For CFOs, it is a rare financial event that does not require consultation with the general counsel (GC). Think about it. Mergers, acquisitions, equity offerings, debt offerings, regulatory filings, environmental disclosures, and many other transactions require legal advice to ensure they are carried out correctly and with as little risk as possible. Moreover, none can be properly executed without the teaming of the CFO and the GC.

But does that teaming between the CFO and the GC happen on a regular basis? And could they work together more effectively to potentially improve results?

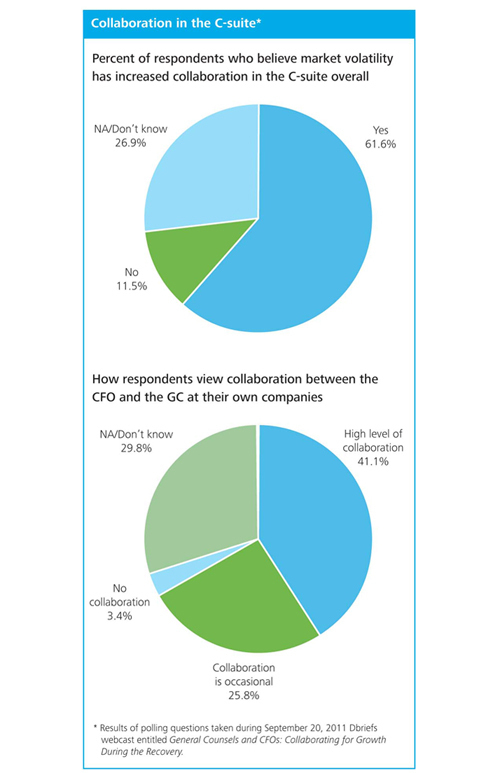

The good news is that the recent financial uncertainty seems to have encouraged a stronger working relationship between CFOs and GCs. In a recent Deloitte Financial Advisory Services LLP Dbriefs poll, more than 60 percent of business executives said market volatility has increased collaboration across the C-suite.

When it comes to collaboration between CFOs and GCs, some 40 percent of respondents to the poll, which was taken during a recent Deloitte webinar, said there is a high level at their companies. But the results makes clear that there is room for improvement as a quarter of the 1,300 respondents characterized collaboration between GCs and CFOs as “occasional,” and three percent said there was no collaboration at all.

In this issue of CFO Insights, we will discuss the role of in-house counsel and areas where legal and finance teams can work together to be more efficient. In addition, we will explore why better interaction between the finance organization and the office of general counsel may not only maximize value while minimizing risk, but also make each department more effective in the process.

But does that teaming between the CFO and the GC happen on a regular basis? And could they work together more effectively to potentially improve results?

The good news is that the recent financial uncertainty seems to have encouraged a stronger working relationship between CFOs and GCs. In a recent Deloitte Financial Advisory Services LLP Dbriefs poll, more than 60 percent of business executives said market volatility has increased collaboration across the C-suite.

When it comes to collaboration between CFOs and GCs, some 40 percent of respondents to the poll, which was taken during a recent Deloitte webinar, said there is a high level at their companies. But the results makes clear that there is room for improvement as a quarter of the 1,300 respondents characterized collaboration between GCs and CFOs as “occasional,” and three percent said there was no collaboration at all.

In this issue of CFO Insights, we will discuss the role of in-house counsel and areas where legal and finance teams can work together to be more efficient. In addition, we will explore why better interaction between the finance organization and the office of general counsel may not only maximize value while minimizing risk, but also make each department more effective in the process.

The four faces of GCs

Traditionally, there has been a natural tension between the CFO and the GC. Much of it stems from the fact that on many business issues, GCs must determine from a legal perspective what is right, what is wrong, what is acceptable, and what is doable. And sometimes their advice may thwart business plans or increase costs — both of which may raise the ire of CFOs.

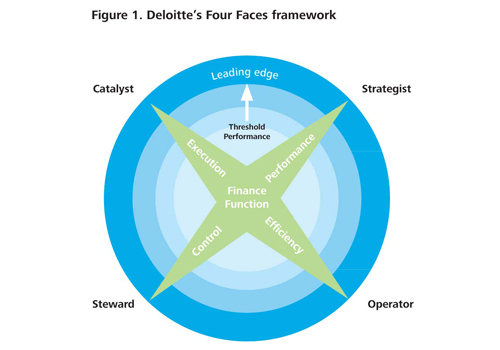

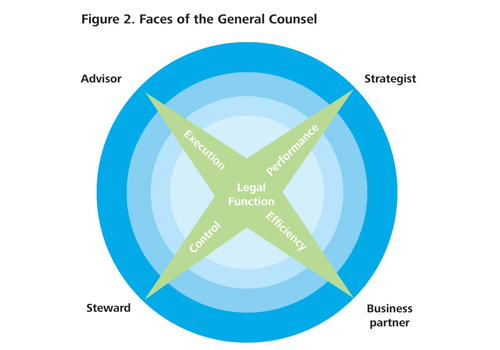

Still, GCs ultimately share the same goal of CFOs — to maximize shareholder value. Moreover, they also share four fundamental roles or “faces” within the corporation. While in the CFO’s case, those faces include operator, steward, strategist, and catalyst (see “Four Face Framework,” Figure 1), the GC’s roles (Figure 2) break down this way:

- Advisor. In this capacity, the GC acts as a filter for business initiatives. On each transaction, the GC helps companies get to a decision that is ethical, legal, as well as executable. Of course, not every decision or idea is a good one, but if it is, GCs can advise on how to make it happen.

