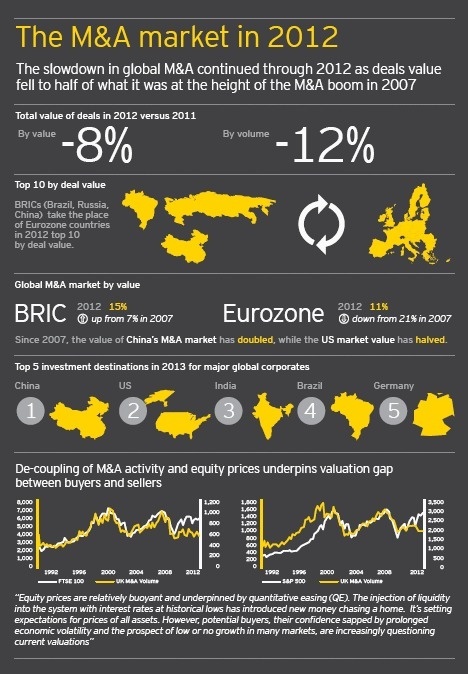

The slowdown in global M&A continued through 2012 as the value of deals fell by 47% to a projected US$2.25trillion from the height of the M&A boom in 2007 of US$4.3trillion and are 21% down in volume to 36,865 in 2012 from 46,701 in 2007, according to data analysis by Ernst & Young, released today.

Global M&A activity in 2012 is down on last year, with volume falling 12% compared to 2011, while the total value of deals fell by 8% as macro-economic concerns, including the ongoing Eurozone crisis and the impending “fiscal cliff” in the US, restricted corporates in the developed markets from committing to acquisitions. M&A activity is predicted to remain low in 2013, with the appetite to acquire among large global corporates falling.

Daniel Benquis, partner Transaction Advisory Services at Ernst & Young, says:

“Acute caution was the prevailing M&A sentiment in 2012. The Eurozone crisis continues to impact 9 global companies in every 10 and in 2012 we saw its impact reduce the appetite for M&A – even in many formerly deal-hungry emerging markets. Limited deal activity will likely continue through 2013, especially if we don’t see a clear, long term resolution to the US fiscal cliff in the US.”

Global M&A activity in 2012 is down on last year, with volume falling 12% compared to 2011, while the total value of deals fell by 8% as macro-economic concerns, including the ongoing Eurozone crisis and the impending “fiscal cliff” in the US, restricted corporates in the developed markets from committing to acquisitions. M&A activity is predicted to remain low in 2013, with the appetite to acquire among large global corporates falling.

Daniel Benquis, partner Transaction Advisory Services at Ernst & Young, says:

“Acute caution was the prevailing M&A sentiment in 2012. The Eurozone crisis continues to impact 9 global companies in every 10 and in 2012 we saw its impact reduce the appetite for M&A – even in many formerly deal-hungry emerging markets. Limited deal activity will likely continue through 2013, especially if we don’t see a clear, long term resolution to the US fiscal cliff in the US.”

Top 10: BRICs replace Eurozone

The rapid rise of M&A in the BRIC nations from 2007 to 2010 was not sustained in 2012 – but they still performed better than the Eurozone countries. In 2007, the BRIC nations accounted for just 7%4 of the global M&A market by value. In 2012 the figure is 15%. The Eurozone in 2007 contributed 21% of the global value of M&A – this has now fallen to 11%.

In 2007, 5 Eurozone countries were in the top 10 by value and, of the BRICs, only Russia featured in the list. Now China (second), Brazil and Russia are all in the top 10. Germany is the only top 10 country left from the 5 Eurozone members from 2007, and only in ninth place.

Compared to last year, the Eurozone M&A market continued to decline, down 19% in deal volume in 2012 compared to 2011 and 24% in value, whereas the BRIC nations saw a smaller decrease in activity of 15% but a rise in overall value of 19%.

Brazil was the most resilient BRIC in 2012, with volume flat, whereas Russia saw a fall of 27%. China fell 10% and India 2%.

Even if the rapid growth of BRICs over the previous few years wasn’t fully sustained in 2012, at least in volume terms, the transformation of the global M&A landscape is still clear– since 2007, the value of China’s M&A market has doubled, while the value of the US market has halved.

“China’s growing global economic influence – along with the other emerging economies – has been a re-occurring narrative over the past decade,” continues Paul Gerber, partner Ernst & Young. “Now the numbers tell their own story – the shift in the balance of M&A power has accelerated since the financial crisis and it will likely become even more pronounced in 2013.”

