Ben Robinson's latest blog sets out his view that fintechs should be highly beneficial for banks provided they embrace it.

I recently took part in a panel discussion at the University of Geneva. The topic was “Will digitalization be disruptive or constructive to the Swiss financial industry?” (1).

My view, as set out below and framed using some of the questions asked to the panel, is that fintech should be a highly beneficial movement for banks – provided banks embrace it.

If banks are open to cultural and technological change and prepared actively to collaborate with the fintech community, then they can capitalize to deliver much better customer outcomes.

What is fintech?

Fintech is an umbrella term used to describe the fast-expanding group of companies that are trying to use technology to deliver superior financial products and services. For the purposes of this discussion, we’ll limit the word “fintechs” to start-ups and challenger banks, although it could be applied more broadly.

Why is it getting so much attention?

The fintech movement is getting a lot of attention for two main reasons.

Firstly, because – rightly – many people see that digitization of the banking industry opens it up to new competitors and business models.

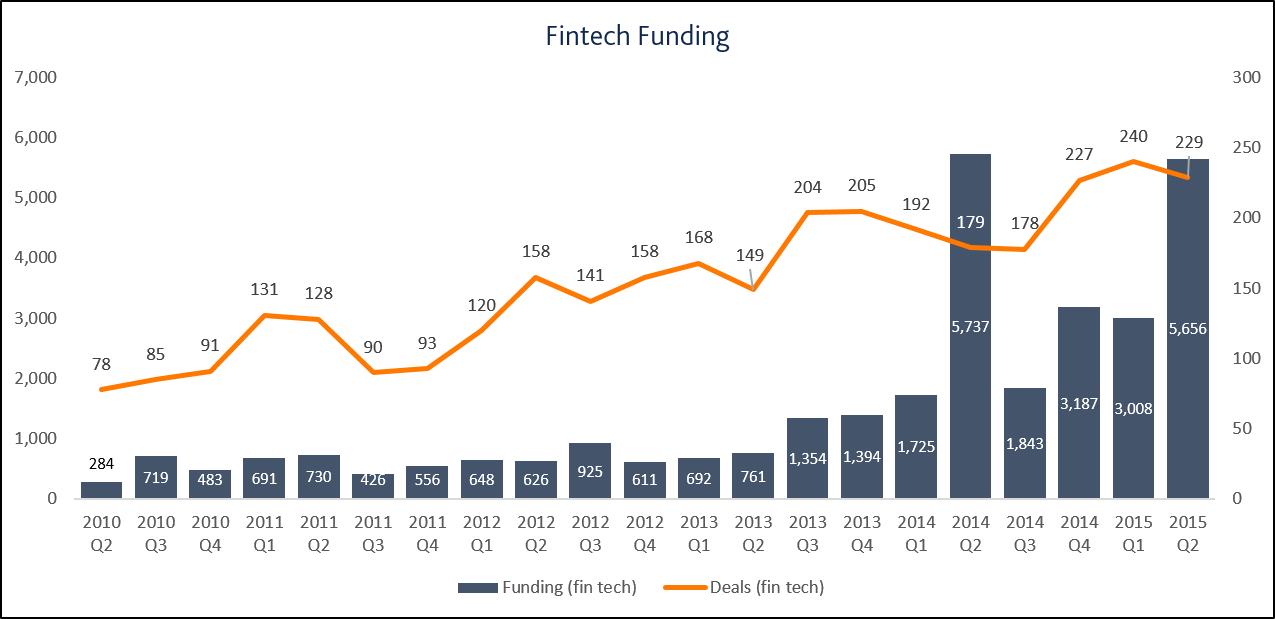

Secondly, the sector is attracting a great deal of investment. According to CB Insights, the sector has attracted almost USD14bn of corporate and VC money over the last 12 months. This represents year-on-year growth of about 40%. There are now more than 12,000 fintechs operating around the world.

