This has spurred some great discussions on social media, including some comments from people who defended the fast follower approach as a sound strategy. So it appears some clarification is needed on my overarching point.

A fast follower approach in terms of making big public bets on new products is absolutely a proven strategy.

A Great Strategy When Well Executed

Apple is often cited as one of the world’s most innovative companies, but they are not known as a bleeding edge pioneer of new technologies. The Apple computer was not the first personal computer, the iPod was not the first digital music player, and the iPad was not the first tablet computer.The iPhone was not the first smartphone, but it controls 92% of the profits of the global smartphone market.

The Apple Watch is not the first smart watch either, as any Android fan will be quick to point out, but within the first quarter of its release it reduced Samsung’s global market share of smart watches from 74% down to 8%.

Within the first quarter of its release.

Within one year Apple became the second largest watch manufacturer in the world. (For way more detail on how Apple, Amazon, Google and Facebook are taking over the world, watch Scott Galloway’s breathless take from the DLD conference.)

The ‘first mover advantage’ theory established in the early days of high tech in the 1980s was pretty much dismantled by Peter Golder and Gerard Tellis at USC in 1993. They found the almost half of product pioneers failed, and even those that didn’t fail had lower average market share than later market entrants. Countless stories abound today of product pioneers being quickly supplanted by upstart rivals.

The Fast Follower strategy is viable, but the operative word is fast. At least in relative terms.

And that is what is missing from most financial institutions, who measure speed by the decade.

Where’s My Jetpack?

As a child of the 1960s, I was promised a jetpack and vacations on the moon. Those were scaled back to a hoverboard and a time-traveling DeLorean in the 1980s, but the future destination of Back to the Future has come and gone with no such improvements in my daily life.

But I do carry around in my pocket every day a the equivalent of a 1970s supercomputer, I regularly video chat with friends and colleagues all over the world on it, and I can now summon my self-driving car from my watch.

