There have been concerns among some commentators that fund managers are returning to market more quickly than before, as they seek to take advantage of institutional investors’ liquidity and appetite for the asset class in order to gather as much capital as possible. Dry powder standing at almost $1.20tn as of March 2018 and record fundraising in 2017 driven by several landmark fund series do seem to offer some evidence to support this.

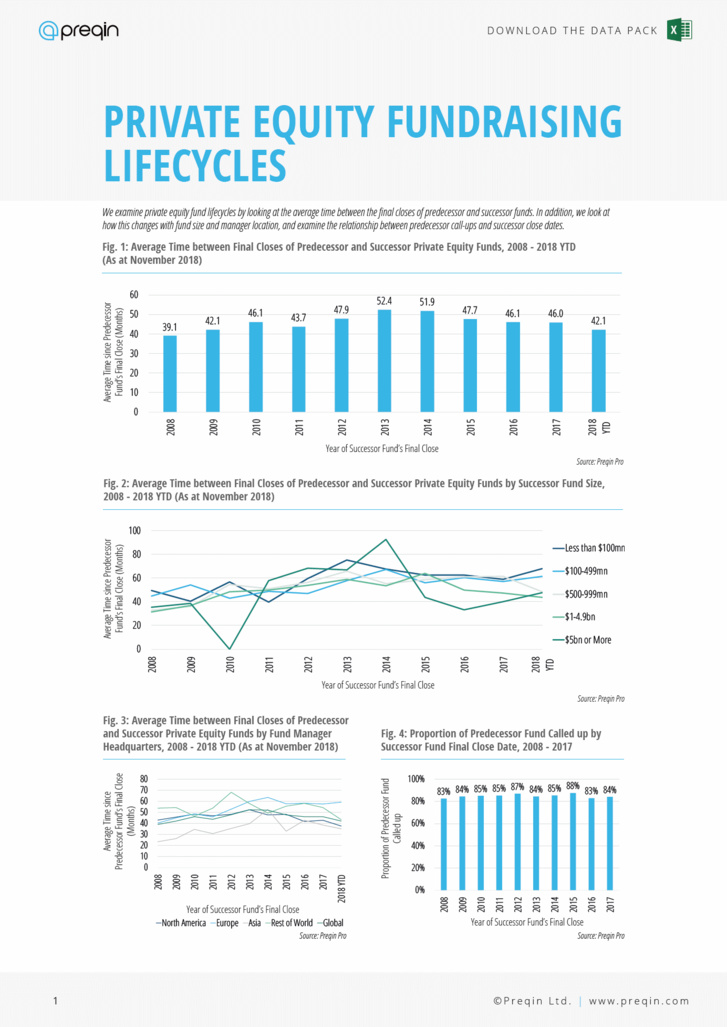

This is true – private equity firms are leaving less time on average between their fundraising cycles, with the period between predecessor and successor funds falling since 2013. But Preqin finds that while the average time between fund closures has fallen by 10 months since 2013, it is still higher than it was in 2008. Additionally, the median proportion of called up capital in predecessor funds at the time that successor funds have closed has remained relatively constant, never falling below 80%. Even though dry powder has risen above one trillion dollars, the ratio of dry powder to called-up capital has remained broadly flat, suggesting that fund managers are deploying capital at a similar rate as they are securing it.

For more information and analysis, see the full Private Equity Fundraising Lifecycle factsheet below.

Christopher Elvin, Head of Private Equity:

“There has been much debate over whether or not we are in a bubble. Record-breaking fundraising, rising dry powder and quicker fundraising cycles have led some to suggest that fund managers are stockpiling capital. But it seems that while fundraising speeds are falling, fund managers are deploying more than 80% of the capital in their funds before closing a successor. This chimes with dry powder to capital called ratios, which have remained below 3.0 since 2015, well below the peak of 3.9 seen in 2010. Fund managers are certainly taking in more capital than ever before, but they are also deploying it at a commensurate rate.

Key Private Equity Fundraising Cycle Facts:

• In 2013, on average, the time taken between the final close of a predecessor and successor private equity fund was just over 52 months.

• Since then, there has been a year-on-year decrease in the average time between the final close dates of a predecessor and successor private equity fund. In 2018 YTD, it took on average of 42 months.

• Successor funds of $5bn or more see more volatility in the average time between final fund closures than successor funds of a smaller size.

• In 2018 YTD, when a successor fund raised $500mn or more, on average the time between final fund closures between that fund and its predecessor was 40 to 50 months.