I recently took part in a panel discussion at the University of Geneva. The topic was “Will digitalization be disruptive or constructive to the Swiss financial industry?” (1).

My view, as set out below and framed using some of the questions asked to the panel, is that fintech should be a highly beneficial movement for banks – provided banks embrace it.

If banks are open to cultural and technological change and prepared actively to collaborate with the fintech community, then they can capitalize to deliver much better customer outcomes.

What is fintech?

Fintech is an umbrella term used to describe the fast-expanding group of companies that are trying to use technology to deliver superior financial products and services. For the purposes of this discussion, we’ll limit the word “fintechs” to start-ups and challenger banks, although it could be applied more broadly.

Why is it getting so much attention?

The fintech movement is getting a lot of attention for two main reasons.

Firstly, because – rightly – many people see that digitization of the banking industry opens it up to new competitors and business models.

Secondly, the sector is attracting a great deal of investment. According to CB Insights, the sector has attracted almost USD14bn of corporate and VC money over the last 12 months. This represents year-on-year growth of about 40%. There are now more than 12,000 fintechs operating around the world.

Are fintechs disrupting incumbent banks?

I’ll probably get lots of negative comments for saying this, but the fact is that fintechs have so far failed to land any really major blows.

There are 25 fintech unicorns according to Business Insider. If you look through the list, these are still far from household names and the scale of their operations is still immaterial in the markets in which they operate – I calculate, for example, that TransferWise has a 0.0003% share of global daily FX volumes.

Furthermore, with few exceptions, the fintechs run on the existing banking rails. So far, fintechs have concentrated their efforts on those areas of the banking value chain where there is one or all of: high friction, high profitability and high regulatory arbitrage. This has led them predominantly to tackle areas such as (un)secured lending, which in itself accounts for c.45% of investment, and payments, accounting for c. 25 % of investment

And in many cases the fintechs, rather than disrupt the status quo, actually serve to extend and reinforce it. Take Square, which is basically aimed at increasing merchant adoption of credit card payments.

This is not to trivialise or minimise what fintechs have achieved. Fintech start-ups are making big progress in reducing friction and lowering the cost of banking services, to the benefit of society in general. The two start-ups which spoke on the panel with me, True Wealth and Fundbase, are doing great work in democratizing wealth management, allowing the general public access to funds and portfolio management services that were once the sole preserve of the very rich.

But, having said that, neither has yet achieved widescale adoption, and it would - for now - be relatively easy for banks to partner, build or buy similar capabilities. BlackRock recently did just that with its acquisition of FutureAdvisor. Goldman Sachs, meanwhile, is creating its own marketplace lending platform.

The situation is changing

The market is of course fluid and changing quickly for various reasons:

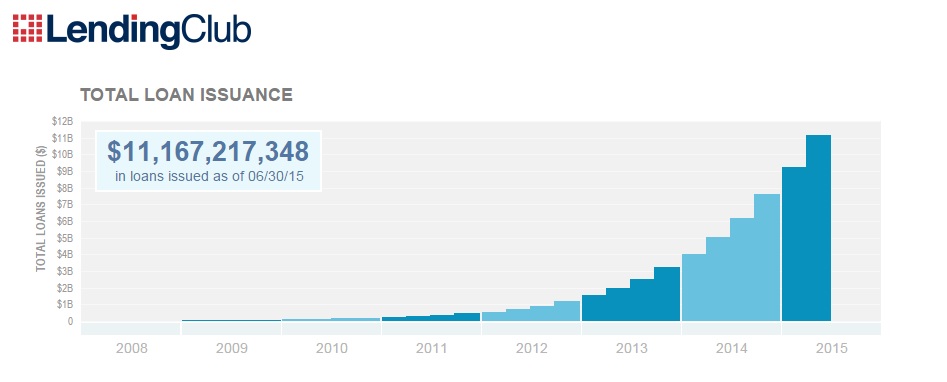

- Growth – the successful companies are growing very quickly. Lending Club, one of the few listed fintechs, is guiding for revenue growth this year of about 90%. Clearly, it won’t take many years of compounded growth at these levels for the company to generate meaningful market share.

