Western countries, and the US in particular, could introduce additional sanctions against Russia which would have a more severe economic impact than those that have been imposed so far. In this research briefing, we assess the potential fallout from two potential extensions.

First, we investigate the implications of further measures that would restrict Russian companies’ access to international capital markets. Such a development would trigger even deeper capital outflows exacerbating downward pressure on the RUB. This would force the Central Bank of Russia (CBR) to tighten monetary policy both through direct foreign exchange intervention (which squeezes domestic liquidity) and further interest rate hikes, further depressing domestic demand and hence near-term growth. In this scenario, GDP growth in Russia might slow to just 0.2% this year with a more modest rebound to 0.9% in 2015, compared with our current forecasts of 0.7% and 1.6% respectively.

Second, we assess the impact of a strategic effort to reduce global oil prices, led by the US. Specifically, we assume that the US releases stocks from its Strategic Petroleum Reserve (SPR) onto the market and leverages its political influence to encourage a gradual increase in OPEC supply (compared with our baseline forecast). These developments, together, might drive oil prices down to around US$70 per barrel by end-2015. We think that such a scenario would have a more deleterious impact on the Russian economy, damaging its primary source of external revenue, and leading to GDP stagnating this year and contracting by 0.8% in 2015.

High risk of additional sanctions

With no definitive resolution to the crisis in Ukraine there is a significant risk that further sanctions will be imposed on Russia by Western governments. So far, the sanctions imposed have been targeted largely at individuals with, in our view, limited implications for the macroeconomy.

Here, we explore the effect of two potential alternatives for extensions to sanctions.

Targeting companies’ access to international capital markets…

Under the first scenario, we assume that sanctions imposed by Western governments are designed to limit the ability of Russian companies to borrow on capital markets. This might be complemented with the exclusion of Russian corporates from international bond market indices. As well as its direct impact on borrowing costs, we assume that such measures would trigger a further surge in capital flight.

…would result in a significant tightening of credit conditions…

To assess the impact of such a development on the Russian economy we ran a scenario using the Oxford Economics Global Economic Model. The increase in capital flight would result in downward pressure on the RUB, necessitating further intervention by the CBR in order to support the exchange rate. Overall, in this scenario, the CBR might be forced to raise the 1-week repo rate to 8.5% by the end of 2014, 150bp higher than in our baseline forecast.

As a result of the tighter conditions in both domestic and international credit markets the average corporate borrowing rate faced by Russian companies might increase by around 4 percentage points by end-2015.

…and a more prolonged slowdown

Our modelling implies that this would result in a more prolonged slowdown, with the economy continuing to stagnate until 2015. Overall, GDP growth would average just 0.2% this year, followed by only a very modest rebound of 0.9% in 2015.

An alternative would be to target oil prices…

An alternative strategy available to the West would be to target Russia’s primary source of external revenues, by coordinating a near-term increase in international oil supply in an effort to lower the global oil price.

Specifically, we assume that the US might release part of its Strategic Petroleum Reserve (SPR). In line with the International Energy Program, the US is obliged to hold reserves to cover 90 days of imports. However, it could release around 750,000 bpd and still maintain this commitment for the next two years.

In addition, we assume that the US leverages its political influence in order to encourage OPEC to increase its supply. Led by Saudi Arabia, we assume that OPEC increases its own supply by 3.2% in 2014 and a further 5% in 2015. This would result in a cumulative 10% increase compared to our baseline forecast by end-2015.

Our modelling indicates that such an increase in supply would drive oil prices down to US$70 per barrel by end- 2015 – compared to our baseline forecast of $104 per barrel. We see efforts to reduce prices any further as unlikely given that it would make a high proportion of current shale oil production and new projects unprofitable.

…worsening pressure on external balance…

Lower oil prices would weaken economic activity through a number of channels. The resulting deterioration in the economy’s terms of trade would place even greater pressure on the economy’s balance of payments position and hence the RUB. This would necessitate further intervention from the CBR, resulting in an additional tightening of monetary policy, exacerbating the impact on economic activity from the initial terms of trade shock.

Moreover, lower budget revenues as a result of lower oil prices would limit the ability of the government to use fiscal policy to stimulate growth.

…triggering an extended recession

Overall, our model indicates that the economy would enter a prolonged recession, with GDP stagnating this year and contracting by 0.8% in 2015.