- Steward. The GC’s core responsibility is to advise on risk and corporate governance issues. But to put those issues in context, it is essential that the GC understand how an organization generates its revenue as well as how it could lose it. With that base of understanding, it is easier to determine which risks are avoidable or can be eliminated and which may be mitigated or minimized.

- Strategist. Like the CFO, the GC strives to help shape an organization’s strategy. By working proactively with finance or business units, the GC’s role as a strategist is to vet a business development concept or other transaction at the earliest stages and identify potential fatal flaws.

- Business partner. If the objective of any enterprise is profitable revenue, then every executive is a steward of that process, including lawyers. So having lawyers become business partners should actually be the goal of the CFO. Conversely, for the GCs, the goal should be to make legal experience a competitive advantage.

Traditionally, there has been a natural tension between the CFO and the GC. Much of it stems from the fact that on many business issues, GCs must determine from a legal perspective what is right, what is wrong, what is acceptable, and what is doable. And sometimes their advice may thwart business plans or increase costs — both of which may raise the ire of CFOs.

Still, GCs ultimately share the same goal of CFOs — to maximize shareholder value. Moreover, they also share four fundamental roles or “faces” within the corporation. While in the CFO’s case, those faces include operator, steward, strategist, and catalyst (see “Four Face Framework,” Figure 1), the GC’s roles (Figure 2) break down this way:

- Advisor. In this capacity, the GC acts as a filter for business initiatives. On each transaction, the GC helps companies get to a decision that is ethical, legal, as well as executable. Of course, not every decision or idea is a good one, but if it is, GCs can advise on how to make it happen.

- Steward. The GC’s core responsibility is to advise on risk and corporate governance issues. But to put those issues in context, it is essential that the GC understand how an organization generates its revenue as well as how it could lose it. With that base of understanding, it is easier to determine which risks are avoidable or can be eliminated and which may be mitigated or minimized.

- Strategist. Like the CFO, the GC strives to help shape an organization’s strategy. By working proactively with finance or business units, the GC’s role as a strategist is to vet a business development concept or other transaction at the earliest stages and identify potential fatal flaws.

- Business partner. If the objective of any enterprise is profitable revenue, then every executive is a steward of that process, including lawyers. So having lawyers become business partners should actually be the goal of the CFO. Conversely, for the GCs, the goal should be to make legal experience a competitive advantage.

Keys to successful collaboration

Obviously there is overlap among the faces, particularly in regard to risk and risk mitigation. But whatever role the GC plays within a company, there are certain attributes that both the CFO and the GC can bring to the table to improve the relationship and the outcome.

The first is communication. Quite simply, GCs need to make finance understand that they are also charged with protecting the organization — they just have a different way of operating. One way to foster better understanding is to effectively relay the objectives and priorities of each organization, and a good place to start is with productive one-on-one communication between the CFO and the GC.

It is also essential to involve general counsel from the beginning of any transaction or major finance event – and to adhere to full transparency. GCs should be at every meeting when a transaction is considered — acquisition, debt offering, major capital investment — and should be viewed as integral members of the business team. The more facts that get on the table early, the better the team will be in preventing missteps and controlling cost in terms of time and money.

In addition to being involved from the beginning, GCs need to bring the right people to the team. Such coordination of the specialized consultants needed to get to the right answer is essential, whether they be tax specialists, mergers and acquisitions (M&A) specialists, etc. But even more important is defining the issue narrowly enough so that only the right people work on the project, and there aren’t too many cooks at the table.

Finally, respect is essential. Both the finance and legal teams need to stay focused on finding the right answer and not get hung up on who comes up with the better ideas. This is not about the GC or the CFO winning. It is about achieving a positive outcome for the company and together doing what is right.

Bridging the gap

It goes without saying that there must be “tone at the top” to foster a collaborative environment. In addition, there are certain practical steps that CFOs and GCs can take to improve their relationship and send a signal to the rest of the organization that legal and financial goals are fully integrated.

1. Invite each to the other’s meetings. It may sound simple, but just practicing inclusion can help bridge the gap between CFOs and GCs. It will also give each a window into the priorities for each department and the thought processes behind legal and financial decisions. It also sends a message throughout the organization that there is a common finance/legal platform.

2. Make collaboration continuous, not episodic. As we have discussed, GCs need to be involved at the beginning of any discussion on a transaction and should be fully integrated into the team. Their participation needs to be routine and ongoing in order to be fully effective.

