Four potential scenarios: Summary

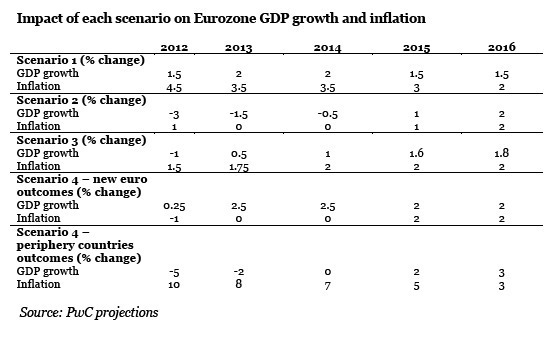

1. Scenario 1 –Monetary expansion: The European Central Bank is given the go ahead to inject significant liquidity to vulnerable economies. Recession is avoided, interest rates are kept low in the short term, but inflation rises well above its 2% target, while the euro depreciates.

2. Scenario 2 – Orderly defaults: A programme of voluntary defaults is agreed for the most indebted countries, which triggers a contractionary debt spiral and a prolonged recession, lasting between two and three years, and which results in a cumulative loss in GDP of around 5% in Eurozone.

3. Scenario 3 – Greek exit: Greece is compelled to leave the Eurozone, and then suffers a sharp deterioration in its economy, a rapid depreciation of its new currency and an inflation spike. The Eurozone seeks to protect its currency through tough fiscal discipline and other investor confidence increasing measures, but still suffers a recession that lasts up to two years.

4. Scenario 4 – New currency bloc: A Franco-German acknowledgement that the existing Eurozone is unsustainable paves the way for a new, smaller and more tightly regulated currency bloc. The ‘new-euro’ would be expected to appreciate dramatically and for the new bloc to benefit from a boom in domestic demand. Economies that are excluded suffer a sharp currency depreciation and severe economic contraction.

Reto Brunner, Leader Business Restructuring Services, PwC Switzerland, commented: “We expect these scenarios could have an impact well beyond the Eurozone. Countries like the UK and US are likely to see falls in exports and banking sector problems but possibly also increased levels of capital inflows, as investors look to place a larger proportion of their portfolios in ‘safe haven’ markets. Other countries, like China, will have to deal with a decline in a significant proportion of their export markets.

“Orderly defaults by the most indebted countries, a Greek exit, or strong monetary expansion in Eurozone are likely to highlight the UK’s position as a safe haven for capital. Capital flows out of the Eurozone and into the UK would cause sterling to appreciate against the euro. Borrowing costs may well be lower as investors purchase UK gilts in preference to risky Eurozone bonds.

“However the UK’s principal trading partner is the Eurozone which is the destination for around 50% of its exports. A relatively strong sterling and a recession in the Eurozone would weigh down on the UK’s growth prospects.”

1. Scenario 1 –Monetary expansion: The European Central Bank is given the go ahead to inject significant liquidity to vulnerable economies. Recession is avoided, interest rates are kept low in the short term, but inflation rises well above its 2% target, while the euro depreciates.

2. Scenario 2 – Orderly defaults: A programme of voluntary defaults is agreed for the most indebted countries, which triggers a contractionary debt spiral and a prolonged recession, lasting between two and three years, and which results in a cumulative loss in GDP of around 5% in Eurozone.

3. Scenario 3 – Greek exit: Greece is compelled to leave the Eurozone, and then suffers a sharp deterioration in its economy, a rapid depreciation of its new currency and an inflation spike. The Eurozone seeks to protect its currency through tough fiscal discipline and other investor confidence increasing measures, but still suffers a recession that lasts up to two years.

4. Scenario 4 – New currency bloc: A Franco-German acknowledgement that the existing Eurozone is unsustainable paves the way for a new, smaller and more tightly regulated currency bloc. The ‘new-euro’ would be expected to appreciate dramatically and for the new bloc to benefit from a boom in domestic demand. Economies that are excluded suffer a sharp currency depreciation and severe economic contraction.