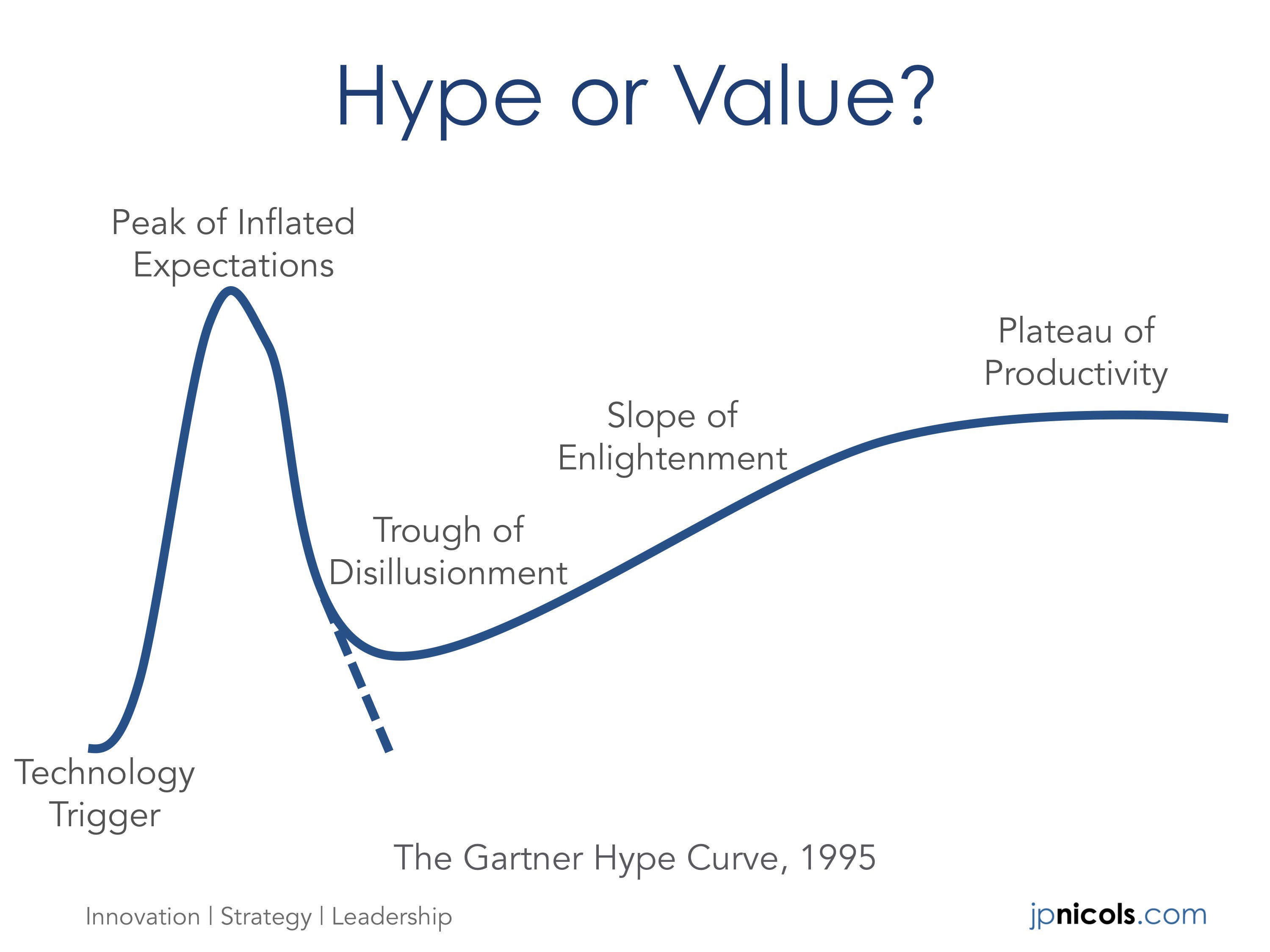

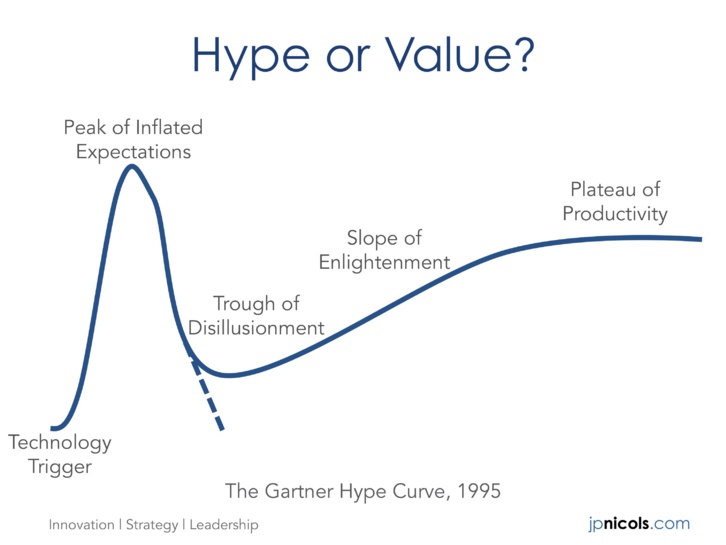

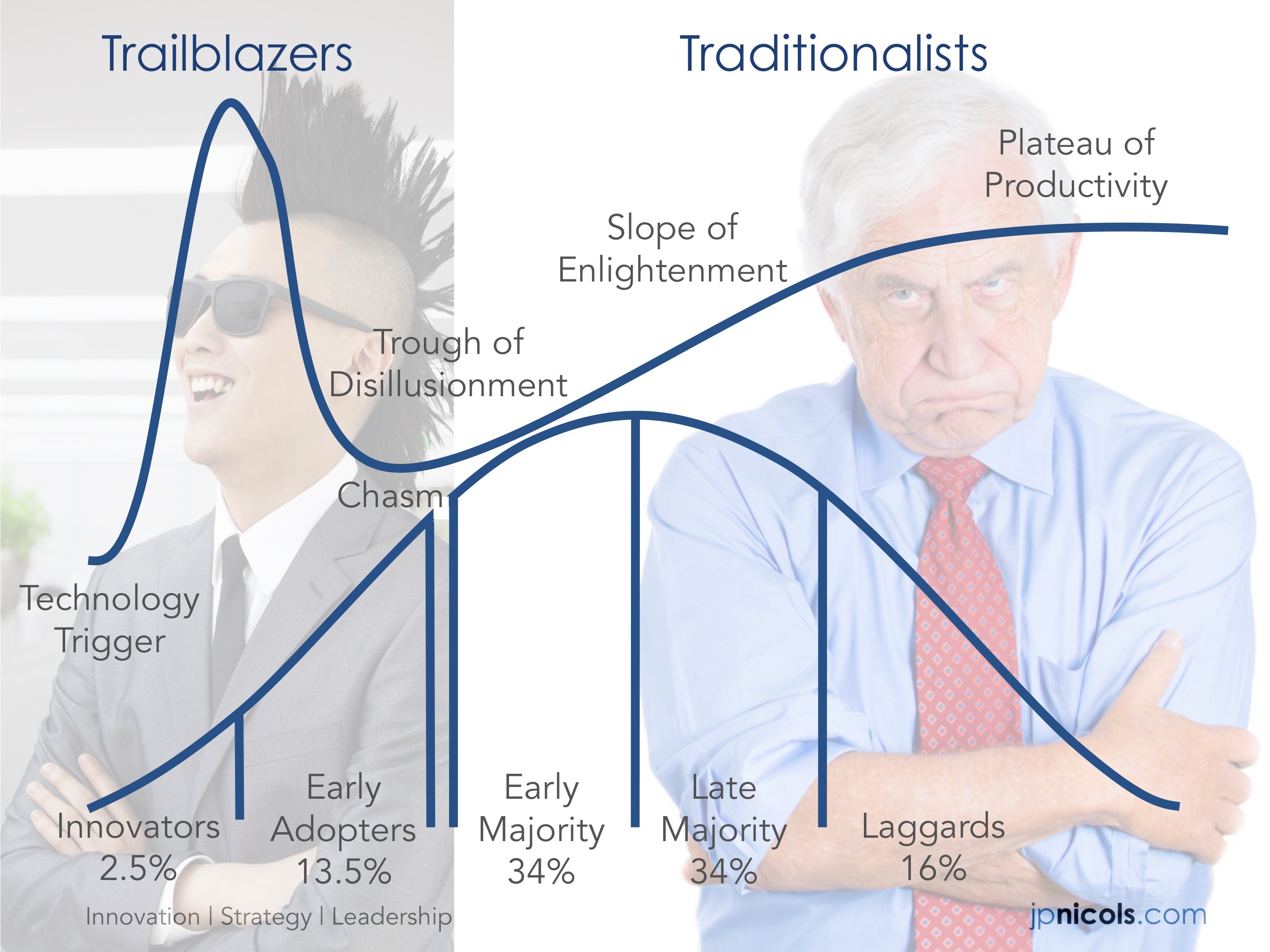

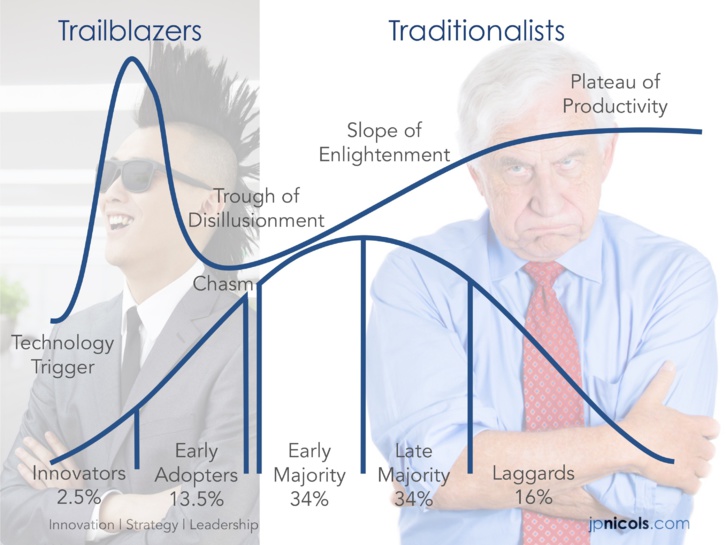

The Gartner Hype Curve is a useful construct to visualize how exaggerated expectations come down to earth in the short run. Some ideas die off, and others are iterated upon and adapted, and their lifespan is extended. Sometimes the passage of time can also help the market catch up to those that were initially ahead of their time.

A fast follower approach in terms of making big public bets on new products is absolutely a proven strategy.