3. Hire outside counsel when needed. Outside counsel typically needs to be engaged on business formation matters. When you are expanding, whether incrementally or organically, law firm attorneys play a valuable role because they have a very different view of the market as well as access to streams of information and perhaps ideas that you have not explored. This is also an area where the GC and CFO can collaborate to figure out the right specialty that is needed. There is a cost involved, of course — sometimes anywhere from $400 an hour to $1,000 an hour. But pay for the right advice and the right person.

Challenge the rates if you want, but don’t forget to assess the efficiency of the overall project and the value of the solutions that are presented.

4. Develop cross-functional expertise. By knowing the business, GCs can become subject matter experts on what is most important — the organization. That allows them to make cross-functional decisions. Bring them in on discussions about tax matters, M&A deals, and cross-border transactions, and they will not only benefit from the information, but the organization will benefit from the breadth of their views.

Collaboration between the CFO and the GC is important throughout any business cycle. To achieve it requires communication, transparency, coordination, and most important, respect. The CFO may not like the answers he or she gets from the GC. But by understanding the lens the legal department uses to view transactions and offer solutions, CFOs can come to better decisions on financial transactions. Moreover, by working effectively with the GC, the CFO can ultimately do what is best for the finance department and the organization.

*Material for this CFO Insights was based on the Deloitte Dbriefs webcast entitled General Counsels and CFOs: Collaborating for Growth During the Recovery (September 20, 2011). Special thanks to John Page, Vice President, General Counsel and Corporate Secretary, Golden State Foods, for participating in that webcast and for his contributions to this article.

www.deloitte.com

Obviously there is overlap among the faces, particularly in regard to risk and risk mitigation. But whatever role the GC plays within a company, there are certain attributes that both the CFO and the GC can bring to the table to improve the relationship and the outcome.

The first is communication. Quite simply, GCs need to make finance understand that they are also charged with protecting the organization — they just have a different way of operating. One way to foster better understanding is to effectively relay the objectives and priorities of each organization, and a good place to start is with productive one-on-one communication between the CFO and the GC.

It is also essential to involve general counsel from the beginning of any transaction or major finance event – and to adhere to full transparency. GCs should be at every meeting when a transaction is considered — acquisition, debt offering, major capital investment — and should be viewed as integral members of the business team. The more facts that get on the table early, the better the team will be in preventing missteps and controlling cost in terms of time and money.

In addition to being involved from the beginning, GCs need to bring the right people to the team. Such coordination of the specialized consultants needed to get to the right answer is essential, whether they be tax specialists, mergers and acquisitions (M&A) specialists, etc. But even more important is defining the issue narrowly enough so that only the right people work on the project, and there aren’t too many cooks at the table.

Finally, respect is essential. Both the finance and legal teams need to stay focused on finding the right answer and not get hung up on who comes up with the better ideas. This is not about the GC or the CFO winning. It is about achieving a positive outcome for the company and together doing what is right.

Bridging the gap

It goes without saying that there must be “tone at the top” to foster a collaborative environment. In addition, there are certain practical steps that CFOs and GCs can take to improve their relationship and send a signal to the rest of the organization that legal and financial goals are fully integrated.

1. Invite each to the other’s meetings. It may sound simple, but just practicing inclusion can help bridge the gap between CFOs and GCs. It will also give each a window into the priorities for each department and the thought processes behind legal and financial decisions. It also sends a message throughout the organization that there is a common finance/legal platform.

2. Make collaboration continuous, not episodic. As we have discussed, GCs need to be involved at the beginning of any discussion on a transaction and should be fully integrated into the team. Their participation needs to be routine and ongoing in order to be fully effective.

3. Hire outside counsel when needed. Outside counsel typically needs to be engaged on business formation matters. When you are expanding, whether incrementally or organically, law firm attorneys play a valuable role because they have a very different view of the market as well as access to streams of information and perhaps ideas that you have not explored. This is also an area where the GC and CFO can collaborate to figure out the right specialty that is needed. There is a cost involved, of course — sometimes anywhere from $400 an hour to $1,000 an hour. But pay for the right advice and the right person.

Challenge the rates if you want, but don’t forget to assess the efficiency of the overall project and the value of the solutions that are presented.

4. Develop cross-functional expertise. By knowing the business, GCs can become subject matter experts on what is most important — the organization. That allows them to make cross-functional decisions. Bring them in on discussions about tax matters, M&A deals, and cross-border transactions, and they will not only benefit from the information, but the organization will benefit from the breadth of their views.

Collaboration between the CFO and the GC is important throughout any business cycle. To achieve it requires communication, transparency, coordination, and most important, respect. The CFO may not like the answers he or she gets from the GC. But by understanding the lens the legal department uses to view transactions and offer solutions, CFOs can come to better decisions on financial transactions. Moreover, by working effectively with the GC, the CFO can ultimately do what is best for the finance department and the organization.

*Material for this CFO Insights was based on the Deloitte Dbriefs webcast entitled General Counsels and CFOs: Collaborating for Growth During the Recovery (September 20, 2011). Special thanks to John Page, Vice President, General Counsel and Corporate Secretary, Golden State Foods, for participating in that webcast and for his contributions to this article.

www.deloitte.com