Since the beginning of April, sellers have been relentlessly pushing valuations to new lows, and that can imply that market participants are liquidating their exposure.

Right after the pandemic hit, there was a coordinated global response in terms of fiscal and monetary stimuli. The newly-created liquidity poured into several asset classes and fostered an impressive bull run.

While crypto was not one of these asset classes, the whole economic awakening was positive for it. However, the market sentiment took a 180-degree turn for several reasons recently.

Bitcoin – stocks correlation weakening

One of the first signs of concern is the low correlation between Bitcoin, as well as the altcoin market, and the stock markets. These two asset classes have been rising and falling together for a long time, but the past two weeks saw a decoupling emerging.

After being down for 8 consecutive weeks, major US indices managed to stage a rebound, in what is assumed by many to be a bear market rally. When looking at cryptocurrencies, though, the prices have barely managed to rebound from the May lows, suggesting there is little interest in gaining exposure to these volatile assets.

A confidence hit?

Figuring out how to trade cryptocurrencies in this environment is tricky, let alone for newcomers. Uncertainty has its impact on traders’ strategies, naturally translating into a shift toward safe-haven assets.

This situation resembles what happened during the first few months of 2018. Back then, the entire crypto market was sold off, and in some cases, tokens posted aggregate losses above 90%. When looking at the crypto market, there seems to be a confidence hit behind the lack of demand.

Those who thought this was the beginning of a longer crypto expansion, backed by growing adoption, are now seeing their expectations shattered, leading to a liquidation process like the one seen at the beginning of May 2022.

Crypto market -a buffer for excess liquidity

Another interesting theory that emerged recently is that the cryptocurrency market has actually acted as a buffer for excess liquidity. Basically, as policymakers suppressed volatility and created a new reflation, they had to spend and print more than was necessary. Some of that capital entered the crypto space, propping up valuations.

Now that the fiscal impulse is waning and central banks are aggressively tightening monetary policies, there is no longer excess liquidity in the system, so the crypto market goes into reverse. Traders need to understand that with assets that don’t have an intrinsic value, finding a bottom is increasingly tricky.

Perhaps that is why cryptocurrency buyers are reacting with a lag, trying to regain exposure to the market once they see clear signs of improved risk appetite. However, if conditions start to deteriorate once again, cryptos are probably the most vulnerable asset class in the face of losses.

Right after the pandemic hit, there was a coordinated global response in terms of fiscal and monetary stimuli. The newly-created liquidity poured into several asset classes and fostered an impressive bull run.

While crypto was not one of these asset classes, the whole economic awakening was positive for it. However, the market sentiment took a 180-degree turn for several reasons recently.

Bitcoin – stocks correlation weakening

One of the first signs of concern is the low correlation between Bitcoin, as well as the altcoin market, and the stock markets. These two asset classes have been rising and falling together for a long time, but the past two weeks saw a decoupling emerging.

After being down for 8 consecutive weeks, major US indices managed to stage a rebound, in what is assumed by many to be a bear market rally. When looking at cryptocurrencies, though, the prices have barely managed to rebound from the May lows, suggesting there is little interest in gaining exposure to these volatile assets.

A confidence hit?

Figuring out how to trade cryptocurrencies in this environment is tricky, let alone for newcomers. Uncertainty has its impact on traders’ strategies, naturally translating into a shift toward safe-haven assets.

This situation resembles what happened during the first few months of 2018. Back then, the entire crypto market was sold off, and in some cases, tokens posted aggregate losses above 90%. When looking at the crypto market, there seems to be a confidence hit behind the lack of demand.

Those who thought this was the beginning of a longer crypto expansion, backed by growing adoption, are now seeing their expectations shattered, leading to a liquidation process like the one seen at the beginning of May 2022.

Crypto market -a buffer for excess liquidity

Another interesting theory that emerged recently is that the cryptocurrency market has actually acted as a buffer for excess liquidity. Basically, as policymakers suppressed volatility and created a new reflation, they had to spend and print more than was necessary. Some of that capital entered the crypto space, propping up valuations.

Now that the fiscal impulse is waning and central banks are aggressively tightening monetary policies, there is no longer excess liquidity in the system, so the crypto market goes into reverse. Traders need to understand that with assets that don’t have an intrinsic value, finding a bottom is increasingly tricky.

Perhaps that is why cryptocurrency buyers are reacting with a lag, trying to regain exposure to the market once they see clear signs of improved risk appetite. However, if conditions start to deteriorate once again, cryptos are probably the most vulnerable asset class in the face of losses.

