The digitisation of insurance (aka Insurtech) started later than the digitisation of banking, but the trajectory has been faster. This maybe even more true as we watch Blockchain disrupt the $4 trillion Insurance before it disrupts Banking.

This is Part Two (Chapter 4) of The Blockchain Economy serialised book. Part Two is where we focus on real world use cases. Today is the $4 trillion insurance business.

This is Part Two (Chapter 4) of The Blockchain Economy serialised book. Part Two is where we focus on real world use cases. Today is the $4 trillion insurance business.

That $4 trillion number: the global insurance market had total gross written premiums of $4,609.3 billion in 2016, representing a compound annual growth rate (CAGR) of 4% between 2012 and 2016.

In this post/chapter we look at:

- Reinsurance As A Service

- Claim to cash time and settlement latency

- Business Process Elimination

- Real time automated claims using smart contracts

- Enforced rules for where to spend the money

- Bit sized insurance in the Rest (of the world)

- Catastrophe swaps Insurance

- Provenance and fraud detection

- Blockchain + P2P Insurance = disruption

- Unbreakable escrow and Solvency 2 on the Blockchain

Reinsurance As A Service

Insurance is a three layer stack:

- Layer # 1: Brokers and Agents to Brokers. Their job is to gather premiums from customers.

- Layer # 2: Insurance Companies. Their primary job is claims processing. They take in premiums via brokers, invest the cash flow and pay out claims when needed.

- Layer # 3: Reinsurance Companies. They are the payers of last resort. They insure the insurance companies. Their job is to have enough capital to pay out claims, even if the models did not predict the volume of claims.

The Reinsurance companies have been very active in Insurtech, becoming a platform for innovation by offering both data (critical to risk models) and capital. This is what we call Reinsurance As A Service.

The big driver of change is reducing the Claim to cash time by reducing settlement latency and this is where this is where the B3i and RiskBlock Alliance are important.

B3i (Blockchain Insurance Industry Initiative) was launched by Insurance companies (such as Aegon and Allianz) and Reinsurance companies (such as Munich Re, Swiss Re and Zurich) with the express mission to:

“explore the potential of using Distributed Ledger Technologies within the re/insurance industry for the benefit of all stakeholders in the value chain. B3i provides insurance solutions on a blockchain platform offering opportunities for efficiency, growth and quality across the value chain to benefit all participants including end customers."

B3i began as a consortium but has morphed into a services business.

There is another consortium in the US called RiskBlock Alliance. They may get into more customer facing use cases (whereas B3i focus is on reinsurer to carrier links).

An emerging use case, that connects to supply chains is Insurwave, a blockchain platform to support marine hull insurance.

This is all about settlement latency. The move from T+2/3 to real time settlement is a big driver of change in equities markets. If you thought 2-3 days was slow, try 4 months in Insurance.

Claim to cash time and settlement latency

Reducing Settlement Latency in Insurance (from claim to cash) is the huge payoff from adopting Blockchain in Insurance.

Settlement takes about 4 months on average. This means all the companies in the process have to manage counterparty credit risk and all the associated processes.

Even bigger than this is the big pay-off for consumers.

Imagine putting in an insurance claim and getting a message a few hours later saying “your claim has been approved, with some deductions detailed below, you will be paid tomorrow”. When you have suffered a tragedy that kind of immediacy is critical and will lead to high customer satisfaction which will drive revenue growth.

This becomes feasible because we move from a consumer defining the event (crash, fire, hurricane etc) to those events being validated data events stored on the Blockchain (which all the parties have access to). Then the consumer simply says “policy # xxx suffered a loss of yyy in event aaa”, with each of those being verified data points in an immutable database that all have access to.

All the participants – customer, broker, insurer, reinsurer – will apply their processes to those data points. The single source of truth eliminates all the reconciliation processes and costs.

No amount of improved mobile front end will make much difference to the full lifecycle experience, but bringing the time from claim to cash from 4 months to days or hours will be a total game-changer. That is why we envision Blockchain getting its first big use cases in Insurance (before we see big rollouts in banking).