A Great Strategy When Well Executed

Apple is often cited as one of the world’s most innovative companies, but they are not known as a bleeding edge pioneer of new technologies. The Apple computer was not the first personal computer, the iPod was not the first digital music player, and the iPad was not the first tablet computer.The iPhone was not the first smartphone, but it controls 92% of the profits of the global smartphone market.

The Apple Watch is not the first smart watch either, as any Android fan will be quick to point out, but within the first quarter of its release it reduced Samsung’s global market share of smart watches from 74% down to 8%.

Within the first quarter of its release.

Within one year Apple became the second largest watch manufacturer in the world. (For way more detail on how Apple, Amazon, Google and Facebook are taking over the world, watch Scott Galloway’s breathless take from the DLD conference.)

The ‘first mover advantage’ theory established in the early days of high tech in the 1980s was pretty much dismantled by Peter Golder and Gerard Tellis at USC in 1993. They found the almost half of product pioneers failed, and even those that didn’t fail had lower average market share than later market entrants. Countless stories abound today of product pioneers being quickly supplanted by upstart rivals.

The Fast Follower strategy is viable, but the operative word is fast. At least in relative terms.

And that is what is missing from most financial institutions, who measure speed by the decade.

Where’s My Jetpack?

As a child of the 1960s, I was promised a jetpack and vacations on the moon. Those were scaled back to a hoverboard and a time-traveling DeLorean in the 1980s, but the future destination of Back to the Future has come and gone with no such improvements in my daily life.

But I do carry around in my pocket every day a the equivalent of a 1970s supercomputer, I regularly video chat with friends and colleagues all over the world on it, and I can now summon my self-driving car from my watch.

The Gartner Hype Curve is a useful construct to visualize how exaggerated expectations come down to earth in the short run. Some ideas die off, and others are iterated upon and adapted, and their lifespan is extended. Sometimes the passage of time can also help the market catch up to those that were initially ahead of their time.