It is important to stress that such an outcome would be dependent on a very high level of international cooperation which we view as unlikely to emerge in reality. Moreover, the US government would need to seek approval from Congress to sell part of its reserves to foreign buyers, and this outcome might be very difficult to realise given the highly polarised state of US politics.

…but, even without sanctions, growth in Russia will be lower if tensions continue

Finally, even in the absence of further sanctions, we think that a continued deterioration in Russia’s relationship with the West will have detrimental economic consequences. Such a development would result in additional capital flight and weaker capital inflows, depriving the corporate sector of funds required to finance investment projects, and potentially place the CBR in the invidious position of having to hike rates further despite the weakness of economic activity.

In addition, Russian companies and banks will find it more expensive to borrow on international markets as investor price in a higher level of country risk.

1 April 2014.

By Mikhail Liluashvili, Economist

www.oxfordeconomics.com

First, we investigate the implications of further measures that would restrict Russian companies’ access to international capital markets. Such a development would trigger even deeper capital outflows exacerbating downward pressure on the RUB. This would force the Central Bank of Russia (CBR) to tighten monetary policy both through direct foreign exchange intervention (which squeezes domestic liquidity) and further interest rate hikes, further depressing domestic demand and hence near-term growth. In this scenario, GDP growth in Russia might slow to just 0.2% this year with a more modest rebound to 0.9% in 2015, compared with our current forecasts of 0.7% and 1.6% respectively.

Second, we assess the impact of a strategic effort to reduce global oil prices, led by the US. Specifically, we assume that the US releases stocks from its Strategic Petroleum Reserve (SPR) onto the market and leverages its political influence to encourage a gradual increase in OPEC supply (compared with our baseline forecast). These developments, together, might drive oil prices down to around US$70 per barrel by end-2015. We think that such a scenario would have a more deleterious impact on the Russian economy, damaging its primary source of external revenue, and leading to GDP stagnating this year and contracting by 0.8% in 2015.

High risk of additional sanctions

With no definitive resolution to the crisis in Ukraine there is a significant risk that further sanctions will be imposed on Russia by Western governments. So far, the sanctions imposed have been targeted largely at individuals with, in our view, limited implications for the macroeconomy.

Here, we explore the effect of two potential alternatives for extensions to sanctions.

Targeting companies’ access to international capital markets…

Under the first scenario, we assume that sanctions imposed by Western governments are designed to limit the ability of Russian companies to borrow on capital markets. This might be complemented with the exclusion of Russian corporates from international bond market indices. As well as its direct impact on borrowing costs, we assume that such measures would trigger a further surge in capital flight.

…would result in a significant tightening of credit conditions…

To assess the impact of such a development on the Russian economy we ran a scenario using the Oxford Economics Global Economic Model. The increase in capital flight would result in downward pressure on the RUB, necessitating further intervention by the CBR in order to support the exchange rate. Overall, in this scenario, the CBR might be forced to raise the 1-week repo rate to 8.5% by the end of 2014, 150bp higher than in our baseline forecast.

As a result of the tighter conditions in both domestic and international credit markets the average corporate borrowing rate faced by Russian companies might increase by around 4 percentage points by end-2015.

…and a more prolonged slowdown

Our modelling implies that this would result in a more prolonged slowdown, with the economy continuing to stagnate until 2015. Overall, GDP growth would average just 0.2% this year, followed by only a very modest rebound of 0.9% in 2015.

An alternative would be to target oil prices…

An alternative strategy available to the West would be to target Russia’s primary source of external revenues, by coordinating a near-term increase in international oil supply in an effort to lower the global oil price.

Specifically, we assume that the US might release part of its Strategic Petroleum Reserve (SPR). In line with the International Energy Program, the US is obliged to hold reserves to cover 90 days of imports. However, it could release around 750,000 bpd and still maintain this commitment for the next two years.

In addition, we assume that the US leverages its political influence in order to encourage OPEC to increase its supply. Led by Saudi Arabia, we assume that OPEC increases its own supply by 3.2% in 2014 and a further 5% in 2015. This would result in a cumulative 10% increase compared to our baseline forecast by end-2015.

Our modelling indicates that such an increase in supply would drive oil prices down to US$70 per barrel by end- 2015 – compared to our baseline forecast of $104 per barrel. We see efforts to reduce prices any further as unlikely given that it would make a high proportion of current shale oil production and new projects unprofitable.