Business Process Elimination

The BPO (Business Process Outsourcing) industry turned India into the back office of the world by taking basic clerical jobs and shifting them to a cheaper location and applying a rigorous approach to process optimization.

Call that global back office version 1.

Version 2 is much more radical. This is when business processes are not optimized – they are eliminated. Call this Business Process Elimination (BPE). Blockchain is critical to this.

You can see this in the context of Real Time Equities Settlement. When that goes mainstream, whole swathes of processes that we now call Post Trade Processing will be eliminated.

The same is happening in Insurance. Real Time Automated Claims Using Smart Contracts will not optimise processes, they will eliminate processes (or at least automate them without human intervention). This will dramatically change the cost base and open up new markets that were price sensitive.

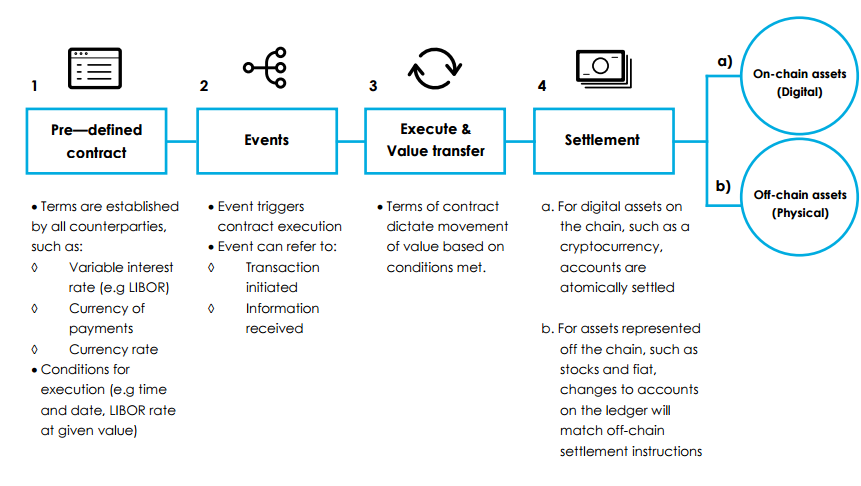

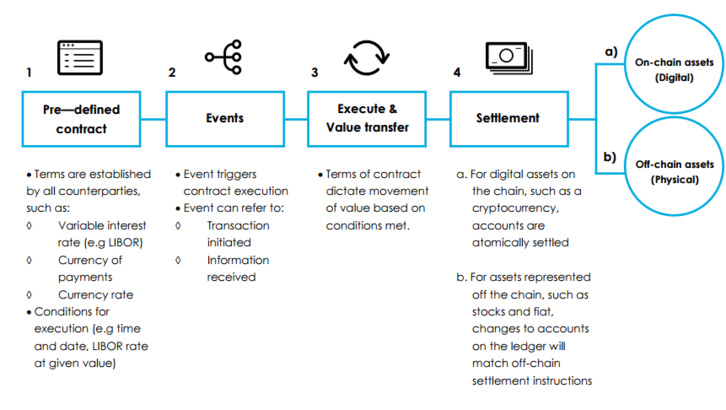

Real time automated claims using smart contracts

Claims could be paid out automatically based on smart contracts. This holds out a win/win promise:

- Elimination of fraud = reduced claims processing cost. The Insurance company does not rely on the customer’s version of truth. There is independently verified data.

- More revenue from happier customers. Customers know that payout is automatic and immediate (no more hassling for payout during the most stressful times when the bad event has actually happened).

For this to work, it has to be binary simplicity. An algo has to make a yes/no decision instantly. Something with complexity (such as who is at fault in an accident or whether a medical procedure is covered) needs judgement base on human intervention.