- Expanding value prop – until now, fintechs have focused chiefly on providing discrete services. But, it is becoming increasingly clear that their ambitions don’t stop there. Take Prosper’s recent acquisition of BillGuard. This shows a clear intention to offer additional, value-added services to its customers: a cross-sell opportunity as well as a way to differentiate in a commoditized market.

- Moving beyond payments and loans – we see the reach of fintechs going beyond payments and loans into other, often more heavily-regulated, parts of banking such as trading, trade finance, current accounts, capital raising and risk management.

- Moving further into the middle- and back-office – as well as expanding horizontally, there is increasing evidence of fintechs delving deeper into the vertical stack. There are lots of fintechs working in areas such as virtual exchanges, alternative due diligence, market information as well as the blockchain.

I’ll probably get lots of negative comments for saying this, but the fact is that fintechs have so far failed to land any really major blows.

There are 25 fintech unicorns according to Business Insider. If you look through the list, these are still far from household names and the scale of their operations is still immaterial in the markets in which they operate – I calculate, for example, that TransferWise has a 0.0003% share of global daily FX volumes.

Furthermore, with few exceptions, the fintechs run on the existing banking rails. So far, fintechs have concentrated their efforts on those areas of the banking value chain where there is one or all of: high friction, high profitability and high regulatory arbitrage. This has led them predominantly to tackle areas such as (un)secured lending, which in itself accounts for c.45% of investment, and payments, accounting for c. 25 % of investment

And in many cases the fintechs, rather than disrupt the status quo, actually serve to extend and reinforce it. Take Square, which is basically aimed at increasing merchant adoption of credit card payments.

This is not to trivialise or minimise what fintechs have achieved. Fintech start-ups are making big progress in reducing friction and lowering the cost of banking services, to the benefit of society in general. The two start-ups which spoke on the panel with me, True Wealth and Fundbase, are doing great work in democratizing wealth management, allowing the general public access to funds and portfolio management services that were once the sole preserve of the very rich.

But, having said that, neither has yet achieved widescale adoption, and it would - for now - be relatively easy for banks to partner, build or buy similar capabilities. BlackRock recently did just that with its acquisition of FutureAdvisor. Goldman Sachs, meanwhile, is creating its own marketplace lending platform.

The situation is changing

The market is of course fluid and changing quickly for various reasons:

- Growth – the successful companies are growing very quickly. Lending Club, one of the few listed fintechs, is guiding for revenue growth this year of about 90%. Clearly, it won’t take many years of compounded growth at these levels for the company to generate meaningful market share.

- Expanding value prop – until now, fintechs have focused chiefly on providing discrete services. But, it is becoming increasingly clear that their ambitions don’t stop there. Take Prosper’s recent acquisition of BillGuard. This shows a clear intention to offer additional, value-added services to its customers: a cross-sell opportunity as well as a way to differentiate in a commoditized market.

- Moving beyond payments and loans – we see the reach of fintechs going beyond payments and loans into other, often more heavily-regulated, parts of banking such as trading, trade finance, current accounts, capital raising and risk management.

- Moving further into the middle- and back-office – as well as expanding horizontally, there is increasing evidence of fintechs delving deeper into the vertical stack. There are lots of fintechs working in areas such as virtual exchanges, alternative due diligence, market information as well as the blockchain.

Displacing banks?

Given all of the above, it is possible that in time we could see the emergence of alternative financial ecosystems consisting entirely of alternative players, which would not rely on banks.

Can’t banks use regulation to protect themselves?

The rationale for this question is basically as follows: regulation has been a highly effective barrier to entry in the past and since banks can influence the regulator, they should lobby to protect themselves from further market share erosion.

