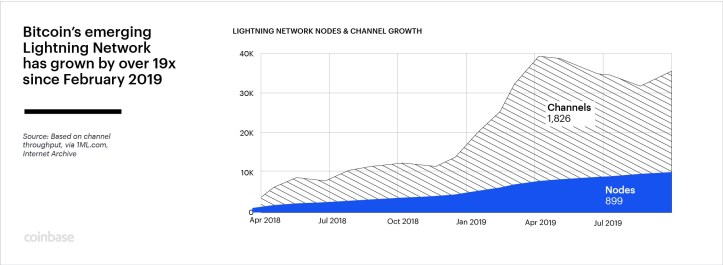

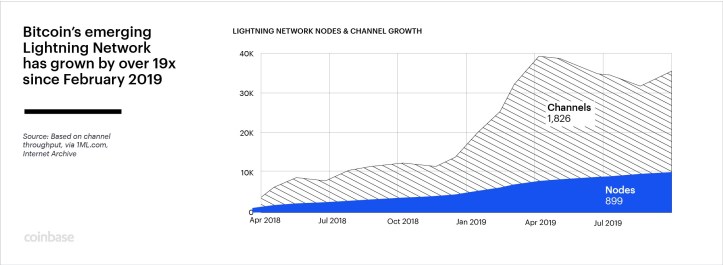

One of the important developments this year is Bitcoin’s Lightning Network, that has increased throughput. The number of Lightning channels has grown 19x in this year alone, and Lightning Network node participation recently surpassed 10,000 nodes in 83 countries around the world.

Before I or anyone else can answer this question. we need to discuss the difference between trading and investing.

Investing is something all of us should be doing, with the goal that the value of the assets we invest in, will increase over time. If you’re an investor, what you invest on, should be long term decision. When you pick the asset classes you want to put your money in, you should plan to stay with them for a while. On the other hand if you’re a trader, that means that you’re going to get in and out of the market quickly. Right now if you get involved with Bitcoin, you are a trader. At the current price and volatility levels, it’s not really an investment. You have to put up a sizable amount to make an investment and to see any kind of significant future returns.

Yo can expect Bitcoin to shoot up to crazy heights and come down crashing to crazy lows. If you don’t know how and when to get in and out of the market and if you don’t have the guts… if don’t have the stomach to handle seeing something losing half it’t value in a short period of time, then you shouldn’t be in Bitcoin. Trading is one of the hardest things you will ever do. It’s easier to become a successful professional athlete than to become a successful trader. You’re competing against the smartest people in the world, you’re competing against hedge funds, you’re competing against everyone and their mother trying to make a buck. So if you’re getting into Bitcoin now, you’re a trader not an investor and make sure you understand what it means and you’re are prepared for it.

The crypto market may not be growing as quickly as many hoped, and we’ve certainly seen some unexpected twists and turns. Yet, blockchain is more mature now than it was two years ago. Needless fat has been removed and a leaner and meaner ecosystem has taken shape.

One of the important developments this year is Bitcoin’s Lightning Network, that has increased throughput. The number of Lightning channels has grown 19x in this year alone, and Lightning Network node participation recently surpassed 10,000 nodes in 83 countries around the world.

Everyday we read predictions about Bitcoin’s future. Some of these predictions are accompanied with charts and analysis, yet some are just ideas. For example Bill Gates is certain that Bitcoin will fail and soon be valued at zero. Jack Dorsey, Twitter’s CEO, hasn’t predicted any price, but thinks Bitcoin will become the Internet’s money. And John McAfee is dead sure that Bitcoin will hit $1 million in 2020.