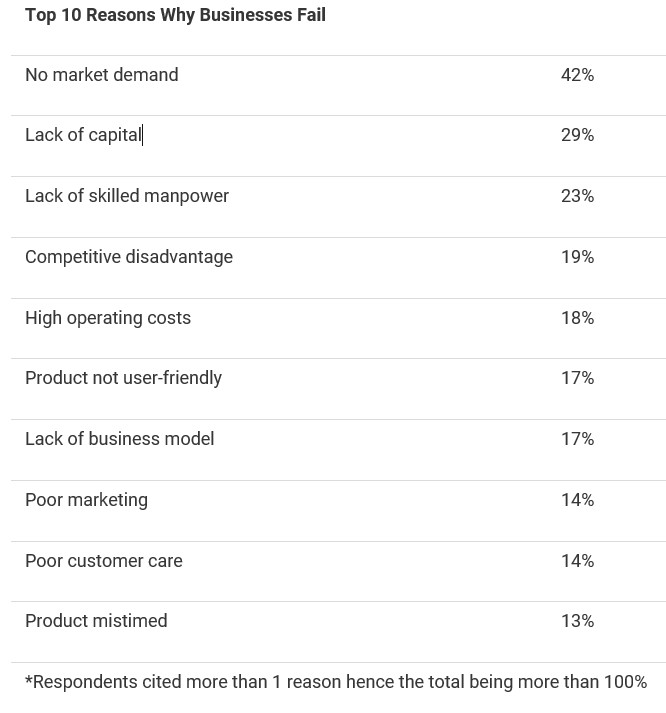

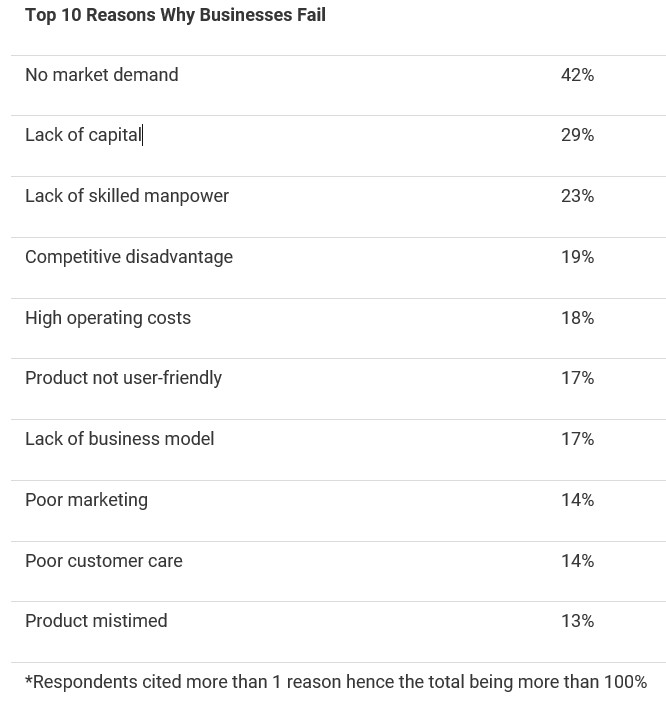

Source: CB Insights

In addition, the COVID-19 pandemic accelerated the business failure rate which was not limited to startups. For instance, renowned fashion brand Victoria's Secret liquidated its UK operations and closed over 200 outlets in North America during the pandemic. Also, in the United States of America, YELP reported that 60% of the businesses that closed at the start of the pandemic had closed permanently by the end of 2020.

Conclusion from Adam J Clarke

In the business age of perpetual crisis such as this, Adam Clarke likes to quote popular motivational speaker Les Brown and says, “It’s not over until you win.” Adam goes on to add, “You should not believe that the entrepreneurs you look up to are different from you. The only difference is the ability to handle failure and rejection at an incredible rate. Standing up again after getting knocked over by failure is the most important part of being an entrepreneur.”

In line with this, it is essential for businesses to be resilient and agile in seasons of crisis. This entails adjusting to challenges and never giving up.

It is also important to note that alternative payment systems, like the technology Macropay offers, can help businesses. Establishments can now process payments from other countries, thus allowing the business to enter new markets faster. Once a business builds international client bases, worldwide success is just around the corner.

Cope with the rapid changes and the seemingly never-ending crisis through valuable business insights at www.macropay.net.

In addition, the COVID-19 pandemic accelerated the business failure rate which was not limited to startups. For instance, renowned fashion brand Victoria's Secret liquidated its UK operations and closed over 200 outlets in North America during the pandemic. Also, in the United States of America, YELP reported that 60% of the businesses that closed at the start of the pandemic had closed permanently by the end of 2020.

Conclusion from Adam J Clarke

In the business age of perpetual crisis such as this, Adam Clarke likes to quote popular motivational speaker Les Brown and says, “It’s not over until you win.” Adam goes on to add, “You should not believe that the entrepreneurs you look up to are different from you. The only difference is the ability to handle failure and rejection at an incredible rate. Standing up again after getting knocked over by failure is the most important part of being an entrepreneur.”

In line with this, it is essential for businesses to be resilient and agile in seasons of crisis. This entails adjusting to challenges and never giving up.

It is also important to note that alternative payment systems, like the technology Macropay offers, can help businesses. Establishments can now process payments from other countries, thus allowing the business to enter new markets faster. Once a business builds international client bases, worldwide success is just around the corner.

Cope with the rapid changes and the seemingly never-ending crisis through valuable business insights at www.macropay.net.

------------------------------------------------------------------------

Disclaimer: The text above is a press release that was not written by Finyear.com.

The issuer is solely responsible for the content of this announcement.

Avertissement : Le texte ci-dessus est un communiqué de presse qui n'a pas été rédigé par Finyear.com.

L'émetteur est seul responsable du contenu de cette annonce.

Disclaimer: The text above is a press release that was not written by Finyear.com.

The issuer is solely responsible for the content of this announcement.

Avertissement : Le texte ci-dessus est un communiqué de presse qui n'a pas été rédigé par Finyear.com.

L'émetteur est seul responsable du contenu de cette annonce.

Autres articles

-

Shiba Inu lève 12 millions de dollars pour lancer sa propre Blockchain

-

Rockfi officialise sa première levée de fonds

-

Nominations | Allen & Overy annonce la première promotion de counsels pour A&O Shearman à Paris

-

Payhawk s'offre le joueur de tennis professionnel, Grigor Dimitrov, comme ambassadeur officiel de la marque

-

Blockchain Life 2024 a fait vibrer Dubaï