In this context, it is interesting to see the growing number of calls from banks such as HSBC and Santander for tougher regulation of alternative players. And, indeed, there does seem to be some movement on the part of the regulators, such as their investigation into the P2P market.

But, in fact, so much of regulatory activity is actually moving in the other direction, towards lowering entry barriers and opening up competition. Consider the European Commission’s moves on MFID II, capping interchange fees or PSD II, the last having potentially massive implications in terms of neutralising one of banks’ biggest sources of competitive advantage by making customer transactional data available to third parties.

Also, even if it were possible to use regulation to bolster protection in the short term, it is doubtful whether such an approach is sustainable. The music industry’s experience with getting Napster shut down would be suitable warning. It didn’t stop the way people wanted to consume music: they first gravitated to iTunes, and in the process turned Apple into the world’s largest music distributor, and then moved on to widespread music streaming.

The fact is that change is inevitable, and banks must embrace it.

Collaboration is the answer

On the one hand, fintechs are small, nimble and innovative.

On the other, banks have large distribution networks and large balance sheets.

Collaboration between banks and fintechs is therefore a win-win, improving the former’s capacity for innovation and giving the latter scale and route to market.

This is why initiatives such as bank-sponsored accelerators, open APIs and app stores represent great opportunities. They are likely to increase in popularity.

Collaboration between banks is also important to build the standards that will allow for many new technologies to be exploited commercially. Take the Blockchain, for example, which everyone is talking about: it will generate significant value only if banks are able to agree on the use cases and a set of common protocols. This why recent announcements, such as the 22 banks which have agreed to work together on R3’s distributed ledger initiative, are so important.

Fintechs aren’t the biggest risk

As all industries digitize, the pinch point in the value chain always becomes distribution; a battle to control the point of customer interaction.

It seems much more likely that it will be the tech giants, such as Apple or Amazon, as opposed to fintechs, who have the potential to control the distribution of banking products.

They already have a deep reach into consumers’ lives. And their advancement into banking is already seen. Apple Pay and Android Pay are clear strategic plays for Google and Apple to become gateways into financial services, while also enabling them to gather more transactional data.

This is why it is so strange to see so many banks advertising Apple Pay. I suppose the analogy is of the victim inviting the killer into their home. For if banks lose the customer interaction, they’ll be reduced to product manufacturers, competing against fintechs - but with substantially higher cost bases.

How do banks hold on to distribution?

Not all is lost for banks. They still have many competitive advantages. Consumers still trust banks more than other providers to safeguard their assets. Banks can offer integrated services. And banks have access to customer transactional data.

What banks need to do is to turn themselves into trusted virtual advisors. Practically, this will mean drawing insights from customers’ transactional, contextual and locational data, and serving them up in the form of expert advice, opportunities to save money and product recommendations they actually need.

It will also mean opening a marketplace for banking and non-banking services, where fintechs supply many of the banking products.

Cultural change is the biggest barrier

There is definitely a danger around complacency.

The IT re-platforming required to become true digital banks is also a challenge, but clearly a surmountable one.

The biggest challenge is cultural. Too few banks are mining their customer data. Too few banks appreciate that to keep distribution will mean giving away many existing services to competitors.

And too few banks are collaborating with fintechs, recognising the friend they could become.

Author: Ben Robinson, Chief Marketing Officer

original link: www.temenos.com/en/blog/2015/october/fintech-friend-or-foe/#

(1) https://www.100womeninhedgefunds.org/pages/event.php?e=1005

Given all of the above, it is possible that in time we could see the emergence of alternative financial ecosystems consisting entirely of alternative players, which would not rely on banks.

Can’t banks use regulation to protect themselves?

The rationale for this question is basically as follows: regulation has been a highly effective barrier to entry in the past and since banks can influence the regulator, they should lobby to protect themselves from further market share erosion.

