Germany is one of the few countries in the world that seems to care more about inflation than growth. The scars of the hyperinflation of the 1920s have never fully healed. The first decade of the Eurozone treated Germany pretty well on this score – inflation averaged just 1.6%. The rest of the Eurozone managed 2.2% over the same period. Understanding this divergence reveals much about why the Eurozone is in the mess it is in, as well as some problems that lie ahead.

Joining a single currency means adopting one monetary policy. This will mean that monetary policy is too loose for some and too tight for others. For simplicity, we classify the original Eurozone countries into three groups. First is the ‘core’ of Germany, Netherlands, Austria, Finland and Luxembourg. These core countries are characterised by strong public finances and current account surpluses. At the other extreme are the periphery countries of Spain, Portugal, Ireland and Greece, all of which have worsening public finances and often very large current account deficits.

In between the core and the periphery is a grouping that could be called the ‘coreiphery’. These are countries with public finances that are weaker than the core but that have more balanced current accounts than the periphery. Italy, Belgium and France all fit into this group. Most commentators treat Italy as part of the periphery because of its debt, but both its public sector balance and its external balance are far stronger than the periphery. Similarly, most commentators include Belgium and France as part of the core, but in our view both have too much weakness in their public finances and small current account deficits.

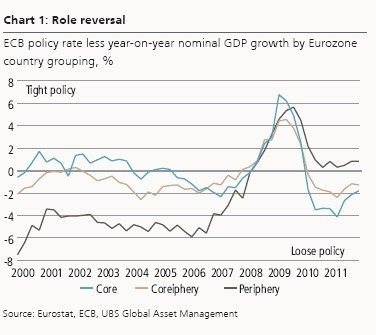

From the start of the single currency, monetary policy was set mostly for the core and the coreiphery. A simplistic measure of the appropriateness of monetary policy is the difference between the central bank rate and nominal GDP growth for each country. In theory optimal policy should average to similar levels to nominal GDP over time. Monetary policy was almost exactly calibrated for the core countries up until the financial crisis (see chart 1). This meant that policy was slightly too loose for the coreiphery and much, much too loose for the periphery.

Joining a single currency means adopting one monetary policy. This will mean that monetary policy is too loose for some and too tight for others. For simplicity, we classify the original Eurozone countries into three groups. First is the ‘core’ of Germany, Netherlands, Austria, Finland and Luxembourg. These core countries are characterised by strong public finances and current account surpluses. At the other extreme are the periphery countries of Spain, Portugal, Ireland and Greece, all of which have worsening public finances and often very large current account deficits.

In between the core and the periphery is a grouping that could be called the ‘coreiphery’. These are countries with public finances that are weaker than the core but that have more balanced current accounts than the periphery. Italy, Belgium and France all fit into this group. Most commentators treat Italy as part of the periphery because of its debt, but both its public sector balance and its external balance are far stronger than the periphery. Similarly, most commentators include Belgium and France as part of the core, but in our view both have too much weakness in their public finances and small current account deficits.

From the start of the single currency, monetary policy was set mostly for the core and the coreiphery. A simplistic measure of the appropriateness of monetary policy is the difference between the central bank rate and nominal GDP growth for each country. In theory optimal policy should average to similar levels to nominal GDP over time. Monetary policy was almost exactly calibrated for the core countries up until the financial crisis (see chart 1). This meant that policy was slightly too loose for the coreiphery and much, much too loose for the periphery.

Two other factors exacerbated this differential. Germany spent the first five years of the single currency undergoing significant structural reforms, pushing down unit labour costs and hardly growing at all. Germany makes up a third of the Eurozone inflation basket, so it is unsurprising that the ECB kept interest rates fairly low. The second factor was that the countries in the periphery enjoyed huge reductions in their borrowing costs just by joining the single currency. At a single stroke, euro membership removed the exchange rate risk premium, most of the inflation risk premium and (in retrospect mistakenly) most of the credit risk premium. Not too surprisingly, households and firms in the periphery all responded to the collapse in interest rates by going on a huge borrowing spree. Without any proper mechanism for fiscal control, governments in the periphery soon joined their populations in spending far more than they should. And so the ground was laid for the crisis Europe faces today.