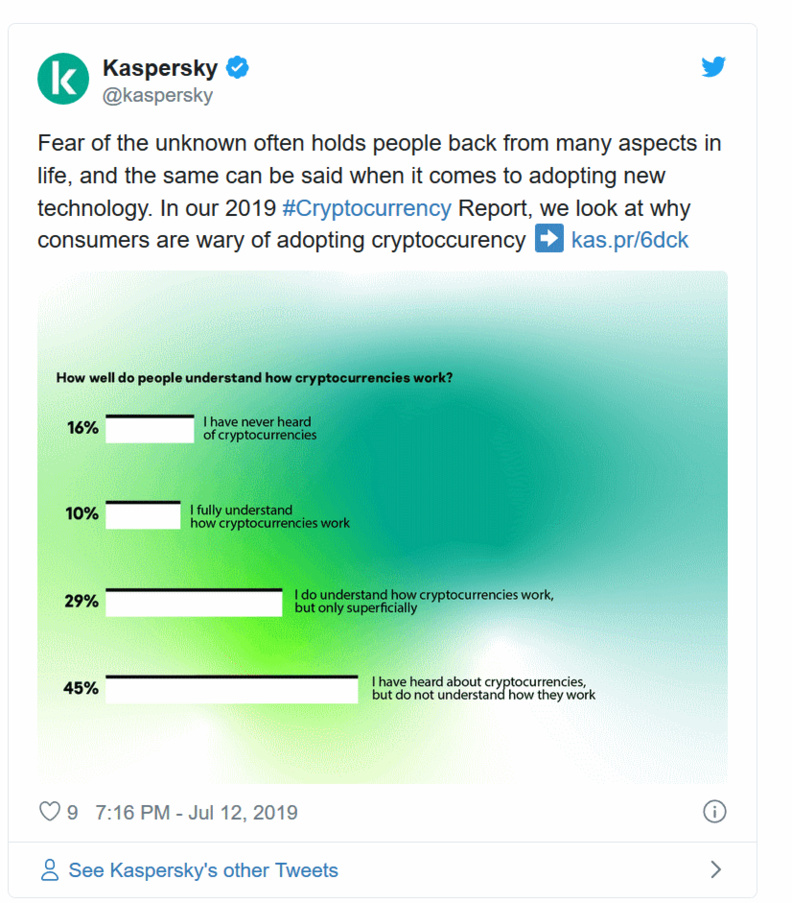

While no one can make price predictions with any certainty, we do know that 1.4 billion people are behind Bitcoin. In June, Kaspersky Lab released key findings of a survey named “The Kaspersky Cryptocurrency Report 2019” The firm interviewed nearly 13,500 people in 22 different countries about their familiarity with cryptocurrencies.

While no one can make price predictions with any certainty, we do know that 1.4 billion people are behind Bitcoin. In June, Kaspersky Lab released key findings of a survey named “The Kaspersky Cryptocurrency Report 2019” The firm interviewed nearly 13,500 people in 22 different countries about their familiarity with cryptocurrencies.

The research by Kaspersky showed that 19% of the world’s total population had purchased cryptocurrencies. This is approximately 1.4 billion people, which aligns with the comments that Binance’s CEO made about who is behind the price of Bitcoin: “Lol, price predictions are easy. It’s just hard to be right about the timing. We will see $16k soon-ish. 1.4 billion people working on it as we speak.”

Google has a famous motto “Don’t be evil.” Companies like Google, Facebook, Amazon, Microsoft and Apple have the power to shut down websites or block specific users, but they don’t flex that muscle. Until they do. Following Google’s corporate restructuring under Alphabet Inc in October 2015, Alphabet changes the motto to: “Do the right thing.” Well, doing the right thing, doesn’t mean that you will. Earlier this year, the NYTimes, wrote a story about “Google’s Shadow Work Force: Temps Who Outnumber Full-Time Employees“, showing how much the company has strayed from its original motto. No company should have so much power, they can get away with murder. Decentralized systems are designed to leave behind, the flaws of centralized systems. Yet, jumping to completely decentralized world with zero governments and autonomous corporations would be a huge shock. Not everything needs to be decentralized, not at least today.

Hal Finney the computer developer who was the recipient of the world’s first Bitcoin transaction, said: “the computer can be used as a tool to liberate and protect people, rather than to control them.” Bitcoin is the world’s first global currency that harnesses the power of computers and humankind’s innate need to innovate, to enable worldwide economic freedom. I am looking forward to what 2020 brings, in Bitcoin and Blockchain adoption and innovation that can’t be evil.

Google has a famous motto “Don’t be evil.” Companies like Google, Facebook, Amazon, Microsoft and Apple have the power to shut down websites or block specific users, but they don’t flex that muscle. Until they do. Following Google’s corporate restructuring under Alphabet Inc in October 2015, Alphabet changes the motto to: “Do the right thing.” Well, doing the right thing, doesn’t mean that you will. Earlier this year, the NYTimes, wrote a story about “Google’s Shadow Work Force: Temps Who Outnumber Full-Time Employees“, showing how much the company has strayed from its original motto. No company should have so much power, they can get away with murder. Decentralized systems are designed to leave behind, the flaws of centralized systems. Yet, jumping to completely decentralized world with zero governments and autonomous corporations would be a huge shock. Not everything needs to be decentralized, not at least today.

Hal Finney the computer developer who was the recipient of the world’s first Bitcoin transaction, said: “the computer can be used as a tool to liberate and protect people, rather than to control them.” Bitcoin is the world’s first global currency that harnesses the power of computers and humankind’s innate need to innovate, to enable worldwide economic freedom. I am looking forward to what 2020 brings, in Bitcoin and Blockchain adoption and innovation that can’t be evil.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

NFT : L'Opéra de Paris dévoilera à la rentrée une nouvelle collection d'art numérique

-

WEB3 : L'Europe, le baby-blues des licornes ?

-

Finyear, partenaire média de la prochaine édition de l'IPEM Paris

-

Banque Delubac & Cie, bientôt des crypto ?

-

MiCA : les Autorités Européennes de Surveillance consultent sur les lignes directrices