The new research, Digital Banking: Banking-as-a-Service, Open Banking & Digital Transformation 2020-2024, found that digital-only banks have gained market share from traditional banks by offering superior user experiences and tightly focused USPs. The research recommends that established banks must personalise the app experience; using AI‑based personal financial management tools to fight back against digital-only bank innovation.

For more insights, download the free whitepaper: How Open APIs are Revolutionising Banking.

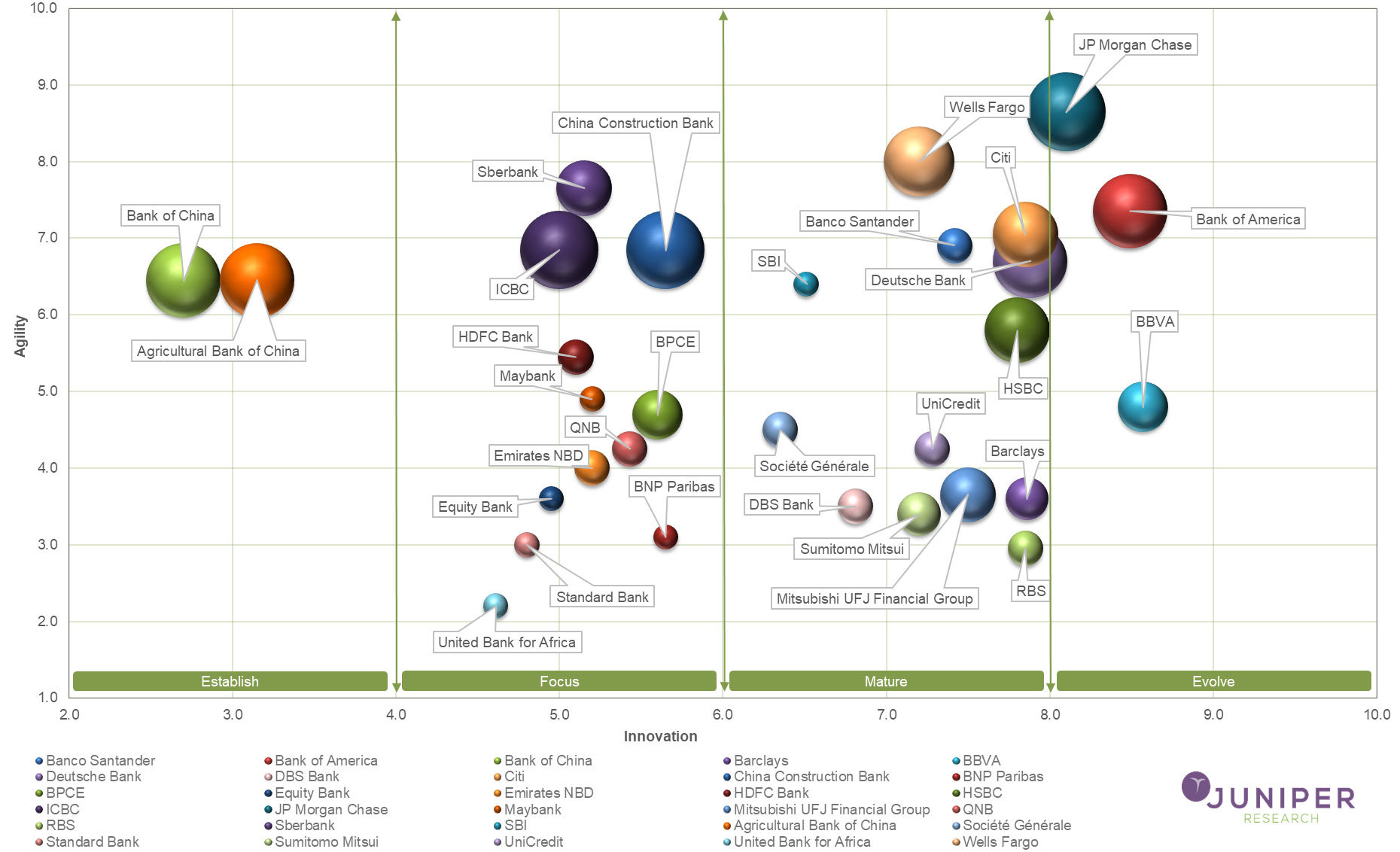

Leading Banks Positioned in Juniper Research’s Digital Transformation Readiness Index 2020

Banks invested heavily in digital transformation and new offerings in 2019, although the extent of these activities varied considerably. Juniper Research’s Digital Transformation in Banking Readiness Index analysed leading Tier 1 banks to evaluate their digital transformation readiness and highlight their respective positioning in their digital innovation roadmaps.