…worsening pressure on external balance…

Lower oil prices would weaken economic activity through a number of channels. The resulting deterioration in the economy’s terms of trade would place even greater pressure on the economy’s balance of payments position and hence the RUB. This would necessitate further intervention from the CBR, resulting in an additional tightening of monetary policy, exacerbating the impact on economic activity from the initial terms of trade shock.

Moreover, lower budget revenues as a result of lower oil prices would limit the ability of the government to use fiscal policy to stimulate growth.

…triggering an extended recession

Overall, our model indicates that the economy would enter a prolonged recession, with GDP stagnating this year and contracting by 0.8% in 2015.

It is important to stress that such an outcome would be dependent on a very high level of international cooperation which we view as unlikely to emerge in reality. Moreover, the US government would need to seek approval from Congress to sell part of its reserves to foreign buyers, and this outcome might be very difficult to realise given the highly polarised state of US politics.

…but, even without sanctions, growth in Russia will be lower if tensions continue

Finally, even in the absence of further sanctions, we think that a continued deterioration in Russia’s relationship with the West will have detrimental economic consequences. Such a development would result in additional capital flight and weaker capital inflows, depriving the corporate sector of funds required to finance investment projects, and potentially place the CBR in the invidious position of having to hike rates further despite the weakness of economic activity.

In addition, Russian companies and banks will find it more expensive to borrow on international markets as investor price in a higher level of country risk.

