Bitcoin, often touted as a sophisticated, digital alternative to traditional currencies, needs to address several fundamental issues outside the cryptographers’ realm before financial institutions embrace it, according to Aite Group. The primary use of the Bitcoin network today is the exchange of the Bitcoin currency—a unit of value that only exists in the digital environment. Aite Group’s research announced today examines the pros and cons of Bitcoin and determines what it would take to see wider Bitcoin adoption.

In its latest report, Bitcoin: The Good, the Bad, and the Ugly, Aite Group has developed its understanding of Bitcoin and the ways that traditional financial services companies might engage with it. Aite Group spoke with a wide variety of stakeholders, including merchants, banks, regulators, and Bitcoin enablers. The research looks at the good, the bad, and the ugly aspects of the cryptocurrency and begins by defining the landscape and examining use cases where Bitcoin is seeing traction. It also examines the abuses that are drawing regulator attention as well as the obstacles that Bitcoin needs to overcome for further financial success.

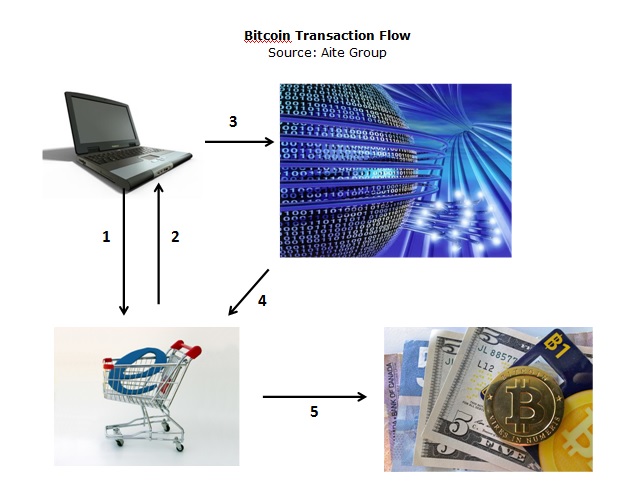

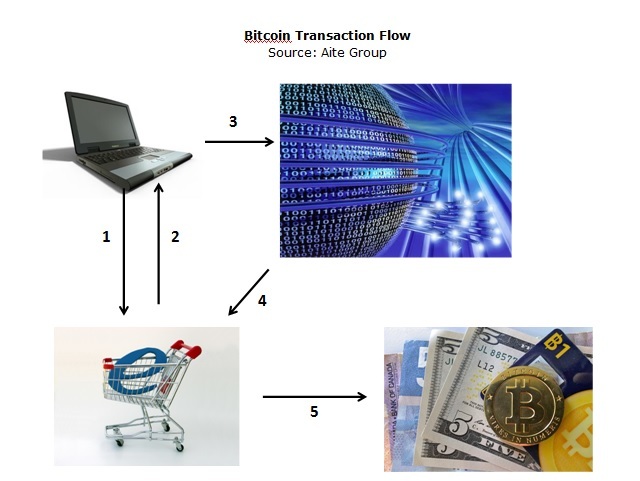

Bitcoin relies on a peer-to-peer network of computers called "miners" for production and processing of Bitcoins, harnessing the computational power of the machines connected to the network to execute the complex calculations required to facilitate Bitcoin transactions. As a reward for lending computer power to the network, participating machines are paid in Bitcoins; these payments constitute a portion of new Bitcoins minted as well as network transaction fees.

In its latest report, Bitcoin: The Good, the Bad, and the Ugly, Aite Group has developed its understanding of Bitcoin and the ways that traditional financial services companies might engage with it. Aite Group spoke with a wide variety of stakeholders, including merchants, banks, regulators, and Bitcoin enablers. The research looks at the good, the bad, and the ugly aspects of the cryptocurrency and begins by defining the landscape and examining use cases where Bitcoin is seeing traction. It also examines the abuses that are drawing regulator attention as well as the obstacles that Bitcoin needs to overcome for further financial success.