When the financial crisis hit, monetary policy was too tight for all the countries (which is generally the case when recession hits). Once economies started growing again an interesting reversal took place. Interest rates became about right for the periphery, but too loose for the coreiphery and the core. Compared to most countries, Germany had a pretty good recession. Growth recovered quickly and unemployment even continued to fall. In the days of the Deutsche mark the Bundesbank would have hiked rates quickly. This time interest rates are being set to deal with problems of the periphery, so Germans are getting much lower interest rates. Combined with a weaker currency Germany is pretty much in the sweet spot. The role reversal is now complete. Whereas in the past German (and other core) growth lagged behind the periphery, this time the periphery is suffering economic stagnation while Germany expands.

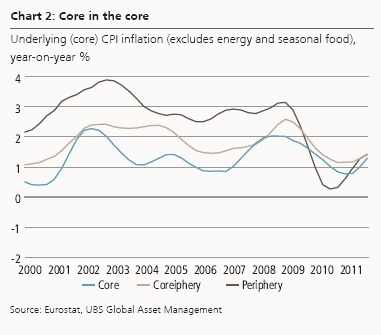

The role reversal is likely to apply to inflation in the coming years. In the past, underlying inflation (excluding energy and food) in the core countries was the lowest, averaging around 1 to 2% (see chart 2). The coreiphery experienced somewhat higher inflation of around a percentage point above that. Fuelled by massive credit expansion and loose fiscal policy, the periphery experienced much higher inflation, well above the ECB target of close to but under 2%.

When the financial crisis hit, monetary policy was too tight for all the countries (which is generally the case when recession hits). Once economies started growing again an interesting reversal took place. Interest rates became about right for the periphery, but too loose for the coreiphery and the core. Compared to most countries, Germany had a pretty good recession. Growth recovered quickly and unemployment even continued to fall. In the days of the Deutsche mark the Bundesbank would have hiked rates quickly. This time interest rates are being set to deal with problems of the periphery, so Germans are getting much lower interest rates. Combined with a weaker currency Germany is pretty much in the sweet spot. The role reversal is now complete. Whereas in the past German (and other core) growth lagged behind the periphery, this time the periphery is suffering economic stagnation while Germany expands.

The role reversal is likely to apply to inflation in the coming years. In the past, underlying inflation (excluding energy and food) in the core countries was the lowest, averaging around 1 to 2% (see chart 2). The coreiphery experienced somewhat higher inflation of around a percentage point above that. Fuelled by massive credit expansion and loose fiscal policy, the periphery experienced much higher inflation, well above the ECB target of close to but under 2%.

The periphery accounts for about a fifth of the Eurozone inflation basket, while the core and coreiphery each make up about two-fifths. However, the much higher inflation of the smaller periphery balanced out the slightly lower inflation of the larger core so that the Eurozone as a whole had inflation on target. Core frugality was balanced by periphery profligacy. For Germany growth was weak but at least it had its all-important low inflation.

A quick mental exercise reveals how much the inflation dynamics are likely to change. The periphery countries are experiencing severe contractions, and the level of spare capacity in their economies is huge. Unemployment is high and wage growth is low or even negative. For Europe to rebalance in terms of trade and competitiveness, relative prices need to fall in these countries. Suppose then that the absence of any pricing power for firms or workers keeps inflation as low as 0.5%. The coreiphery countries face their own lesser troubles, so suppose that they get inflation of 1.5%. With those levels of inflation, if the ECB wants to achieve inflation of around 2% it will need to let inflation in the core get above 3%. To put it another way, for Europe to rebalance its economy the core will need to accept that higher growth will come with higher inflation than in the past.

The first signs of inflation differential are coming through. Although underlying inflation is now similar in all the regions, much of the increase in the periphery is temporary because it comes from increases in sales taxes. In Germany inflation looks to be coming from domestic demand, and recent wage agreements are showing the first signs that ‘cost push’ inflation could be picking up. German house prices have also started to rise, perhaps reflecting the recycling of German export earnings into their domestic economy.

The core, and in particular Germany, did not complain when the ECB allowed excessive inflation in the periphery to compensate for their own low inflation. They are likely to be less happy if the situation is the other way around.

