Open up the field of possibilities by reducing the unexpected. Support the required evolution of the company by controlling the risks. Contribute to the growth of the turnover by preserving the financial balance. Directing towards profitable sales. Sell and get paid. These are some of the definitions of credit management that demonstrate the necessity of this function in the company, especially nowadays.

Over the last thirty years, has the unexpected ever been more important than it is today? The risks more pronounced? The financial balance of markets, states and companies more subject to unstable and destabilizing waves?

Professionalizing the sales cycle from the beginning (prospecting) to the end (payment collection) is an essential way to make your company manageable and agile, with the financial capacity to adapt and/or rebound.

Optimal management of open invoices, those that have not yet been paid, enables you to identify and deal with most of the malfunctions in the quote to cash process, and therefore to continuously improve the internal processes of your company.

Particularly virtuous, this management improves cash, profitability and customer satisfaction! What more could you ask for? It returns to the company the financial resources consumed by the accounts receivable so it can invest and transform itself.

What could be more vital today than to transform our business models? Market demands are evolving extremely fast, the ecological imperative is imposed on companies that have no choice but to fully integrate it, to continue to sell and recruit among the new generations whose tolerance level towards polluters, or those who practice greenwashing, is rightly getting lower and lower.

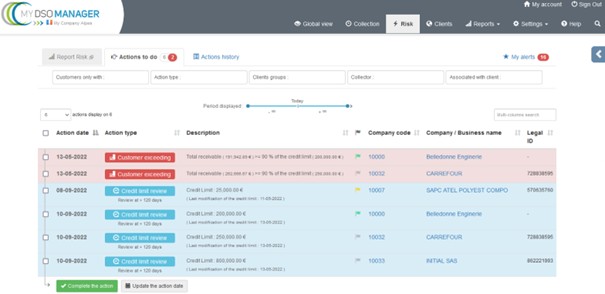

A software like My DSO Manager digitizes the financial customer relationship, eliminates the use of paper, and makes it infinitely more efficient. Thanks to new functionalities focused on customer risk management, the software allows you to anticipate any risk of non-payment and to manage the receivables of your customers in an efficient and precise way.

Over the last thirty years, has the unexpected ever been more important than it is today? The risks more pronounced? The financial balance of markets, states and companies more subject to unstable and destabilizing waves?

Professionalizing the sales cycle from the beginning (prospecting) to the end (payment collection) is an essential way to make your company manageable and agile, with the financial capacity to adapt and/or rebound.

Optimal management of open invoices, those that have not yet been paid, enables you to identify and deal with most of the malfunctions in the quote to cash process, and therefore to continuously improve the internal processes of your company.

Particularly virtuous, this management improves cash, profitability and customer satisfaction! What more could you ask for? It returns to the company the financial resources consumed by the accounts receivable so it can invest and transform itself.

What could be more vital today than to transform our business models? Market demands are evolving extremely fast, the ecological imperative is imposed on companies that have no choice but to fully integrate it, to continue to sell and recruit among the new generations whose tolerance level towards polluters, or those who practice greenwashing, is rightly getting lower and lower.

A software like My DSO Manager digitizes the financial customer relationship, eliminates the use of paper, and makes it infinitely more efficient. Thanks to new functionalities focused on customer risk management, the software allows you to anticipate any risk of non-payment and to manage the receivables of your customers in an efficient and precise way.

In credit management, prevention is better than cure!

Indeed, it is particularly difficult to cure unpaid invoices. They leave their mark on your company's profitability and cash flow. They are responsible for one in four company bankruptcies.

The Risk Agenda, combined with existing functionalities such as the connections with financial information providers, credit insurers, consolidated risk reports, credit limit validation workflows, etc., increases the credit risk management skills according to the current volatility and the ever-changing economic constraints.

Indeed, it is particularly difficult to cure unpaid invoices. They leave their mark on your company's profitability and cash flow. They are responsible for one in four company bankruptcies.

The Risk Agenda, combined with existing functionalities such as the connections with financial information providers, credit insurers, consolidated risk reports, credit limit validation workflows, etc., increases the credit risk management skills according to the current volatility and the ever-changing economic constraints.

Performance and agility are the qualities that guarantee a successful future for any company. Digitization, thanks to agile and efficient tools, allows this transformation, which is essential today. The analogy with the alpine style is very clear. My DSO Manager becomes a pillar of the prosperity of companies and their adequacy in today's world.

Autres articles

-

France Fintech édite le guide pratique à l'usage des fintechs

-

Payhawk rejoint le programme de partenariat American Express Sync

-

Proof of Talk 2024 initie son concours Proof of Pitch

-

Opinion | Krik Gunning, CEO Fourthline "Comment les banques traditionnelles peuvent surclasser l'expérience client"

-

Analyste Private Equity - Stage - Septembre 2024