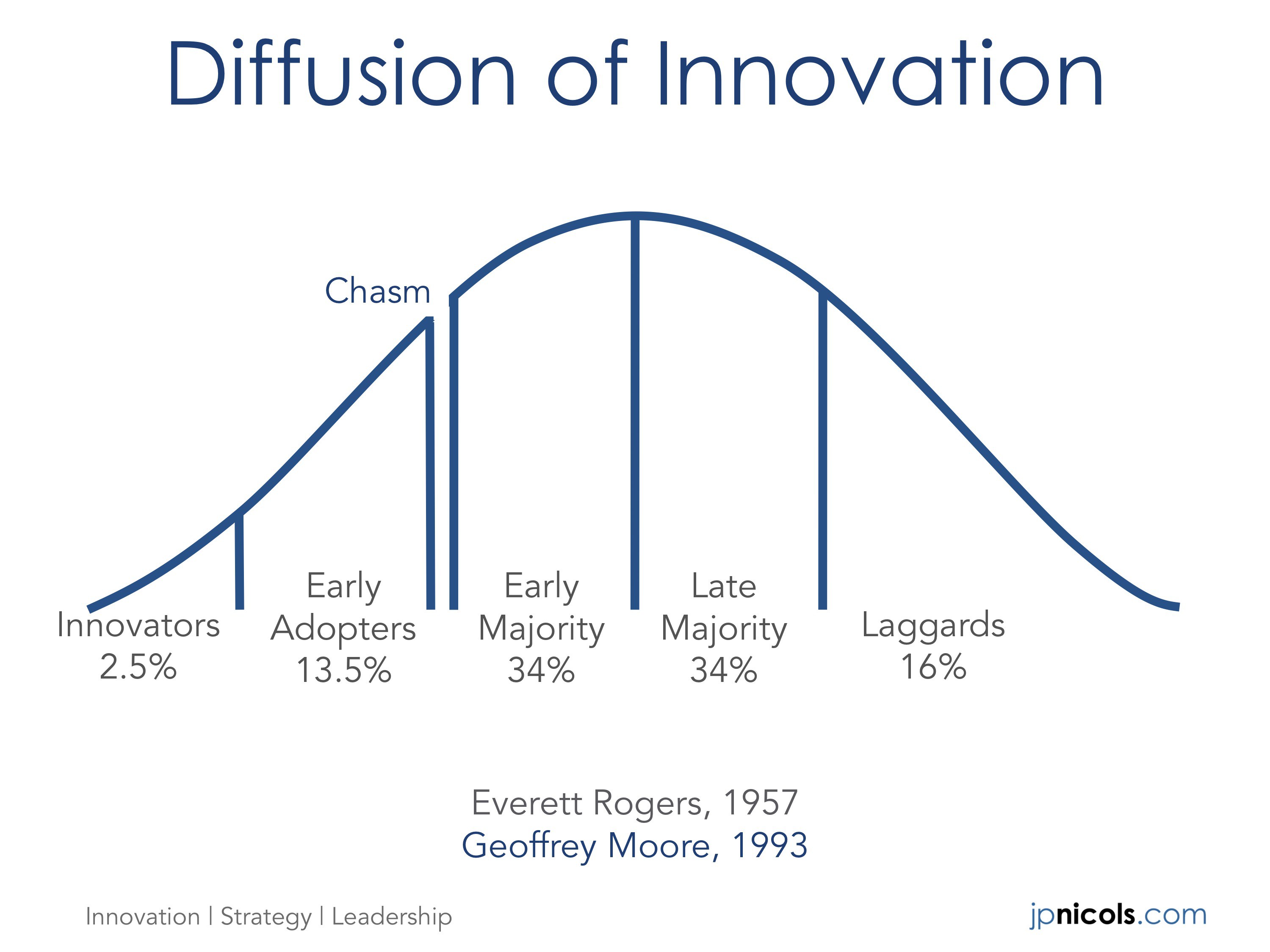

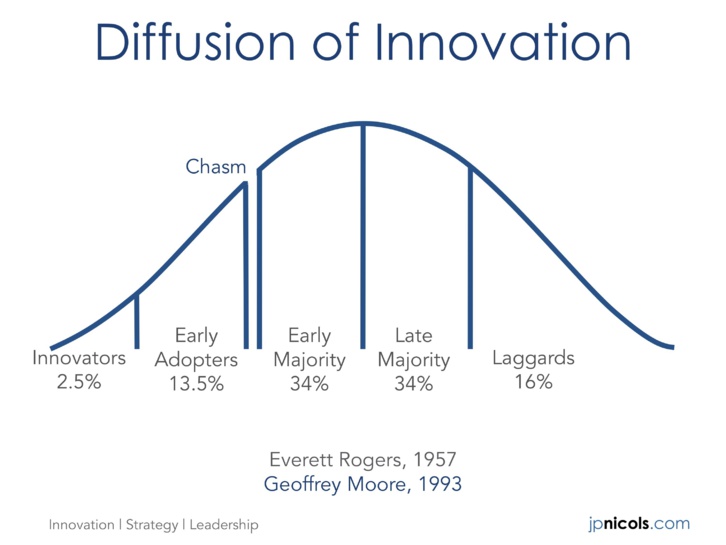

Ideas don’t exist in a vacuum, they catch on (or not) in a society of humans through a fairly predictable pattern that Everett Rogers called the Diffusion of Innovation curve.

This bell curve shows how early or late segments of the population adopt new ideas. Innovators flock to new ideas, followed quickly by the Early Adopters. Over time some of these ideas are picked up by the Early Majority, followed by the Late Majority, and eventually even the Laggards.

This bell curve shows how early or late segments of the population adopt new ideas. Innovators flock to new ideas, followed quickly by the Early Adopters. Over time some of these ideas are picked up by the Early Majority, followed by the Late Majority, and eventually even the Laggards.

Trailblazers, Traditionalists, and the Chasm Between

In 1993 Geoffrey Moore introduced to Rogers’ curve the concept of the ‘chasm’ that exists between the Innovators and Early Adopters and the rest of the segments on the curve. Left of the chasm, people live to explore new ideas, and they are willing to take a reasonable amount of risk in order to reap the benefits of being early. They are the first buyers of new products, the ones waiting in line overnight for the pride of owning version 1.0.

Right of the chasm is where phrases like “Nobody ever got fired for hiring IBM” come from. They want to take zero to very little risk, and they are willing to accept a relatively limited upside in exchange for this reduced risk.

These two broad groups— the left and right sides of the chasm— align closely with the groups I have highlighted before as Trailblazers and Traditionalists. Trailblazers want to explore the unknown and establish next practices, while Traditionalists want to master the known knowns and enforce best practices.

The picture becomes even clearer when you plot the two curves together. Ideas must cross the chasm to have commercial viability.