Bitcoin relies on a peer-to-peer network of computers called "miners" for production and processing of Bitcoins, harnessing the computational power of the machines connected to the network to execute the complex calculations required to facilitate Bitcoin transactions. As a reward for lending computer power to the network, participating machines are paid in Bitcoins; these payments constitute a portion of new Bitcoins minted as well as network transaction fees.

To reach any long-term success, however, Aite Group sees that some fundamental weaknesses in the original Bitcoin model need to be addressed, and even if Bitcoin doesn’t stand the test of time, its business model is predicted to be successful.

These weaknesses include the self-imposed programmatic limit of 21 million Bitcoins in circulation which leads to a deflationary outcome by discouraging spending in favor of saving, with the expectation that the Bitcoin value will continue to appreciate over time. There’s processing overhead, as the computational firepower required to process and produce Bitcoins is expensive. As Bitcoin production slows, the idea is that transaction fees will represent an increasing proportion of the compensation that Bitcoin miners expect, but this is by no means a conclusive theory. Also, the anonymity inherent in Bitcoin and many of its brethren is a boon to cybercriminals and a significant cause for concern among regulators.

Although, Bitcoin has proposed solutions to some of these issues, Aite Group feels that most financial institutions are still sitting on the sidelines at present, keeping tabs on Bitcoin and similar brethren, but not actively engaging with them.

“How and whether to engage with Bitcoin is not the only question that players in the legacy payment industry should be contemplating,” says Julie Conroy, research director in Retail Banking at Aite Group. “How to address the challenges of Bitcoin 1.0 and capitalize on the platform’s promise represents opportunity for all.”

Aite Group

aitegroup.com

These weaknesses include the self-imposed programmatic limit of 21 million Bitcoins in circulation which leads to a deflationary outcome by discouraging spending in favor of saving, with the expectation that the Bitcoin value will continue to appreciate over time. There’s processing overhead, as the computational firepower required to process and produce Bitcoins is expensive. As Bitcoin production slows, the idea is that transaction fees will represent an increasing proportion of the compensation that Bitcoin miners expect, but this is by no means a conclusive theory. Also, the anonymity inherent in Bitcoin and many of its brethren is a boon to cybercriminals and a significant cause for concern among regulators.

Although, Bitcoin has proposed solutions to some of these issues, Aite Group feels that most financial institutions are still sitting on the sidelines at present, keeping tabs on Bitcoin and similar brethren, but not actively engaging with them.

“How and whether to engage with Bitcoin is not the only question that players in the legacy payment industry should be contemplating,” says Julie Conroy, research director in Retail Banking at Aite Group. “How to address the challenges of Bitcoin 1.0 and capitalize on the platform’s promise represents opportunity for all.”

Aite Group

aitegroup.com

Lisez gratuitement chaque jour (5j/7) le quotidien Finyear.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise.

Lien direct pour vous abonner : www.finyear.com/newsletter

Lisez gratuitement chaque mois :

- le magazine digital Finyear sur www.finyear.com/magazine

- la lettre digitale "Le Directeur Financier" sur www.finyear.com/ledirecteurfinancier

- la lettre digitale "Le Trésorier" sur www.finyear.com/letresorier

- la lettre digitale "Le Credit Manager" sur www.finyear.com/lecreditmanager

- la lettre digitale "Le Capital Investisseur" sur www.finyear.com/lecapitalinvestisseur

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise.

Lien direct pour vous abonner : www.finyear.com/newsletter

Lisez gratuitement chaque mois :

- le magazine digital Finyear sur www.finyear.com/magazine

- la lettre digitale "Le Directeur Financier" sur www.finyear.com/ledirecteurfinancier

- la lettre digitale "Le Trésorier" sur www.finyear.com/letresorier

- la lettre digitale "Le Credit Manager" sur www.finyear.com/lecreditmanager

- la lettre digitale "Le Capital Investisseur" sur www.finyear.com/lecapitalinvestisseur

Autres articles

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group

-

Giddy Wallet Announces First-Ever Autogas Feature for Polygon