One example of where we see that binary simplicity is flight insurance. The flight was either cancelled or it was not. Blockchain systems use external data sources (e.g via the Oraclize service ) to get this proof of what happened. A Proof Of Concept for this flight insurance use case was coded during a weekend at a hackathon using Ethereum – proving that technical risk is not the prime concern. In the twelve months to May 2015, there were 558,000 passengers who did not claim for delayed or cancelled flights in and out of the UK. In fact, less that 40% of passengers claimed money back from their insurance policy.

We expect to see lots of use cases where this binary rule applies where really low cost insurance can be offered (thanks to elimination of fraud and claims processing). This is classic disruption at the edge – where disruption usually gets traction. For example, there are lots of use cases within the sharing economy. These are on demand or just-in-time insurance use cases.

One mainstream use case is Life Insurance. Life or death is pretty binary. Smart Contracts can look at online death registers and make payout to the designated account. Given the stress that grieving relatives are under, this would score high on Net Promoter Scores.

Enforced rules for where to spend the money

In more complex claims processes it is more about enforcing rules on where a customer spends the money. For example, in an auto accident, only go to these garages or in a ski accident, only go to these doctors. This is a win/win as the customer has confidence of getting reimbursement and the insurer gets lower and more predictable claims. Using geo location and smart phones it is pretty simple for the customer to make a decision where to go even in stressful situations and will take this action if there is 100% confidence in auto payout via a Blockchain resident smart contract. Ideally the vendor (garage, doctor etc) gets notification on their phone of incoming customer and notification from the smart contract of what they can charge, so the customer does not have to pay and reclaim later.

For example in auto insurance, smart contracts enable insurers to control claims costs after an accident. The trigger that there has been an accident would come from a smartphone app or the connected car via the Internet to the blockchain. Insurers are always frustrated when customers go a more expensive route for repairs, recovery and car hire. So, with a smart contract, insurers could code the policy conditions to only pay- out to the designated third parties.

Bit sized insurance in the Rest (of the world)

"Bite size insurance", a possibly better term than Microinsurance, is what Stephen Goldstein wrote about a few days ago in his review of Insurance in India. The key is to dramatically bring down the price by smart contract automation so more people can get insurance. With Insurance globally at a CAGR around 4%, the double digit CAGR in markets like India is key growth driver. But these markets operate at different price points, so Real Time automated claims using Smart Contracts are key to these markets.

We expect to see new Insurance companies that are born-on-the blockchain with a radically lower cost base.

Catastrophe Swaps Insurance

A catastrophe swap is a financial instrument traded in the over-the-counter derivatives market. Insurers need protection after a large natural disaster because numerous policyholders will file claims within a short time frame. A catastrophe swap helps insurance companies transfer some of the risk they’ve assumed through policy issuance and provides an alternative to purchasing reinsurance or issuing a catastrophe bond.

Lets look at an example of how this was done using Blockchain. In a catastrophe swap, two parties, an insurer (e.g Allianz) and an investor (e.g Nephila Capital), exchange streams of periodic payments. The insurer’s payments are based on a portfolio of the investor’s securities, and the investor’s payments are based on potential catastrophe losses as predicted by a catastrophe loss index (created by third party firms to quantify the magnitude of insurance claims expected from major disasters).

Risk modelling gets a lot more complex if Climate Change is real – the historic models simply don’t apply any more.

This is life or death for the billions living on $1 or $2 per day. Climate Change is not just an inconvenience, it is life threatening if their crops fail. Anything that makes crop insurance easier and cheaper will change the lives of billions. Any innovation at the risk modelling and financing level that helps is to be greatly welcomed.

Provenance and fraud detection in hard assets

The use case for Insurance that has been understood for some time is Provenance. This affects assets such as jewelry, art and antiques where it is critical to know that the “asset is what the customer claims it is”. An immutable blockchain is the obvious solution. An early pioneer in this use case is Everledger (our note on Everledger from July 2015 is here).

The big issue is not how to record the data. Blockchain obviously does that. The key issue is how to stop the “garbage in” data problem. How do you stop fraudulent data hitting the Blockchain? Fraud costs the global economy more than $600 billion a year. In some countries, nearly 70% of certain life-saving drugs are counterfeit.

