The Rise of Vietnam – the new Asian Innovation hub

11/09/2019

The rise of Vietnam as an innovation/Fintech hotbed is a fascinating trend. A tech savvy population, supportive government regulations, and high smartphone penetration – a great combo that has done wonders to several countries across the world.

Vietnam ranks third in South East Asia for the most populated country. It has been growing phenomenally over the past few years. In 2018, it saw GDP grow by 7.08%. The growth in the country has been praised by the president of the World Economic Forum Borge Brende. Vietnam’s economic reforms have helped reduce debt and lay a strong foundation for public finance.

So why are they special and what has triggered this new boom in the economy and investments going in for innovation? These statistics will shed light on the opportunity and growth.

– 100 Million population

– 84% Smartphone Adoption in Tier 1 cities, and 71% in Tier 2 cities

– 40% Unbanked, and set to go down to 30% by 2020

– Second Fastest growing Data analytics market in the world (CAGR 19.4%)

– 161% growth in digital wallets in 2018

– $70 Billion Mobile Payments by 2025 expected

– Reforms to reduce cash transactions to 10%

– 30% to shop online by 2020

– 2019 startup investment to top $800 Million vs 2018 number of $444 Million

3000 startups in the country – from 400 in 2012.

Amongst South East Asian innovation hubs, Vietnam has attracted about 17% of the startup investments. It ranks third behind Indonesia at 48% and Singapore at 25%.

Just to compare Vietnam to hubs like Singapore feels unfair to me. Singapore is arguably the most matured Fintech hub in Asia. To get anywhere close to Singapore in terms of investments is an amazing achievement for any Asian country.

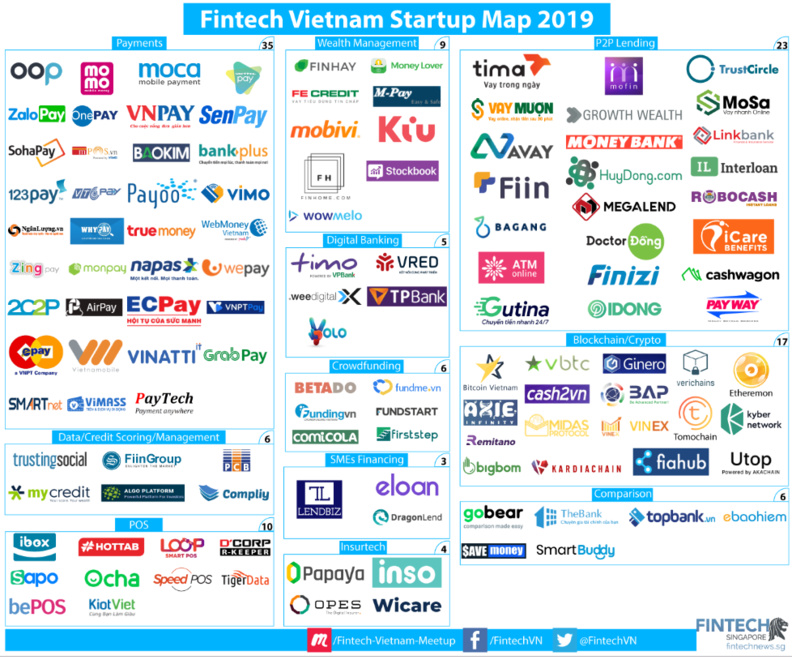

The Vietnamese government have been very supportive of innovation in the country. As a result there are several startups in Fintech, Blockchain, Sharing Economy and other themes. A map of Vietnam’s Fintech startups should show the breadth of coverage across different clusters within Fintech.

The buzz in Vietnam could also be attributed to a tech savvy population. The country now has over 250,000 technology professionals, who are fast adopting and learning technology trends.

Some Vietnamese professionals who are overseas educated have also contributed to inspiring a new generation. The Education startup Elsa, run by Vietnamese CEO Vu Van have a base in Ho Chi Minh City. They are based in Silicon valley, however, Vu Van who is Stanford educated, wanted to grow her app in Vietnam.

There is a saying in my mother tongue which means, it only takes a spark to light a forest. The rise of Vietnam definitely sounds like one of those examples.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Finyear & Chaineum

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear’s newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

————————

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients’ business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum’s blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

————————-

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.