Unsurprisingly, China is the most preferred investment destination for global corporates in 2013, while India (third) and Brazil (fourth) are also in the top five. Completing that list are Germany (fifth) and the US (second) – the inclusion of which provides some substance to hopes of an M&A recovery in mature markets in 2013.

De-coupling of M&A activity and stock market indices

A growing number of global executives looking to make an acquisition see the gap between their valuation of potential assets and the prices sought by sellers as the main reason not to do a deal in 2013.

Historically, M&A activity levels have tracked equity prices in many developed markets – such as the US and UK – but in recent years we have seen the de-coupling of those prices and M&A activity. That gap is now widening.

Paul Gerber says: “Equity prices remain relatively buoyant and underpinned by quantitative easing (QE). The injection of liquidity into the system with interest rates at historical lows has introduced new money chasing a home. It’s setting expectations for prices of all assets among would-be sellers. However, potential buyers, their confidence sapped by prolonged economic volatility and the prospect of low or no growth in many markets, are increasingly questioning current valuations.”

Industry outlook remains subdued

Sectors hardest hit in terms of deal volume in 2012 include asset management (-18.5%), mining and metals (-18%) and automotive (-18%), with telecommunications, insurance, power and utilities, and consumer products following close behind.13 In terms of value, the hardest hit by the fall in M&A appetite in 2012 include power and utilities (-51%), technology (-30%) and life sciences (-29%).

Bucking the trend in terms of M&A value in 2012 due to small number of large deals were telecommunications (-95%); insurance (+33%) and media and entertainment (-20%).

The sector outlook for 2013: In what will likely be a subdued M&A market overall, industrial products (34% of global corporates in that sector say they are likely to acquire in 2013), financial services (32%), oil and gas, and consumer products (both 28%) are the sectors most likely to pursue acquisitions in the next 12 months. The least likely are automotive (18%), technology (18%), power and utilities, life sciences, and public sector (all 21%).The sectors most likely to divest are: financial services, industrial products, technology, consumer products and automotive.

Will companies look for bargains in the new year?

Major companies are ending the year less confident than they started it: only 22% of believe the global economic situation is improving, down from 52% in the first half of 2012 while 78% have seen no improvement since then.The number of companies who report declining sentiment, increased from 20% to 31%.

Daniel Benquis concludes: “Will the M&A market improve in 2013? The fundamentals support increased activity: in developed markets we see availability of cheap corporate debt and strong cash positions. In emerging markets, companies have increasing fire power for deals and private equity still has plenty of ‘dry powder’ to call upon right around the world.

“However, M&A activity globally is likely to remain low with little sign of a significant upturn in the coming months as executives continue to exercise restraint and “wait and see” before taking a seat at the deal table. While there will always be opportunistic transformational deals, we are likely to see fewer of them next year. What we will see is bolt on and complementary acquisitions as risk-averse executives look at deals to fill strategic gaps.”

“For M&A to really fire, we need a convincing resolution of economic events in the US and the Eurozone. That would generate confidence as a result of greater stability, could narrow the valuation gap and help executives rediscover their appetite for inorganic growth.”

Sources:

Volumes and values data is sourced from ThomsonReuters (02.12.12) and M&A appetite data from Ernst & Young Capital Confidence Barometer (October 2012).

Methodology: Full year 2012 values and volumes are based on year to date data (02.12.12), extrapolated to year end based on historically observed patterns of M&A (2007-11). This is applied globally, by geography and industry.

Ernst & Young

The rapid rise of M&A in the BRIC nations from 2007 to 2010 was not sustained in 2012 – but they still performed better than the Eurozone countries. In 2007, the BRIC nations accounted for just 7%4 of the global M&A market by value. In 2012 the figure is 15%. The Eurozone in 2007 contributed 21% of the global value of M&A – this has now fallen to 11%.

In 2007, 5 Eurozone countries were in the top 10 by value and, of the BRICs, only Russia featured in the list. Now China (second), Brazil and Russia are all in the top 10. Germany is the only top 10 country left from the 5 Eurozone members from 2007, and only in ninth place.

Compared to last year, the Eurozone M&A market continued to decline, down 19% in deal volume in 2012 compared to 2011 and 24% in value, whereas the BRIC nations saw a smaller decrease in activity of 15% but a rise in overall value of 19%.

Brazil was the most resilient BRIC in 2012, with volume flat, whereas Russia saw a fall of 27%. China fell 10% and India 2%.

