2016: Top global risks (World Economic Forum)

22/01/2016

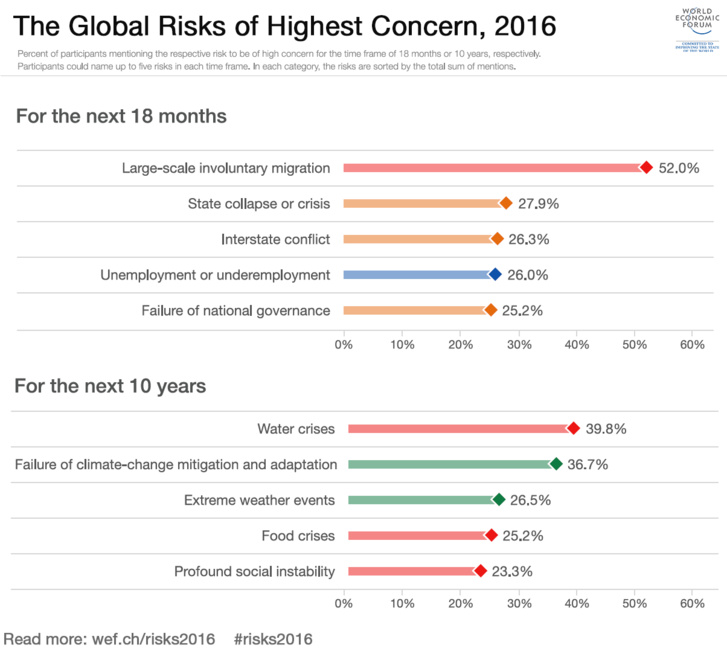

Such a broad risk landscape is unprecedented in the 11 years the report has been measuring global risks. For the first time, four out of five categories – environmental, geopolitical, societal and economic – feature among the top five most impactful risks. The only category not to feature is technological risk, where the highest ranking risk is cyberattack, in 11th position in both likelihood and impact.

In addition to measuring their likelihood and potential impact, the Global Risks Report 2016 also examines the interconnections among the risks. Here, data suggests a convergence may be occurring, with a small number of key risks wielding great influence. All five of the most interconnected pairs of risks in 2016 accounted for more interconnections than in 2015. At the top end of the scale, 2016’s two most interconnected risks – profound social instability and structural unemployment or under-employment – account for 5% of all interconnections.

Knowledge of such interconnections is important in helping leaders prioritize areas for action, as well as to plan for contingencies. “We know climate change is exacerbating other risks such as migration and security, but these are by no means the only interconnections that are rapidly evolving to impact societies, often in unpredictable ways. Mitigation measures against such risks are important, but adaptation is vital,” said Margareta Drzeniek-Hanouz, Head of the Global Competitiveness and Risks, World Economic Forum.

Environmental risks have come to prominence in the global risks landscape in 2016, despite the presence on the horizon of a large number of other, highly visible risks. Income disparity, which was highlighted by the report in 2014, is this year reflected in the growing interconnections involving profound social instability and both structural unemployment and underemployment and adverse consequences of technological advances.

“Events such as Europe’s refugee crisis and terrorist attacks have raised global political instability to its highest level since the Cold War. This is widening the backdrop of uncertainty against which international firms will increasingly be forced to make their strategic decisions. The need for business leaders to consider the implications of these risks on their firm’s footprint, reputation, and supply chain has never been more pressing,” said John Drzik, President, Global Risk and Specialties, Marsh.

Geopolitical risks, one of which – interstate conflict with regional consequences – was 2015’s most likely risk, are also present: while interstate conflict has dropped to fourth in terms of likelihood, weapons of mass destruction ranks as the second most impactful risk, one place higher than last year and its highest ranking ever in our report.

“Climate change is exacerbating more risks than ever before in terms of water crises, food shortages, constrained economic growth, weaker societal cohesion and increased security risks. Meanwhile, geopolitical instability is exposing businesses to cancelled projects, revoked licenses, interrupted production, damaged assets and restricted movement of funds across borders. These political conflicts are in turn making the challenge of climate change all the more insurmountable – reducing the potential for political co-operation, as well as diverting resource, innovation and time away from climate change resilience and prevention," said Cecilia Reyes, Chief Risk Officer of Zurich Insurance Group.

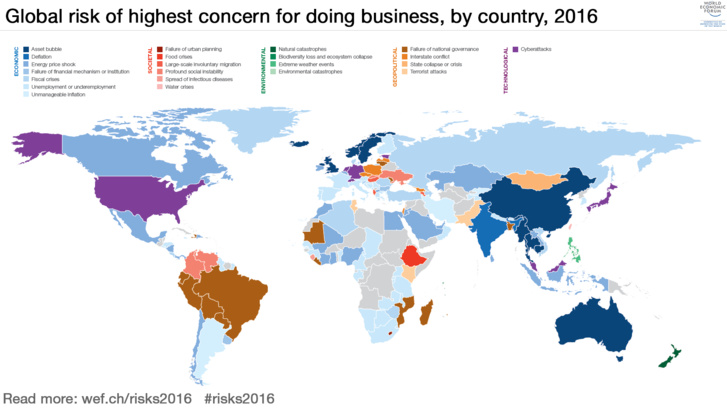

One potential black swan event could be in the area of technological risk. While cyberattacks rise slightly in terms of likelihood and impact in 2016, others, including failure of critical information infrastructure, appear to be declining as a risk in the eyes of experts. Technological crises have yet to impact economies or securities in a systemic way, but the risk still remains high, something that potentially may not have been fully priced in by experts. Our separate survey of business leaders assessing risks for doing business finds cyberattacks to be the top risk in no fewer than eight countries, including the USA, Japan, Germany, Switzerland and Singapore.

In addition to assessing the likelihood and potential impact of 29 global risks, the Global Risks Report 2016 takes an in-depth look at how the global security landscape could evolve in the future. The report features the outcomes of a year-long study to examine current trends and possible driving forces for the future of international security.

Through its analysis of the interconnections between risks, the 2016 report also explores three areas where global risks have the potential to impact society. These are the concept of the “(dis)empowered citizen”, the impact of climate change on food security, and the potential of pandemics to threaten social cohesion.

Risks for doing business

For the second year, the Global Risks Report also provides country-level data on how businesses perceive global risks in their countries. This year’s analysis uncovered patterns among both advanced and emerging economies. Unemployment and under-employment appears as the risk of highest concern for doing business in more than a fourth of the 140 economies covered, and is especially featured as the top risk in two regions, sub-Saharan Africa and the Middle East and North Africa. The only region where it does not feature in the top five is North America. Energy price shock is the next most widespread risk, featuring in the top five risks for doing business in 93 economies. Cyberattacks, mentioned above, feature among the top five risks in 27 economies, indicating the extent to which businesses in many countries have been impacted already by this rising threat.

The Global Risks Report 2016 is available here:

http://wef.ch/risks2016

Les médias du groupe Finyear

Le quotidien Finyear :

– Finyear Quotidien

La newsletter quotidienne :

– Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d’affaires.

Les 6 lettres mensuelles digitales :

– Le Directeur Financier

– Le Trésorier

– Le Credit Manager

– The FinTecher

– The Blockchainer

– Le Capital Investisseur

Le magazine trimestriel digital :

– Finyear Magazine

Un seul formulaire d’abonnement pour recevoir un avis de publication pour une ou plusieurs lettres