It seems not a week goes by without the launch of a new platform. Experts are quick to point out that a consolidation phase will soon be inevitable. If such an upheaval takes place, platforms with a robust and active user base will be well-placed to cement their position vis-à-vis their less-established competitors. One strong indicator (although by far not the only one) of a platform’s robustness is its total funding volume. To help foster an informed discussion around this issue, we have compiled a list of the European online investment platforms that have crossed the €10 million mark in terms of total funding volume since their inception.

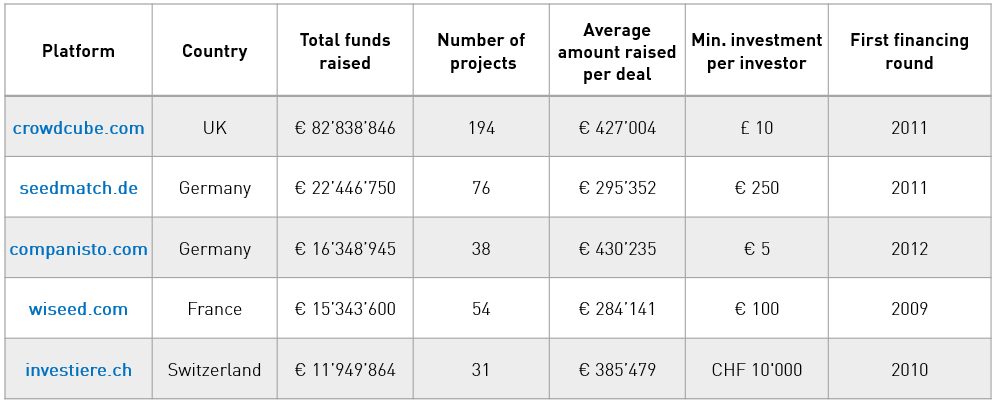

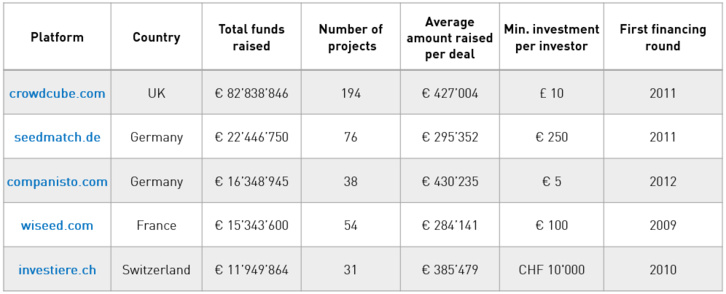

So without further ado, here is the list of Europe’s top 5 investment platforms:

So without further ado, here is the list of Europe’s top 5 investment platforms:

UK-based Crowdcube made the top of the list having raised a total of €82.8 million. Crowdcube leads the rest of the pack by a significant amount and is followed by Germany’s Seedmatch with €22.4 million. Another German player, Companisto, comes in 3rd with a total investment volume of €16.3 million. The 4th spot is reserved for the French site Wiseed which so far has raised €15.3 million. Coming in 5th is the Swiss platform investiere which has raised a total of €11.9 million.

In terms of average amount raised per successful financing round, the ranking is as follows: Companisto (€430’235), Crowdcube (€427’004), investiere (€385’479), Seedmatch (€295’352) and Wiseed (€284,141).

Minimum Investment

These funding volumes are achieved with different approaches regarding minimum contributions per investor. On this issue investiere is the odd man out with a minimum investment ticket per investor of CHF 10’000 (€9’330) and an average investment per investor of €26’124 (CHF 28’000) in 2014, by far the highest minimum and average. Seedmatch comes in 2nd with a minimum of €250 and an average investment per investor of €1’000 in 2014. Following Seedmatch is Wiseed with a minimum of €100. Crowdcube sets its minimum at £10 and on average investors contribute €2’380 (£2’500) per investment. At €5, Companisto has the lowest minimum investment ticket.

Equity? Not Always Quite

A second differentiating factor is the underlying investment model. Crowdcube and investiere both offer equity investments. Investors thus become direct shareholders in the companies they choose to fund. In Crowdcube’s case, companies can also decide to raise finance using Crowdcube as a nominee that maintains the relationship between investors and the company by holding investors’ shares. In a similar fashion, Wiseed sets up a holding structure (a SAS or société par actions simplifiées) for each company it finances. The investors are pooled in the SAS and the structure is managed by Wiseed.

The German platforms Seedmatch and Companisto do not offer equity, but so-called subordinated loans (in German: partiarisches Nachrangdarlehen). In case of a default, creditors with subordinated debt are not paid out until after the other creditors are paid in full. Compared to equity, subordinated loans generally offer more limited information and voting rights. Still, subordinated loans are the most popular participation model of German platforms given the fact that they are exempt from the prospectus requirement set forth by the German Federal Financial Supervisory Authority, Bafin. A prospectus needs to adhere to Bafin guidelines and ultimately obtain approval, making it a significant additional cost both in terms of time and money.

Favorable Conditions in the UK

Crowdcube clearly leads the top 5 with regard to funding volume. There are two factors related to the UK’s regulatory framework that help explain Crowdcube’s dominance. First of all, the UK has the most advanced crowdinvesting guidelines and regulations in Europe, which significantly reduces the regulatory risk of companies active in the online investing space. Second of all, platforms in the UK benefit from the fact that investors receive strong tax incentives to invest in startups. The Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS) are designed to help young high-risk companies raise funds by offering investors tax reliefs such as reduced initial tax as well as reductions and exemptions on capital gains tax.

