Our information sources include:

- Our recruiting and staffing professionals who specialize in accounting and finance and make thousands of fulltime and interim placements each year

- Robert Half’s comprehensive analysis of current and future hiring trends

- Exclusive workplace research we conduct regularly among chief financial officers (CFOs), senior managers and employees at organizations throughout the United States

Our Salary Guide includes projected starting salary ranges for more than 350 accounting and finance positions. The figures in the guide are national averages but can be adjusted for more than 135 markets across the United States using the local variance information beginning on Page 23.

The salary ranges represent starting compensation only, because factors such as service time and work ethic make ongoing pay difficult to measure. Bonuses, incentives and other forms of compensation, such as benefits and retirement packages, also are not taken into account. For more than 60 years, we have published a new guide annually to ensure our data reflect the most recent employment trends. Employers, job seekers, academic institutions, professional associations and the media rely on the information in the Salary Guide. In addition, the U.S.

Department of Labor’s Bureau of Labor Statistics has cited it when compiling the Occupational Outlook Handbook.

The Hiring Environment

Hiring has taken on greater urgency as more firms realize they need to add staff to achieve growth objectives. Many employers have reached the limit of what they can achieve with existing staff. They are looking for professionals who can fill roles that complement their teams and, perhaps most critically, support expansion. Still, some businesses are taking a conservative approach to hiring. While a degree of caution is necessary to avoid

overhiring, companies that do not move quickly enough are losing out on promising candidates. Already, talent shortages are emerging for positions such as financial analyst and senior accountant.

Delaying the hiring process too much can also affect the morale and retention of existing employees who may feel they’ve waited long enough for reinforcements. Voluntary turnover is rising as professionals feel more confident

about leaving for other opportunities, and in-demand professionals often are receiving salary increases when changing jobs.

To help address staffing shortfalls and alleviate the workloads of their full-time teams, companies are turning to temporary and project-based professionals while they ride out the economic recovery. In addition, a growing number

of employers are using temporary-to-hire arrangements as a means of evaluating workers for full-time positions.

A Tale of Two Job Markets: Recruiting Challenges Intensify

The changing employment landscape frequently comes as a surprise to businesses looking to add staff. Many are having difficulty finding people with the specialized talents they need. They’re realizing there are two job markets at play: While general unemployment remains high, universitydegreed workers with specialized skills are experiencing low unemployment. In fact, unemployment rates in areas such as accounting and auditing and financial analysis are frequently well below the national average.

Employers must offer competitive salaries to hire top professionals. Signing bonuses are reappearing in some markets as a way to secure candidates. Annual and discretionary bonuses, promotions, training and development opportunities, and flexible schedules also have proved to be effective tools for attracting and retaining sought-after talent.

To guard against turnover, companies need to reward their best people now, not after they receive another job offer. Counteroffers are becoming increasingly common, but most employers would rather not have to extend one since this strategy has proved ineffective and damaging to staff morale.

Where the Jobs Are

Employers are shifting their hiring focus toward core accounting roles and positions that support business growth. Financial analysts and business systems analysts are in especially strong demand, as are experienced accountants who can help companies manage business expansion opportunities.

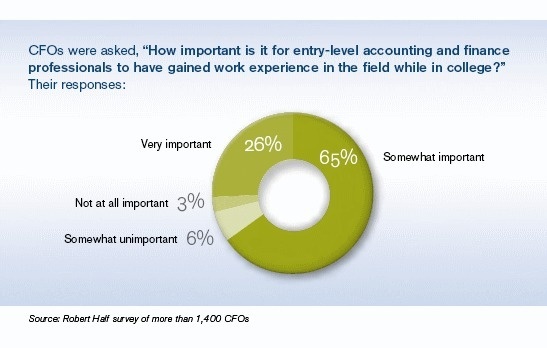

Entry-level hiring also is picking up, as firms show renewed interest in professionals in the early stages of their careers, hoping these employees will grow with the organization. When hiring for these roles, employers often seek candidates with previous work experience, either through internships or part-time jobs during college.

In-Demand Credentials and Skills

The certified public accountant (CPA) designation continues to inspire confidence in employers and remains the most frequently requested and versatile credential. CPAs who have experience with a Big Four accounting firm are in particularly high demand.