1 April 2014.

By Mikhail Liluashvili, Economist

www.oxfordeconomics.com

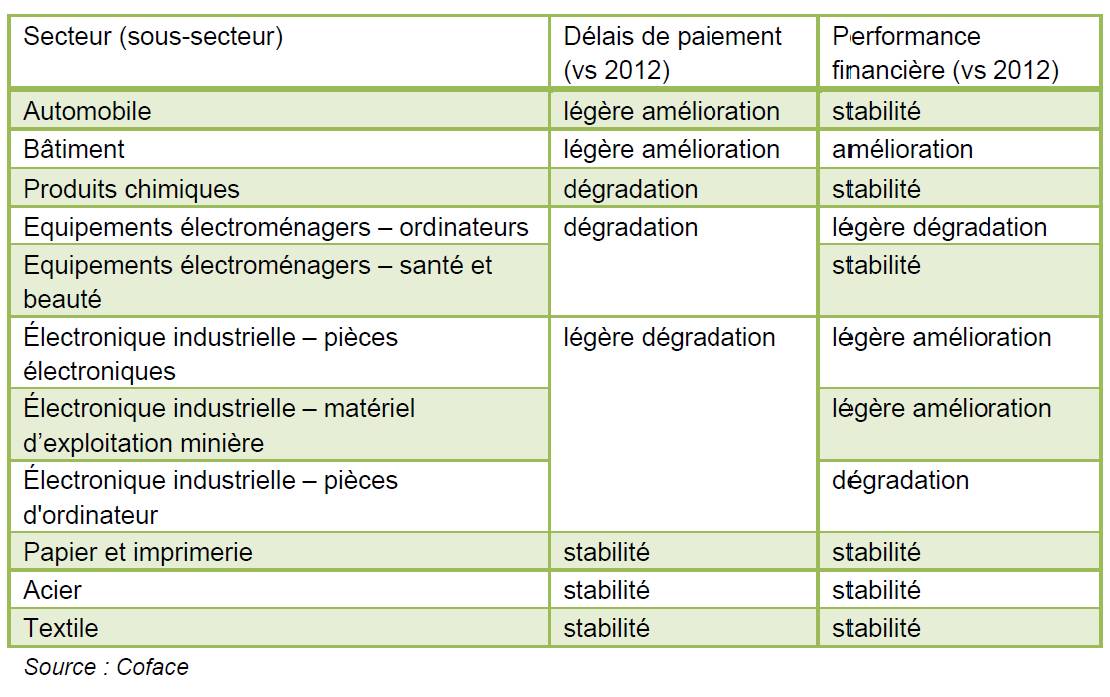

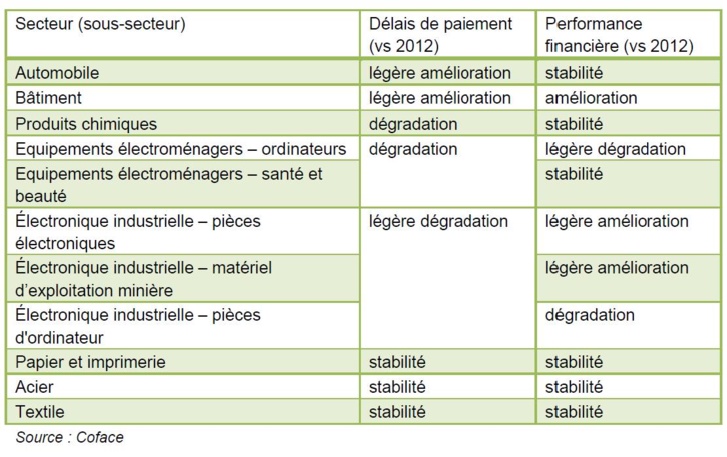

Les entreprises préoccupées par la croissance économique chinoise et le resserrement du crédit en 2014

L’augmentation du coût du travail et l‘appréciation du renminbi (RMB) pourraient faire les gros titres de la presse, mais ces facteurs sont loin de faire partie des principales inquiétudes des entreprises chinoises. En effet, ils sont considérés comme inquiétants par, respectivement, 26 % et 9 % des entreprises interrogées. C’est principalement le ralentissement économique en Chine qui préoccupe les entreprises (61%), alors que la moitié d’entre elles craignent qu’un resserrement du crédit ne puisse restreindre leur accès au financement (Annexe 4).

En 2014, le contexte macroéconomique global de la Chine reste solide, bien qu'un ralentissement de la croissance économique soit attendu durant le processus de rééquilibrage en cours. Conformément à la volonté du gouvernement chinois de modérer la croissance, la croissance réelle devrait afficher une légère baisse. Le taux de croissance du PIB réel en 2013 (+7,7%) a été le plus bas jamais enregistré par la deuxième économie mondiale depuis 14 ans. Ce taux vient appuyer le discours du gouvernement chinois, qui entend désormais se concentrer sur la qualité de la croissance chinoise plutôt que sur son ampleur. Toujours est-il que, selon les prévisions de Coface, la croissance chinoise restera parmi les plus soutenues dans le monde (+7,2 % en 2014).

Malgré tous les espoirs placés dans le modèle de croissance chinois tiré par la consommation, c’est l’investissement qui continuera a être le moteur de la croissance à moyen terme. La progression du revenu des ménages devrait ralentir encore en 2014, dans la continuité de la tendance observée ces dernières années. Les taux de croissance du revenu moyen et des dépenses de consommation se sont réduits respectivement de 12,4 % et 10 % en 2012 à 9,6 % et 8,1 % en 2013.

Sensibiliser les entreprises chinoises à la gestion des créances

Actuellement, 90 % des entreprises chinoises ont recours à la vente à crédit dans le cadre de leurs échanges commerciaux intérieurs. Nouvelle encourageante, plus de 60 % des entreprises ont déclaré dans l’enquête utiliser différents outils de gestion du crédit pour leurs opérations.

« Les créances client sont aussi importantes que les autres actifs, il peut même s’agir du poste le plus important pour certaines entreprises. Vendre à crédit est sans aucun doute une manière efficace de conclure une vente, mais l’absence de contrôle approprié peut avoir une incidence considérable sur la situation financière de l’entreprise. Aussi, il est encourageant de constater que le recours à l’assurance-crédit s’est développé, passant de 18 % en 2012 à 24 % en 2013 », commente Richard Burton, directeur régional Asie Pacifique de Coface.

Au sujet de l’enquête

L’enquête 2013 constitue la 11e édition de l’étude réalisée par Coface depuis 2003 sur le comportement de paiement des entreprises. 956 sociétés de différents secteurs d’activité ont participé à cette enquête entre octobre et décembre 2013. Son objectif est de mieux comprendre la situation des entreprises basées en Chine à l’égard des paiements, ainsi que leurs pratiques en matière de contrôle du crédit fournisseurs.

Téléchargez ci-dessous l'étude "China Payment Survey" (PDF 21 pages en anglais).