Fortunately there is some new technology aiming to solve that problem. For example, IBM Research introduced Crypto Anchor Verifier, a new technology that uses artificial intelligence and optical imaging (using doit phone’s camera) to verify the identity and authenticity of objects before storing that data on a blockchain. Crypto Anchor Verifier can identify the authenticity of forged goods such as fine wine, diamonds and medicine, as well as analyze water quality and detect bacteria, such as E.coli.

These “crypto anchors” are tamper-proof digital fingerprints that are embedded into products, or parts of products, and linked to the blockchain.

This makes it a lot easier to ensure a product, which is big enabler because a lot of insurance fraud relates to fraudulent products.

Blockchain + P2P Insurance = Disruption

P2P Insurance has been suggested by many as the disruptive model for Insurance and we have covered this many times on Daily Fintech. It maybe that P2P is only viable with Blockchain resident smart contracts that can guarantee the payout. For the fundamental theory behind this, read a white paper from Joshua Davis entitled “Peer to Peer Insurance on the Ethereum Blockchain”. The Distributed Autonomous Corporation (DAO) that takes in premiums and makes payouts would be owned and controlled by policyholders who have an affinity (ie part of a cohort with a shared risk profile).

Joshua Davis, who wrote that seminal white paper went on to turn theory into practice by creating Dynamis. They are not trying to boil the ocean; their niche is supplemental unemployment insurance.

Unbreakable Escrow and Solvency 2 on the Blockchain

Blockhain based smart contract Insurance works through an “unbreakable escrow”. The insurer will pay out before they even know about it. This has dramatic and complex implications on solvency regulation that will take time to play out.

Solvency 2 regulation is designed to

ensure that insurance companies have enough capital to pay claims.

The issue is how much capital the investor has to put at risk to enable “unbreakable escrow”. Will it be back to the future where the equivalent of Lloyds Names agree to unlimited liability? Or will Insurance companies have to deposit a far higher % of reserves to guarantee the payout. A P2P DAO owned by the policy holders can afford to do this. A traditional insurance company cannot afford to do this. This is classic disruption and could lead to a back to the future digital version of the old Lloyds of London. A Blockchain based Insurance marketplace connecting brokers, carriers and reinsurance could replace the human “runners” in the Lloyds room carrying paper between the parties with a shared ledger and smart contracts.

Data standards are critical for this vision. Accord data - which serves a similar role to the FIX standard in capital markets - serves that data standard in the Insurance business.

Thanks to Stephen Goldstein, the Insurtech Expert on the Daily Fintech team, who helped with input and who had this to say in conclusion:

"Blockchain shows great promise in the Insurance sector. Our industry relies on contracts between numerous parties (reinsurers and primary carriers, primary carriers and providers of care, primary carriers to policyholders, etc). In order to transact on these contracts, numerous data points need to be validated, which is typically a manual and tedious process. Blockchain can assist with making these processes more transparent and efficient. There is still a learning curve for the industry to understand blockchain before more widespread adoption, however we are starting to see more live use cases like AXA's Fizzy product and Insurwave Marine Insurance by EY, Guardtime, A.P. Møller-Maersk, Microsoft, Willis Towers Watson, XL Catlin, MS Amlin and ACORD"

In this post/chapter we look at:

- Reinsurance As A Service

- Claim to cash time and settlement latency

- Business Process Elimination

- Real time automated claims using smart contracts

- Enforced rules for where to spend the money

- Bit sized insurance in the Rest (of the world)

- Catastrophe swaps Insurance

- Provenance and fraud detection

- Blockchain + P2P Insurance = disruption

- Unbreakable escrow and Solvency 2 on the Blockchain

Reinsurance As A Service

Insurance is a three layer stack:

- Layer # 1: Brokers and Agents to Brokers. Their job is to gather premiums from customers.

- Layer # 2: Insurance Companies. Their primary job is claims processing. They take in premiums via brokers, invest the cash flow and pay out claims when needed.