It identified the leading group of banks for digital transformation:

- Bank of America

- BBVA

- JPMorgan Chase

Bank of America offers extensive digital solutions, including the Erica chatbot, and has had noticeable upticks in digital usage and engagement. BBVA has focused on capitalising on APIs in banking, by offering the BBVA Open Platform, which is a Banking-as-a-Service platform. JPMorgan Chase has experimented with blockchain and is rumoured to be planning a digital-only launch in the UK.

Research author Nick Maynard noted: “These banks have executed highly effective digital transitions; however digital transformation is never complete. These banks must now refocus on the new strategies required to retain their digital leadership”.

The research also noted that traditional banks are launching digital-only brands, such as Bó from UK bank NatWest. The research cautioned that these launches must be differentiated from existing offerings and digital-only competition, in terms of providing a more personalised experience, or they will fail to gain momentum.

Juniper Research provides research and analytical services to the global hi-tech communications sector; providing consultancy, analyst reports and industry commentary.

juniperresearch.com

For more insights, download the free whitepaper: How Open APIs are Revolutionising Banking.

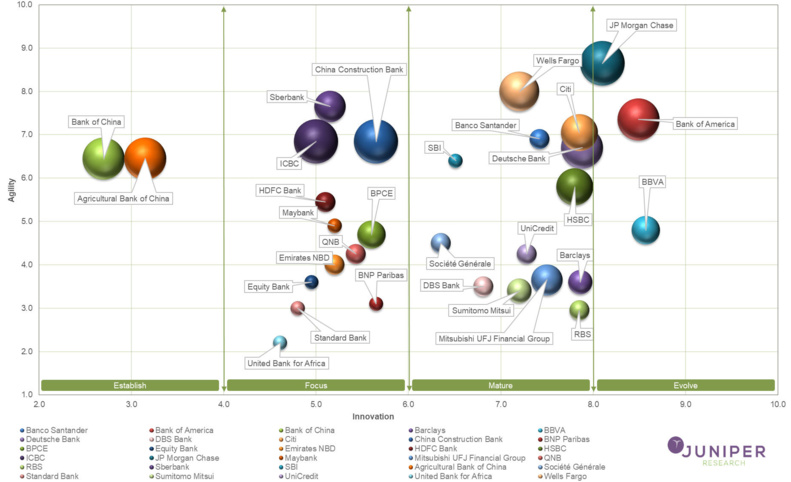

Leading Banks Positioned in Juniper Research’s Digital Transformation Readiness Index 2020

Banks invested heavily in digital transformation and new offerings in 2019, although the extent of these activities varied considerably. Juniper Research’s Digital Transformation in Banking Readiness Index analysed leading Tier 1 banks to evaluate their digital transformation readiness and highlight their respective positioning in their digital innovation roadmaps.

It identified the leading group of banks for digital transformation:

- Bank of America

- BBVA

- JPMorgan Chase

Bank of America offers extensive digital solutions, including the Erica chatbot, and has had noticeable upticks in digital usage and engagement. BBVA has focused on capitalising on APIs in banking, by offering the BBVA Open Platform, which is a Banking-as-a-Service platform. JPMorgan Chase has experimented with blockchain and is rumoured to be planning a digital-only launch in the UK.

Research author Nick Maynard noted: “These banks have executed highly effective digital transitions; however digital transformation is never complete. These banks must now refocus on the new strategies required to retain their digital leadership”.

The research also noted that traditional banks are launching digital-only brands, such as Bó from UK bank NatWest. The research cautioned that these launches must be differentiated from existing offerings and digital-only competition, in terms of providing a more personalised experience, or they will fail to gain momentum.

Juniper Research provides research and analytical services to the global hi-tech communications sector; providing consultancy, analyst reports and industry commentary.

juniperresearch.com

Chaineum : Neo Investment Banking Firm

Laurent Leloup : Conférencier & consultant blockchain

HealthTech Finance : HealthTech Investment Banking, levée de fonds

Laurent Leloup : Conférencier & consultant blockchain

HealthTech Finance : HealthTech Investment Banking, levée de fonds

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

La fintech française, Powens officialise son rapprochement avec l'Espagnole Unnax. Objectif : devenir le leader de l'open finance et de la finance embarquée en Europe

-

Stables amorce un nouveau virage stratégique avec l'arrivée Tezos et d'un nouveau DG au capital

-

Stage - Corporate Finance (M/F) - Luxembourg

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Shiba Inu lève 12 millions de dollars pour lancer sa propre Blockchain