Özlem Özüner, CEO of Euler Hermes in Turkey, opened the event with a summary of the company’s credit insurance activities in Turkey and overall 2012 financial results. Subran then presented a trend analysis by Euler Hermes economic research specialists in the context of evaluating market opportunities and risks in Turkey and globally.

Below are the speech highlights from the event:

Özlem Özüner, Euler Hermes Turkey CEO

- Euler Hermes as a group achieved excellent results in 2012 in a challenging environment. A selective and disciplined technical underwriting enabled the group to post a consolidated turnover of €2.4 billion. Turkey is noted as one of the countries contributing to top line growth.

- Turkey is defined by Euler Hermes as one of six growth markets for investment. A positive gross written premium (GWP) based growth of 114% was achieved in 2012, in parallel with an increase in national market share to 37% (1). Turkey is part of the group’s Mediterranean, Middle East and Africa region (MMEA), which recorded the third highest growth last year after the Americas and Asia regions. MMEA performance was also affected by the economic slowdown in countries such as Spain and Greece.

Ludovic Subran, Euler Hermes chief economist

- 2013 will only bring a moderate increase in global growth of 2.5% after an even weaker than expected 2012 growth of 2.4%. Euler Hermes expects world trade to recover only slightly in 2013-2014. There are growing concerns about vulnerability from external trade and the pressures brought on by currency issues.

- Supported by further expansionary policies, the leader in global growth will be the Asia-Pacific region with a forecast 6.4% in 2013, up from 5.9% in 2012. While country risk in the region’s main economies remains low, diminished export demand and potential volatility in capital flows, exchange rates and inflation remain significant risks.

- Debate about the state of the Eurozone continues despite Europe making progress in adjusting imbalances by reversing budget deficits, external deficits and loss in competitiveness. This adjustment has been supported by much- needed structural and institutional reforms, however, challenges still exist. There is a need to re-establish nominal GDP growth and revise public debt trajectories throughout Europe, while dealing with social pressures resulting from a continued high level of unemployment.

Turkey the green island of Europe

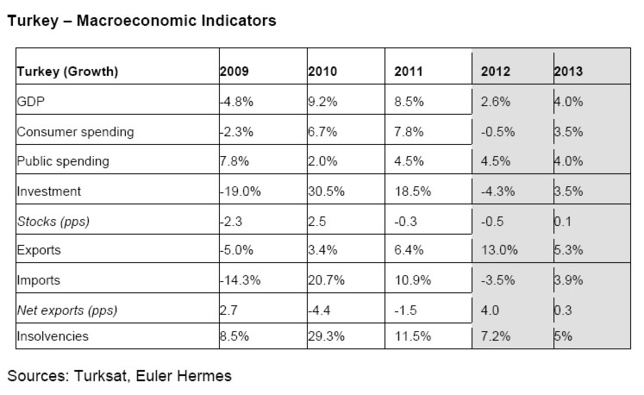

- In 2013, Euler Hermes forecasts that Turkey will post a GDP growth of 4%, harvesting lowered interest rates and the sharp increase of reserve requirements. Despite narrowing, the financing of Turkey’s current account deficit remains a concern at approximately 6.2% of GDP in 2012. The stability of the exchange rate and access to credit are critical for healthy trade with Turkey.

- Turkey is heading for a soft landing and more secure growth in 2013 after showing resilience in 2012. Domestic demand in Turkey sharply weakened in 2012 with consumer spending contracting by -0.5% after a growth of 7.8% in 2011. This triggered a contraction of imports by -3.5%, offset by an increased external demand that helped to maintain moderate overall growth.

- Optimism about Turkey’s business environment will improve with the maturity of payment practices and insolvency resolution. Payment terms are on average 70 days, but often extend to 150-180 days in contrast to the new EU directive target of 60 days by 2015. Insolvencies in Turkey are characterized by low recovery rates and longer resolution periods.

- The 2012 Turkish law which reduced credit protection on post-dated cheques is a major positive step forward for Turkey. It will help raise local trading practices to the open account system now used globally. Efforts to support trade in this transition period are needed; the cash flow of companies should be protected and sound credit management is required.

- Parallel to a weakened demand in global trade, the number of global insolvencies is projected to increase by +4% in 2013. With Spain leading the list at 25%, 24 countries representing 52% of world GDP display an upward trend in insolvency levels for the year ahead. The number of insolvencies in Turkey has risen steadily over the past 12 years and is set to increase by 5% in 2013. This is still behind the pace of increase in Belgium, Brazil, the Czech Republic, Greece and Luxembourg.

Euler Hermes’ scenario foresees higher value-added Turkish industries expanding their export market share:

- Machinery sector: Machinery has replaced textile and clothing as the largest export sector, driven by highly competitive and adaptable small and medium-sized businesses (SMEs) which form the bulk of the country’s industrial production.

- Food sector: Turkey is a major producer of agricultural raw materials which will generate food revenue sector of US$ 167 billion in 2013. Dairy products are the fastest growing sub-sector, at 165% between 2004-2009.

- Textile sector: Turkey’s advantages include production flexibility and proximity to Europe and other main export markets as it competes with the “lower price” strategies of Bangladesh, China and India. Turkey is the largest textile manufacturer in Europe, with textile and ready-to-wear garments representing over 10% of GDP.