In 1993 Geoffrey Moore introduced to Rogers’ curve the concept of the ‘chasm’ that exists between the Innovators and Early Adopters and the rest of the segments on the curve. Left of the chasm, people live to explore new ideas, and they are willing to take a reasonable amount of risk in order to reap the benefits of being early. They are the first buyers of new products, the ones waiting in line overnight for the pride of owning version 1.0.

Right of the chasm is where phrases like “Nobody ever got fired for hiring IBM” come from. They want to take zero to very little risk, and they are willing to accept a relatively limited upside in exchange for this reduced risk.

These two broad groups— the left and right sides of the chasm— align closely with the groups I have highlighted before as Trailblazers and Traditionalists. Trailblazers want to explore the unknown and establish next practices, while Traditionalists want to master the known knowns and enforce best practices.

The picture becomes even clearer when you plot the two curves together. Ideas must cross the chasm to have commercial viability.

This highlights the challenges of truly being fast when you’re a follower.

The kinds of companies full of Trailblazers that come up with groundbreaking new ideas often do not have the very different skills of scaling up those ideas for mass market adoption. This goes a long way to explain why the first movers often fail to maintain commanding market share over the long run.

Likewise, mature organizations in mature industries full of Traditionalist employees, like, say, financial institutions, often don’t have the skills (or inclination) to develop and incubate new ideas. Hence the launch of new bank innovation teams and labs in recent years.

The Key to the Fast Follower Approach

The danger is in waiting too long so that the new idea— once groundbreaking and with the potential to set your institution apart from the pack— is now mainstream.

Before long, mainstream becomes table stakes. The longer you wait, the wider becomes the customer experience gap— the gap between what your customers have come to expect as a minimum, and what you actually provide them.

As Innosight’s Scott Anthony puts it in Harvard Business Review:

“But make sure that when you say that you want to be a fast follower you aren’t really saying, “Can’t I just go back to running my core business?” Too often people find that when it is a strategic imperative to respond, it is too late.”

So a fast follower approach can be a wise one, providing you’re actually fast enough to capture an idea on the upside of a growth curve.

Otherwise, it’s a riskier strategy than you realize.

The kinds of companies full of Trailblazers that come up with groundbreaking new ideas often do not have the very different skills of scaling up those ideas for mass market adoption. This goes a long way to explain why the first movers often fail to maintain commanding market share over the long run.

Likewise, mature organizations in mature industries full of Traditionalist employees, like, say, financial institutions, often don’t have the skills (or inclination) to develop and incubate new ideas. Hence the launch of new bank innovation teams and labs in recent years.

The Key to the Fast Follower Approach

The danger is in waiting too long so that the new idea— once groundbreaking and with the potential to set your institution apart from the pack— is now mainstream.

Before long, mainstream becomes table stakes. The longer you wait, the wider becomes the customer experience gap— the gap between what your customers have come to expect as a minimum, and what you actually provide them.

As Innosight’s Scott Anthony puts it in Harvard Business Review:

“But make sure that when you say that you want to be a fast follower you aren’t really saying, “Can’t I just go back to running my core business?” Too often people find that when it is a strategic imperative to respond, it is too late.”

So a fast follower approach can be a wise one, providing you’re actually fast enough to capture an idea on the upside of a growth curve.

Otherwise, it’s a riskier strategy than you realize.

JP Nicols, CFP®

Internationally recognized as a leading voice for innovation, strategy and leadership for the future of financial services, JP combines 20+ years of experience with a fresh perspective on combining high-tech with hightouch. His work has been featured in some of the industry’s top publications, including American Banker, BAI Banking Strategies and Investment News.

He is the founder and CEO of Clientific, and the co-founder of the Bank Innovators Council.

www.clientific.net

www.bankinnovatorscouncil.org/

Internationally recognized as a leading voice for innovation, strategy and leadership for the future of financial services, JP combines 20+ years of experience with a fresh perspective on combining high-tech with hightouch. His work has been featured in some of the industry’s top publications, including American Banker, BAI Banking Strategies and Investment News.

He is the founder and CEO of Clientific, and the co-founder of the Bank Innovators Council.

www.clientific.net

www.bankinnovatorscouncil.org/

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group

-

Giddy Wallet Announces First-Ever Autogas Feature for Polygon