Can They Maintain Their Dominant Position?

While their high funding volumes will help the top 5 attract new investors and maintain their positions, the list of platforms vying for investors’ attention (and investments) is growing by the day. Will new players take the lead, or will these more established platforms be able to secure their dominance?

Sources

www.crowdcube.com

www.companisto.com

www.investiere.ch

www.seedmatch.de

www.wiseed.com

Remarks on Methodology

- This analysis only takes platforms into consideration that publish their funding volumes on their websites. Platforms who do not publish their funding volumes were not taken into account.

- We have excluded Seedrs which does not publish aggregate numbers on investment amounts or deals funded.

- We have excluded Syndicate Room because they do not disclose the amounts their investors raise, but only the amount of the total round (including co-investors).

- This analysis only considers platforms that offer equity or equity-like mezzanine investment opportunities.

- The data reflects the funding volumes as stated on the platforms’ websites on 20th February 2015.

- All data was extracted exclusively from the platforms’ websites on 20th February 2015.

- The exchange rate of 20th February 2015 was used to calculate the volumes of platforms operating outside the EURO zone.

SOURCE :

https://www.investiere.ch/post/2015/03/06/europe%E2%80%99s-top-5-crowdinvesting-platforms

In terms of average amount raised per successful financing round, the ranking is as follows: Companisto (€430’235), Crowdcube (€427’004), investiere (€385’479), Seedmatch (€295’352) and Wiseed (€284,141).

Minimum Investment

These funding volumes are achieved with different approaches regarding minimum contributions per investor. On this issue investiere is the odd man out with a minimum investment ticket per investor of CHF 10’000 (€9’330) and an average investment per investor of €26’124 (CHF 28’000) in 2014, by far the highest minimum and average. Seedmatch comes in 2nd with a minimum of €250 and an average investment per investor of €1’000 in 2014. Following Seedmatch is Wiseed with a minimum of €100. Crowdcube sets its minimum at £10 and on average investors contribute €2’380 (£2’500) per investment. At €5, Companisto has the lowest minimum investment ticket.

Equity? Not Always Quite

A second differentiating factor is the underlying investment model. Crowdcube and investiere both offer equity investments. Investors thus become direct shareholders in the companies they choose to fund. In Crowdcube’s case, companies can also decide to raise finance using Crowdcube as a nominee that maintains the relationship between investors and the company by holding investors’ shares. In a similar fashion, Wiseed sets up a holding structure (a SAS or société par actions simplifiées) for each company it finances. The investors are pooled in the SAS and the structure is managed by Wiseed.

The German platforms Seedmatch and Companisto do not offer equity, but so-called subordinated loans (in German: partiarisches Nachrangdarlehen). In case of a default, creditors with subordinated debt are not paid out until after the other creditors are paid in full. Compared to equity, subordinated loans generally offer more limited information and voting rights. Still, subordinated loans are the most popular participation model of German platforms given the fact that they are exempt from the prospectus requirement set forth by the German Federal Financial Supervisory Authority, Bafin. A prospectus needs to adhere to Bafin guidelines and ultimately obtain approval, making it a significant additional cost both in terms of time and money.

Favorable Conditions in the UK

Crowdcube clearly leads the top 5 with regard to funding volume. There are two factors related to the UK’s regulatory framework that help explain Crowdcube’s dominance. First of all, the UK has the most advanced crowdinvesting guidelines and regulations in Europe, which significantly reduces the regulatory risk of companies active in the online investing space. Second of all, platforms in the UK benefit from the fact that investors receive strong tax incentives to invest in startups. The Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS) are designed to help young high-risk companies raise funds by offering investors tax reliefs such as reduced initial tax as well as reductions and exemptions on capital gains tax.

Can They Maintain Their Dominant Position?

While their high funding volumes will help the top 5 attract new investors and maintain their positions, the list of platforms vying for investors’ attention (and investments) is growing by the day. Will new players take the lead, or will these more established platforms be able to secure their dominance?

Sources

www.crowdcube.com

www.companisto.com

www.investiere.ch

www.seedmatch.de

www.wiseed.com

Remarks on Methodology

- This analysis only takes platforms into consideration that publish their funding volumes on their websites. Platforms who do not publish their funding volumes were not taken into account.

- We have excluded Seedrs which does not publish aggregate numbers on investment amounts or deals funded.

- We have excluded Syndicate Room because they do not disclose the amounts their investors raise, but only the amount of the total round (including co-investors).

- This analysis only considers platforms that offer equity or equity-like mezzanine investment opportunities.

- The data reflects the funding volumes as stated on the platforms’ websites on 20th February 2015.

- All data was extracted exclusively from the platforms’ websites on 20th February 2015.

- The exchange rate of 20th February 2015 was used to calculate the volumes of platforms operating outside the EURO zone.

SOURCE :

https://www.investiere.ch/post/2015/03/06/europe%E2%80%99s-top-5-crowdinvesting-platforms

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

Le magazine bimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

Le magazine bimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group

-

Giddy Wallet Announces First-Ever Autogas Feature for Polygon