- Metals sector: Turkey ranks 8th among global manufacturers with the sector equalling 10% of Turkey’s total export revenue in 2011. China is expected to lower production while Middle East and emerging market consumption will increase due to investments in infrastructure, construction and industry -- leaving Turkey well positioned.

- Chemical sector: A diversified sector which accounts for 13% of the total foreign capital in Turkey. Pharmaceuticals is a high added-value sub-sector expected to reach a 28% share of the global market by 2015.

Below are the speech highlights from the event:

Özlem Özüner, Euler Hermes Turkey CEO

- Euler Hermes as a group achieved excellent results in 2012 in a challenging environment. A selective and disciplined technical underwriting enabled the group to post a consolidated turnover of €2.4 billion. Turkey is noted as one of the countries contributing to top line growth.

- Turkey is defined by Euler Hermes as one of six growth markets for investment. A positive gross written premium (GWP) based growth of 114% was achieved in 2012, in parallel with an increase in national market share to 37% (1). Turkey is part of the group’s Mediterranean, Middle East and Africa region (MMEA), which recorded the third highest growth last year after the Americas and Asia regions. MMEA performance was also affected by the economic slowdown in countries such as Spain and Greece.

Ludovic Subran, Euler Hermes chief economist

- 2013 will only bring a moderate increase in global growth of 2.5% after an even weaker than expected 2012 growth of 2.4%. Euler Hermes expects world trade to recover only slightly in 2013-2014. There are growing concerns about vulnerability from external trade and the pressures brought on by currency issues.

- Supported by further expansionary policies, the leader in global growth will be the Asia-Pacific region with a forecast 6.4% in 2013, up from 5.9% in 2012. While country risk in the region’s main economies remains low, diminished export demand and potential volatility in capital flows, exchange rates and inflation remain significant risks.

- Debate about the state of the Eurozone continues despite Europe making progress in adjusting imbalances by reversing budget deficits, external deficits and loss in competitiveness. This adjustment has been supported by much- needed structural and institutional reforms, however, challenges still exist. There is a need to re-establish nominal GDP growth and revise public debt trajectories throughout Europe, while dealing with social pressures resulting from a continued high level of unemployment.

Turkey the green island of Europe

- In 2013, Euler Hermes forecasts that Turkey will post a GDP growth of 4%, harvesting lowered interest rates and the sharp increase of reserve requirements. Despite narrowing, the financing of Turkey’s current account deficit remains a concern at approximately 6.2% of GDP in 2012. The stability of the exchange rate and access to credit are critical for healthy trade with Turkey.

- Turkey is heading for a soft landing and more secure growth in 2013 after showing resilience in 2012. Domestic demand in Turkey sharply weakened in 2012 with consumer spending contracting by -0.5% after a growth of 7.8% in 2011. This triggered a contraction of imports by -3.5%, offset by an increased external demand that helped to maintain moderate overall growth.

- Optimism about Turkey’s business environment will improve with the maturity of payment practices and insolvency resolution. Payment terms are on average 70 days, but often extend to 150-180 days in contrast to the new EU directive target of 60 days by 2015. Insolvencies in Turkey are characterized by low recovery rates and longer resolution periods.

- The 2012 Turkish law which reduced credit protection on post-dated cheques is a major positive step forward for Turkey. It will help raise local trading practices to the open account system now used globally. Efforts to support trade in this transition period are needed; the cash flow of companies should be protected and sound credit management is required.

- Parallel to a weakened demand in global trade, the number of global insolvencies is projected to increase by +4% in 2013. With Spain leading the list at 25%, 24 countries representing 52% of world GDP display an upward trend in insolvency levels for the year ahead. The number of insolvencies in Turkey has risen steadily over the past 12 years and is set to increase by 5% in 2013. This is still behind the pace of increase in Belgium, Brazil, the Czech Republic, Greece and Luxembourg.

Euler Hermes’ scenario foresees higher value-added Turkish industries expanding their export market share:

- Machinery sector: Machinery has replaced textile and clothing as the largest export sector, driven by highly competitive and adaptable small and medium-sized businesses (SMEs) which form the bulk of the country’s industrial production.

- Food sector: Turkey is a major producer of agricultural raw materials which will generate food revenue sector of US$ 167 billion in 2013. Dairy products are the fastest growing sub-sector, at 165% between 2004-2009.

- Textile sector: Turkey’s advantages include production flexibility and proximity to Europe and other main export markets as it competes with the “lower price” strategies of Bangladesh, China and India. Turkey is the largest textile manufacturer in Europe, with textile and ready-to-wear garments representing over 10% of GDP.

- Metals sector: Turkey ranks 8th among global manufacturers with the sector equalling 10% of Turkey’s total export revenue in 2011. China is expected to lower production while Middle East and emerging market consumption will increase due to investments in infrastructure, construction and industry -- leaving Turkey well positioned.

- Chemical sector: A diversified sector which accounts for 13% of the total foreign capital in Turkey. Pharmaceuticals is a high added-value sub-sector expected to reach a 28% share of the global market by 2015.

(1) Based on Turkish Insurance Association (TSRSB) figures.

EULER HERMES

EULER HERMES

Autres articles

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group