In this context, it is interesting to see the growing number of calls from banks such as HSBC and Santander for tougher regulation of alternative players. And, indeed, there does seem to be some movement on the part of the regulators, such as their investigation into the P2P market.

But, in fact, so much of regulatory activity is actually moving in the other direction, towards lowering entry barriers and opening up competition. Consider the European Commission’s moves on MFID II, capping interchange fees or PSD II, the last having potentially massive implications in terms of neutralising one of banks’ biggest sources of competitive advantage by making customer transactional data available to third parties.

Also, even if it were possible to use regulation to bolster protection in the short term, it is doubtful whether such an approach is sustainable. The music industry’s experience with getting Napster shut down would be suitable warning. It didn’t stop the way people wanted to consume music: they first gravitated to iTunes, and in the process turned Apple into the world’s largest music distributor, and then moved on to widespread music streaming.

The fact is that change is inevitable, and banks must embrace it.

Collaboration is the answer

On the one hand, fintechs are small, nimble and innovative.

On the other, banks have large distribution networks and large balance sheets.

Collaboration between banks and fintechs is therefore a win-win, improving the former’s capacity for innovation and giving the latter scale and route to market.

This is why initiatives such as bank-sponsored accelerators, open APIs and app stores represent great opportunities. They are likely to increase in popularity.

Collaboration between banks is also important to build the standards that will allow for many new technologies to be exploited commercially. Take the Blockchain, for example, which everyone is talking about: it will generate significant value only if banks are able to agree on the use cases and a set of common protocols. This why recent announcements, such as the 22 banks which have agreed to work together on R3’s distributed ledger initiative, are so important.

Fintechs aren’t the biggest risk

As all industries digitize, the pinch point in the value chain always becomes distribution; a battle to control the point of customer interaction.

It seems much more likely that it will be the tech giants, such as Apple or Amazon, as opposed to fintechs, who have the potential to control the distribution of banking products.

They already have a deep reach into consumers’ lives. And their advancement into banking is already seen. Apple Pay and Android Pay are clear strategic plays for Google and Apple to become gateways into financial services, while also enabling them to gather more transactional data.

This is why it is so strange to see so many banks advertising Apple Pay. I suppose the analogy is of the victim inviting the killer into their home. For if banks lose the customer interaction, they’ll be reduced to product manufacturers, competing against fintechs - but with substantially higher cost bases.

How do banks hold on to distribution?

Not all is lost for banks. They still have many competitive advantages. Consumers still trust banks more than other providers to safeguard their assets. Banks can offer integrated services. And banks have access to customer transactional data.

What banks need to do is to turn themselves into trusted virtual advisors. Practically, this will mean drawing insights from customers’ transactional, contextual and locational data, and serving them up in the form of expert advice, opportunities to save money and product recommendations they actually need.

It will also mean opening a marketplace for banking and non-banking services, where fintechs supply many of the banking products.

Cultural change is the biggest barrier

There is definitely a danger around complacency.

The IT re-platforming required to become true digital banks is also a challenge, but clearly a surmountable one.

The biggest challenge is cultural. Too few banks are mining their customer data. Too few banks appreciate that to keep distribution will mean giving away many existing services to competitors.

And too few banks are collaborating with fintechs, recognising the friend they could become.

Author: Ben Robinson, Chief Marketing Officer

original link: www.temenos.com/en/blog/2015/october/fintech-friend-or-foe/#

(1) https://www.100womeninhedgefunds.org/pages/event.php?e=1005

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

NFT Factory s'envisage en mode itinérant avant de se ré-ancrer au coeur de la capitale

-

La startup française, Multis s'abrite désormais au sein de l'entreprise suisse, Safe,

-

Mon Petit Placement se place auprès du grand public

-

Shine : les deux co-fondateurs passent la main à la direction de la fintech

-

Spendesk fait l’acquisition d’Okko pour mutualiser la gestion des achats et des dépenses