Adam J Clarke on The Business Age of Perpetual Crisis

13/06/2022

Adam Clarke launched Macropay, a global payment gateway, in a living room in 2013. Since then, Macropay has grown into a multi-million-euro business. Having successfully launched a startup well on its way to becoming a unicorn, Adam Clarke shared his experience with other aspiring entrepreneurs.

First of all, Adam is no stranger to adversity having grown up with ADHD. In fact, the tech guru dropped out of high school and joined the workforce at the tender age of 16. This decision came as a response to challenges he faced within the traditional education system. Adam found that school practices did not cater to how his mind works. Thus, he left in pursuit of a better fit.

That fit came first in the form of a sales job where he outperformed over 250 colleagues to become the self-proclaimed "sales champion". Instead of finding satisfaction in this, Adam Clarke set his sights on a higher goal and started Macropay.

Leveraging digitalisation for business growth

In 2013 the world was still recovering from the 2007/2008 global financial recession. To some, this would have been the worst time to launch a digital financial solution. However, Adam Clarke recognised early on that the future of business was digital. Adam Clarke saw the potential benefits for businesses the world over that could arise from a digital solution like Macropay. Since then, the internet has taken over and ecommerce is now essential for business survival.

In addition, the past few years have given rise to digitalisation, which has revolutionised how businesses operate. The COVID pandemic further fueled the adoption of digital solutions, a situation that left most businesses grappling to adjust to the shifting tide.

Fortunately, Macropay was able to offer a timely solution through its customisable financial solutions and infrastructure such as APMs. Apart from being a crisis response, APMs have been proven to improve customer user experience and retention. In fact, Adam claims, “alternative payment methods are critical. [It is] life or death customer experience.”

The hidden value of APMs

To clarify, an Alternative Payment Method or APM is any form of payment other than cash or credit cards offered by a major bank. This makes APMs cheaper, more versatile, and agile than their mainstream counterparts. At the same time, APMs allow business to reduce payment friction and avoid foreign exchange risk when operating cross border. The Macropay ecosystem offers businesses financial solutions and infrastructure that enable safe online payments among other things. In addition to APMs, Macropay also supports and utilises cutting-edge technology, AI and the latest in cybersecurity.

According to Founder & CEO Adam J Clarke, Macropay offers “access to various alternative payment methods and open banking. You can manage all of your accounts under Macropay’s all-in-one dashboard.” This makes the payment gateway ideal for any business looking to grow and accept payments globally.

Also, globalisation has made it possible for businesses to operate from anywhere in the world. Global and regional trade agreements have made it easier for goods to move across borders faster and cheaper. These lower barriers to entry mean increased competition in local markets. In some cases, this makes it harder for local businesses to compete with international brands.

Reasons why businesses fail

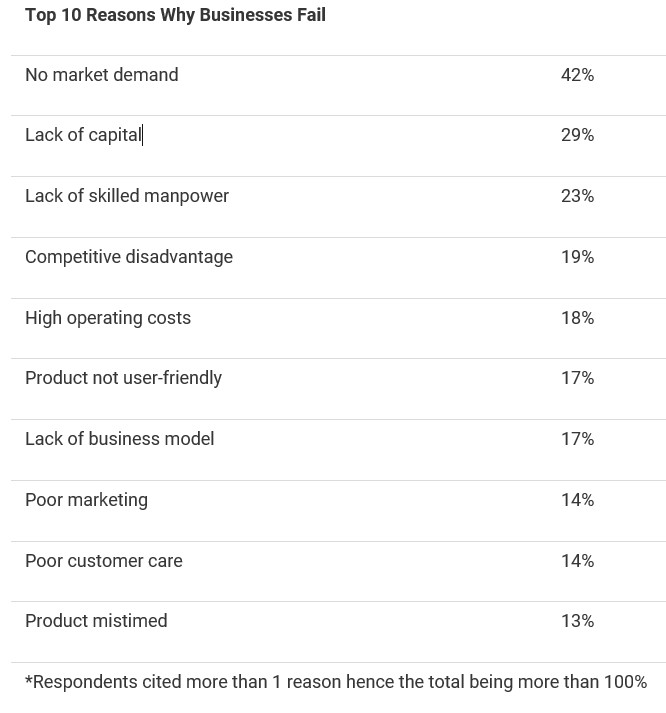

While using APMs will improve user experience and retention, this is only one of many factors that influence whether a business fails or succeeds. According to Entrepreneur.com, 50% of startups fail within the first five years. 20% fail within the first year and an extra 10% by the end of the second year. Of note, several reasons contribute towards this high failure rate. In a survey conducted by CB Insights, some startups identified the top 10 reasons why startups fail as follows:

In addition, the COVID-19 pandemic accelerated the business failure rate which was not limited to startups. For instance, renowned fashion brand Victoria’s Secret liquidated its UK operations and closed over 200 outlets in North America during the pandemic. Also, in the United States of America, YELP reported that 60% of the businesses that closed at the start of the pandemic had closed permanently by the end of 2020.

Conclusion from Adam J Clarke

In the business age of perpetual crisis such as this, Adam Clarke likes to quote popular motivational speaker Les Brown and says, “It’s not over until you win.” Adam goes on to add, “You should not believe that the entrepreneurs you look up to are different from you. The only difference is the ability to handle failure and rejection at an incredible rate. Standing up again after getting knocked over by failure is the most important part of being an entrepreneur.”

In line with this, it is essential for businesses to be resilient and agile in seasons of crisis. This entails adjusting to challenges and never giving up.

It is also important to note that alternative payment systems, like the technology Macropay offers, can help businesses. Establishments can now process payments from other countries, thus allowing the business to enter new markets faster. Once a business builds international client bases, worldwide success is just around the corner.

Cope with the rapid changes and the seemingly never-ending crisis through valuable business insights at http://www.macropay.net.

Disclaimer: The text above is a press release that was not written by Finyear.com.

The issuer is solely responsible for the content of this announcement.

Avertissement : Le texte ci-dessus est un communiqué de presse qui n’a pas été rédigé par Finyear.com.

L’émetteur est seul responsable du contenu de cette annonce.