- Layer # 3: Reinsurance Companies. They are the payers of last resort. They insure the insurance companies. Their job is to have enough capital to pay out claims, even if the models did not predict the volume of claims.

The Reinsurance companies have been very active in Insurtech, becoming a platform for innovation by offering both data (critical to risk models) and capital. This is what we call Reinsurance As A Service.

The big driver of change is reducing the Claim to cash time by reducing settlement latency and this is where this is where the B3i and RiskBlock Alliance are important.

B3i (Blockchain Insurance Industry Initiative) was launched by Insurance companies (such as Aegon and Allianz) and Reinsurance companies (such as Munich Re, Swiss Re and Zurich) with the express mission to:

“explore the potential of using Distributed Ledger Technologies within the re/insurance industry for the benefit of all stakeholders in the value chain. B3i provides insurance solutions on a blockchain platform offering opportunities for efficiency, growth and quality across the value chain to benefit all participants including end customers."

B3i began as a consortium but has morphed into a services business.

There is another consortium in the US called RiskBlock Alliance. They may get into more customer facing use cases (whereas B3i focus is on reinsurer to carrier links).

An emerging use case, that connects to supply chains is Insurwave, a blockchain platform to support marine hull insurance.

This is all about settlement latency. The move from T+2/3 to real time settlement is a big driver of change in equities markets. If you thought 2-3 days was slow, try 4 months in Insurance.

Claim to cash time and settlement latency

Reducing Settlement Latency in Insurance (from claim to cash) is the huge payoff from adopting Blockchain in Insurance.

Settlement takes about 4 months on average. This means all the companies in the process have to manage counterparty credit risk and all the associated processes.

Even bigger than this is the big pay-off for consumers.

Imagine putting in an insurance claim and getting a message a few hours later saying “your claim has been approved, with some deductions detailed below, you will be paid tomorrow”. When you have suffered a tragedy that kind of immediacy is critical and will lead to high customer satisfaction which will drive revenue growth.

This becomes feasible because we move from a consumer defining the event (crash, fire, hurricane etc) to those events being validated data events stored on the Blockchain (which all the parties have access to). Then the consumer simply says “policy # xxx suffered a loss of yyy in event aaa”, with each of those being verified data points in an immutable database that all have access to.

All the participants – customer, broker, insurer, reinsurer – will apply their processes to those data points. The single source of truth eliminates all the reconciliation processes and costs.

No amount of improved mobile front end will make much difference to the full lifecycle experience, but bringing the time from claim to cash from 4 months to days or hours will be a total game-changer. That is why we envision Blockchain getting its first big use cases in Insurance (before we see big rollouts in banking).

Business Process Elimination

The BPO (Business Process Outsourcing) industry turned India into the back office of the world by taking basic clerical jobs and shifting them to a cheaper location and applying a rigorous approach to process optimization.

Call that global back office version 1.

Version 2 is much more radical. This is when business processes are not optimized – they are eliminated. Call this Business Process Elimination (BPE). Blockchain is critical to this.

You can see this in the context of Real Time Equities Settlement. When that goes mainstream, whole swathes of processes that we now call Post Trade Processing will be eliminated.

The same is happening in Insurance. Real Time Automated Claims Using Smart Contracts will not optimise processes, they will eliminate processes (or at least automate them without human intervention). This will dramatically change the cost base and open up new markets that were price sensitive.

Real time automated claims using smart contracts

Claims could be paid out automatically based on smart contracts. This holds out a win/win promise:

- Elimination of fraud = reduced claims processing cost. The Insurance company does not rely on the customer’s version of truth. There is independently verified data.

- More revenue from happier customers. Customers know that payout is automatic and immediate (no more hassling for payout during the most stressful times when the bad event has actually happened).

For this to work, it has to be binary simplicity. An algo has to make a yes/no decision instantly. Something with complexity (such as who is at fault in an accident or whether a medical procedure is covered) needs judgement base on human intervention.