Even if the rapid growth of BRICs over the previous few years wasn’t fully sustained in 2012, at least in volume terms, the transformation of the global M&A landscape is still clear– since 2007, the value of China’s M&A market has doubled, while the value of the US market has halved.

“China’s growing global economic influence – along with the other emerging economies – has been a re-occurring narrative over the past decade,” continues Paul Gerber, partner Ernst & Young. “Now the numbers tell their own story – the shift in the balance of M&A power has accelerated since the financial crisis and it will likely become even more pronounced in 2013.”

Unsurprisingly, China is the most preferred investment destination for global corporates in 2013, while India (third) and Brazil (fourth) are also in the top five. Completing that list are Germany (fifth) and the US (second) – the inclusion of which provides some substance to hopes of an M&A recovery in mature markets in 2013.

De-coupling of M&A activity and stock market indices

A growing number of global executives looking to make an acquisition see the gap between their valuation of potential assets and the prices sought by sellers as the main reason not to do a deal in 2013.

Historically, M&A activity levels have tracked equity prices in many developed markets – such as the US and UK – but in recent years we have seen the de-coupling of those prices and M&A activity. That gap is now widening.

Paul Gerber says: “Equity prices remain relatively buoyant and underpinned by quantitative easing (QE). The injection of liquidity into the system with interest rates at historical lows has introduced new money chasing a home. It’s setting expectations for prices of all assets among would-be sellers. However, potential buyers, their confidence sapped by prolonged economic volatility and the prospect of low or no growth in many markets, are increasingly questioning current valuations.”

Industry outlook remains subdued

Sectors hardest hit in terms of deal volume in 2012 include asset management (-18.5%), mining and metals (-18%) and automotive (-18%), with telecommunications, insurance, power and utilities, and consumer products following close behind.13 In terms of value, the hardest hit by the fall in M&A appetite in 2012 include power and utilities (-51%), technology (-30%) and life sciences (-29%).

Bucking the trend in terms of M&A value in 2012 due to small number of large deals were telecommunications (-95%); insurance (+33%) and media and entertainment (-20%).

The sector outlook for 2013: In what will likely be a subdued M&A market overall, industrial products (34% of global corporates in that sector say they are likely to acquire in 2013), financial services (32%), oil and gas, and consumer products (both 28%) are the sectors most likely to pursue acquisitions in the next 12 months. The least likely are automotive (18%), technology (18%), power and utilities, life sciences, and public sector (all 21%).The sectors most likely to divest are: financial services, industrial products, technology, consumer products and automotive.

Will companies look for bargains in the new year?

Major companies are ending the year less confident than they started it: only 22% of believe the global economic situation is improving, down from 52% in the first half of 2012 while 78% have seen no improvement since then.The number of companies who report declining sentiment, increased from 20% to 31%.

Daniel Benquis concludes: “Will the M&A market improve in 2013? The fundamentals support increased activity: in developed markets we see availability of cheap corporate debt and strong cash positions. In emerging markets, companies have increasing fire power for deals and private equity still has plenty of ‘dry powder’ to call upon right around the world.

“However, M&A activity globally is likely to remain low with little sign of a significant upturn in the coming months as executives continue to exercise restraint and “wait and see” before taking a seat at the deal table. While there will always be opportunistic transformational deals, we are likely to see fewer of them next year. What we will see is bolt on and complementary acquisitions as risk-averse executives look at deals to fill strategic gaps.”

“For M&A to really fire, we need a convincing resolution of economic events in the US and the Eurozone. That would generate confidence as a result of greater stability, could narrow the valuation gap and help executives rediscover their appetite for inorganic growth.”

Sources:

Volumes and values data is sourced from ThomsonReuters (02.12.12) and M&A appetite data from Ernst & Young Capital Confidence Barometer (October 2012).

Methodology: Full year 2012 values and volumes are based on year to date data (02.12.12), extrapolated to year end based on historically observed patterns of M&A (2007-11). This is applied globally, by geography and industry.

Ernst & Young

Autres articles

-

Hong Kong : bientôt des premiers ETF Bitcoin ?

-

TMS Network (TMSN) Powers Up As Cryptocurrency Domain Appears Unstoppable. What Does This Mean For Dogecoin (DOGE) and Solana (SOL)?

-

The Growing Popularity of Crypto Payments: Could TMS Network (TMSN), Alchemy Pay (ACH), and Ripple (XRP) Lead The Way Despite The Whales?

-

DigiFT DEX Raises $10.5M in Pre-Series A Funding Led by Shanda Group

-

Giddy Wallet Announces First-Ever Autogas Feature for Polygon