L’augmentation du coût du travail et l‘appréciation du renminbi (RMB) pourraient faire les gros titres de la presse, mais ces facteurs sont loin de faire partie des principales inquiétudes des entreprises chinoises. En effet, ils sont considérés comme inquiétants par, respectivement, 26 % et 9 % des entreprises interrogées. C’est principalement le ralentissement économique en Chine qui préoccupe les entreprises (61%), alors que la moitié d’entre elles craignent qu’un resserrement du crédit ne puisse restreindre leur accès au financement (Annexe 4).

En 2014, le contexte macroéconomique global de la Chine reste solide, bien qu'un ralentissement de la croissance économique soit attendu durant le processus de rééquilibrage en cours. Conformément à la volonté du gouvernement chinois de modérer la croissance, la croissance réelle devrait afficher une légère baisse. Le taux de croissance du PIB réel en 2013 (+7,7%) a été le plus bas jamais enregistré par la deuxième économie mondiale depuis 14 ans. Ce taux vient appuyer le discours du gouvernement chinois, qui entend désormais se concentrer sur la qualité de la croissance chinoise plutôt que sur son ampleur. Toujours est-il que, selon les prévisions de Coface, la croissance chinoise restera parmi les plus soutenues dans le monde (+7,2 % en 2014).

Malgré tous les espoirs placés dans le modèle de croissance chinois tiré par la consommation, c’est l’investissement qui continuera a être le moteur de la croissance à moyen terme. La progression du revenu des ménages devrait ralentir encore en 2014, dans la continuité de la tendance observée ces dernières années. Les taux de croissance du revenu moyen et des dépenses de consommation se sont réduits respectivement de 12,4 % et 10 % en 2012 à 9,6 % et 8,1 % en 2013.

Sensibiliser les entreprises chinoises à la gestion des créances

Actuellement, 90 % des entreprises chinoises ont recours à la vente à crédit dans le cadre de leurs échanges commerciaux intérieurs. Nouvelle encourageante, plus de 60 % des entreprises ont déclaré dans l’enquête utiliser différents outils de gestion du crédit pour leurs opérations.

« Les créances client sont aussi importantes que les autres actifs, il peut même s’agir du poste le plus important pour certaines entreprises. Vendre à crédit est sans aucun doute une manière efficace de conclure une vente, mais l’absence de contrôle approprié peut avoir une incidence considérable sur la situation financière de l’entreprise. Aussi, il est encourageant de constater que le recours à l’assurance-crédit s’est développé, passant de 18 % en 2012 à 24 % en 2013 », commente Richard Burton, directeur régional Asie Pacifique de Coface.

Au sujet de l’enquête

L’enquête 2013 constitue la 11e édition de l’étude réalisée par Coface depuis 2003 sur le comportement de paiement des entreprises. 956 sociétés de différents secteurs d’activité ont participé à cette enquête entre octobre et décembre 2013. Son objectif est de mieux comprendre la situation des entreprises basées en Chine à l’égard des paiements, ainsi que leurs pratiques en matière de contrôle du crédit fournisseurs.

Téléchargez ci-dessous l'étude "China Payment Survey" (PDF 21 pages en anglais).

Lisez gratuitement chaque jour (5j/7) le quotidien Finyear.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise.

Lien direct pour vous abonner : www.finyear.com/newsletter

Lisez gratuitement chaque mois :

- le magazine digital Finyear sur www.finyear.com/magazine

- la lettre digitale "Le Directeur Financier" sur www.finyear.com/ledirecteurfinancier

- la lettre digitale "Le Trésorier" sur www.finyear.com/letresorier

- la lettre digitale "Le Credit Manager" sur www.finyear.com/lecreditmanager

- la lettre digitale "Le Capital Investisseur" sur www.finyear.com/lecapitalinvestisseur

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise.

Lien direct pour vous abonner : www.finyear.com/newsletter

Lisez gratuitement chaque mois :

- le magazine digital Finyear sur www.finyear.com/magazine

- la lettre digitale "Le Directeur Financier" sur www.finyear.com/ledirecteurfinancier

- la lettre digitale "Le Trésorier" sur www.finyear.com/letresorier

- la lettre digitale "Le Credit Manager" sur www.finyear.com/lecreditmanager

- la lettre digitale "Le Capital Investisseur" sur www.finyear.com/lecapitalinvestisseur

Autres articles

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group

-

Giddy Wallet Announces First-Ever Autogas Feature for Polygon