One example of where we see that binary simplicity is flight insurance. The flight was either cancelled or it was not. Blockchain systems use external data sources (e.g via the Oraclize service ) to get this proof of what happened. A Proof Of Concept for this flight insurance use case was coded during a weekend at a hackathon using Ethereum – proving that technical risk is not the prime concern. In the twelve months to May 2015, there were 558,000 passengers who did not claim for delayed or cancelled flights in and out of the UK. In fact, less that 40% of passengers claimed money back from their insurance policy.

We expect to see lots of use cases where this binary rule applies where really low cost insurance can be offered (thanks to elimination of fraud and claims processing). This is classic disruption at the edge – where disruption usually gets traction. For example, there are lots of use cases within the sharing economy. These are on demand or just-in-time insurance use cases.

One mainstream use case is Life Insurance. Life or death is pretty binary. Smart Contracts can look at online death registers and make payout to the designated account. Given the stress that grieving relatives are under, this would score high on Net Promoter Scores.

Enforced rules for where to spend the money

In more complex claims processes it is more about enforcing rules on where a customer spends the money. For example, in an auto accident, only go to these garages or in a ski accident, only go to these doctors. This is a win/win as the customer has confidence of getting reimbursement and the insurer gets lower and more predictable claims. Using geo location and smart phones it is pretty simple for the customer to make a decision where to go even in stressful situations and will take this action if there is 100% confidence in auto payout via a Blockchain resident smart contract. Ideally the vendor (garage, doctor etc) gets notification on their phone of incoming customer and notification from the smart contract of what they can charge, so the customer does not have to pay and reclaim later.

For example in auto insurance, smart contracts enable insurers to control claims costs after an accident. The trigger that there has been an accident would come from a smartphone app or the connected car via the Internet to the blockchain. Insurers are always frustrated when customers go a more expensive route for repairs, recovery and car hire. So, with a smart contract, insurers could code the policy conditions to only pay- out to the designated third parties.

Bit sized insurance in the Rest (of the world)

"Bite size insurance", a possibly better term than Microinsurance, is what Stephen Goldstein wrote about a few days ago in his review of Insurance in India. The key is to dramatically bring down the price by smart contract automation so more people can get insurance. With Insurance globally at a CAGR around 4%, the double digit CAGR in markets like India is key growth driver. But these markets operate at different price points, so Real Time automated claims using Smart Contracts are key to these markets.

We expect to see new Insurance companies that are born-on-the blockchain with a radically lower cost base.

Catastrophe Swaps Insurance

A catastrophe swap is a financial instrument traded in the over-the-counter derivatives market. Insurers need protection after a large natural disaster because numerous policyholders will file claims within a short time frame. A catastrophe swap helps insurance companies transfer some of the risk they’ve assumed through policy issuance and provides an alternative to purchasing reinsurance or issuing a catastrophe bond.

Lets look at an example of how this was done using Blockchain. In a catastrophe swap, two parties, an insurer (e.g Allianz) and an investor (e.g Nephila Capital), exchange streams of periodic payments. The insurer’s payments are based on a portfolio of the investor’s securities, and the investor’s payments are based on potential catastrophe losses as predicted by a catastrophe loss index (created by third party firms to quantify the magnitude of insurance claims expected from major disasters).

Risk modelling gets a lot more complex if Climate Change is real – the historic models simply don’t apply any more.

This is life or death for the billions living on $1 or $2 per day. Climate Change is not just an inconvenience, it is life threatening if their crops fail. Anything that makes crop insurance easier and cheaper will change the lives of billions. Any innovation at the risk modelling and financing level that helps is to be greatly welcomed.

Provenance and fraud detection in hard assets

The use case for Insurance that has been understood for some time is Provenance. This affects assets such as jewelry, art and antiques where it is critical to know that the “asset is what the customer claims it is”. An immutable blockchain is the obvious solution. An early pioneer in this use case is Everledger (our note on Everledger from July 2015 is here).

