Trust is a foundational element of business. Yet maintaining it—particularly throughout a global economy that is becoming increasingly digital—is expensive, time-consuming, and, in many cases, inefficient.

Some organizations are exploring how blockchain, the backbone behind bitcoin, might provide a viable alternative to the current procedural, organizational, and technological infrastructure required to create institutionalized trust.

Though these exploratory efforts are still nascent, the payoff could be profound. Like the Internet reinvented communication, blockchain may similarly disrupt transactions, contracts, and trust —the underpinnings of business, government, and society.

Some organizations are exploring how blockchain, the backbone behind bitcoin, might provide a viable alternative to the current procedural, organizational, and technological infrastructure required to create institutionalized trust.

Though these exploratory efforts are still nascent, the payoff could be profound. Like the Internet reinvented communication, blockchain may similarly disrupt transactions, contracts, and trust —the underpinnings of business, government, and society.

Discussions of blockchain often begin with bitcoin, the cryptocurrency that gained notoriety as much for its novelty as for the volatility of its valuation. In a fog of media reports driven by bitcoin’s associations with dubious use cases,1 the far-reaching potential of blockchain—the technology underpinning bitcoin—remained largely obscured. Yet, that is changing. Organizations throughout the public and private sectors have begun exploring ways that blockchain might profoundly transform some of their most basic operations, from the way they execute contracts and carry out transactions to the ways they engage customers and more.

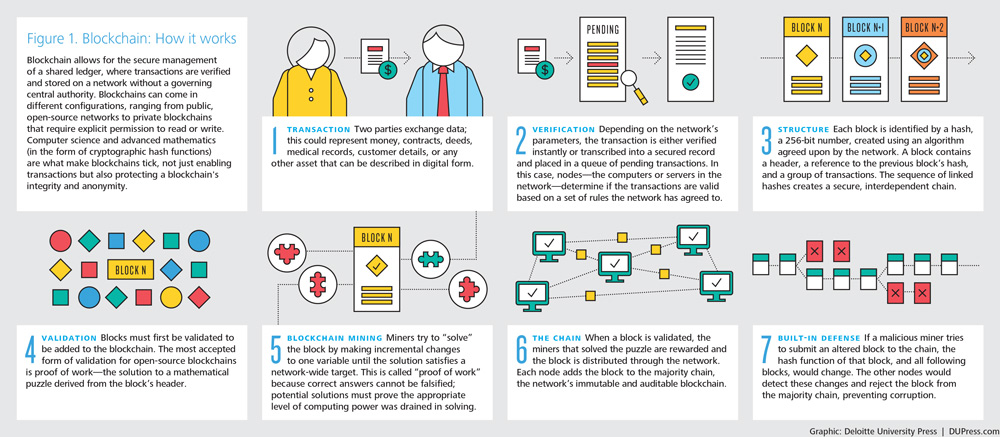

What is blockchain? Simply put, it is a distributed ledger that provides a way for information to be recorded and shared by a community. In this community, each member maintains his or her own copy of the information and all members must validate any updates collectively. The information could represent transactions, contracts, assets, identities, or practically anything else that can be described in digital form. Entries are permanent, transparent, and searchable, which makes it possible for community members to view transaction histories in their entirety. Each update is a new “block” added to the end of the “chain.” A protocol manages how new edits or entries are initiated, validated, recorded, and distributed. With blockchain, cryptology replaces third-party intermediaries as the keeper of trust, with all blockchain participants running complex algorithms to certify the integrity of the whole.

More:

http://dupress.com/articles/blockchain-applications-and-trust-in-a-global-economy/

What is blockchain? Simply put, it is a distributed ledger that provides a way for information to be recorded and shared by a community. In this community, each member maintains his or her own copy of the information and all members must validate any updates collectively. The information could represent transactions, contracts, assets, identities, or practically anything else that can be described in digital form. Entries are permanent, transparent, and searchable, which makes it possible for community members to view transaction histories in their entirety. Each update is a new “block” added to the end of the “chain.” A protocol manages how new edits or entries are initiated, validated, recorded, and distributed. With blockchain, cryptology replaces third-party intermediaries as the keeper of trust, with all blockchain participants running complex algorithms to certify the integrity of the whole.

More:

http://dupress.com/articles/blockchain-applications-and-trust-in-a-global-economy/

Pour lire tous les articles Finyear dédiés Blockchain rendez-vous sur www.finyear.com/search/Blockchain/

Participez aux conférences Blockchain éditées par Finyear :

www.blockchain.vision

www.assurchain.com

Participez aux conférences Blockchain éditées par Finyear :

www.blockchain.vision

www.assurchain.com

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

NFT : L'Opéra de Paris dévoilera à la rentrée une nouvelle collection d'art numérique

-

WEB3 : L'Europe, le baby-blues des licornes ?

-

Finyear, partenaire média de la prochaine édition de l'IPEM Paris

-

Banque Delubac & Cie, bientôt des crypto ?

-

MiCA : les Autorités Européennes de Surveillance consultent sur les lignes directrices