As technology and finance continue to overlap, the certified information systems auditor (CISA) designation is increasingly sought. Other valued certifications include the chartered financial analyst (CFA), certified internal auditor (CIA), certified management accountant (CMA), chartered global management accountant (CGMA) and certified payroll professional (CPP).

- Our recruiting and staffing professionals who specialize in accounting and finance and make thousands of fulltime and interim placements each year

- Robert Half’s comprehensive analysis of current and future hiring trends

- Exclusive workplace research we conduct regularly among chief financial officers (CFOs), senior managers and employees at organizations throughout the United States

Our Salary Guide includes projected starting salary ranges for more than 350 accounting and finance positions. The figures in the guide are national averages but can be adjusted for more than 135 markets across the United States using the local variance information beginning on Page 23.

The salary ranges represent starting compensation only, because factors such as service time and work ethic make ongoing pay difficult to measure. Bonuses, incentives and other forms of compensation, such as benefits and retirement packages, also are not taken into account. For more than 60 years, we have published a new guide annually to ensure our data reflect the most recent employment trends. Employers, job seekers, academic institutions, professional associations and the media rely on the information in the Salary Guide. In addition, the U.S.

Department of Labor’s Bureau of Labor Statistics has cited it when compiling the Occupational Outlook Handbook.

The Hiring Environment

Hiring has taken on greater urgency as more firms realize they need to add staff to achieve growth objectives. Many employers have reached the limit of what they can achieve with existing staff. They are looking for professionals who can fill roles that complement their teams and, perhaps most critically, support expansion. Still, some businesses are taking a conservative approach to hiring. While a degree of caution is necessary to avoid

overhiring, companies that do not move quickly enough are losing out on promising candidates. Already, talent shortages are emerging for positions such as financial analyst and senior accountant.

Delaying the hiring process too much can also affect the morale and retention of existing employees who may feel they’ve waited long enough for reinforcements. Voluntary turnover is rising as professionals feel more confident

about leaving for other opportunities, and in-demand professionals often are receiving salary increases when changing jobs.

To help address staffing shortfalls and alleviate the workloads of their full-time teams, companies are turning to temporary and project-based professionals while they ride out the economic recovery. In addition, a growing number

of employers are using temporary-to-hire arrangements as a means of evaluating workers for full-time positions.

A Tale of Two Job Markets: Recruiting Challenges Intensify

The changing employment landscape frequently comes as a surprise to businesses looking to add staff. Many are having difficulty finding people with the specialized talents they need. They’re realizing there are two job markets at play: While general unemployment remains high, universitydegreed workers with specialized skills are experiencing low unemployment. In fact, unemployment rates in areas such as accounting and auditing and financial analysis are frequently well below the national average.

Employers must offer competitive salaries to hire top professionals. Signing bonuses are reappearing in some markets as a way to secure candidates. Annual and discretionary bonuses, promotions, training and development opportunities, and flexible schedules also have proved to be effective tools for attracting and retaining sought-after talent.

To guard against turnover, companies need to reward their best people now, not after they receive another job offer. Counteroffers are becoming increasingly common, but most employers would rather not have to extend one since this strategy has proved ineffective and damaging to staff morale.

Where the Jobs Are

Employers are shifting their hiring focus toward core accounting roles and positions that support business growth. Financial analysts and business systems analysts are in especially strong demand, as are experienced accountants who can help companies manage business expansion opportunities.

Entry-level hiring also is picking up, as firms show renewed interest in professionals in the early stages of their careers, hoping these employees will grow with the organization. When hiring for these roles, employers often seek candidates with previous work experience, either through internships or part-time jobs during college.

In-Demand Credentials and Skills

The certified public accountant (CPA) designation continues to inspire confidence in employers and remains the most frequently requested and versatile credential. CPAs who have experience with a Big Four accounting firm are in particularly high demand.

As technology and finance continue to overlap, the certified information systems auditor (CISA) designation is increasingly sought. Other valued certifications include the chartered financial analyst (CFA), certified internal auditor (CIA), certified management accountant (CMA), chartered global management accountant (CGMA) and certified payroll professional (CPP).

A master’s degree in business administration (MBA) remains valuable for senior finance and analyst roles. For entry-level accounting positions, a degree in accounting is more important than ever. Prospective employers also are taking a closer look at grade point averages and campus involvement when evaluating early career professionals.

