Earlier this year, Hongkong offered digital banking licenses to Alibaba, Tencent and Xiaomi. Therefore, it is not surprising to hear that the Monetary Authority of Singapore (MAS) are opening up their doors to digital banks too. Applications are open for firms wanting to set up a digital bank in Singapore.

The deadline for applications is the 31st of December. MAS have announced that five applications will be accepted in this round. Two of them will be full digital banks and three wholesale digital banks.

Hongkong and Singapore have locked horns to be Asia’s Fintech hub. While Hongkong enjoyed its access to China’s consumer base, Singapore had the ASEAN bedrock. With the emergence of South East Asia as a big potential consumer Fintech base, Singapore is well placed to make the most of the growth.

MAS have set several criteria that the applicants need to meet to have a good chance at winning the banking license.

- Capitalisation: A S$15 Million paid up capital and a paid-up capital of S$1.5 billion within three to five years’ time of setting up business.

- Deposits: A total deposit cap of S$50 Million and per customer deposit cap of S$75,000.

- Track Record: At least one entity that holds a 20% stake in the applying entity will need to have a track record of 3 years in running a technology or e-commerce business. (This is an interesting rule)

- Path to Profitability: Applicants should submit five year financial projections, through which they should be able to demonstrate a roadmap to profitability.

It is interesting to see the last two criteria. It invites Tech companies to apply for the license, however, only the ones that can convince the decision makers that they can make a profit. In a WeWork era, “Profitable tech companies” is perhaps oxymoronic though.

MAS have announced that, applicants that show a consistent loss making pattern will not be provided their digital banking license.

Firms like Ping-An from China, and Grab (a Softbank fund’s portfolio firm) from Indonesia are openly declaring their interest to apply for the banking license. We have seen several lifestyle businesses move into digital payments, and some into lending. Grab might be the first ride sharing business that would be a digital bank.

This could trigger a massive market in South East Asia for digital banks, if MAS can demonstrate viability. Singapore is a key member of ASEAN, and there are other national regulators waiting to open up their doors for digital banks. Malaysia could be open up applications for digital banks this year.

The deadline for applications is the 31st of December. MAS have announced that five applications will be accepted in this round. Two of them will be full digital banks and three wholesale digital banks.

Hongkong and Singapore have locked horns to be Asia’s Fintech hub. While Hongkong enjoyed its access to China’s consumer base, Singapore had the ASEAN bedrock. With the emergence of South East Asia as a big potential consumer Fintech base, Singapore is well placed to make the most of the growth.

MAS have set several criteria that the applicants need to meet to have a good chance at winning the banking license.

- Capitalisation: A S$15 Million paid up capital and a paid-up capital of S$1.5 billion within three to five years’ time of setting up business.

- Deposits: A total deposit cap of S$50 Million and per customer deposit cap of S$75,000.

- Track Record: At least one entity that holds a 20% stake in the applying entity will need to have a track record of 3 years in running a technology or e-commerce business. (This is an interesting rule)

- Path to Profitability: Applicants should submit five year financial projections, through which they should be able to demonstrate a roadmap to profitability.

It is interesting to see the last two criteria. It invites Tech companies to apply for the license, however, only the ones that can convince the decision makers that they can make a profit. In a WeWork era, “Profitable tech companies” is perhaps oxymoronic though.

MAS have announced that, applicants that show a consistent loss making pattern will not be provided their digital banking license.

Firms like Ping-An from China, and Grab (a Softbank fund’s portfolio firm) from Indonesia are openly declaring their interest to apply for the banking license. We have seen several lifestyle businesses move into digital payments, and some into lending. Grab might be the first ride sharing business that would be a digital bank.

This could trigger a massive market in South East Asia for digital banks, if MAS can demonstrate viability. Singapore is a key member of ASEAN, and there are other national regulators waiting to open up their doors for digital banks. Malaysia could be open up applications for digital banks this year.