Reto Brunner, Leader Business Restructuring Services, PwC Switzerland, commented: “We expect these scenarios could have an impact well beyond the Eurozone. Countries like the UK and US are likely to see falls in exports and banking sector problems but possibly also increased levels of capital inflows, as investors look to place a larger proportion of their portfolios in ‘safe haven’ markets. Other countries, like China, will have to deal with a decline in a significant proportion of their export markets.

“Orderly defaults by the most indebted countries, a Greek exit, or strong monetary expansion in Eurozone are likely to highlight the UK’s position as a safe haven for capital. Capital flows out of the Eurozone and into the UK would cause sterling to appreciate against the euro. Borrowing costs may well be lower as investors purchase UK gilts in preference to risky Eurozone bonds.

“However the UK’s principal trading partner is the Eurozone which is the destination for around 50% of its exports. A relatively strong sterling and a recession in the Eurozone would weigh down on the UK’s growth prospects.”

Reto Brunner concluded:

“Expect surprises next year.We are currently experiencing unprecedented levels of uncertainty in the Eurozone. The potential political and economic outcomes emerging from the Eurozone crisis in 2012 are disparate, although all share a similar theme. A harsh adjustment to a new fiscal reality will be unavoidable, regardless of the path politicians decide to follow.

“The Eurozone that re-emerges next year is likely to be very different to the one we know today and the implications for business within and outside this region are enormous. Growing market pressure and significant tranches of sovereign debt due for refinancing by early Spring point at a likely resolution to the current phase of the crisis around the first quarter of 2012.

“Although it will have taken politicians two years to face up to the moment, the resolution they finally agree is likely to be implemented overnight in order to minimise market actions that can make it harder to implement.”

PwC Switzerland (www.pwc.ch) provides industry-focused assurance, tax, legal and advisory services to build public trust and enhance value for its clients and their stakeholders. 169,000 people in 158 countries across the global network of PwC firms share their thinking, experience and solutions to develop fresh perspectives and practical advice. "PwC" is the brand under which member firms of PricewaterhouseCoopers International Limited (PwCIL) operate and provide services. Together, these firms formthe PwC network. Each firmin the network is a separate legal entity and does not act as agent of PwCIL or any othermember firm. PwCIL does not provide any services to clients. PwCIL is not responsible or liable for the acts or omissions of any of itsmember firms nor can it control the exercise of their professional judgment or bind them in any way.

“Expect surprises next year.We are currently experiencing unprecedented levels of uncertainty in the Eurozone. The potential political and economic outcomes emerging from the Eurozone crisis in 2012 are disparate, although all share a similar theme. A harsh adjustment to a new fiscal reality will be unavoidable, regardless of the path politicians decide to follow.

“The Eurozone that re-emerges next year is likely to be very different to the one we know today and the implications for business within and outside this region are enormous. Growing market pressure and significant tranches of sovereign debt due for refinancing by early Spring point at a likely resolution to the current phase of the crisis around the first quarter of 2012.

“Although it will have taken politicians two years to face up to the moment, the resolution they finally agree is likely to be implemented overnight in order to minimise market actions that can make it harder to implement.”

PwC Switzerland (www.pwc.ch) provides industry-focused assurance, tax, legal and advisory services to build public trust and enhance value for its clients and their stakeholders. 169,000 people in 158 countries across the global network of PwC firms share their thinking, experience and solutions to develop fresh perspectives and practical advice. "PwC" is the brand under which member firms of PricewaterhouseCoopers International Limited (PwCIL) operate and provide services. Together, these firms formthe PwC network. Each firmin the network is a separate legal entity and does not act as agent of PwCIL or any othermember firm. PwCIL does not provide any services to clients. PwCIL is not responsible or liable for the acts or omissions of any of itsmember firms nor can it control the exercise of their professional judgment or bind them in any way.