Candidates with technology skills remain in demand. Advanced knowledge of Microsoft Excel and Access is valued by employers across the board. Companies also seek professionals who can assist with upgrades of the most widely used enterprise resource planning (ERP) systems. Experience with software packages such as Microsoft Dynamics GP (formerly Great Plains) and QuickBooks is often requested by small and midsize firms. Other sought-after skills include financial reporting and analysis, forecasting, and budgeting.

Organizations also look for accounting and finance professionals with outstanding interpersonal abilities. Employers need staff skilled at communicating financial information using a variety of media for diverse audiences.

Positions in Demand

Financial analysts – Demand for financial analysts exceeds the supply in some cases. Companies place a premium on business-savvy analysts who can help identify trends in financial data and offer timely input for decision making. Candidates with strong communication skills and an MBA are highly sought.

Business systems analysts – Employers are working with business systems analysts to support better decision making by enhancing their financial systems. As firms continue to upgrade their information technology (IT) infrastructures, demand is accelerating for professionals who are familiar with company-specific ERP systems and possess finance and technology expertise.

Accountants – Companies seek accountants at the staff, senior and manager levels. Demand is especially strong for those with at least three years of experience and a CPA designation. Many firms that lost midlevel staff in recent years due to cutbacks or attrition are eager to groom new hires for future leadership roles.

Compliance officers – With the regulatory environment constantly evolving, businesses need compliance officers to oversee activities and report directly to top management. A law degree is often required for executive positions, as are strong leadership and communication skills.

Auditors – Demand is growing for auditors in public accounting and industry. Companies have a need for auditing services related to compliance and lending requirements, as well as due diligence reviews.

IT auditors – Individuals who understand the interrelation between IT audit procedures and business process controls and risks are highly sought.

Cost accountants – Demand is steady for skilled cost accountants who can help companies minimize costs by merging accounting and analysis skills in a manufacturing environment.

Controllers – As they rebuild their finance-function infrastructures, growth-focused companies continue to hire for this critical role.

...

Read more. Download the guide (PDF 32 pages):

www.roberthalffinance.com/Finance-Salary

Candidates with technology skills remain in demand. Advanced knowledge of Microsoft Excel and Access is valued by employers across the board. Companies also seek professionals who can assist with upgrades of the most widely used enterprise resource planning (ERP) systems. Experience with software packages such as Microsoft Dynamics GP (formerly Great Plains) and QuickBooks is often requested by small and midsize firms. Other sought-after skills include financial reporting and analysis, forecasting, and budgeting.

Organizations also look for accounting and finance professionals with outstanding interpersonal abilities. Employers need staff skilled at communicating financial information using a variety of media for diverse audiences.

Positions in Demand

Financial analysts – Demand for financial analysts exceeds the supply in some cases. Companies place a premium on business-savvy analysts who can help identify trends in financial data and offer timely input for decision making. Candidates with strong communication skills and an MBA are highly sought.

Business systems analysts – Employers are working with business systems analysts to support better decision making by enhancing their financial systems. As firms continue to upgrade their information technology (IT) infrastructures, demand is accelerating for professionals who are familiar with company-specific ERP systems and possess finance and technology expertise.

Accountants – Companies seek accountants at the staff, senior and manager levels. Demand is especially strong for those with at least three years of experience and a CPA designation. Many firms that lost midlevel staff in recent years due to cutbacks or attrition are eager to groom new hires for future leadership roles.

Compliance officers – With the regulatory environment constantly evolving, businesses need compliance officers to oversee activities and report directly to top management. A law degree is often required for executive positions, as are strong leadership and communication skills.

Auditors – Demand is growing for auditors in public accounting and industry. Companies have a need for auditing services related to compliance and lending requirements, as well as due diligence reviews.

IT auditors – Individuals who understand the interrelation between IT audit procedures and business process controls and risks are highly sought.

Cost accountants – Demand is steady for skilled cost accountants who can help companies minimize costs by merging accounting and analysis skills in a manufacturing environment.

Controllers – As they rebuild their finance-function infrastructures, growth-focused companies continue to hire for this critical role.

...

Read more. Download the guide (PDF 32 pages):

www.roberthalffinance.com/Finance-Salary

Autres articles

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group

-

Giddy Wallet Announces First-Ever Autogas Feature for Polygon