By Joshua McCallum, Senior Fixed Income Economist UBS Global Asset Management

and Gianluca Moretti, Fixed Income Economist UBS Global Asset Management

www.ubs.com

The views expressed are as of April 2012 and are a general guide to the views of UBS Global Asset Management. This document does not replace portfolio and fund-specific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund. This document is intended for limited distribution to the clients and associates of UBS Global Asset Management. Use or distribution by any other person is prohibited. Copying any part of this publication without the written permission of UBS Global Asset Management is prohibited. Care has been taken to ensure the accuracy of its content but no responsibility is accepted for any errors or omissions herein. Please note that past performance is not a guide to the future. Potential for profit is accompanied by the possibility of loss. The value of investments and the income from them may go down as well as up and investors may not get back the original amount invested. This document is a marketing communication. Any market or investment views expressed are not intended to be investment research. The document has not been prepared in line with the requirements of any jurisdiction designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information contained in this document does not constitute a distribution, nor should it be considered a recommendation to purchase or sell any particular security or fund. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith. All such information and opinions are subject to change without notice. A number of the comments in this document are based on current expectations and are considered “forward-looking statements”. Actual future results, however, may prove to be different from expectations. The opinions expressed are a reflection of UBS Global Asset Management’s best judgment at the time this document is compiled and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed. Furthermore, these views are not intended to predict or guarantee the future performance of any individual security, asset class, markets generally, nor are they intended to predict the future performance of any UBS Global Asset Management account, portfolio or fund.

© UBS 2012. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

A quick mental exercise reveals how much the inflation dynamics are likely to change. The periphery countries are experiencing severe contractions, and the level of spare capacity in their economies is huge. Unemployment is high and wage growth is low or even negative. For Europe to rebalance in terms of trade and competitiveness, relative prices need to fall in these countries. Suppose then that the absence of any pricing power for firms or workers keeps inflation as low as 0.5%. The coreiphery countries face their own lesser troubles, so suppose that they get inflation of 1.5%. With those levels of inflation, if the ECB wants to achieve inflation of around 2% it will need to let inflation in the core get above 3%. To put it another way, for Europe to rebalance its economy the core will need to accept that higher growth will come with higher inflation than in the past.

The first signs of inflation differential are coming through. Although underlying inflation is now similar in all the regions, much of the increase in the periphery is temporary because it comes from increases in sales taxes. In Germany inflation looks to be coming from domestic demand, and recent wage agreements are showing the first signs that ‘cost push’ inflation could be picking up. German house prices have also started to rise, perhaps reflecting the recycling of German export earnings into their domestic economy.

The core, and in particular Germany, did not complain when the ECB allowed excessive inflation in the periphery to compensate for their own low inflation. They are likely to be less happy if the situation is the other way around.

By Joshua McCallum, Senior Fixed Income Economist UBS Global Asset Management

and Gianluca Moretti, Fixed Income Economist UBS Global Asset Management

www.ubs.com

The views expressed are as of April 2012 and are a general guide to the views of UBS Global Asset Management. This document does not replace portfolio and fund-specific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund. This document is intended for limited distribution to the clients and associates of UBS Global Asset Management. Use or distribution by any other person is prohibited. Copying any part of this publication without the written permission of UBS Global Asset Management is prohibited. Care has been taken to ensure the accuracy of its content but no responsibility is accepted for any errors or omissions herein. Please note that past performance is not a guide to the future. Potential for profit is accompanied by the possibility of loss. The value of investments and the income from them may go down as well as up and investors may not get back the original amount invested. This document is a marketing communication. Any market or investment views expressed are not intended to be investment research. The document has not been prepared in line with the requirements of any jurisdiction designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information contained in this document does not constitute a distribution, nor should it be considered a recommendation to purchase or sell any particular security or fund. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith. All such information and opinions are subject to change without notice. A number of the comments in this document are based on current expectations and are considered “forward-looking statements”. Actual future results, however, may prove to be different from expectations. The opinions expressed are a reflection of UBS Global Asset Management’s best judgment at the time this document is compiled and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed. Furthermore, these views are not intended to predict or guarantee the future performance of any individual security, asset class, markets generally, nor are they intended to predict the future performance of any UBS Global Asset Management account, portfolio or fund.

© UBS 2012. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.