• Asia-based private equity firms typically raise a successor fund more quickly than other regions, with an average of 35 months taken between the final closes of their predecessor and successor funds in 2018.

• North America-based firms raised funds at a similar pace to their Asia-based counterparts: on average, 38 months passed between the final close of a predecessor fund and a successor fund closed in 2018.

• Although private equity firms are taking less time to raise their successor funds, the proportion of their predecessor fund which was called up before raising a successor fund has largely stayed unchanged. In 2017, on average, firms called up 84% of their predecessor fund.

Preqin is the home of alternative assets, providing industry-leading intelligence on the market and cutting-edge tools to support participants at every stage of the investment cycle. More than 60,000 industry participants in over 90 countries rely on Preqin as their indispensable source of data, solutions and insights.

Preqin’s data and analysis is frequently presented at industry conferences, and is used in the global financial press and academic journals & white papers. We are always happy to support journalists by providing reports, custom data and one-on-one interviews.

This is true – private equity firms are leaving less time on average between their fundraising cycles, with the period between predecessor and successor funds falling since 2013. But Preqin finds that while the average time between fund closures has fallen by 10 months since 2013, it is still higher than it was in 2008. Additionally, the median proportion of called up capital in predecessor funds at the time that successor funds have closed has remained relatively constant, never falling below 80%. Even though dry powder has risen above one trillion dollars, the ratio of dry powder to called-up capital has remained broadly flat, suggesting that fund managers are deploying capital at a similar rate as they are securing it.

For more information and analysis, see the full Private Equity Fundraising Lifecycle factsheet below.

Christopher Elvin, Head of Private Equity:

“There has been much debate over whether or not we are in a bubble. Record-breaking fundraising, rising dry powder and quicker fundraising cycles have led some to suggest that fund managers are stockpiling capital. But it seems that while fundraising speeds are falling, fund managers are deploying more than 80% of the capital in their funds before closing a successor. This chimes with dry powder to capital called ratios, which have remained below 3.0 since 2015, well below the peak of 3.9 seen in 2010. Fund managers are certainly taking in more capital than ever before, but they are also deploying it at a commensurate rate.

Key Private Equity Fundraising Cycle Facts:

• In 2013, on average, the time taken between the final close of a predecessor and successor private equity fund was just over 52 months.

• Since then, there has been a year-on-year decrease in the average time between the final close dates of a predecessor and successor private equity fund. In 2018 YTD, it took on average of 42 months.

• Successor funds of $5bn or more see more volatility in the average time between final fund closures than successor funds of a smaller size.

• In 2018 YTD, when a successor fund raised $500mn or more, on average the time between final fund closures between that fund and its predecessor was 40 to 50 months.

• Asia-based private equity firms typically raise a successor fund more quickly than other regions, with an average of 35 months taken between the final closes of their predecessor and successor funds in 2018.

• North America-based firms raised funds at a similar pace to their Asia-based counterparts: on average, 38 months passed between the final close of a predecessor fund and a successor fund closed in 2018.

• Although private equity firms are taking less time to raise their successor funds, the proportion of their predecessor fund which was called up before raising a successor fund has largely stayed unchanged. In 2017, on average, firms called up 84% of their predecessor fund.

Preqin is the home of alternative assets, providing industry-leading intelligence on the market and cutting-edge tools to support participants at every stage of the investment cycle. More than 60,000 industry participants in over 90 countries rely on Preqin as their indispensable source of data, solutions and insights.

Preqin’s data and analysis is frequently presented at industry conferences, and is used in the global financial press and academic journals & white papers. We are always happy to support journalists by providing reports, custom data and one-on-one interviews.

Finyear & Chaineum

Le quotidien Finyear

- Sa newsletter quotidienne :

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Finance Digitale, Cryptofinance.

Read for free :

The daily newspaper Finyear

- Its daily newsletter :

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in Finance innovation, Digital Finance, Cryptofinance.

----------------

Chaineum Capital Partners, independent advisory firm.

ICO & STO advisory boutique, fundraising, corporate finance.

- Sa newsletter quotidienne :

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Finance Digitale, Cryptofinance.

Read for free :

The daily newspaper Finyear

- Its daily newsletter :

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in Finance innovation, Digital Finance, Cryptofinance.

----------------

Chaineum Capital Partners, independent advisory firm.

ICO & STO advisory boutique, fundraising, corporate finance.