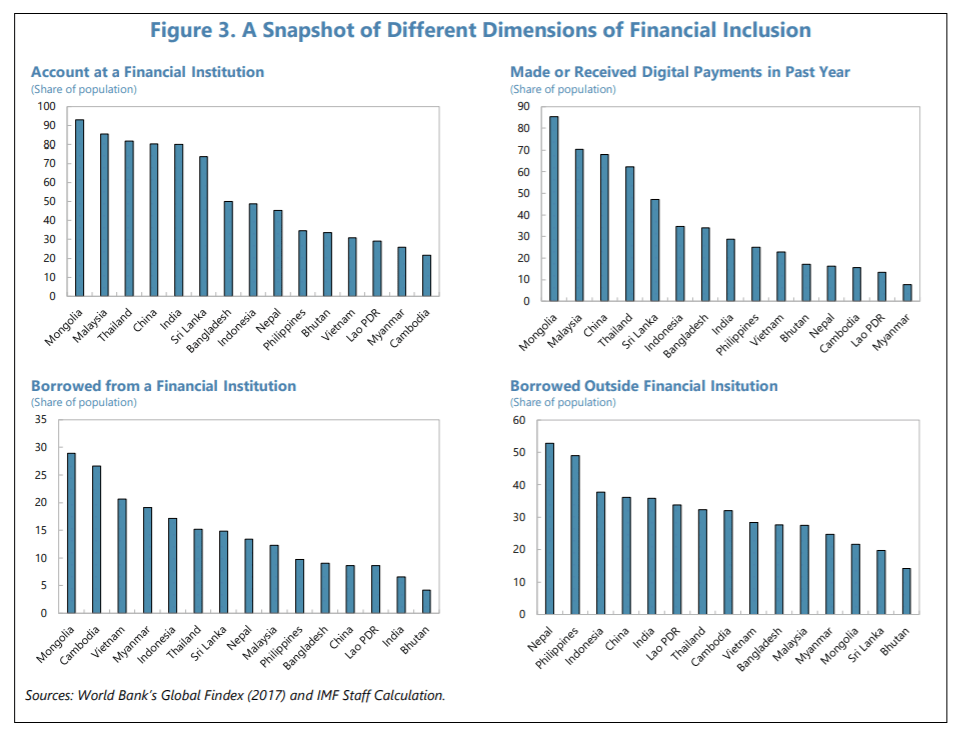

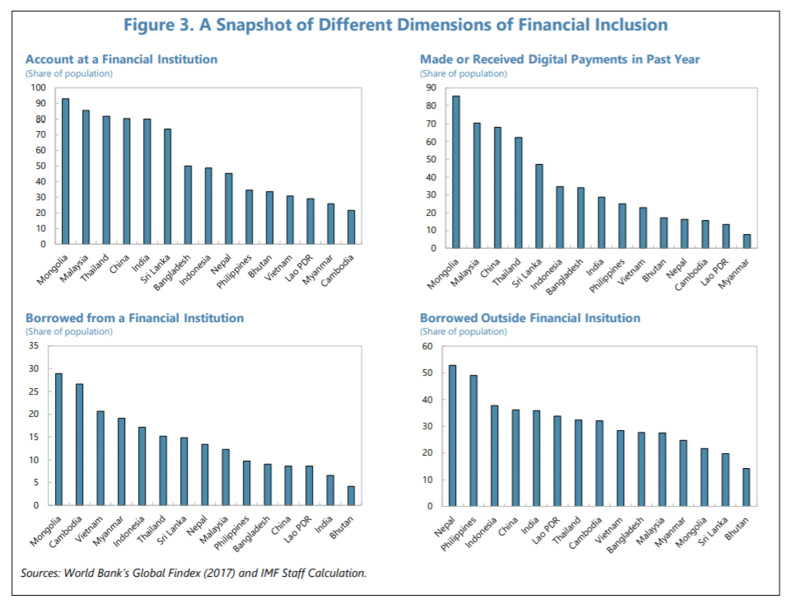

As a financial inclusion follower, it is exciting to see these developments. In 2017, roughly 39% of the adult population in low- and middle income countries did not have a bank account. 55% of this population live in Asia. However, with an extremely high rate of mobile penetration over the past few years, this trend is improving.

The IMF report that provides this data clearly articulates that there are definite macro economic benefits for low and middle income nations that embrace financial inclusion. With technology firms joining the digital and financial inclusion wave, Asia (not just China) could be the new consumer fintech hub of the world!

The IMF report that provides this data clearly articulates that there are definite macro economic benefits for low and middle income nations that embrace financial inclusion. With technology firms joining the digital and financial inclusion wave, Asia (not just China) could be the new consumer fintech hub of the world!

Arunkumar Krishnakumar

Arunkumar Krishnakumar is a Venture Capital investor at Green Shores Capital focusing on Inclusion and a podcast host.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

dailyfintech.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

La fintech française, Powens officialise son rapprochement avec l'Espagnole Unnax. Objectif : devenir le leader de l'open finance et de la finance embarquée en Europe

-

Stables amorce un nouveau virage stratégique avec l'arrivée Tezos et d'un nouveau DG au capital

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Shiba Inu lève 12 millions de dollars pour lancer sa propre Blockchain

-

Louis Vuitton dévoile un nouveau Collectible exclusif pour sa Communauté VIA