The big issue is not how to record the data. Blockchain obviously does that. The key issue is how to stop the “garbage in” data problem. How do you stop fraudulent data hitting the Blockchain? Fraud costs the global economy more than $600 billion a year. In some countries, nearly 70% of certain life-saving drugs are counterfeit.

Fortunately there is some new technology aiming to solve that problem. For example, IBM Research introduced Crypto Anchor Verifier, a new technology that uses artificial intelligence and optical imaging (using doit phone’s camera) to verify the identity and authenticity of objects before storing that data on a blockchain. Crypto Anchor Verifier can identify the authenticity of forged goods such as fine wine, diamonds and medicine, as well as analyze water quality and detect bacteria, such as E.coli.

These “crypto anchors” are tamper-proof digital fingerprints that are embedded into products, or parts of products, and linked to the blockchain.

This makes it a lot easier to ensure a product, which is big enabler because a lot of insurance fraud relates to fraudulent products.

Blockchain + P2P Insurance = Disruption

P2P Insurance has been suggested by many as the disruptive model for Insurance and we have covered this many times on Daily Fintech. It maybe that P2P is only viable with Blockchain resident smart contracts that can guarantee the payout. For the fundamental theory behind this, read a white paper from Joshua Davis entitled “Peer to Peer Insurance on the Ethereum Blockchain”. The Distributed Autonomous Corporation (DAO) that takes in premiums and makes payouts would be owned and controlled by policyholders who have an affinity (ie part of a cohort with a shared risk profile).

Joshua Davis, who wrote that seminal white paper went on to turn theory into practice by creating Dynamis. They are not trying to boil the ocean; their niche is supplemental unemployment insurance.

Unbreakable Escrow and Solvency 2 on the Blockchain

Blockhain based smart contract Insurance works through an “unbreakable escrow”. The insurer will pay out before they even know about it. This has dramatic and complex implications on solvency regulation that will take time to play out.

Solvency 2 regulation is designed to

ensure that insurance companies have enough capital to pay claims.

The issue is how much capital the investor has to put at risk to enable “unbreakable escrow”. Will it be back to the future where the equivalent of Lloyds Names agree to unlimited liability? Or will Insurance companies have to deposit a far higher % of reserves to guarantee the payout. A P2P DAO owned by the policy holders can afford to do this. A traditional insurance company cannot afford to do this. This is classic disruption and could lead to a back to the future digital version of the old Lloyds of London. A Blockchain based Insurance marketplace connecting brokers, carriers and reinsurance could replace the human “runners” in the Lloyds room carrying paper between the parties with a shared ledger and smart contracts.

Data standards are critical for this vision. Accord data - which serves a similar role to the FIX standard in capital markets - serves that data standard in the Insurance business.

Thanks to Stephen Goldstein, the Insurtech Expert on the Daily Fintech team, who helped with input and who had this to say in conclusion:

"Blockchain shows great promise in the Insurance sector. Our industry relies on contracts between numerous parties (reinsurers and primary carriers, primary carriers and providers of care, primary carriers to policyholders, etc). In order to transact on these contracts, numerous data points need to be validated, which is typically a manual and tedious process. Blockchain can assist with making these processes more transparent and efficient. There is still a learning curve for the industry to understand blockchain before more widespread adoption, however we are starting to see more live use cases like AXA's Fizzy product and Insurwave Marine Insurance by EY, Guardtime, A.P. Møller-Maersk, Microsoft, Willis Towers Watson, XL Catlin, MS Amlin and ACORD"

Bernard Lunn

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Finyear - Daily News

Lisez gratuitement :

Le quotidien Finyear

- Sa newsletter quotidienne :

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Finance Digitale, Cryptofinance.

- Sa lettre mensuelle Le Trésorier

Le quotidien Finyear

- Sa newsletter quotidienne :

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Finance Digitale, Cryptofinance.

- Sa lettre mensuelle Le Trésorier

Autres articles

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group

-

Giddy Wallet Announces First-Ever Autogas Feature for Polygon